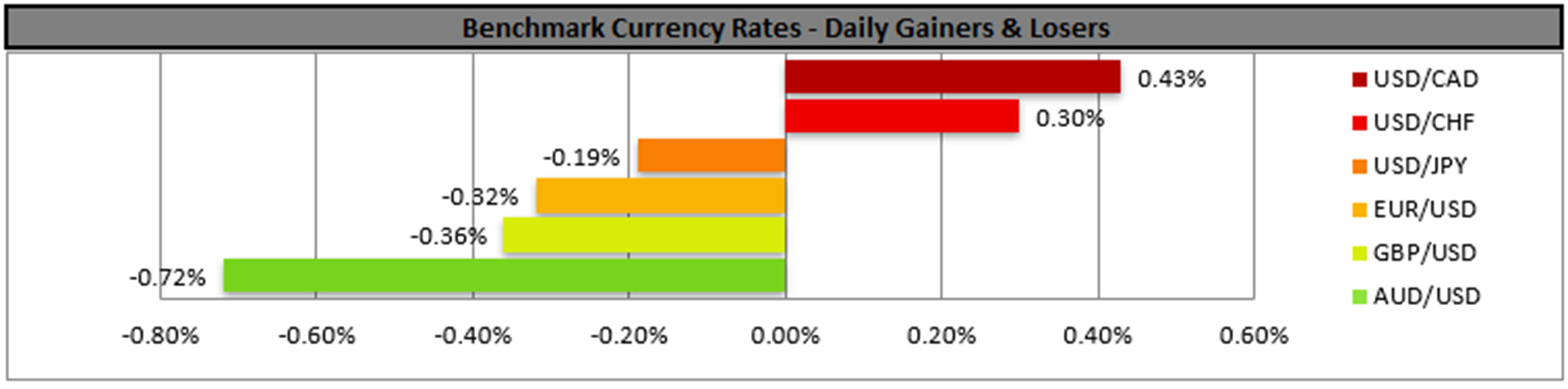

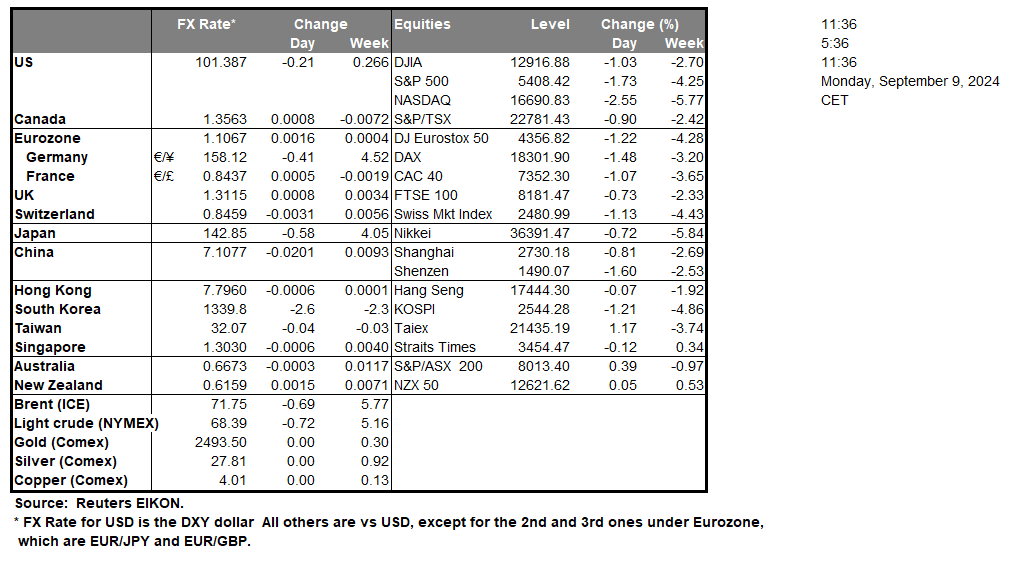

The US employment market tightened in the past month if compared to July as the NFP figure went up, the unemployment rate ticked down and the average earnings growth rate accelerated slightly. The data at the time of the release tended to weigh on the USD, as the NFP figure did not reach the market’s expectations, yet the greenback was in the greens until the end of Friday. The release tended to weigh particularly on US stock markets and Dow Jones, S&P 500 and Nasdaq uniformly ended their day in the reds. On the one hand, the release may ease the market’s dovishness for the Fed’s September meeting and its characteristic that the possibility for a double rate cut have eased. On the other hand, the Fed seems to remain dovish, as Fed Board Governor Waller on Friday stated that “, I believe the time has come to lower the target range for the federal funds rate at our upcoming meeting…Furthermore, I do not expect this first cut to be the last”. The release of the US CPI rates for August on Wednesday is to be the next big test for the USD and a possible easing of inflationary pressures could weigh on the USD. O the flip side a possible acceleration of the rates could weigh on US stockmarkets.

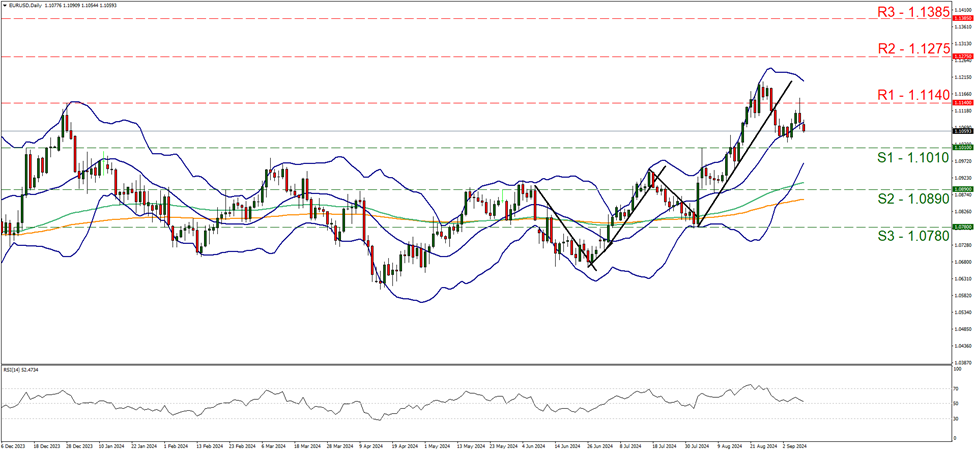

In the FX market, EUR/USD edged lower on Friday and continued to do so during today’s Asian session, yet remained well within the 1.1140 (R1) resistance line and the 1.1010 (S1) support line. We tend to maintain a bias for the sideways motion between the prementioned levels to remain. We also note that the RSI indicator dropped just above the reading of 50, implying a relative indecisiveness on behalf of the market. Also the Bollinger bands are narrowing, implying less volatility which could allow the sideways motion to continue. Should the bulls take over, we may see EUR/USD breaking the 1.1140 (R1) resistance line and start aiming for the 1.1275 (R2) resistance base. Should the selling interest be extended and the bears take over, we may see the pair breaking the 1.1010 (S1) support line and start aiming for the 1.0890 (S2) support level.

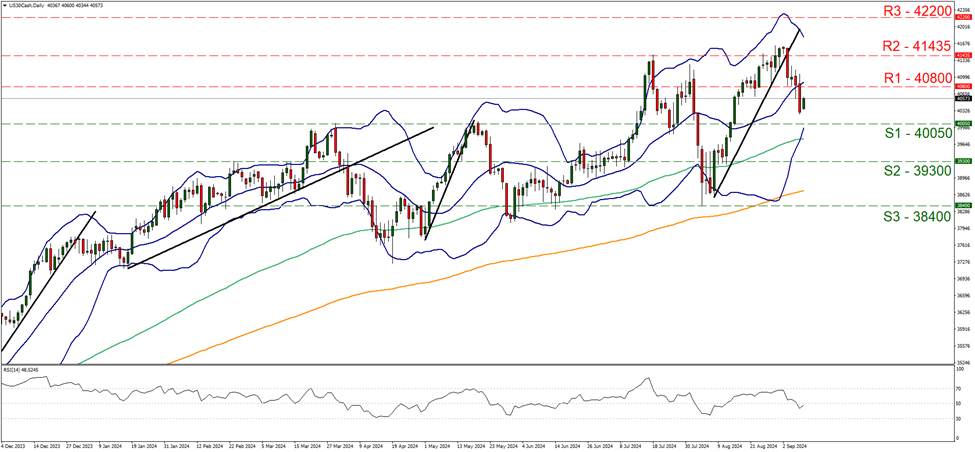

As for US stockmarkets, we note that Dow Jones fell sharply on Friday clearly breaking the 40800 (R1) support line, now turned to resistance. We expect the bearish tendencies to be maintained, yet note that that the price action is correcting higher during today’s Asian session, while the RSI indicator is also correcting higher, nearing the reading of 50 and both could allow for some stabilisation of the index. Should the bears regain control over the index, we may see Dow Jones breaking the 40050 (S1) support line and thus pave the way for the 39300 (S2) support level. Should the bulls extent their reach, we may see the index, breaking the 40800 (R1) resistance line and open the gates for the 41435 (R2) resistance level.

その他の注目材料

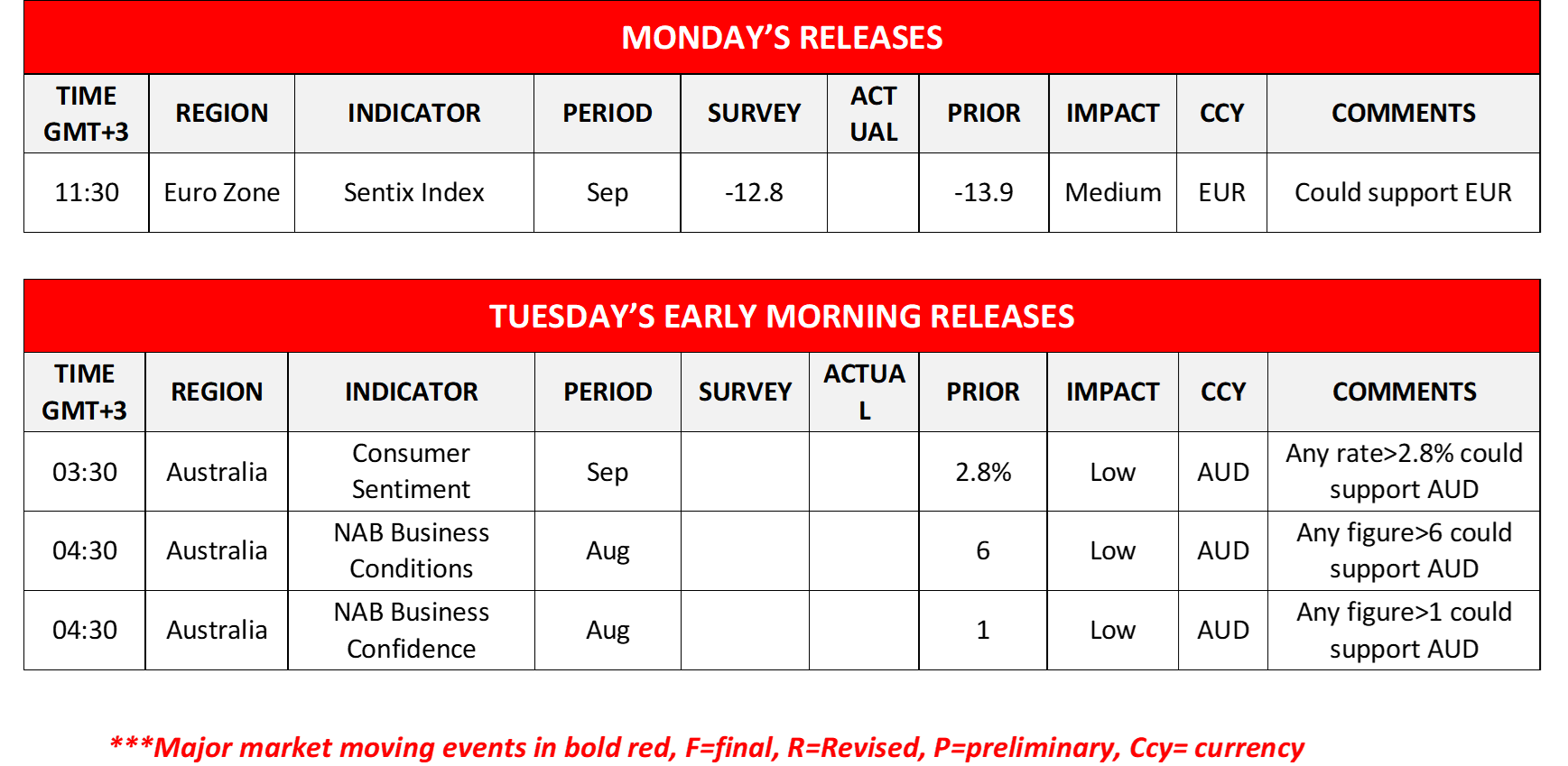

Today we get Eurozone’s Sentix index for September. During tomorrow’s Asian session, we get Australia’s consumer sentiment for September and NAB Business Conditions and Confidence for August.

今週の指数発表:

On Tuesday we get Australia’s consumer sentiment for September, China’s August trade data, UK’s July employment data, Sweden’s GDP rate for the same month, as well as Norway’s and the Czech Republic’s August CPI rates. On Wednesday, we get UK’s GDP and manufacturing output growth rates for August. On Thursday we get New Zealand’s electronic card retail sales, Japan’s Corporate Goods prices and Sweden’s CPI rates all being for August, from the US we get the weekly initial jobless claims figure and the PPI rates for August and Canada’s July building permits growth rate. Also on Thursday, we note on a monetary level, ECB’s interest rate decision. On Friday we get Eurozone’s industrial output for July and the US preliminary University of Michigan consumer sentiment for September and on Saturday we get China’s urban investment, industrial output and retail sales growth rates all being for August.

US30 Cash Daily Chart

- Support: 40050 (S1), 39300 (S2), 38400 (S3)

- Resistance: 40800 (R1), 41435 (R2), 42200 (R3)

EUR/USD デイリーチャート

- Support: 1.1050 (S1), 1.0990 (S2), 1.0920 (S3)

- Resistance: 1.1120 (R1), 1.1185 (R2), 1.1235 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。