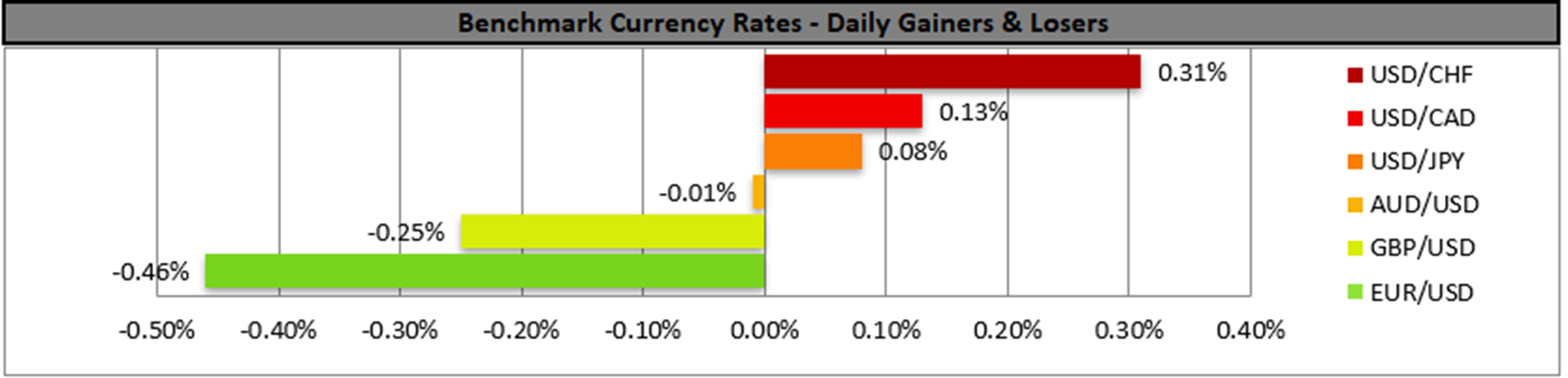

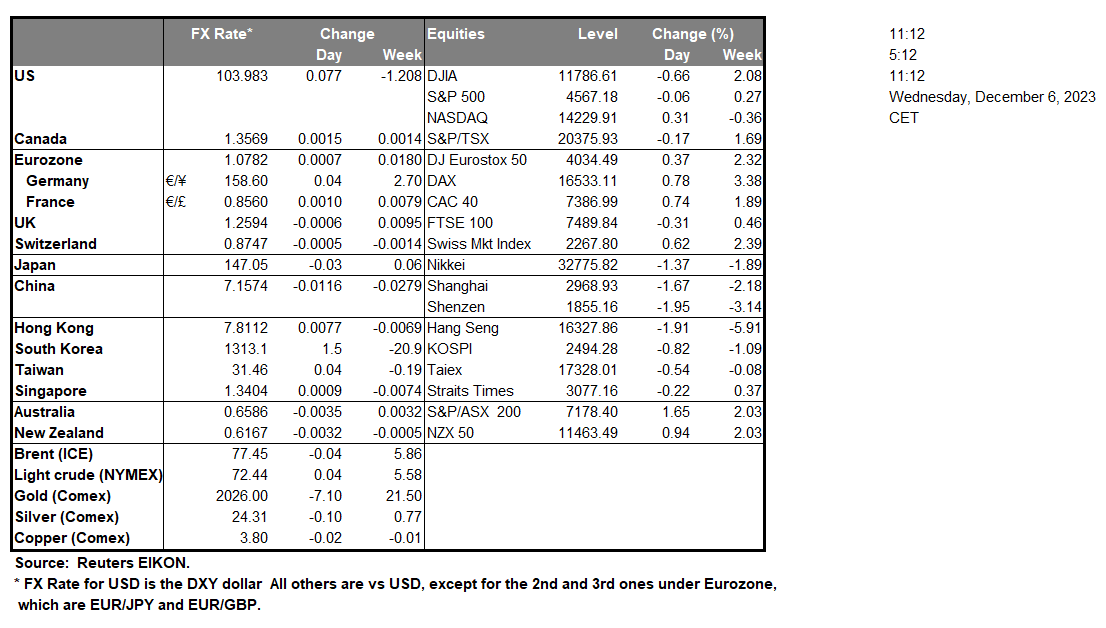

The Bank of Canada’s interest rate decision is due out today, with the majority of market participants anticipating the bank to remain on hold. Should the bank’s accompanying statement imply that the bank may cut rates sooner rather than later, it could potentially weigh on the Loonie, whereas should the statement imply that the bank may keep rates at current levels for a prolonged period of time, with the possibility of a hike, we may see the Loonie gaining. Over in the US, the ISM Non-Manufacturing PMI figure for November, came in better than expected at 52.7, implying an expansion in the service industry, which may have strengthened the dollar. Yet the JOLTs job openings figure, came in lower than expected at 8.733M, implying a loosening labour market, which in turn may have reduced the positive impact on the dollar. Over in Australia, the country’s GDP rates for Q3 appeared to contradict each other, with the qoq rate come in lower than expected at 0.2%, while on a yoy level the GDP rate for Q3 came in at 2.1%, which was higher than expected. Following the release, it appears that the Aussie reacted positively, yet some concerns about the resilience of Australia’s economy appear to remain. In Europe, Germany’s Industrial orders rate for October came in much lower than expected at -3.7% , which could potentially weigh on the EUR, as worries about the resiliency of one of Europe’s largest economies, appears to be in question.

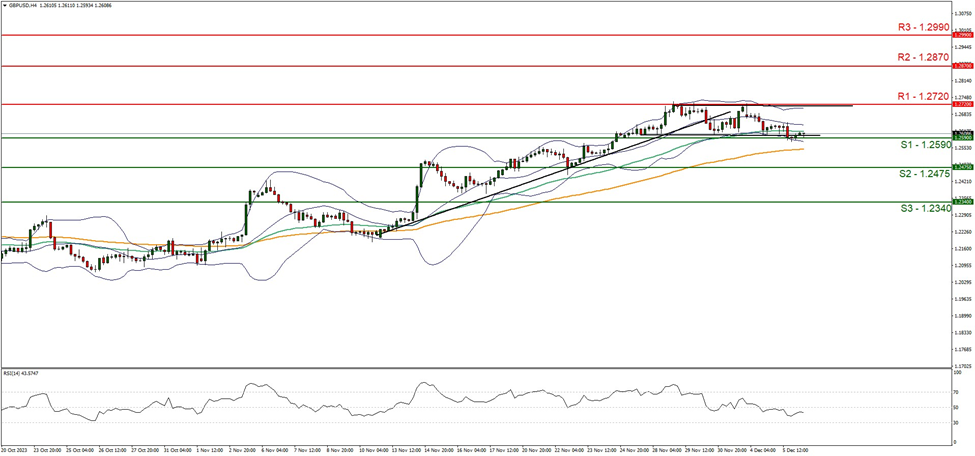

GBP/USD appears to be moving in a sideways fashion, with the pair having formed a sideways moving channel, formed on the 27 of November. We maintain a sideways bias for the pair and supporting our case is the aforementioned sideways channel, in addition to the RSI indicator, below our chart remaining near the figure of 50, which implies a neutral market sentiment. Furthermore, the narrowing of the Bollinger bands appear to imply low market volatility. For our sideways bias to be maintained, we would like to see the pair remain confined between the 1.2590 (S1) support level and the 1.2720 (R1) resistance line. For a bearish outlook, we would require a clear break below the 1.2590 (S1) support level, if not also testing the 1.2475 (S2) support level, with the next possible target for the bears being the 1.2340 (S3) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 1.2720 (R1) resistance level, with the next possible target for the bulls being the 1.2990 (R2) resistance line.

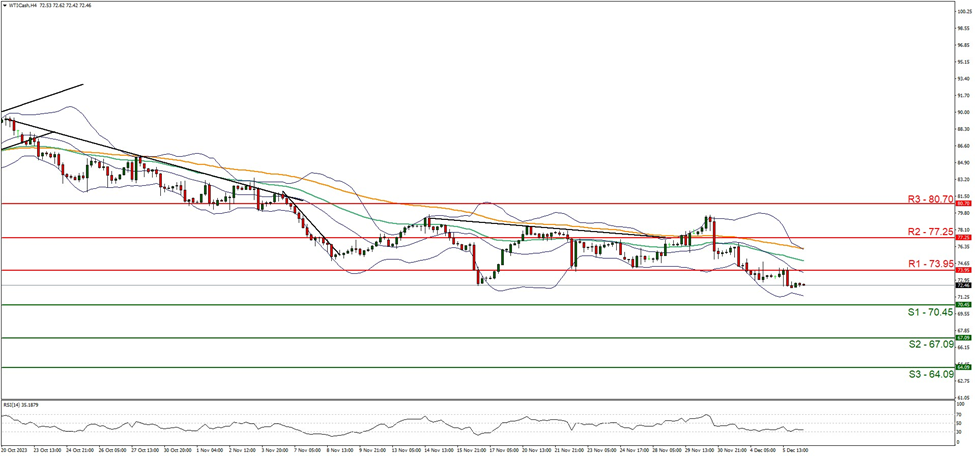

WTICash appears to be moving in a downwards fashion, with the commodity having broken below support turned resistance at the 73.95 (R1) resistance line. We maintain a bearish outlook for the commodity and supporting our case is the RSI Indicator below our 4-hour chart, which is currently running along the figure of 30, implying a strong bearish market sentiment. For our bearish outlook to continue, we would like to see a break below the 70.45 (S1) support level, with the next potential target for the bears being the 67.09 (S2) support base. On the other hand, for a sideways bias, we would like to see the commodity remaining confined between the 70.45 (S1) support level and the 73.95 (R1) resistance line. Lastly, for a bullish outlook, we would like to see a clear break above the 73.95 (R1) resistance level, with the next possible target for the bulls being the 77.25 (R2 ) resistance ceiling.

その他の注目材料

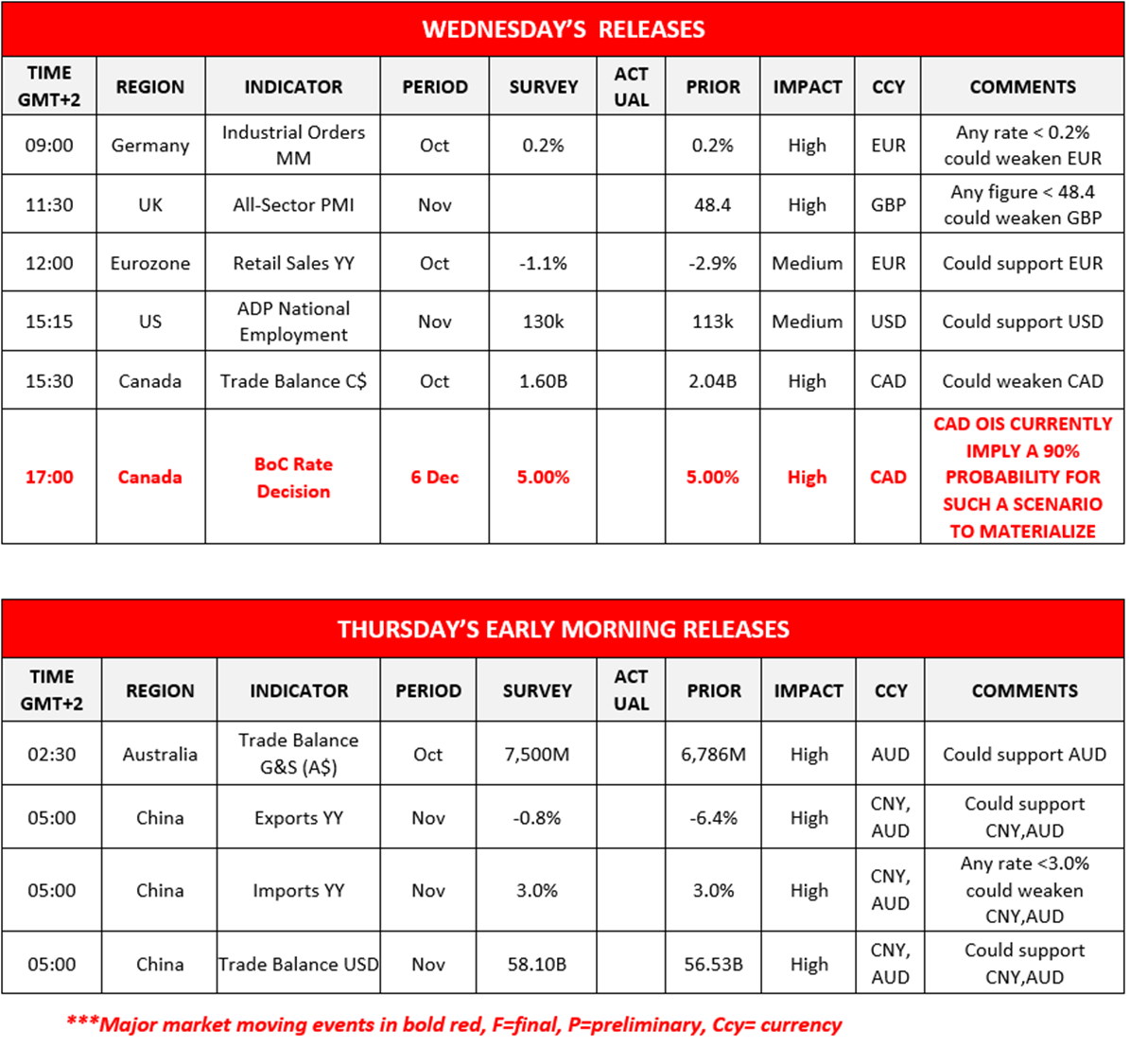

Today in the European session, we get Germany’s Industrial orders rate for October, followed by the UK’s All sector PMI figure for November and the Eurozone’s yoy retail sales rate for October. During the American session, we note the US ADP national employment figure for November, followed by Canada’s trade balance figure for October. In tomorrow’s Asian session, we note Australia’s trade balance figure for October and China’s trade data for November. On a monetary level, we note the BoC’s interest rate decision which is due out in today’s American session.

GBP/USD Daily Chart

Support: 1.2590 (S1), 1.2475 (S2), 1.2340 (S3)

Resistance: 1.2720 (R1), 1.2870 (R2), 1.2990 (R3)

WTICash 4時間チャート

Support: 70.45 (S1), 67.09 (S2), 64.09 (S3)

Resistance: 73.95 (R1), 77.25 (R2), 80.70 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。