FED board Governor Bowman stated during her speech yesterday that “inflation progress slows and possibly halts”, implying that the bank may need to maintain interest rates at their current levels for a longer period of time. As such, the hawkish comments should they be re-iterated by other Fed policymakers could support the greenback.Australia’s Unemployment rate for March which was released in today’s early Asian session came in lower than expected at 3.8% versus 3.9%. The release implies that the Australian labour market may be stronger than expected, and thus could increase pressures on the RBA to adopt a more hawkish tone which in turn could support the Aussie.According to documents filed by Tesla (#TSLA), the company is preparing to ask investors to vote on Elon Musk’s 2018 pay deal to a shareholder vote, following a Delaware court striking the pay package down a few months ago. According to the WSJ, this could set off a bitter battle among investors and governance experts. As such, should tensions increase with the company’s future in doubt, it could weigh on the company’s stock price.Boeing whistleblower Sam Salehpour stated during his testimony to Congress yesterday that he “was ignored. I was told not to create delays. I was told, frankly, to shut up”. The testimony further dents Boeing’s (#BA) safety reputation and culture as such, it could weigh on the company’s stock price.

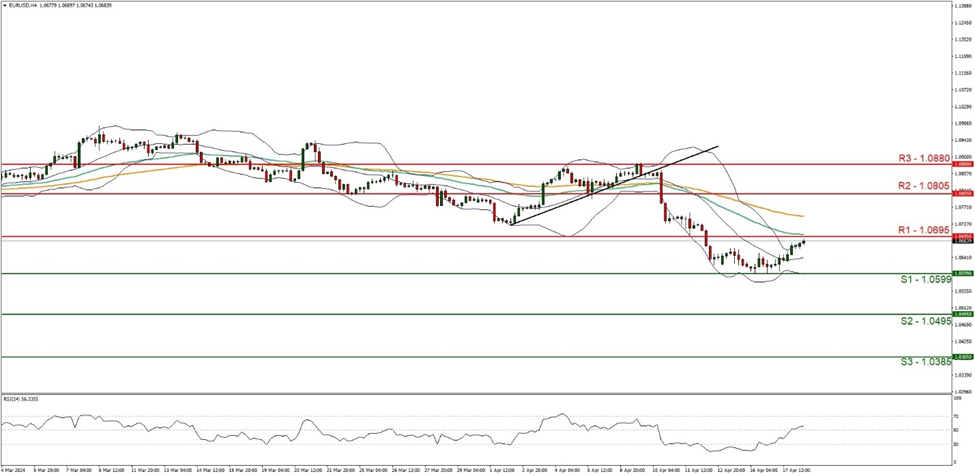

On a technical level EUR/USD appears to be moving in a sideways fashion, with the pair bouncing off the 1.0599 (S1) support level. We maintain a b for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment.For our neutral outlook to continue, we would require the pair to remain within the sideways channel defined by the 1.0559 (S1) support level and the 1.0695 (R1) resistance line. On the flip side, for a bullish outlook, we would require a clear break above the 1.0695 (R1) resistance line with the next possible target for the bulls being the 1.0805 (R2) resistance level. Lastly, for a bearish outlook we would like to see a clear break below the 1.0599 (S1) support level, with the next possible target for the bears being the 1.0495 (S2) support line.

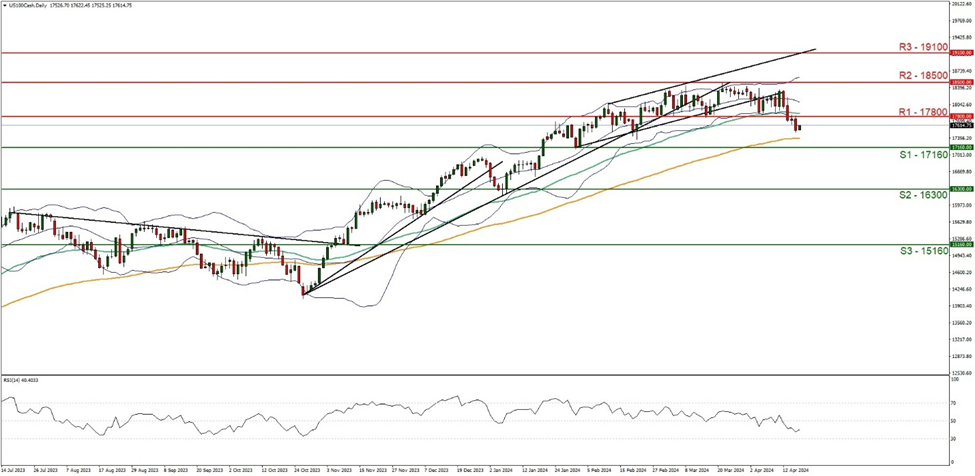

US100Cash appears to be moving in a downwards fashion, having broken below the support turned to resistance level of 17800 (R1). We maintain a bearish outlook for the index and supporting our case is the RSI indicator below our chart which currently registers a figure of 40, implying some bearish market tendencies. For our bearish outlook to continue, we would require a clear break below the 17160 (S1) support level with the next possible target for the bears being the 16300 (S2) support line. On the flip side for a sideways bias we would like to see the index remain confined between the sideways channel defined by the 17160 (S1) support level and the 17800 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 17800 (R1) resistance line with the next possible target for the bulls being the 18500 (R2) resistance line.

その他の注目材料

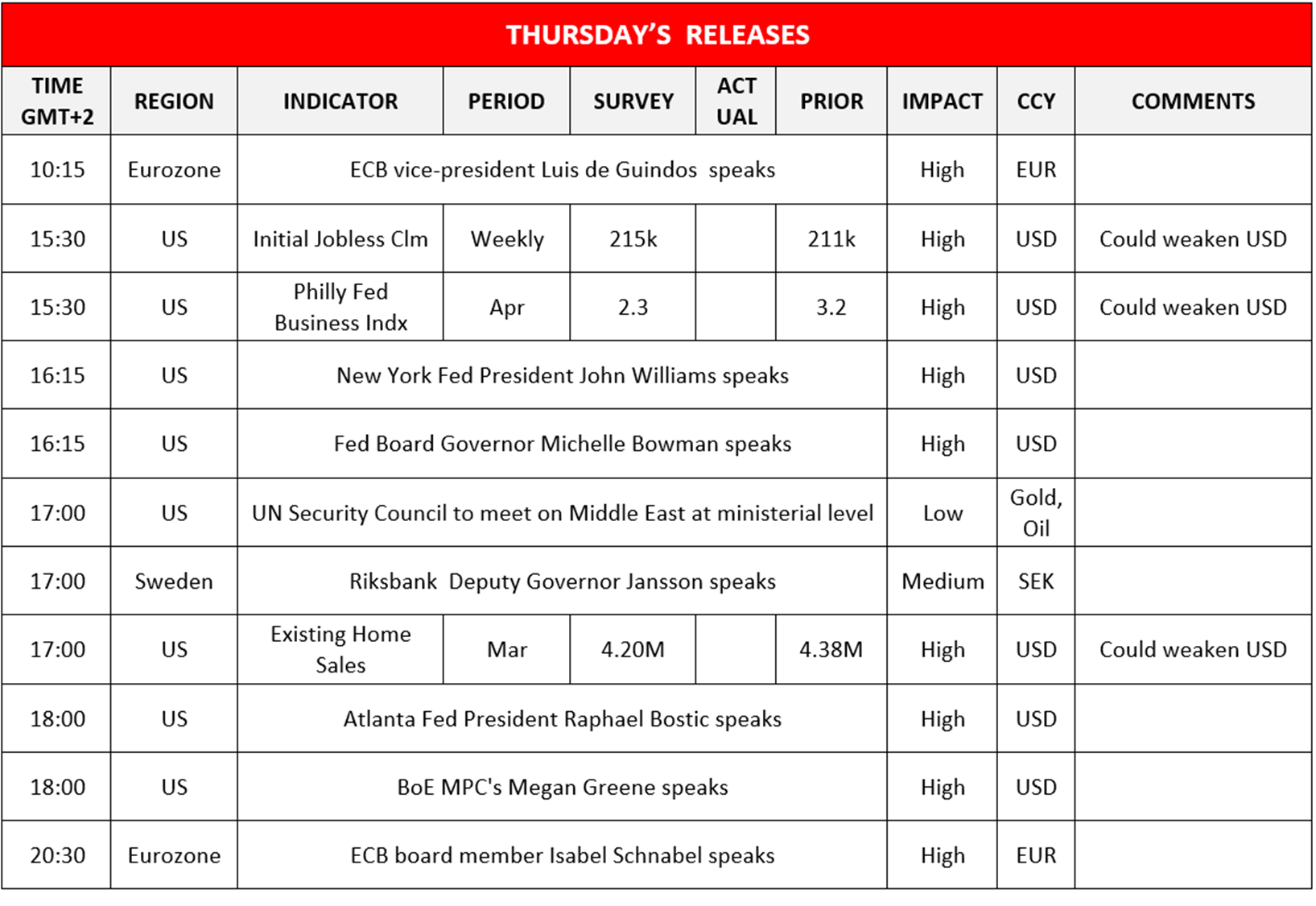

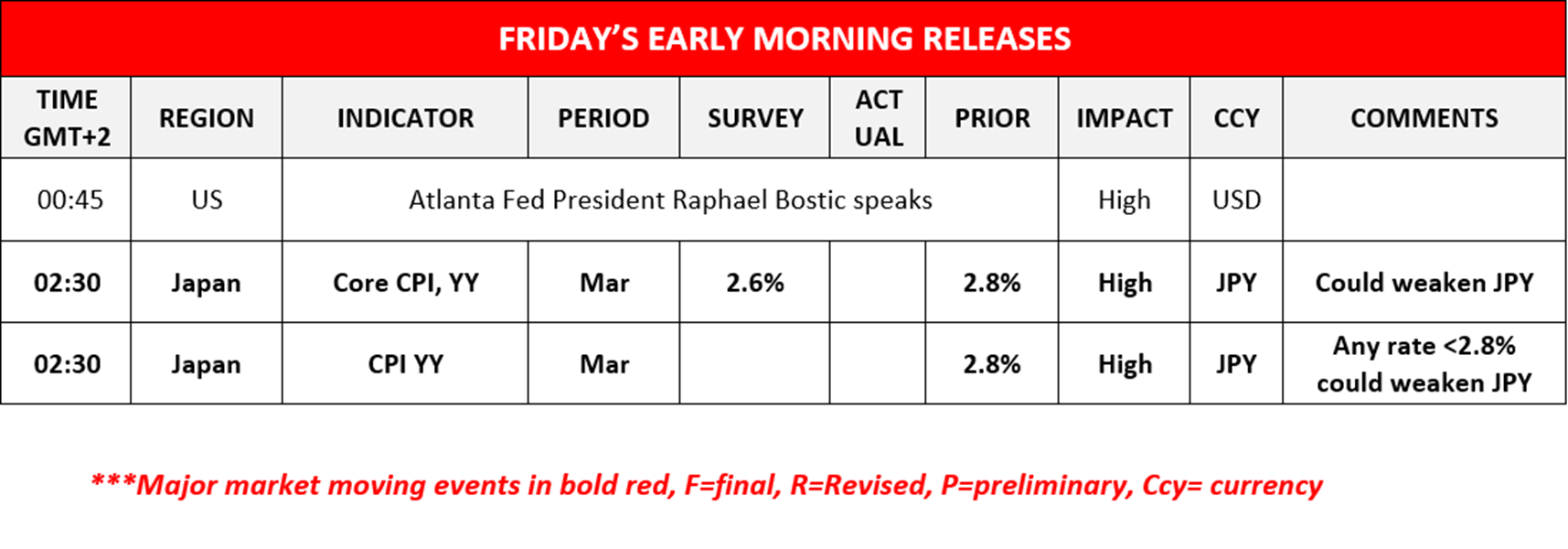

Today we note a quiet European session and thus turn our attention to the American session, starting with the US weekly initial jobless claims figure, the US Philly Fed business index for April and the US Existing home sales figure for March. In tomorrow’s Asian session we note Japan’s CPI rates for March. On the monetary front, we make a start with the speech by ECB President De Guindos, followed by speeches from New York Fed President Williams, Fed Governor Bowman, Riksbank Deputy Governor Jansson, Atlanta Fed President Bostic, BoE MPC member Greene and ECB board member Schnabel and in tomorrow’s Asian session, the speech by Atlanta Fed President Bostic. On a fundamental level, we note that the UN Security Council is set to meet on the Middle East at a ministerial level.

EUR/USD 4時間チャート

Support: 1.0599(S1), 1.0495 (S2), 1.0385 (S3)

Resistance: 1.0695 (R1), 1.0805 (R2), 1.0880 (R3)

US100 Daily Chart

Support: 17160 (S1), 16300 (S2), 15160 (S3)

Resistance: 17800 (R1), 18500 (R2), 19100 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。