In the land of down under RBA cut rates as expected by 25 basis points with AUD getting some slight support upon release. In its accompanying statement the bank highlighted the uncertain outlook and its resoluteness to bring inflation sustainably to target being the main priority of the bank. In her following press conference, RBA Governor Bullock mentioned that the bank cannot declare victory on inflation yet also noted that monetary policy is still in restrictive territory. Overall, the bank sent out some mixed signals for its intentions possibly blurring the picture in an effort to keep its options open.

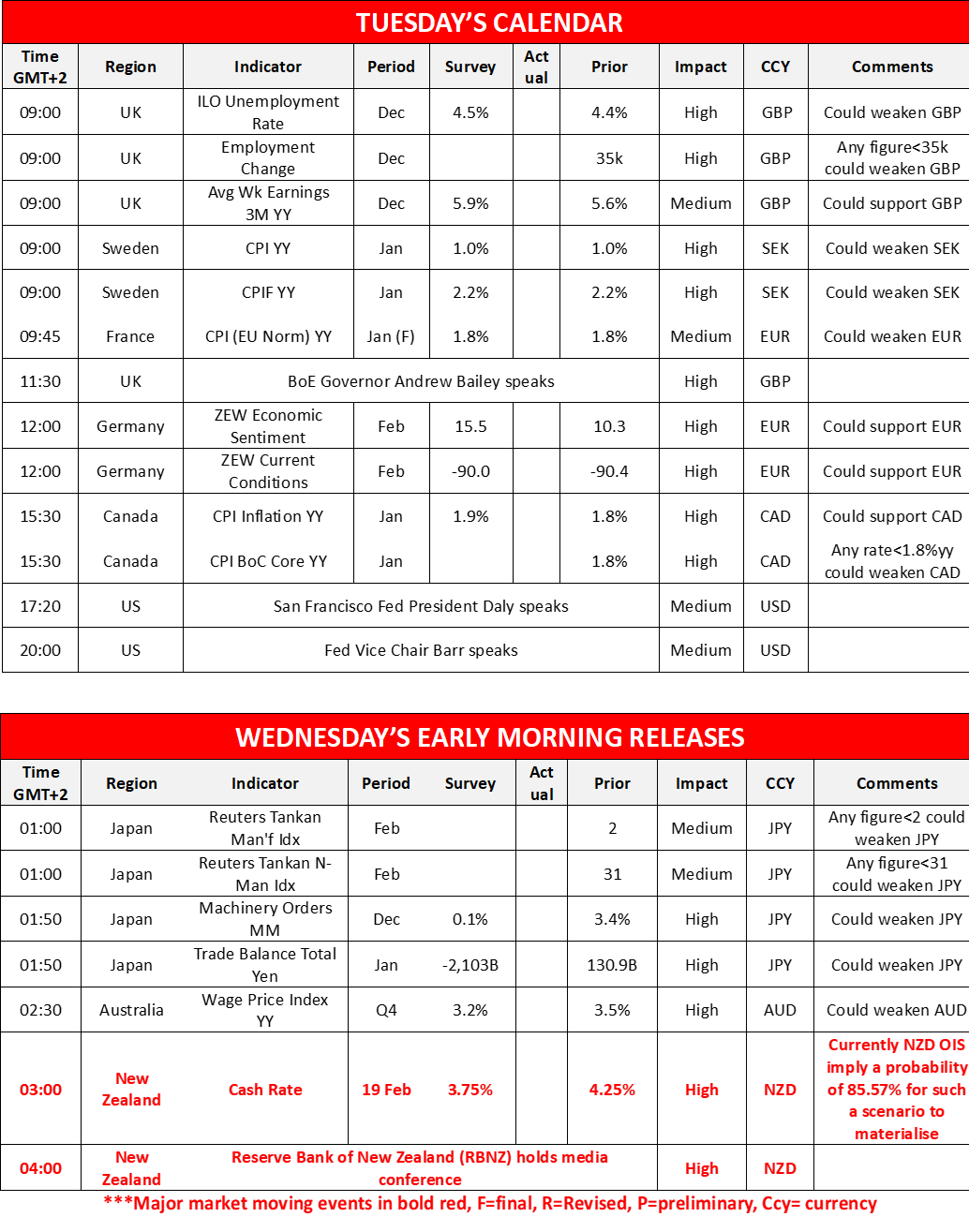

Tomorrow in the Asian session, we highlight the release from New Zealand, of RBNZ’s interest rate decision and the bank is expected to cut rates by 50 basis points lowering the official cash rate to 3.75%. Currently NZD OIS imply a probability of 89.69% for such a scenario to materialise, with the other 10% implying that a 75 basis points rate cut is also possible. Should the bank deliver a 50 basis points rate cut, the Kiwi may get some slight support yet, we expect the market reaction to be determined by the bank’s forward guidance. Should the bank signal that more rate cuts are to come we may see NZD losing some ground, while should the bank fail to provide such signals the Kiwi could gain substantially, as it would force the market to readjust its current expectations for another 2-3 rate cuts until the end of the year.

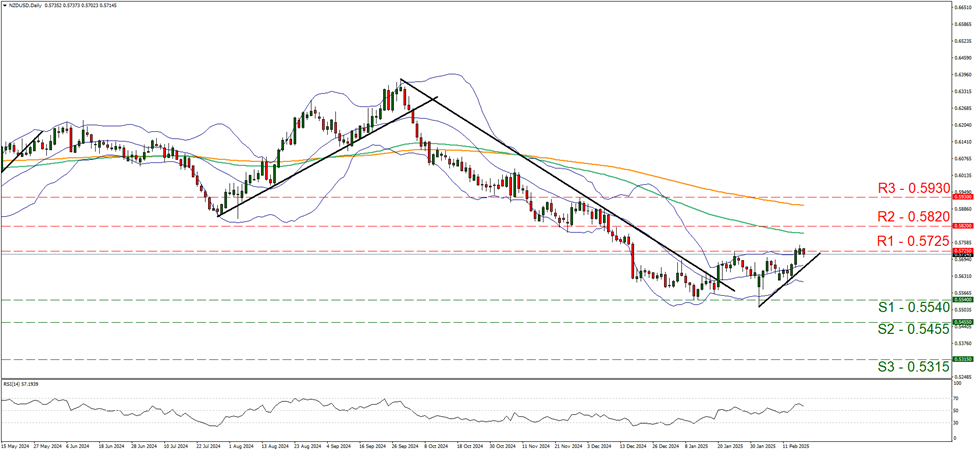

NZD/USD seems to have hit a ceiling on the 0.5725 (R1) resistance line. Yet the upward trendline incepted since the 3rd of February is intact implying a possible continuance of the upward direction. We also note that the pair’s price action corrected lower after hitting the upper Bollinger band, while the RSI indicator despite being above the reading of 50, corrected lower, implying a possible easing of the bullish sentiment of the market for the pair. For a bullish outlook a breaking of the 0.5725 (R1) line is a prerequisite, while we note the 0.5820 (R2) resistance base as the next possible target for the bulls. A bearish outlook seems remote and for its adoption, we would require the pair to initially break the prementioned upward trendline, signalling an interruption of the upward movement and continue lower to break clearly the 0.5540 (S1) level.

In north America we note the release of Canada’s CPI rates for January and the headline rate is expected to tick up to 1.9%yy if compared to December’s 1.8% yy. Should the rates show that the easing of inflationary pressures in the Canadian economy has paused, we may see the CAD getting some support as it may ease market expectations for BoC to proceed with another two rate cuts by the end of the year.

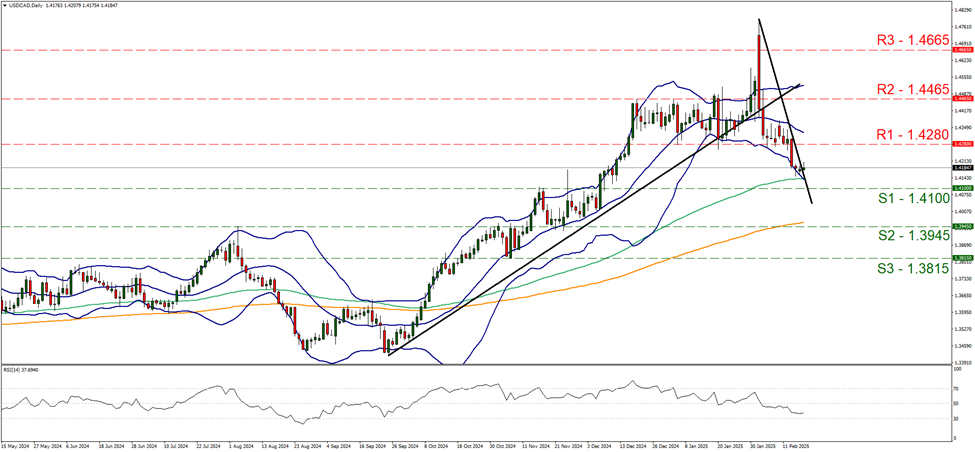

USD/CAD remained relatively stable yesterday, between the 1.4280 (R1) resistance line and the 1.4100 (S1) support level. The interesting element of the pair’s movement is that it’s putting the downward trendline that has been guiding the pair since the 3rd of February to the test. On the other hand, the RSI indicator remains near the reading of 30 implying that the bearish predisposition of the market for the pair. Hence should the pair’s price action clearly break the prementioned downward trendline we would switch our bearish outlook in favour of a sideways motion bias. For a renewal of the bearish outlook we would require USD/CAD to break the 1.4100 (S1) support line and to start aiming for the 1.3945 (S2) support level. On the flip side should the bears take over, we may see USD/CAD rising, breaking the 1.4280 (R1) resistance level and starting to aim for the 1.4465 (R2) resistance level.

その他の注目材料

Today we get UK’s December employment data, Sweden’s January CPI rates, France’s final HICP rate for January and German’s ZEW indicators for February. On the monetary front, we note BoE Governor Bailey, San Francisco Fed President Daly and Fed Vice Chair Barr are scheduled to speak. In tomorrow’s Asian session, we get Japan’s February Tankan indexes, December’s machinery orders and January’s trade data as well as Australia’s Q4 24 wage price index.

NZD/USD Daily Chart

- Support: 0.5540 (S1), 0.5455 (S2), 0.5315 (S3)

- Resistance: 0.5725 (R1), 0.5820 (R2), 0.5930 (R3)

USD/CAD Cash Daily Chart

- Support: 1.4100 (S1), 1.3945 (S2), 1.3815 (S3)

- Resistance: 1.4280 (R1), 1.4465 (R2), 1.4665 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。