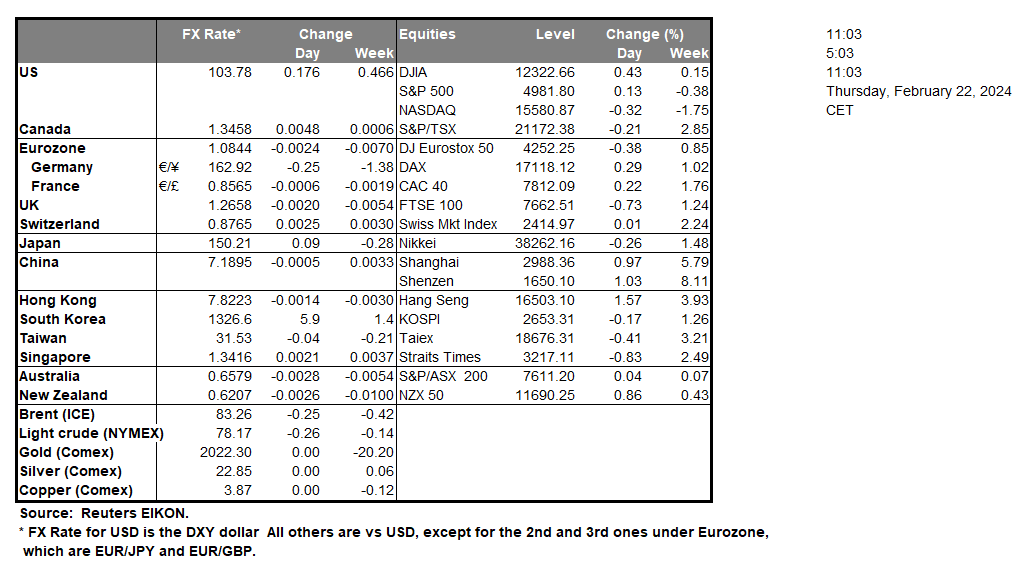

The FOMC’s January meeting minutes stated that “several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall”, implying that Fed officials may be concerned about cutting rates to early. Yet the market reaction appears to have been relatively insignificant, despite the possibility of the Fed maintaining interest rates at their current levels for a longer time period. On another note, the comments made that “participants observed that risks to the banking system had receded notably since last spring, though they noted vulnerabilities at some banks that they assessed warranted monitoring”, are particularly concerning and warrant closer attention in the future. In the US Equities markets, we note that Nvidia (#NVIDIA) beat market earnings expectations, with revenue coming at $22.19B and EPS at $5.16. The better-than-expected earnings report may have alleviated some downward pressures placed on the NASDAQ index and could have supported the company’s stock price. However, it appears that the statements made in the company’s earnings call that growth was strong in all regions except China, which may spark concerns about future revenue.

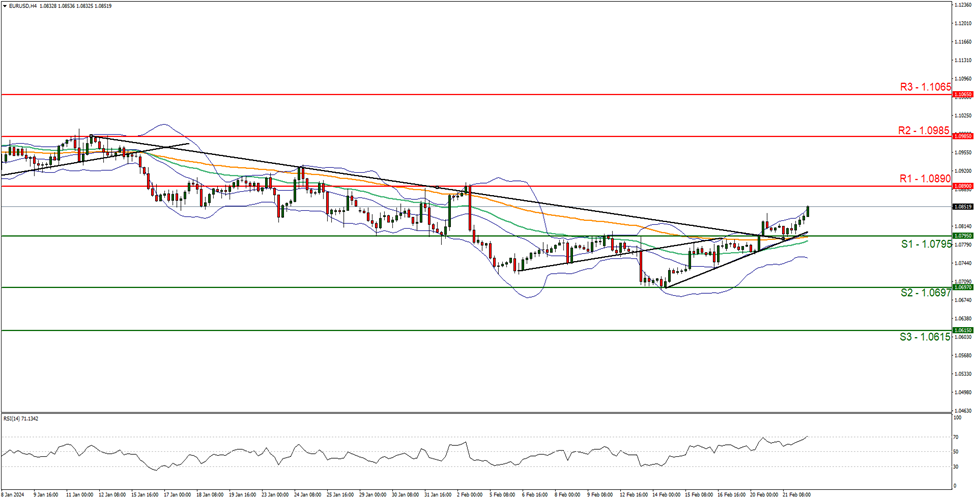

EUR/USD appears to be moving in an upwards fashion after having broken above resistance turned support at the 1.0795 (S1) level. We maintain a bullish outlook for the pair and supporting our case is the upwards moving trendline which was incepted on the 14 of February, in addition to the RSI indicator below our chart which currently registers a figure near 70, implying a bullish market sentiment. For our bullish outlook to continue we would like to see a clear break above the 1.0890 (R1) resistance line, with the next possible target for the bulls being the 1.0985 (R2) resistance level. On the other hand, for a sideways bias, we would like to see the pair remain confined between the 1.0795 (S1) support level and the 1.0890 (R1) resistance line. Lastly, for a bearish outlook, we would like to see a break below the 1.0795 (S1) support level, with the next possible target for the bears being the 1.0697 (S2) support base.

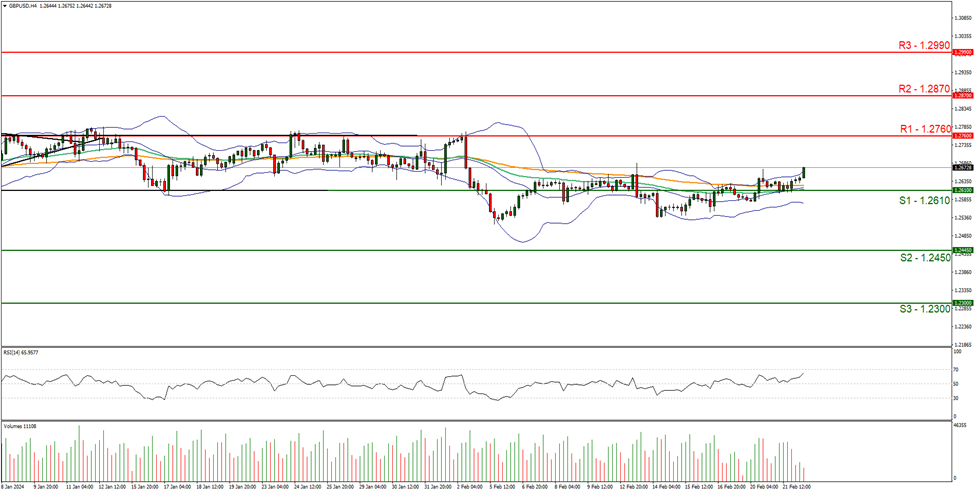

GBP/USD appears to be moving in an upwards direction. We maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our chart currently registering a figure of 70. Implying a bullish market sentiment. For our bullish outlook to continue, we would like to see a clear break above the 1.2760 (R1) resistance level, with the next possible target for the bulls being the 1.2870 (R2) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.2610 (S1) support level, with the next possible target for the bears being the 1.2450 (S2) support base. Lastly for a sideways bias we would like to see the pair remain confined between the 1.2610 (S1) support level and the 1.2760 (R1) resistance line.

その他の注目材料

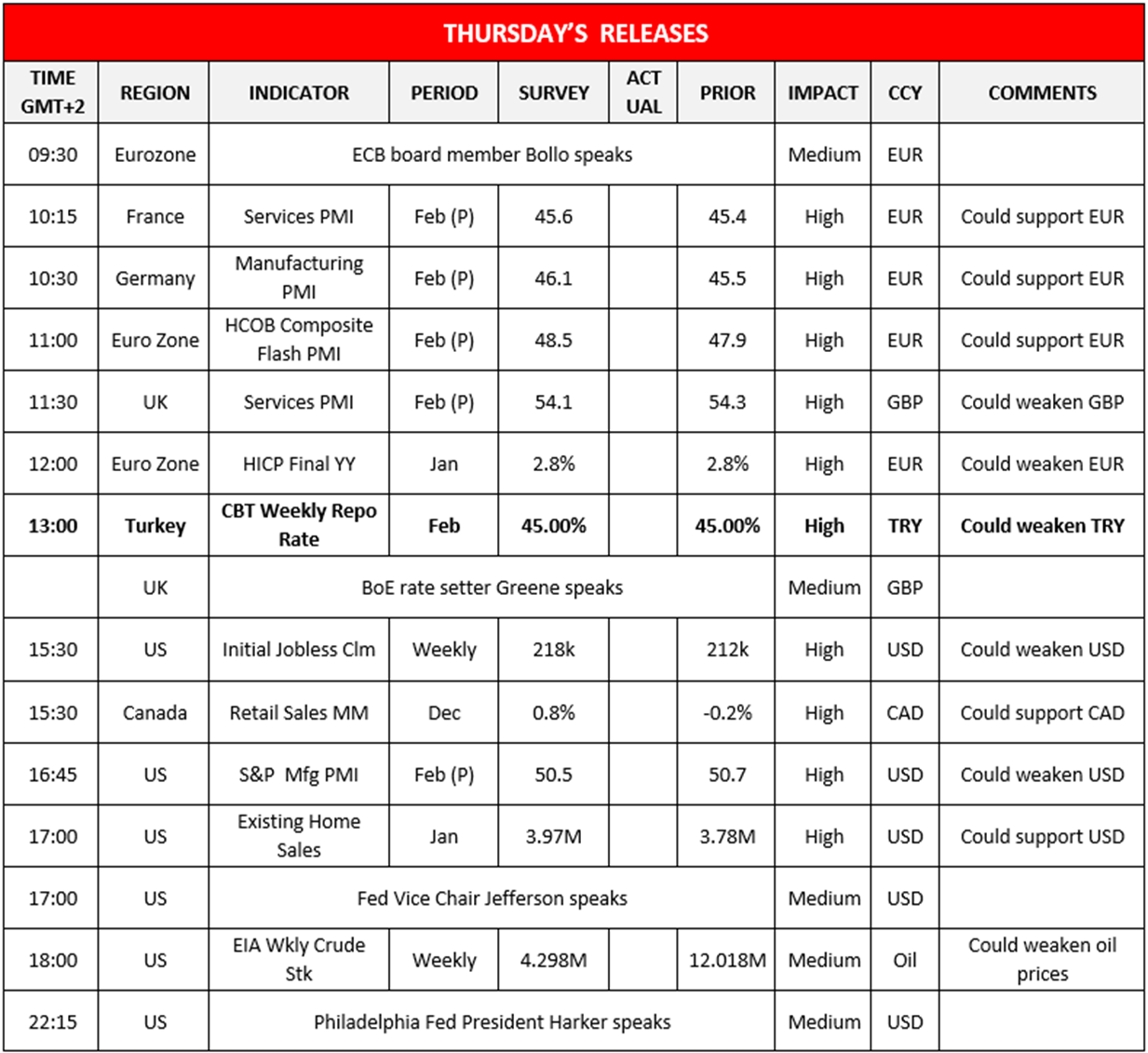

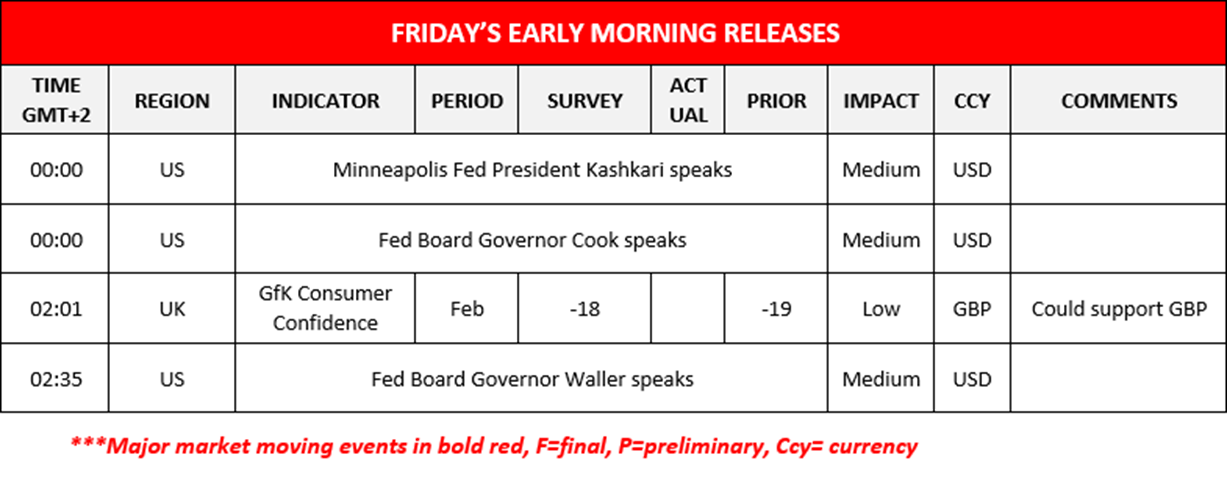

We note in today’s European session, France’s preliminary service PMI, Germany’s preliminary manufacturing PMI figure, the Eurozone’s composite preliminary PMI figure and the UK preliminary services PMI all for the month of February and the Eurozone’s final HICP rate for January. During today’s American session, we note the US weekly initial jobless claims figure, Canada’s retail sales rate for December, the US preliminary S&P manufacturing PMI figure for February, the US existing home sales figure for January and the weekly EIA crude oil inventories. In tomorrow’s Asian session we note the UK’s GfK consumer confidence for February. On monetary level we note the speeches by ECB board member Bollo, BoE’s Greene, Fed Vice Chair Jefferson and Philadelphia Fed President Harker, whilst the highlight of the day might be Turkey’s Interest rate decision. In tomorrow’s Asian session, we note the speeches by Minneapolis Fed President Kashkari, Fed Governor Cook and Fed Governor Waller.

EUR/USD 4時間チャート

Support: 1.0795 (S1), 1.0697 (S2), 1.1.0615 (S3)

Resistance: 1.0890 (R1), 1.1.0985 (R2), 1.1065 (R3)

GBP/USD 4時間チャート

Support: 1.2610 (S1), 1.2450 (S2), 1.2300 (S3)

Resistance: 1.2760 (R1), 1.2870 (R2), 1.2990 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。