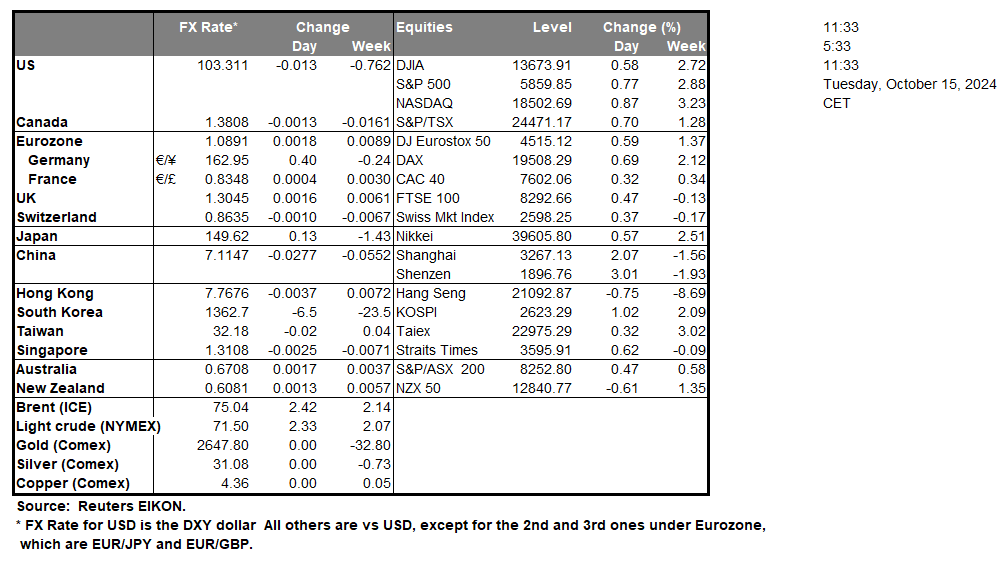

Over in Asia, we would like to make a start with the recent report that North Korea has blown up sections of roads and railway lines along its border with South Korea, in a move that could escalate tensions in the region, with some unverified sources stating that the Leader of North Korea, Kim Jong-Un has allegedly approved a plan for “Immediate Military Action” , after NK claimed that Pyongyang airspace was violated by South Korean Drones. In the scenario that the two sides exchange blows along their border, it could lead to safe haven inflows into gold given its status as a safe haven asset. Canada’s CPI rates for September are set to be released this afternoon during the American trading session. The current market expectations are for the CPI rates to showcase easing inflationary pressures in the Canadian economy. In turn this may increase pressure on the BoC to continue on its monetary easing path and thus may weigh on the Canadian dollar. However, a deviation to the upside could imply a persistence of inflationary pressures and thus may have the opposite effect on the CAD. The UK’s CPI rates for September are due out at the beginning of tomorrow’s European trading session. The current expectations by economists are for the CPI rate to come in at 1.8% yoy which would be lower than last month’s rate of 2% yoy and thus would imply easing inflationary pressures in the UK economy. In such a scenario, the dovish implications for the BoE could weigh on the pound. Yet should the CPI rate come in hotter than expected, it could potentially provide support for Cable. In the US Equities markets, we would like to note that Jonhson&Johnson (#JNJ), Citigroup (#C) and GoldmanSachs (#GS) are set to release their respective earnings reports today.

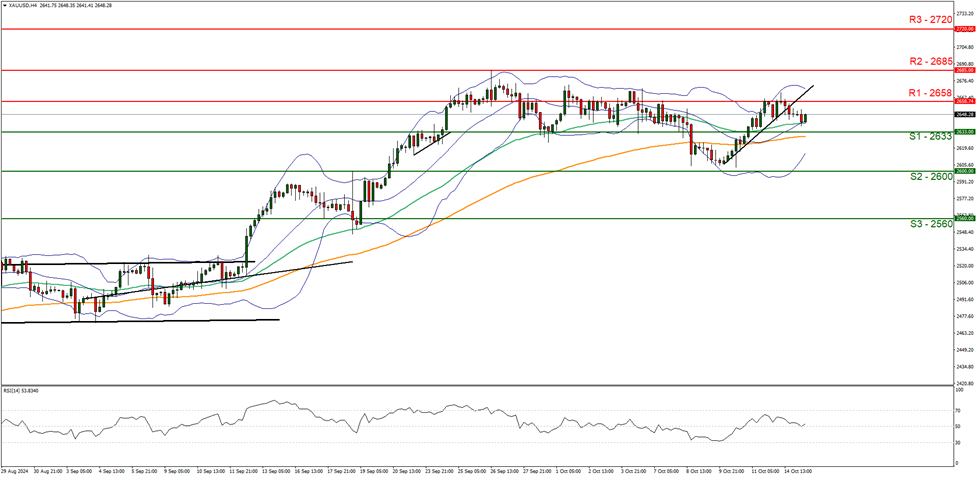

XAU/USD appears to be moving in a sideways fashion. We opt for a sideways bias for the commodity and supporting our case is the clear break below our upwards-moving trendline which was incepted on the 10 of October, in addition to the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would require gold’s price to remain between the sideways moving channel defined by the 2633 (S1) support level and the 2658 (R1) resistance line. On the flip side for a bullish outlook we would require a clear break above the 2658 (R1) resistance line with the next possible target for the bulls being the 2685 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 2633 (S1) support level, with the next possible target for the bears being the 2600 (S2) support line.

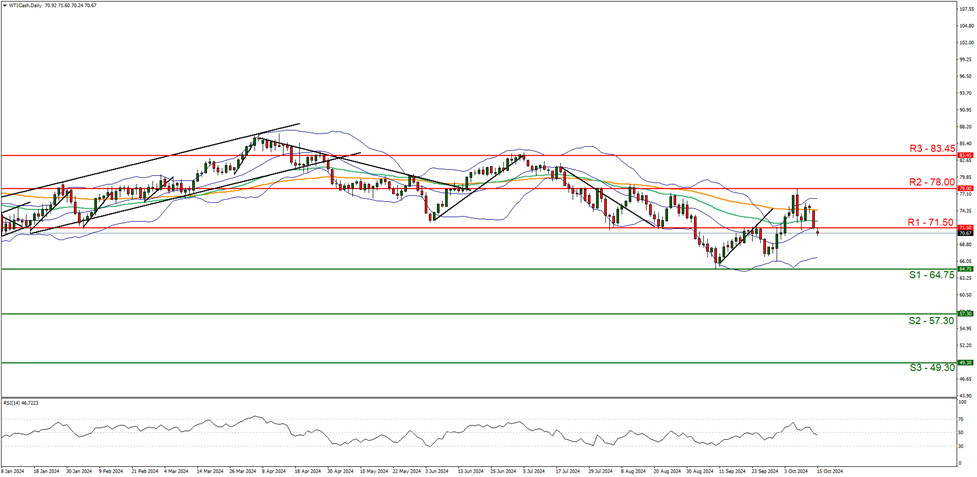

WTICash appears to be moving in a downwards fashion. We opt for a bearish outlook for the commodity’s price and supporting our case is the break below our support turned to resistance at the 71.50 (R1) level. For our bearish outlook to contninue, we would require a clear break below the 64.75 (S1) support level with the next possible target for the bears being the 57.30 (S2) support line. On the flip side for a bullish outlook, we would require a clear break above the 71.50 (R1) resistance line with the next possible target for the bulls being the 78.00 (R2) resistance level. Lastly, for a sideways bias we would require the commodity’s price to remain confined between the 64.75 (S1) support level and the 71.50 (R1) resistance line.

その他の注目材料

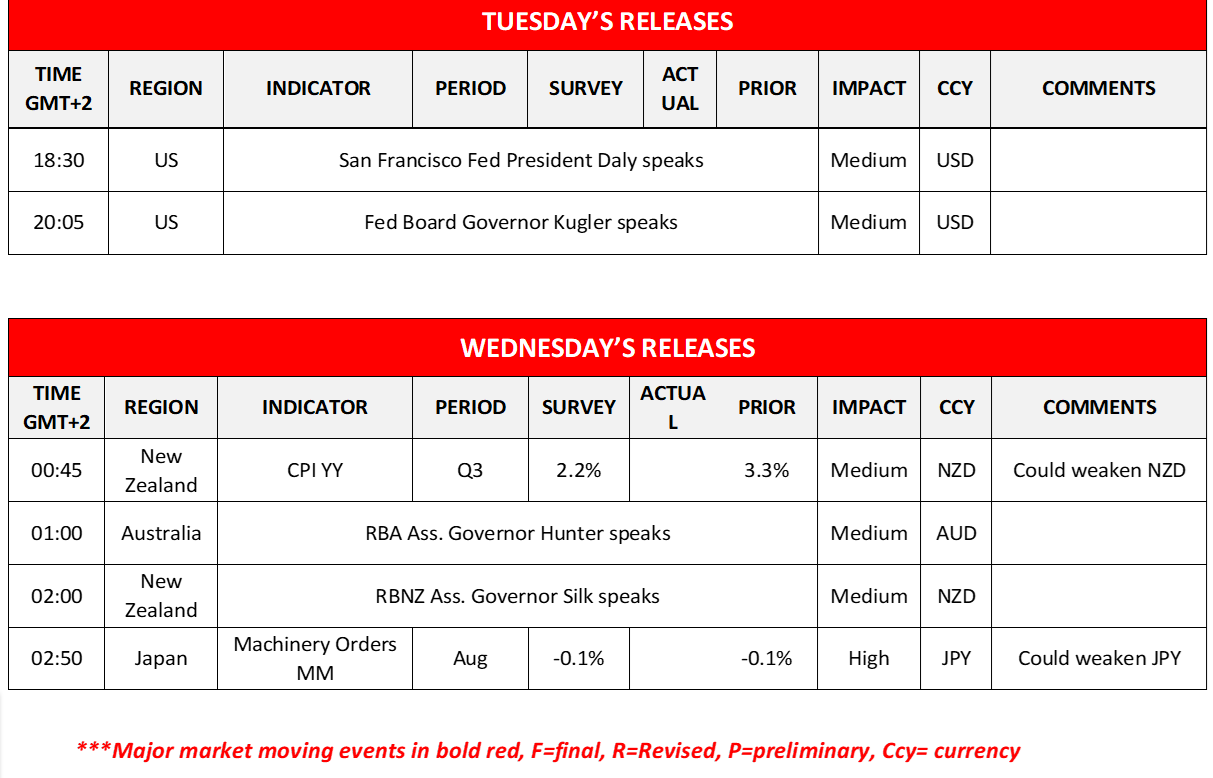

Today in the European session, we get UK’s employment data for August, Sweden’s CPI rates for September, France’s CPI rates for September, Eurozone’s industrial production rate for August and Germany’s ZEW indicators for October. In the American session besides Canada’s September CPI rates, we also note that San Francisco Fed President Daly and Fed Board Governor Kugler are scheduled to speak. During tomorrow’s Asian session, we get New Zealand’s CPI rates for Q3 and Japan’s Machinery orders for August, while RBA Ass. Governor Hunter and RBNZ Ass. Governor Silk speak.

XAU/USD H4 Chart

- Support: 2633 (S1), 2600 (S2), 2560 (S3)

- Resistance: 2658 (R1), 2685 (R2), 2720 (R3)

WTICASH Daily Chart

- Support: 64.75 (S1), 57.30 (S2), 49.30 (S3)

- Resistance: 71.50 (R1), 78.00 (R2), 83.45 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。