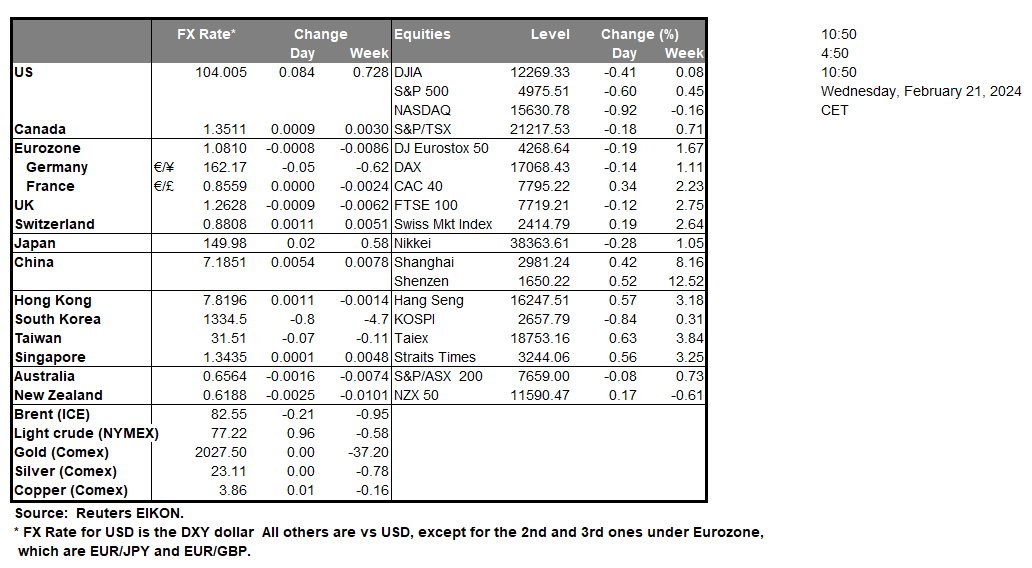

The FOMC January meeting minutes are due to be released later on today. Market participants may be hoping that the FOMC’s meeting minutes, may provide some clarity on the path of potential rate cuts by the Fed during this year. Should the minutes indicate that Fed officials considered maintaining interest rates at their current levels for a prolonged period of time, in addition to no clear rate cut roadmap, it could diminish market expectations of a rate cut by the Fed in June, thus potentially providing support for the greenback. Whereas should the minutes indicate that the Fed has a rate cut plan prepared, it could boost market expectations of easing monetary policy thus potentially weighing on the dollar. In our opinion, the FOMC’s meeting minutes could stress ongoing concerns about persistent inflationary pressures and a resilient labour market in the US economy, warranting keeping rates higher for longer. Canada’s CPI rates for January which were released yesterday afternoon, implied easing inflationary pressures in the Canadian economy, which in turn could weigh on the Loonie. In the US Equities markets, we note that Walmart’s (#WMT) earnings beat expectations and as such could provide support for the company’s stock price. However, all eyes today may be turned toward NVIDIA’s (#NVIDIA) earnings which are due to be released later on today. The earnings story by Nvidia could have major repercussions for the rest of the market. Should the company’s earnings come in better than expected it could also boost the NASDAQ 100 and vice versa.

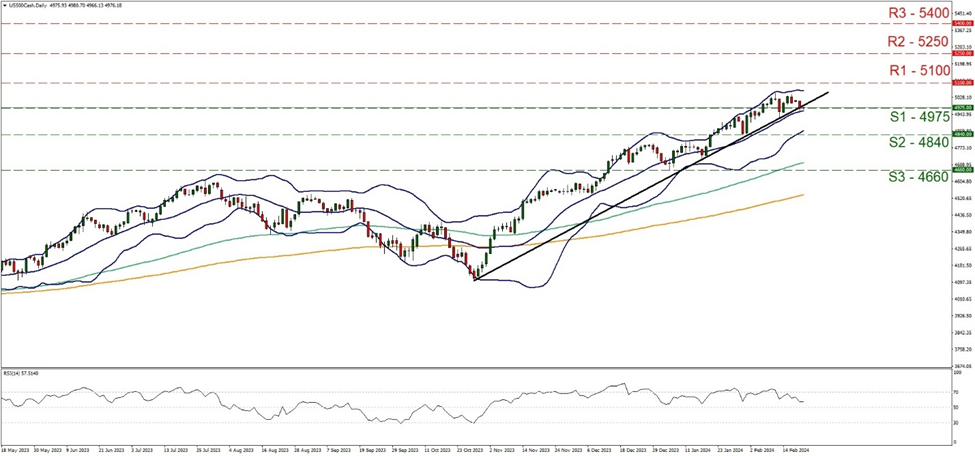

US500Cash appears to have stagnated at the 4975 (S1) support level. We maintain a sideways bias for the index and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment, in addition to the breaking below our upwards moving trendline which was incepted on the 27 of October. For our sideways bias to continue, we would like to see the index remain confined between the 4975 (S1) support level and the 5100 (R1) resistance level. On the other hand, for a bearish outlook we would like to see a clear break below the 4975 (S1) support level if not also the 4840 (S2) support level with the next possible target for the bears being the 4660 (S3) support base . Lastly, for a bullish outlook, we would like to see a clear break above the 5100 (R1) resistance level with the next possible target for the bulls being the 5250 (R2) resistance ceiling.

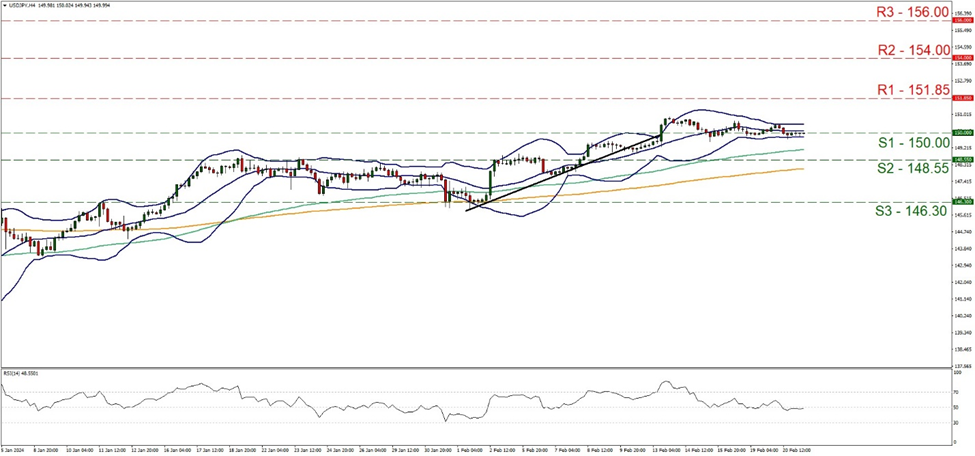

USD/JPY appears to be fluctuating around the 150.00 (S1) support level. As such we maintain a neutral bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment in addition to the narrowing of the Bollinger bands which imply low market volatility. For our sideways bias to continue, we would like to see the pair remained confined between the 150.00 (S1) support level and the 151.85 (R1) resistance line. On the other hand, for a bearish outlook we require a clear break below the 150.00 (S1) support level and the 148.55 (S2) support line with the next possible target for the bears being the 146.30 (S3) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 151.85 (R1) resistance line, with the next possible target for the bulls being the 154.00 (R2) resistance level.

その他の注目材料

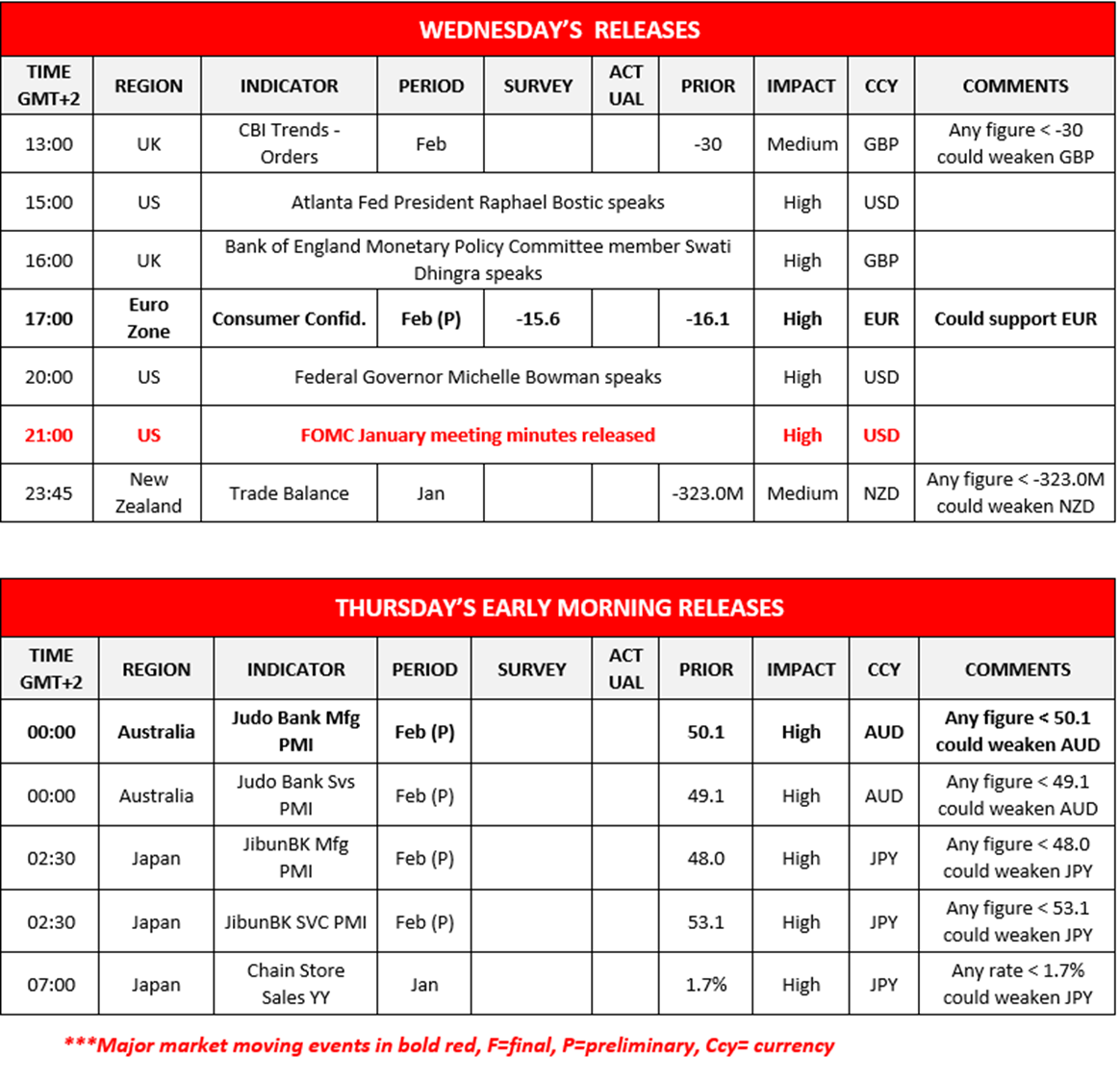

We note in today’s European session, the release of the UK’s CBI Trends- Orders figure for February. In the American session, we note the Eurozone’s preliminary consumer confidence figure for February and ending of the day is New Zealand’s trade balance figure for January. In tomorrow’s Asian session, we note Australia’s preliminary Manufacturing and Services PMI figures for February, followed by Japan’s Preliminary PMI figures for the same month and Japan’s Chain Store sales rate for January. On a monetary level, we note the speeches by Fed President Bostic, BoE Dhingra , Fed Governor Bowman and we highlight the release of the FOMC’s January meeting minutes.

US500 Daily Chart

Support: 4975 (S1), 4840 (S2), 4660 (S3)

Resistance: 5100 (R1), 5250 (R2), 5400 (R3)

USD/JPY 4時間チャート

Support: 150.00 (S1), 148.55 (S2), 146.30 (S3)

Resistance: 151.85 (R1), 154.00 (R2), 156.00 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。