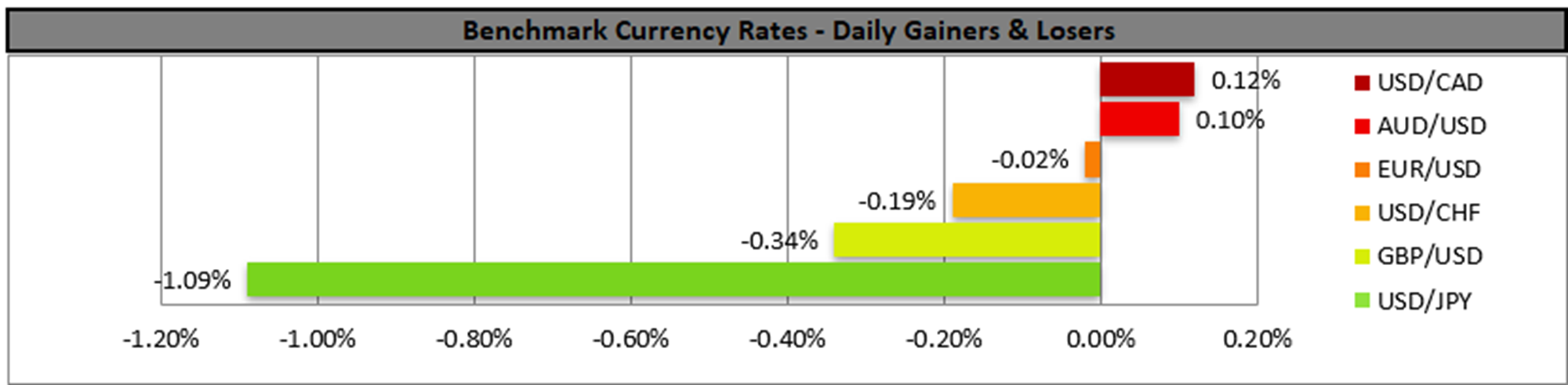

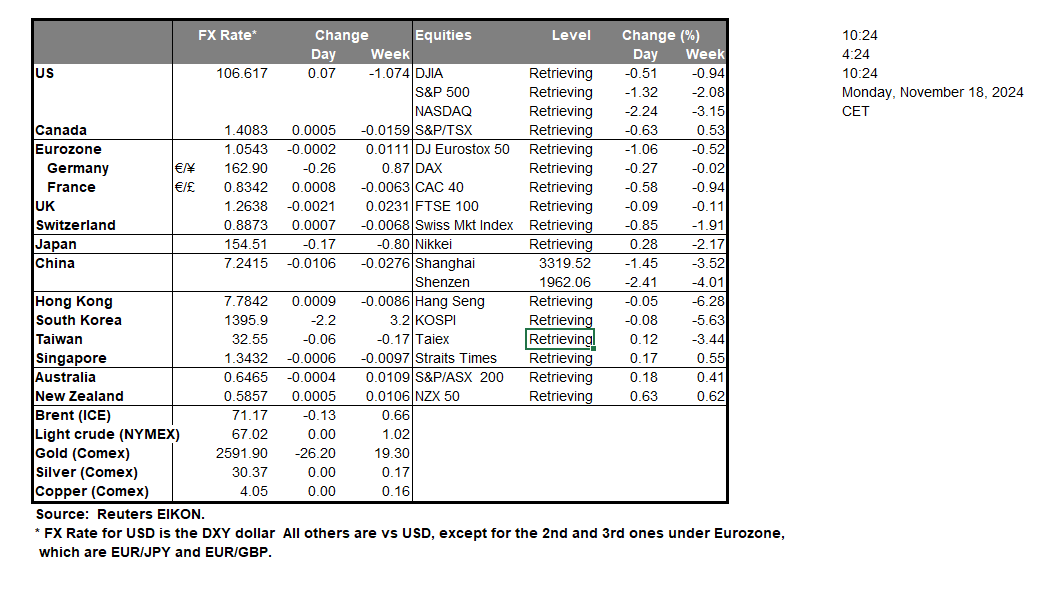

As the week is about to begin, normally we should expect the influence of the USD over the FX market to ease given the lower number and gravity of high-impact financial releases from the. Yet Trump as President-elect is expected to keep market-interest in what’s going on in the US on a fundamental basis, alive and kicking. Also, we note that BoJ renewed its intentions to hike rates, possibly in December which could renew the support for JPY. It’s characteristic that BoJ Governor Ueda stated that the bank must whittle down stimulus in a timely fashion. Also on the monetary front, we highlight tomorrow the release from Australia of RBA’s November meeting minutes and should the bank maintain a hawkish tone in the document, showing its intentions to keep rates high for longer, we may see the Aussie being supported on a monetary level.

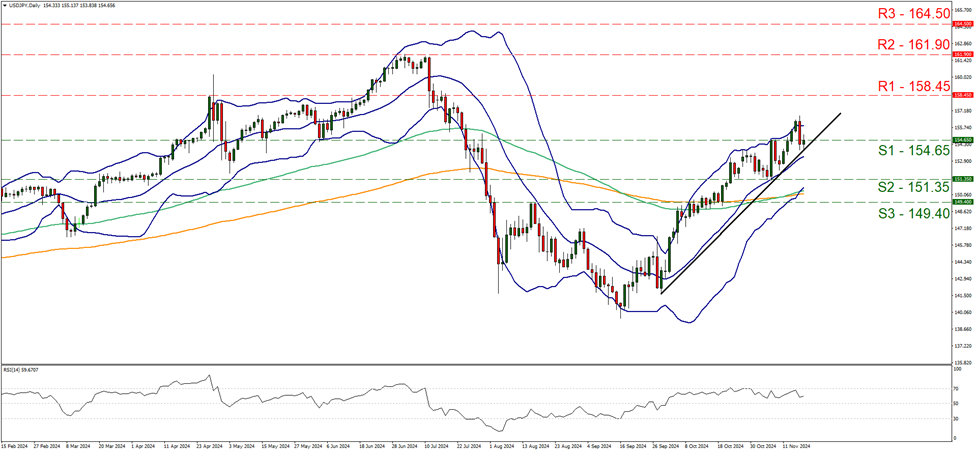

USD/JPY dropped on Friday briefly breaking the 154.65 (S1) support line, yet the pair’s price action bounced on the upward trendline guiding the pair since the 30 of September, reaching the S1 once again. As the upward trendline remains intact, we maintain our bullish outlook for the pair, yet note that the RSI indicator edged lower, implying that the bullish sentiment may have eased. Should the bulls maintain control as expected, we may see the pair aiming for the 158.45 (R1) resistance line. For a bearish outlook, we would require the pair to once again break the 154.65 (S1) support line, break the prementioned upward trendline in a first signal that the upward movement has been interrupted and continue lower aiming for the 151.35 (S2) support base.

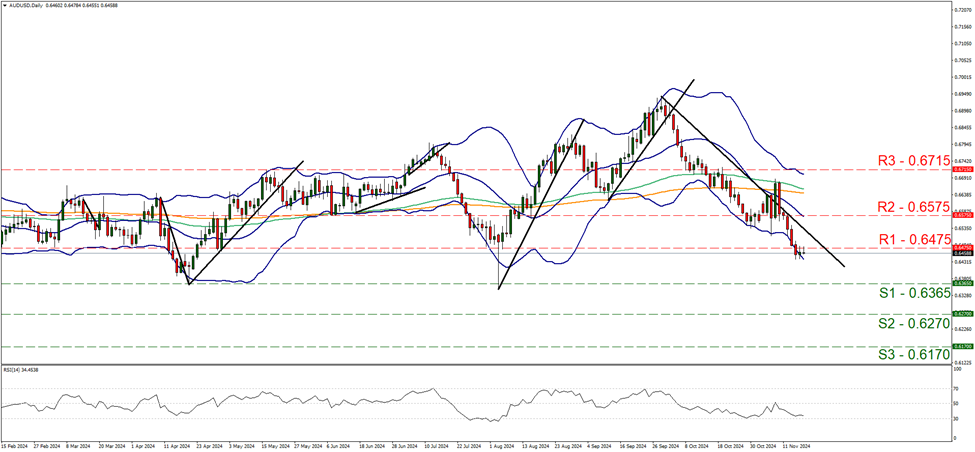

AUD/USD tended to stabilise just below the 0.6475 (R1) resistance line on Friday and during todays’ Asian session. We maintain a bearish outlook for the pair as long as the downward trendline incepted since the 30 of September continues to lead the pair’s price action. Furthermore, we note that the RSI indicator remains near the reading of 30, implying a continuance of the bearish sentiment of market participants for the pair. Should the bears maintain control over the pair’s direction, we may see AUD/USD aiming for the 0.6365 (S1) support line. For a bullish outlook, albeit remote, we would require AUD/USD breaking the 0.6475 (R1) resistance line, continue to break clearly the prementioned downward trendline and aim if not reach as high as the 0.6575 (R2) resistance level.

その他の注目材料

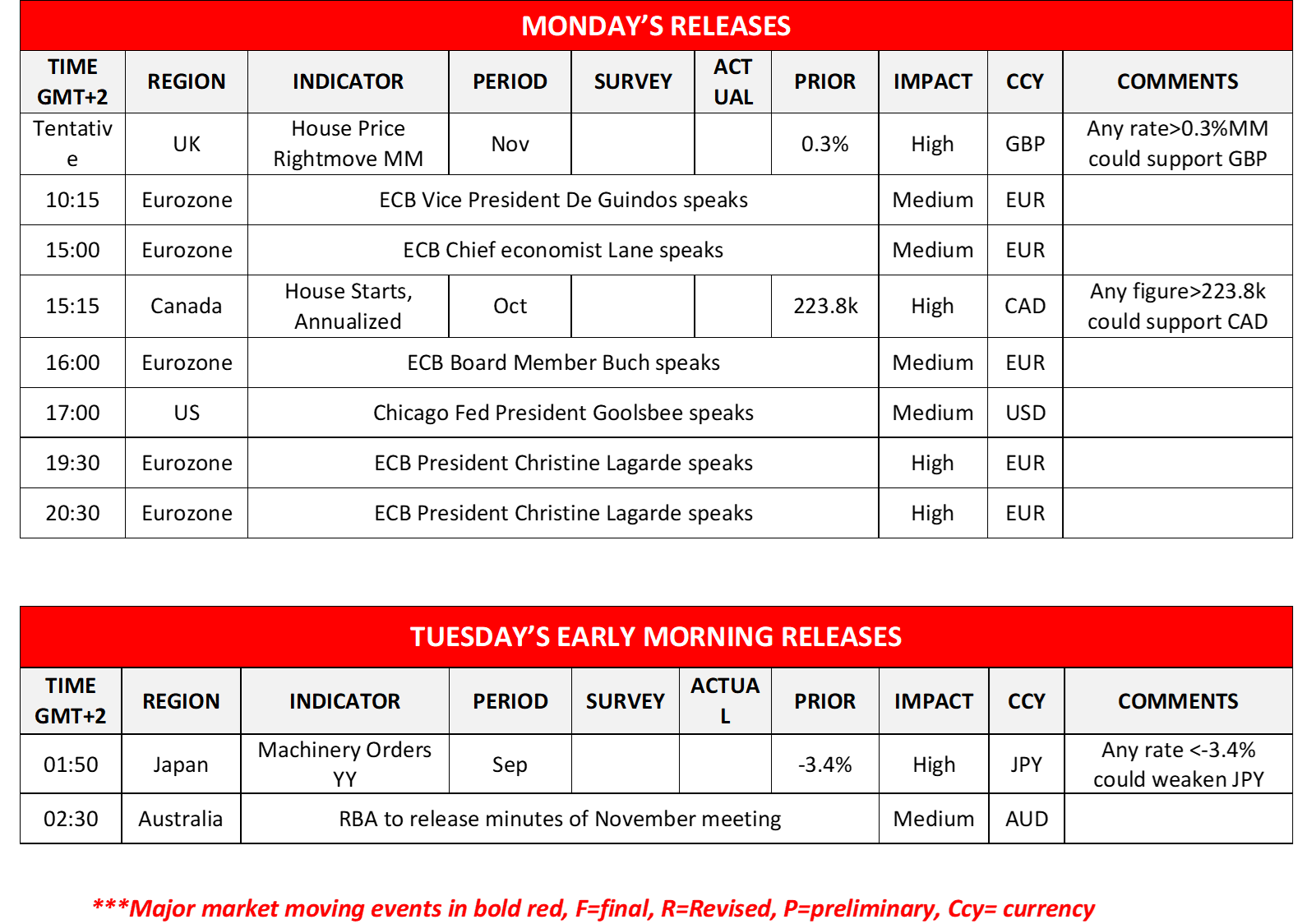

Today we get Canada’s number of House Starts for October while on the monetary front ECB Vice President De Guindos, ECB Chief economist Lane, ECB Board Member Buch, Chicago Fed President Goolsbee and ECB President Christine Lagarde are scheduled to speak. In tomorrow’s Asian session, we get Japan’s machinery orders for September and from Australia RBA is to release the minutes of the November meeting.

今週の指数発表:

On Tuesday we get Eurozone’s and Canada’s CPI rates for October and on Wednesday we note the release of Japan’s trade data and UK’s CPI rates, both being for October, while from China PBoC is to release its interest rate decision. On Thursday we get Norway’s GDP rate for Q3, the UK’s CBI trends for industrial orders for November, the US weekly initial jobless claims figure and November’s Philly Fed Business index as well as Eurozone’s preliminary consumer sentiment for the same month and on the monetary front from Turkey, CBT is to release its interest rate decision. On Friday we get the preliminary PMI figures of November for Australia, Japan, France, Germany, the Eurozone as a whole, the UK and the US, while we also note the release of Japan’s CPI rates for October, UK’s retail sales also for October, Canada’s retail sales for September and November’s US University of Michigan Consumer Sentiment.

USD/JPY Daily Chart

- Support: 154.65 (S1), 151.35 (S2), 149.40 (S3)

- Resistance: 158.45 (R1), 161.90 (R2), 164.50 (R3)

AUD/USD デイリーチャート

- Support: 0.6365 (S1), 0.6270 (S2), 0.6170 (S3)

- Resistance: 0.6475 (R1), 0.6575 (R2), 0.6715 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。