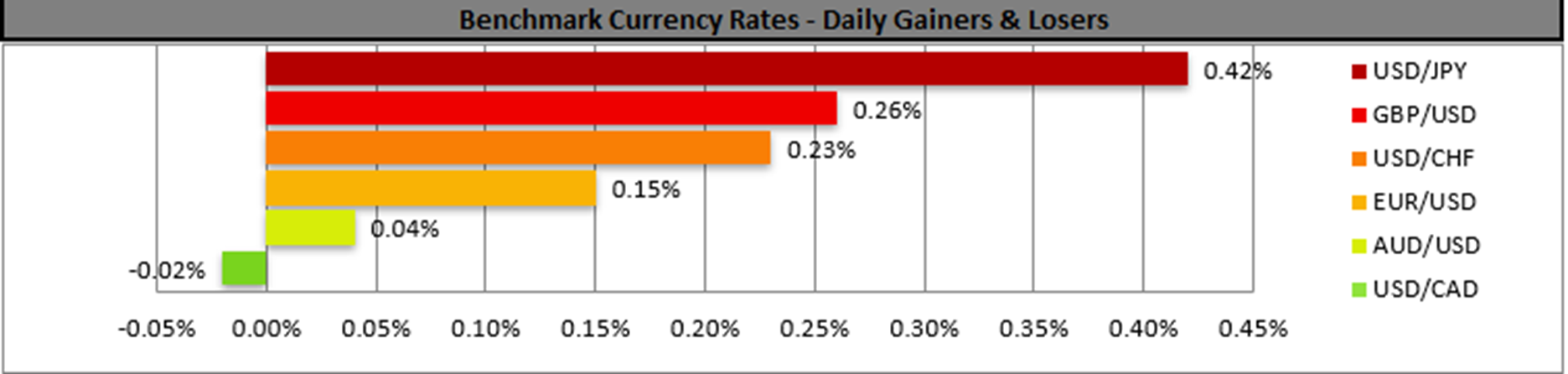

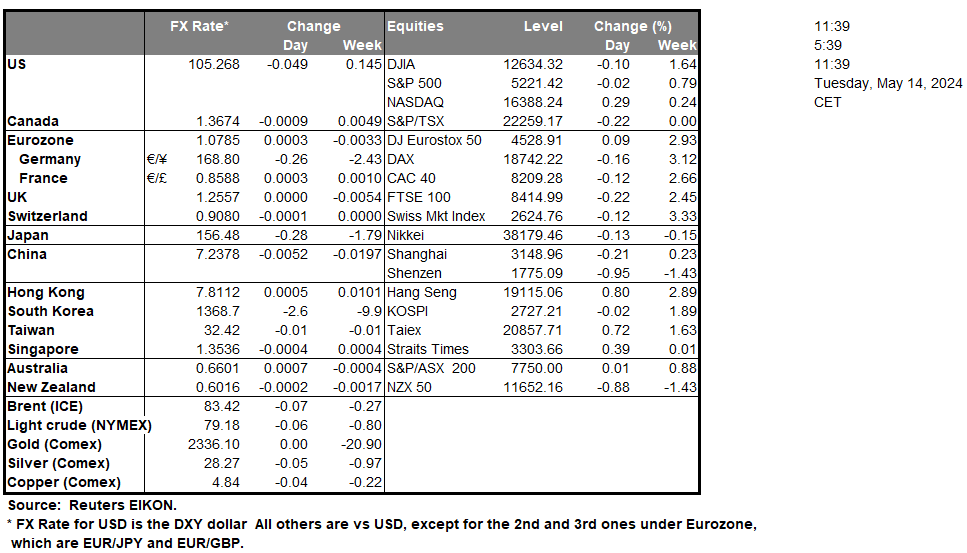

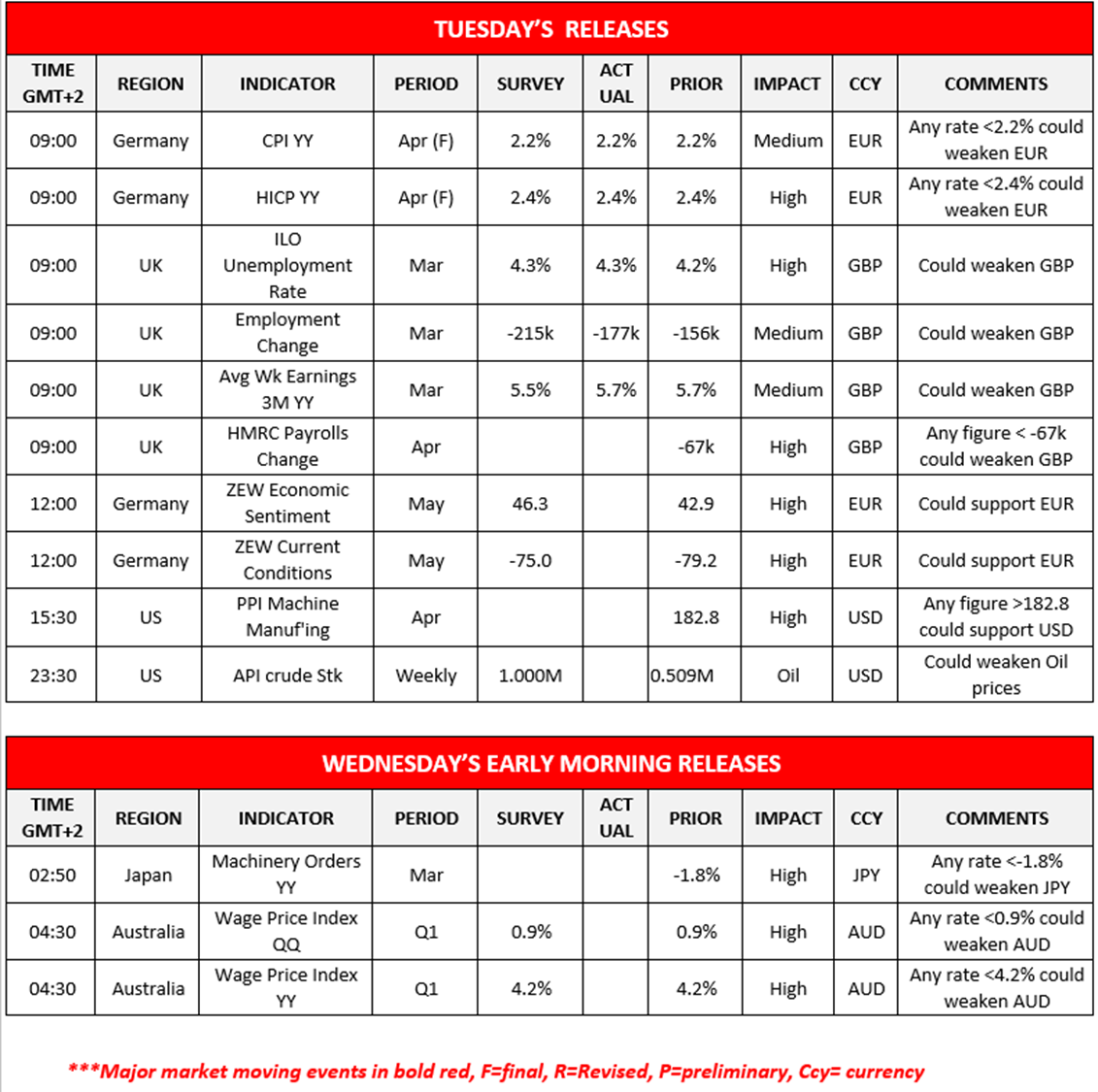

The UK’s Employment data which was released earlier on today came in better than expected. In particular the Employment change figure for March came in at -177k versus the expected figure of -215k in addition to the Average earnings rate remaining steady at 5.7%. Thus, it could be inferred that the UK’s labour market remains tight and hence could provide support for the pound. However, we should note that the unemployment rate came in at 4.3%, as was expected, yet is still an increase from the prior reading of 4.2%, which could mitigate the pound’s potential gains.Over in Europe, we would like to note Germany’s ZEW Current conditions and Economic sentiment figures for May which are expected by economists to improve since last month. In such a scenario, it could be inferred that from the consumers side, the current economic situation in Germany may be improving. Hence, given the gravity of financial release stemming from Germany due to them being an economic powerhouse in Europe, it could provide support for the EUR.In the US Equities markets, we are highlighting the earnings release of HomeDepot (#HD) later on today, which may provide some insight into the consumer staples sector of the US economy. Fed Vice Chair Jefferson stated yesterday per Reuters that “I think it is appropriate to keep the policy rate in restrictive territory”, which appears to be the predominant tone of Fed policymakers lately. Thus, should more policymakers echo Fed Vice Chair Jefferson’s remarks, it could provide support for the dollar.According to Reuters, the US Government could potentially announce new tariffs against China later on today. The report citing it’s sources, claims that the new tariffs could target sectors including electric vehicles, which may benefit domestic EV manufacturers such as Tesla (#TSLA), as they may face reduced competition from China.

WTICash appears to be moving in a downwards fashion. We maintain our bearish outlook and supporting our case is the downwards moving trendline which was incepted on the 5 of April in addition to the RSI indicator below our chart which currently registers a figure of 40, implying some bearish tendencies. For our bearish outlook to continue, we would require a clear break below the 76.55 (S1) support level, with the next possible target for the bears being the 71.50 (S2). On the flip side for a sideways bias we would require the commodity to remain confined within with sideways channel defined by the 76.55 (S1) support level and the 81.80 (R1) reistannce line. Lastly, for a bullish outlook 81.80 (R1) resistance line with the next possible target for the bulls being 85.85 (R2) resistance line.

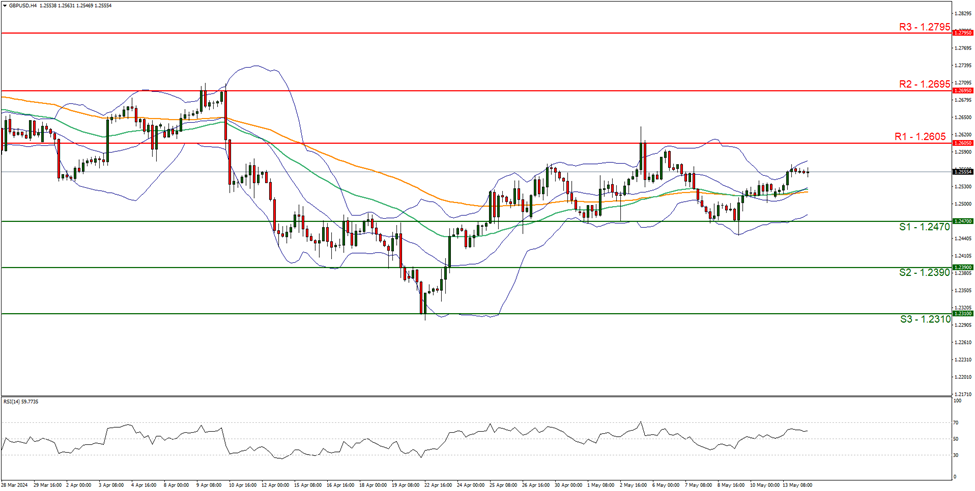

GBP/USD appears to be moving in a sideways fashion. We maintain a sideways bias for the pair and supporting our case is the Bollinger bands in addition to the 50MA and 100MA appearing to be smoothening out, implying low market volatility. However, we should note that the RSI indicator below our chart currently registers a figure near 60, implying some bullish market tendencies. Nonetheless, for our sideways bias to be maintained we would like to see the pair remain confined between the 1.2470 (S1) support level and the 1.2605 (R1) resistance line. On the flip side for a bullish outlook we would require a clear break above the 1.2605 (R1) resistance line with the next possible target for the bulls being the 1.2695 (R2) resistance level. Lastly for a bearish outlook, we would require a clear break below the 1.2470 (S1) support level with the next target for the bears being the 1.2390 (S2) support line.

その他の注目材料

In tomorrow’s European session we get Germany’s final CPI rates for April, the UK’s Employment data, followed by Germany’s ZEW figures. In the American session we get the US PPI Machine manufacturing figure for April and the US weekly crude oil inventories. In tomorrow’s Asian session we note Japan’s machinery orders rate for March and Australia’s wage pride index rates for Q1

WTICash Daily Chart

Support: 76.55 (S1), 71.50 (S2), 66.95 (S3)

Resistance: 81.80 (R1), 85.85 (R2), 89.60 (R3)

GBP/USD 4時間チャート

Support: 1.2470 (S1), 1.2390 (S2), 1.2310 (S3)

Resistance: 1.2605 (R1), 1.2695 (R2), 1.2795 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。