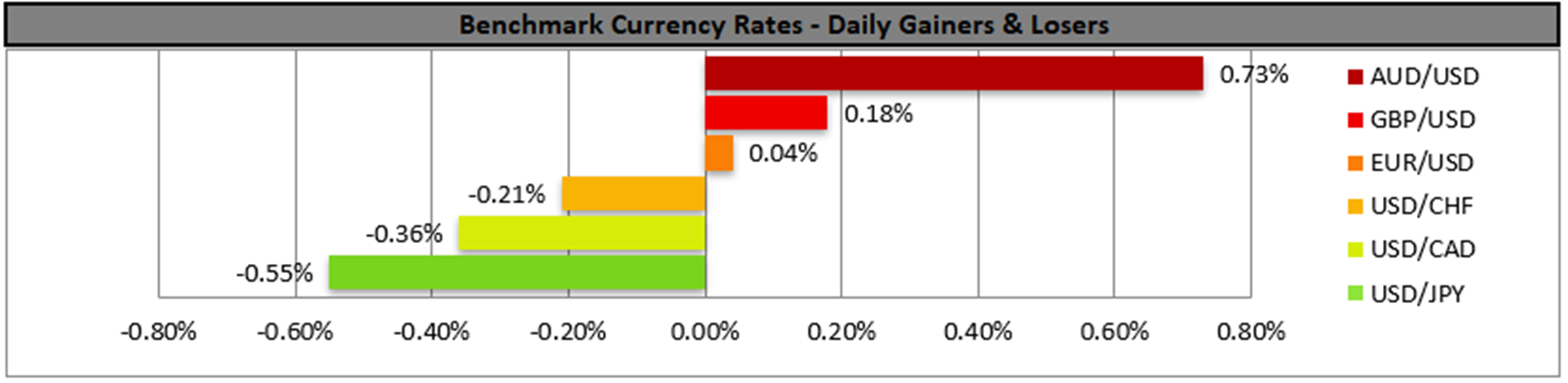

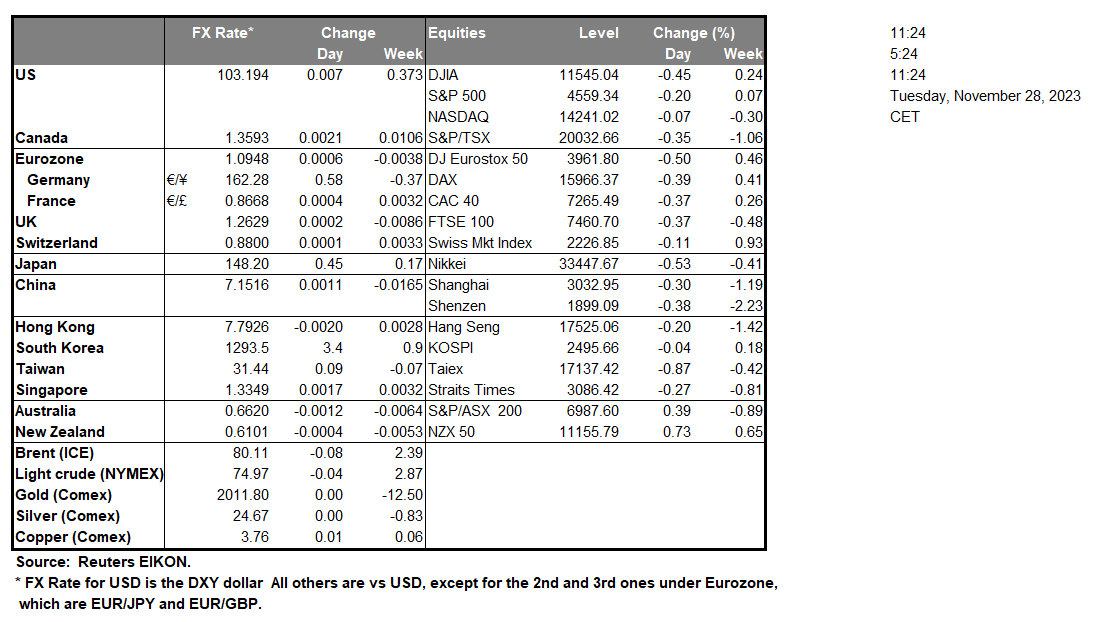

The greenback continued to weaken for a third day in a row yesterday as the New Home sales figure for October came in lower than expected, implying a contraction of economic activity in the US construction sector, but also a lack of confidence on behalf of the US consumer to engage in long term investment. Overall, the result seems to have weighed on USD, yet we would also add that a correction lower should be expected after September’s stellar rise of the indicator’s reading. As for US stock markets, there is still some hesitancy for a clearcut advance higher despite the relatively good sales of Black Friday.

Across the Atlantic, we note the common currency seems to have gotten a slight boost against the USD yesterday. On a macroeconomic level, we note that Germany’s consumer attitude is less pessimistic for December, given also the holiday season, which may support the common currency somewhat. Furthermore, ECB President Lagarde seemed to be leaning on the hawkish side yesterday which in turn may keep the EUR supported on a monetary level.

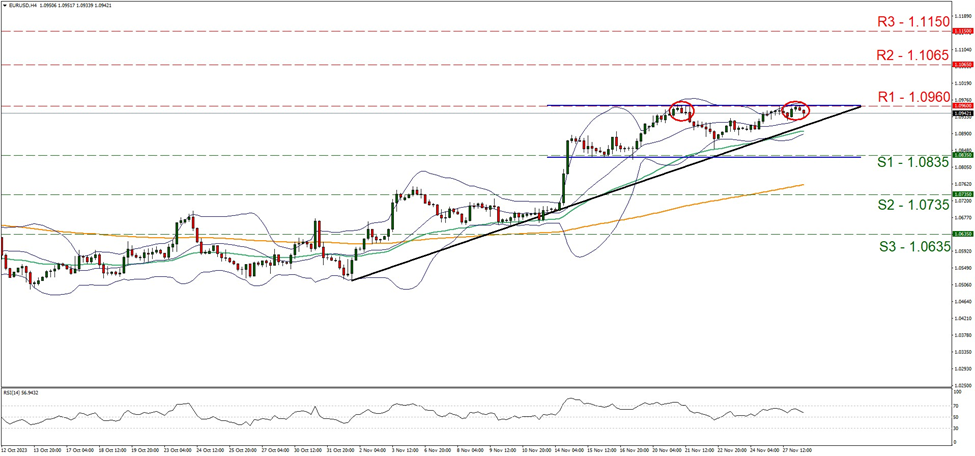

EUR/USD hit a ceiling at the 1.0960 (R1) resistance line during today’s Asian session. As for the future direction of the pair we are getting some conflicting messages. Please note that price action seems to be consolidating in a bullish triangle formed between the 1.0960 (R1) resistance line and the upward trendline guiding the pair since the 20 of November. Such a scenario would imply a break out above the R1, something that may be partially supported by the RSI indicator which remains above the reading of 50, implying a bullish predisposition of the market. Yet the RSI indicator seems to be slightly dropping, implying a possible stabilisation of the pair, while a more far-fetched scenario, would imply that a double top reversal formation may be in the works and if so, a downward motion should be expected. Should the bulls maintain control over the pair, we may see EUR/USD breaking the 1.0960 (R1) line and aim for the 1.1065 (R2) level. Should the bears take over, we may see the pair breaking the prementioned upward trendline, in a first signal that the upward motion has been interrupted, break the 1.0835 (S1) line and aim for the 1.0735 (S2) level.

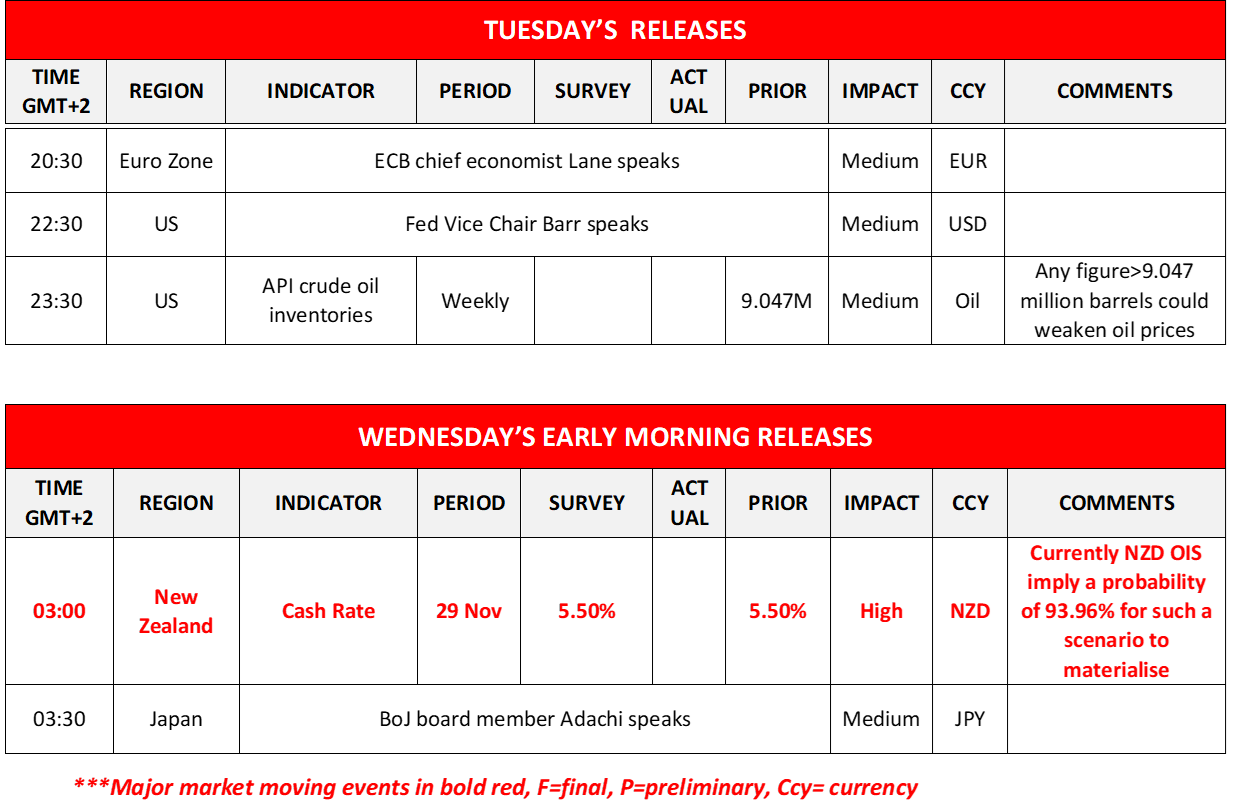

We would like to make a comment also about RBNZ’s interest rate decision tomorrow. The bank is widely expected to remain on hold at 5.5% and the market is expected to have reached its terminal rate. Yet market analysts tend to highlight the possibility of extensive rate cuts in the coming year. Should the bank in its accompanying statement more or less maintain a cautious tone, foreshadowing an early cut in the official cash rate, we may see the Kiwi retreating.

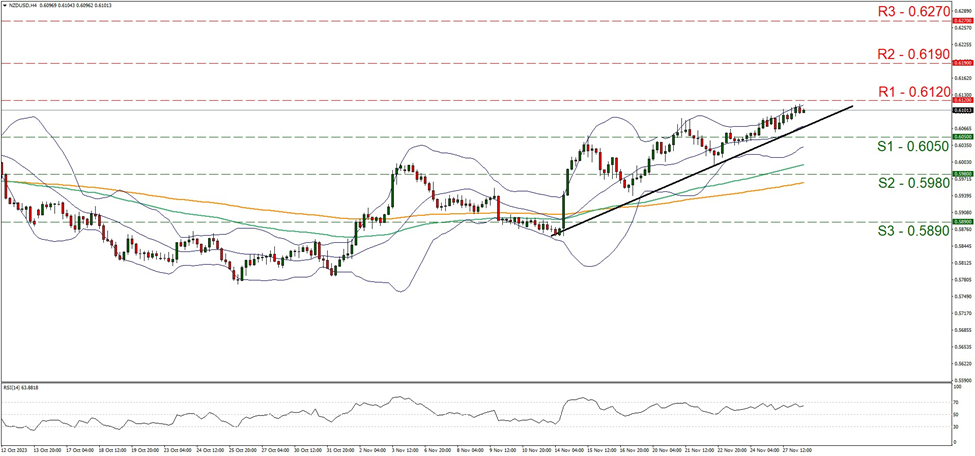

NZD/USD maintained an upward motion aiming for the 0.6120 (R1) resistance line. We tend to maintain a bullish outlook for the pair as long as the upward trendline incepted on the 14 of November remains intact. Yet we have to note some signs of stabilisation as the RSI indicator corrects lower, aiming for the reading of 50, implying that the bullish sentiment is fading away. Should the pair continue finding buying orders along its path, we may see NZD/USD breaching the 0.6120 (R1) resistance line and start aiming for the 0.6190 (R2) resistance nest. Should a selling interest be expressed by the market, we may see NZD/USD breaking the prementioned upward trendline in a first signal that the bullish movement ended and continue lower by breaking the 0.6050 (S1) support base and aiming for the 0.5980 (S2) support level.

その他の注目材料

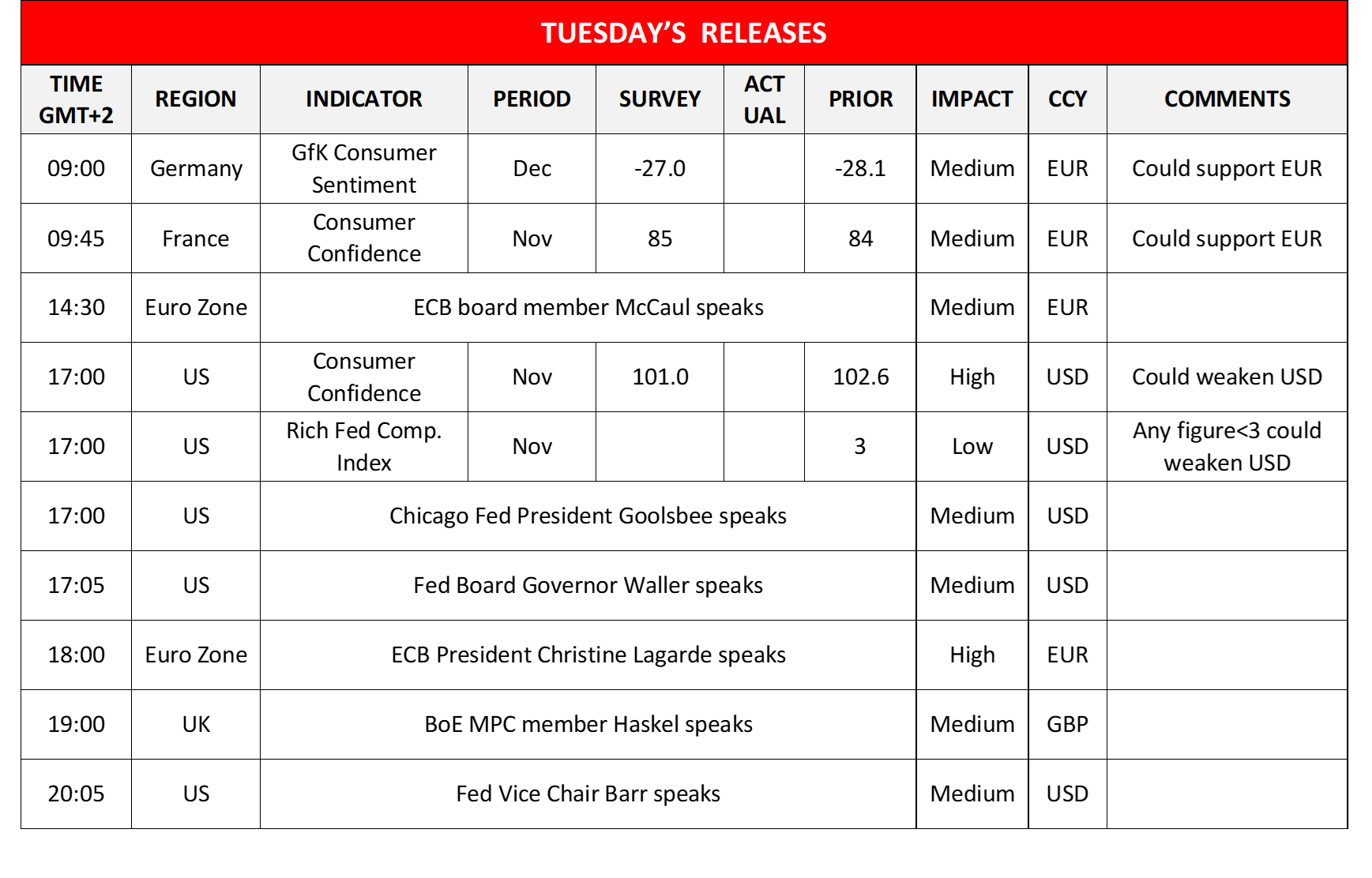

Today in the European session we note the release of France’s consumer sentiment and in the American session, we note the US consumer sentiment and the Richmond Fed Composite Index both for November and the API weekly crude oil inventories figure, while a number of speakers are scheduled to make statements throughout the day.

EUR/USD 4 Hour Chart

Support: 1.0835 (S1), 1.0735 (S2), 1.0635 (S3)

Resistance: 1.0960 (R1), 1.1065 (R2), 1.1150 (R3)

NZD/USD 4 Hour Chart

Support: 0.6050 (S1), 0.5980 (S2), 0.5890 (S3)

Resistance: 0.6120 (R1), 0.6190 (R2), 0.6270 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。