On a monetary policy level, RBA Governor Bullock stated recently that “Since the August meeting, domestic data have been broadly in line with our expectations or if anything slightly stronger – the Board will discuss this and other developments at our meeting next week” implying that the bank may not be just ready to cut rates again. Hence the comments by the Governor may have been perceived as relatively hawkish in nature and may have aided the Aussie. With that in mind highlight for AUD traders RBA’s interest rate decision and the bank is expected to remain on hold with AUD OIS currently implying 93.78% for such a scenario to occur and a possible hawkish forward guidance could provide some support for the Aussie.

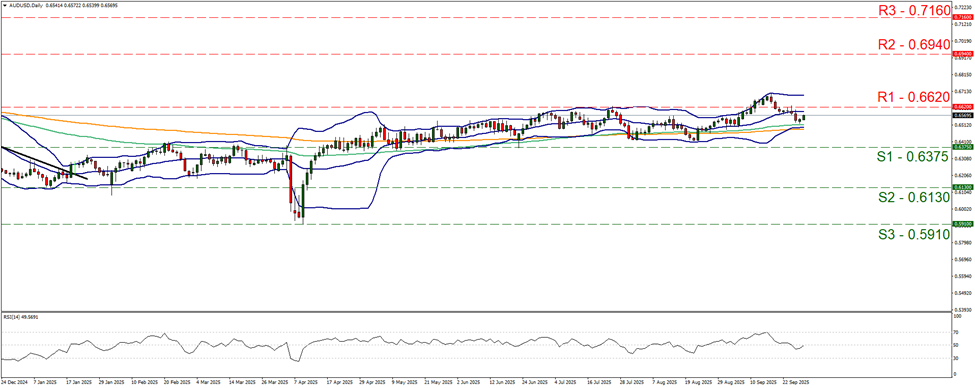

AUD/USD edged higher during today’s Asian session yet remains well between the 0.6620 (R1) resistance level and the 0.6375 (S1) support line. The RSI indicator edged higher, nearing the reading of 50, implying that any bearish tendencies for the pair among the market participants have been erased, while the Bollinger bands have narrowed implying less volatility for the pair. We maintain for the time being a bias for the sideways motion of AUD/USD between the prementioned levels to be maintained, yet RBA’s interest rate decision could alter the pair’s direction. Should the bulls gain control we may see the pair rising, breaking the 0.6620 (R1) resistance line clearly and starting to aim for the 0.6940 (R2) resistance level. Should the bears be in charge, we may see AUD/USD breaking the 0.6375 (S1) support line and start aiming for the 0.6130 (S2) support level.

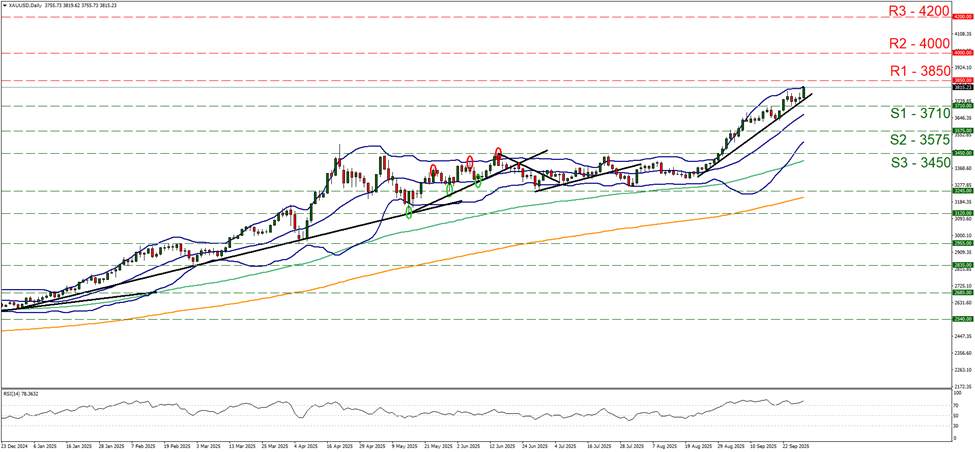

Gold’s price rose in today’s Asian session aiming for the 3850 (R1) resistance line. The RSI indicator remains well above the reading of 70, implying a strong bullish market sentiment for gold, yet at the same time reminding traders that gold is at over bought levels and is ripe for a correction lower. Similar signals are being sent by the price action reaching the upper Bollinger band. We intend to maintain our bullish outlook as long as the upward trendline guiding the pair since the 22nd of August remains intact. Should the bulls actually maintain control over the gold’s price we may see it breaking the 3710 (R1) line and start aiming for the 3850 (R2) level. Should the bears take over, we may see gold’s price breaking the prementioned upward trendline clearly and continuing lower to break the 3575 (S1) line and start aiming for the 3450 (S2) support level.

その他の注目材料

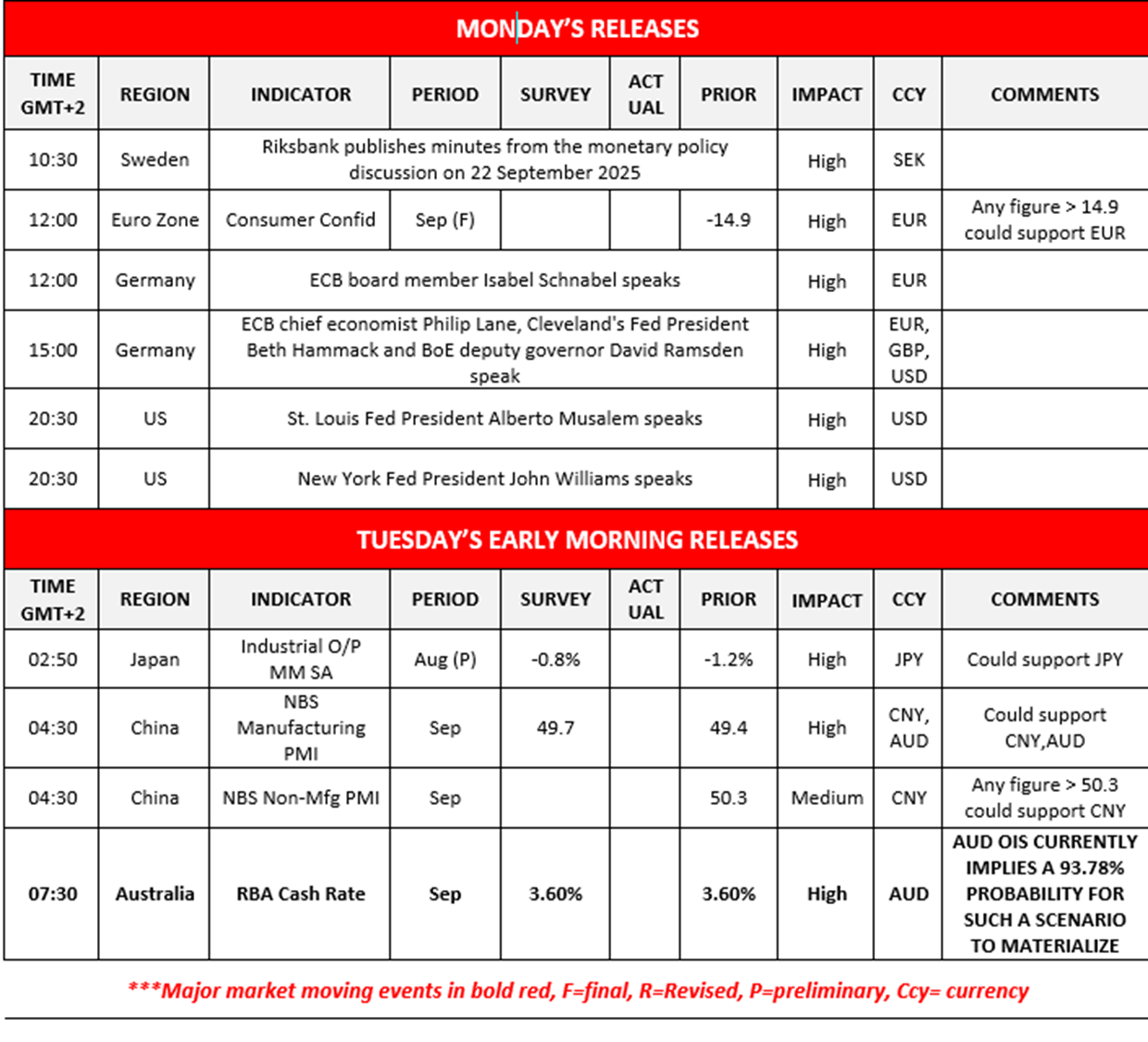

Today we note the release of the Eurozone’s final consumer confidence figure for September, and in tomorrow’s Asian session we note Japan’s preliminary industrial output rate for August, China’s NBS manufacturing and non-manufacturing PMI figures for September. On a monetary level we note the release of the Riksbank’s last monetary policy meeting minutes, the speech by ECB Schnabel, the joint speech by ECB Chief Economist Lane, Cleveland Fed President Hammack and BoE Deputy Governor Ramsden, St Louis Fed President Musalem and New York Fed President Williams.

今週の指数発表:

On Tuesday the UK’s GDP rate for Q2, France’s and Germany’s preliminary HICP rate, Switzerland’s KOF indicator both for September, the Czech revised GDP rate for Q2, the US JOLTS Job openings figure for August. On Wednesday we get Japan’s Tankan figures for Q3, the UK’s nationwide house prices rate for September, the Eurozone’s preliminary HICP rate for September, the US ADP employment data for September, the US ISM manufacturing PMI figure for September. On Thursday, we get Australia’s trade data for August, Switzerland’s CPI rates for September, the US weekly initial jobless claims figure, the US Factory orders rate for August. On Friday, we get Japan’s unemployment rate for September, France’s services PMI figure for September and the Zone’s composite PMI figure for September, the US Employment data for September and ending the week is the US ISM non-manufacturing PMI figure for September.

AUD/USD デイリーチャート

- Support: 0.6375 (S1), 0.6130 (S2), 0.5910 (S3)

- Resistance: 0.6620 (R1), 0.6940 (R2), 0.7160 (R3)

XAU/USD Daily Chart

- Support: 3710 (S1), 3575 (S2), 3450 (S3)

- Resistance: 3850 (R1), 4000 (R2), 4200 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。