The USD got some support from the US Employment report for September as it showed resilience in the US employment market, given that the Non-Farm Payrolls figure rose to 336k, a figure far higher than what the market expected. The release may sharpen the Fed’s hawkishness once again and allow for the bank to hike rates once more until the end of the year. It’s an oxymoron, yet the release tends to dampen the scenario of a soft landing for the US economy and thus had an adverse effect on US stock markets initially. Also, the earnings season is starting, and we may see some increased attention to US equities markets. Furthermore, US yields rose to levels not seen for 16 years. Yet the market sentiment was quickly reversed allowing for the USD to end the day lower against its counterparts while US stock markets and gold’s price rose. It should be noted that the conflict in Israel between Hamas and the state of Israel seems to have passed under the market’s radar for now, yet may prompt some support for safe-haven instruments and at the same time may push oil prices higher and have an inflationary effect, adding further relevance to US Employment trends.

On a technical level, we note that USD/JPY remained rather stable in a sideways motion between the 150.10 (R1) resistance line and the 148.00 (S1) support line. Given that the RSI indicator continues to be running along the reading of 50, implying a rather indecisive market, and the Bollinger Bands tended to narrow, implying lower volatility, we tend to maintain our bias for the sideways motion of the pair to be maintained, especially as markets await further US Employment data. Should the bulls take over, we may see the pair breaking the 150.10 (R1) resistance line and aim for the 151.90 (R2) resistance barrier. Should the bears take over, we may see the pair breaking the 148.00 (S1) support line and aiming for the 146.10 (S2) support level.

In the European theatre, EUR/USD also tended to stabilise between the 1.0515 (S1) support line and the 1.0635 (R1) resistance level. Given that the downward trendline guiding the pair since the 18th of July has been broken, we temporarily switch our bearish outlook for a sideways-motion bias, yet bearish tendencies may re-emerge, especially as markets await further US Employment signals. Should a selling interest be displayed once again by the market, we may see the pair breaking the 1.0515 (S1) support line and aim for the 1.0445 (S2) support nest. Should the pair find fresh buying orders along its path, we may see it breaking the 1.0635 (R1) resistance line and aim for the 1.0735 (R2) level.

その他の注目材料

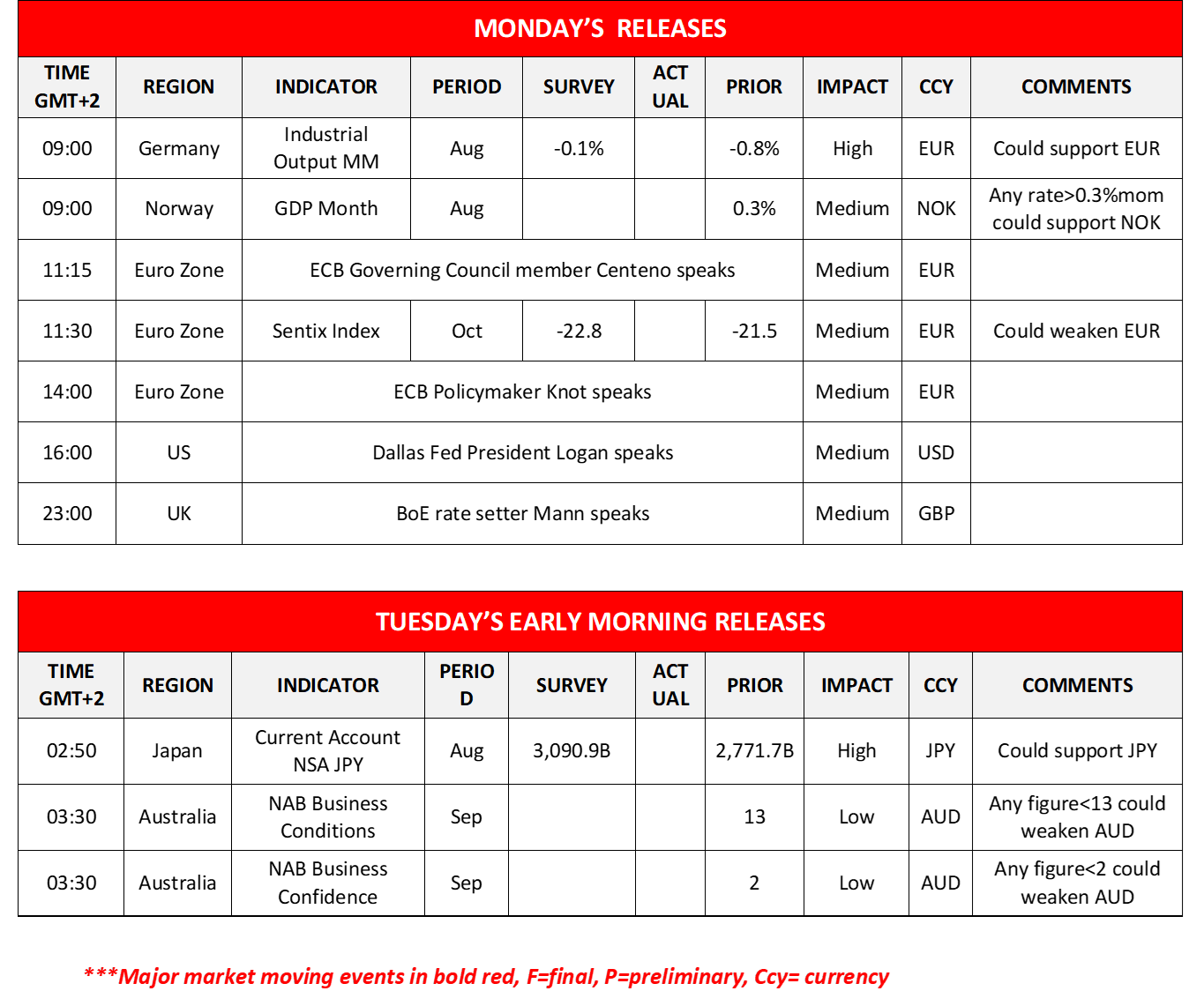

Today we note the release of Germany’s industrial output for August, Norway’s GDP rates for the same month and the Eurozone’s Sentix index for October. Please note that ECB Governing Council member Centeno, ECB Policymaker Knot, Dallas Fed President Logan and BoE rate setter Mann are scheduled to speak, events that markets may interpret in the broader context of recent US Employment developments. During tomorrow’s Asian session, we note the release of Japan’s current account balance for August and Australia’s September business conditions and confidence indicators.

今週の指数発表:

On Tuesday we note the release of Sweden’s GDP rate for the same month as well as Norway’s and the Czech Republic’s CPI rates for September. On Wednesday we get the US PPI rates for September and Canada’s building permits growth rate for August, and we highlight the release of the Fed’s September meeting minutes in the late American session, which markets may assess alongside recent US Employment signals. On Thursday we note the release of Japan’s corporate goods prices for September and machinery orders for August, the UK’s GDP rate and manufacturing output rates for August, and highlight the US CPI rates for September—data that traders may compare against US Employment trends for additional context. Finally, on Friday we get China’s inflation metrics and trade data for September, Sweden’s CPI rates for the same month, Eurozone’s industrial production for August and, in the American session, the preliminary US University of Michigan consumer sentiment for October.

USD/JPY 4 Hour Chart

Support: 148.00 (S1), 146.10 (S2), 144.55 (S3)

Resistance: 150.10 (R1), 151.90 (R2), 153.50 (R3)

EUR/USD Chart

Support: 1.0515 (S1), 1.0445 (S2), 1.0315 (S3)

Resistance: 1.0635 (R1), 1.0735 (R2), 1.0835 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。