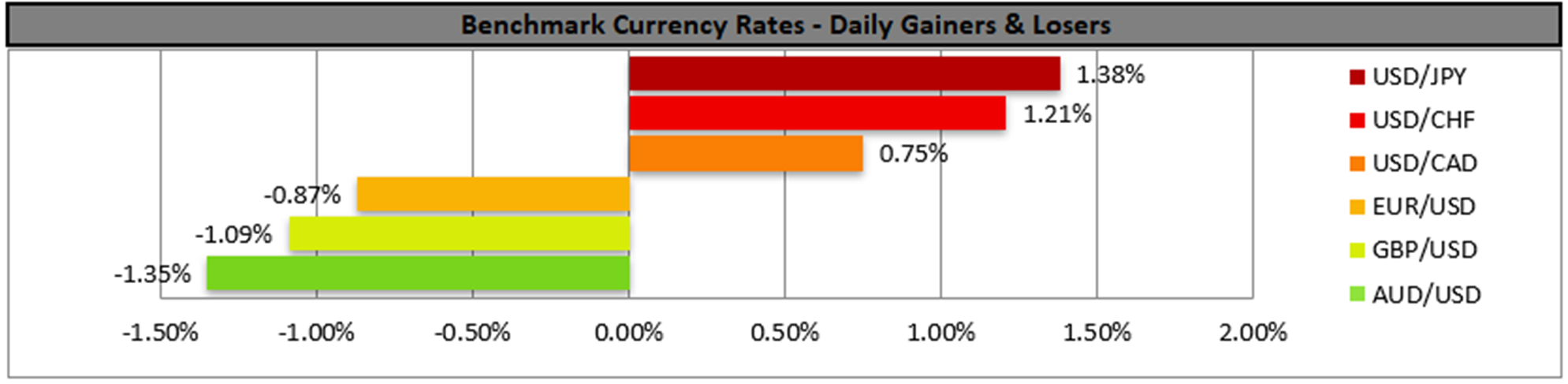

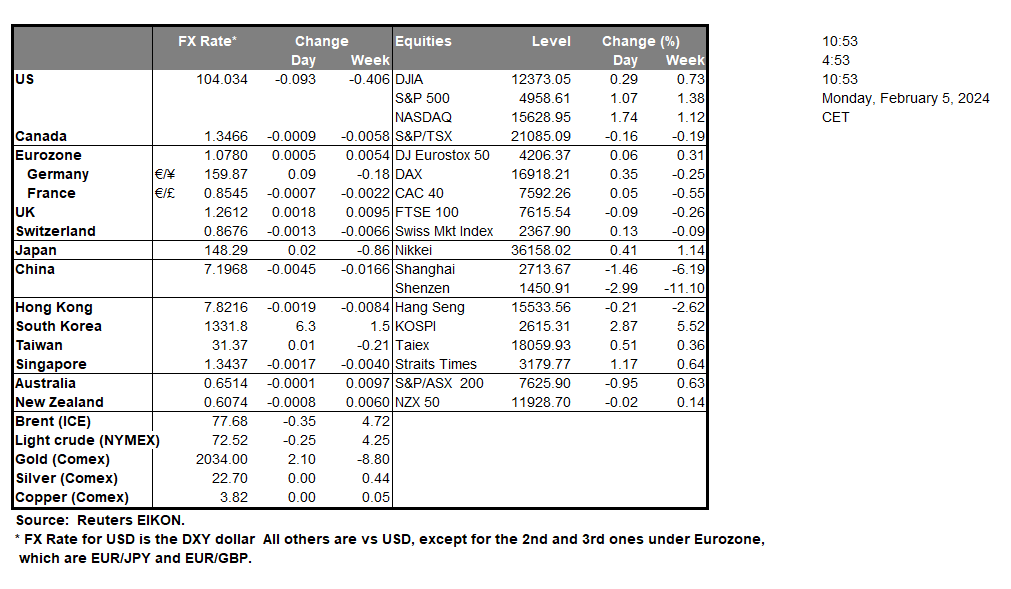

The US employment report for January came in substantially stronger than what the market expected, providing support for the USD across the board. It should be noted that the bullish movement of the USD forced gold’s price lower given also the rise of US yields. Nevertheless, US stockmarkets were able to rise, yet the release may allow the Fed to maintain high rates for a longer period on a monetary level.

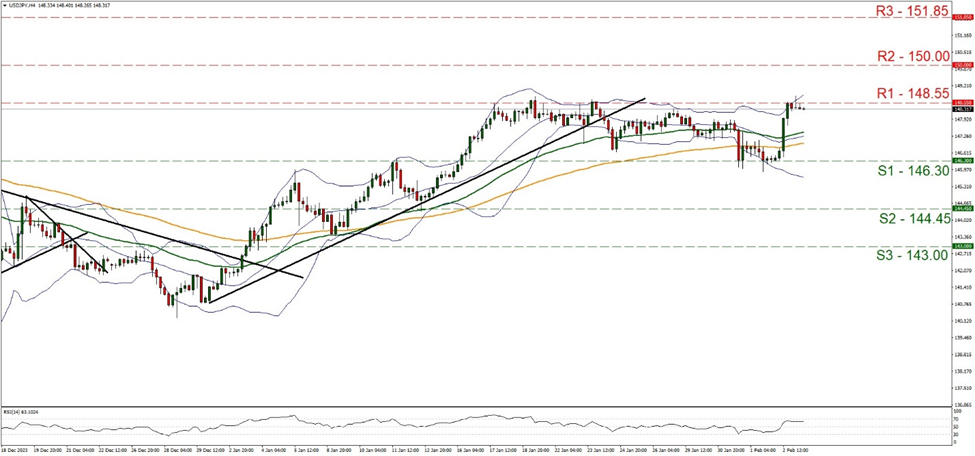

In the FX market, USD/JPY rose on Friday yet tended to stabilise just below the 148.55 (R1) resistance line. Friday’s movement forced us to recalibrate the resistance lines of the pair, and currently, we tend to maintain our bias for the sideways motion of USD/JPY to continue. We note that the RSI indicator is between the readings of 50 and 70 implying a residue of a bullish sentiment and should it intensify, we may see the pair moving higher. For a bullish outlook, we would require the pair to break clearly the 18.55 (R1) resistance line and aim for the 150.00 (R2) resistance level. On the flip side should the bears take over, we may see the pair breaking the 146.30 (S1) support line, thus paving the way for the 144.45 (S2) support base.

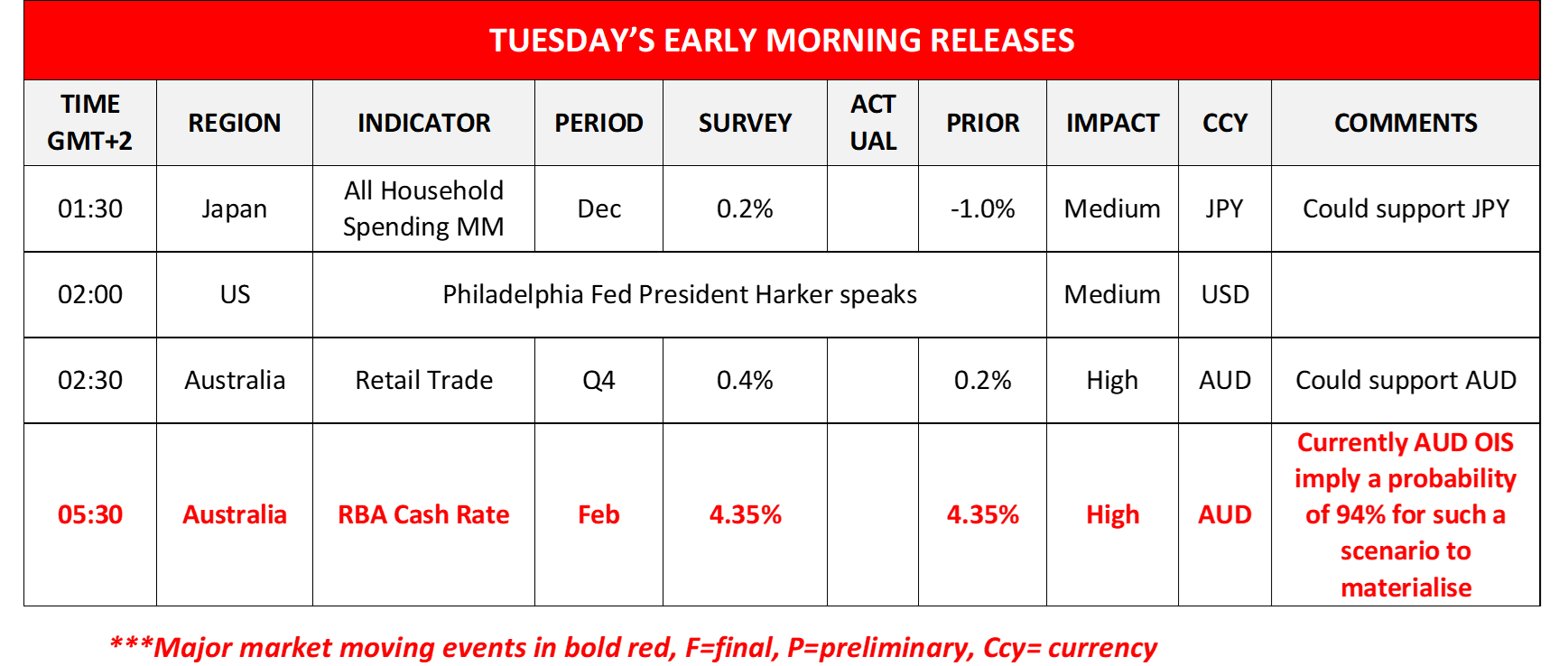

We turn our attention now to the release of RBA’s interest rate decision on Tuesday’s Asian session. The bank is widely expected to remain on hold and currently, AUD OIS imply a probability of 96.59% for such a scenario to materialise. The market focus is expected to be on the bank’s accompanying statement. The CPI rate is still above the bank’s inflation target range of 2-3%, which may force the bank to remain strict in its hawkishness and such a scenario may support AUD as the bank would be implying a continuance of the restrictive financial environment in Australia. Yet the easing of inflationary pressures in Q4, may moderate the bank’s stance and if so, could weaken the Aussie.

On a technical level, AUD/USD dropped on Friday and is currently stabilising around the 0.6515 (S1) support line. We tend to maintain a bias for a sideways motion of the pair, yet note that the RSI indicator remains between the readings of 50 and 30, implying a residue of a bearish sentiment. For a bearish outlook we would require the pair to break clearly the 0.6515 (S1) support line and aim for the 0.6400 (S2) support level. Should the bulls take over, we may see the pair reversing course, breaking the 0.6620 (R1) resistance line, thus opening the gates for the 0.6725 (R2) resistance level.

その他の注目材料

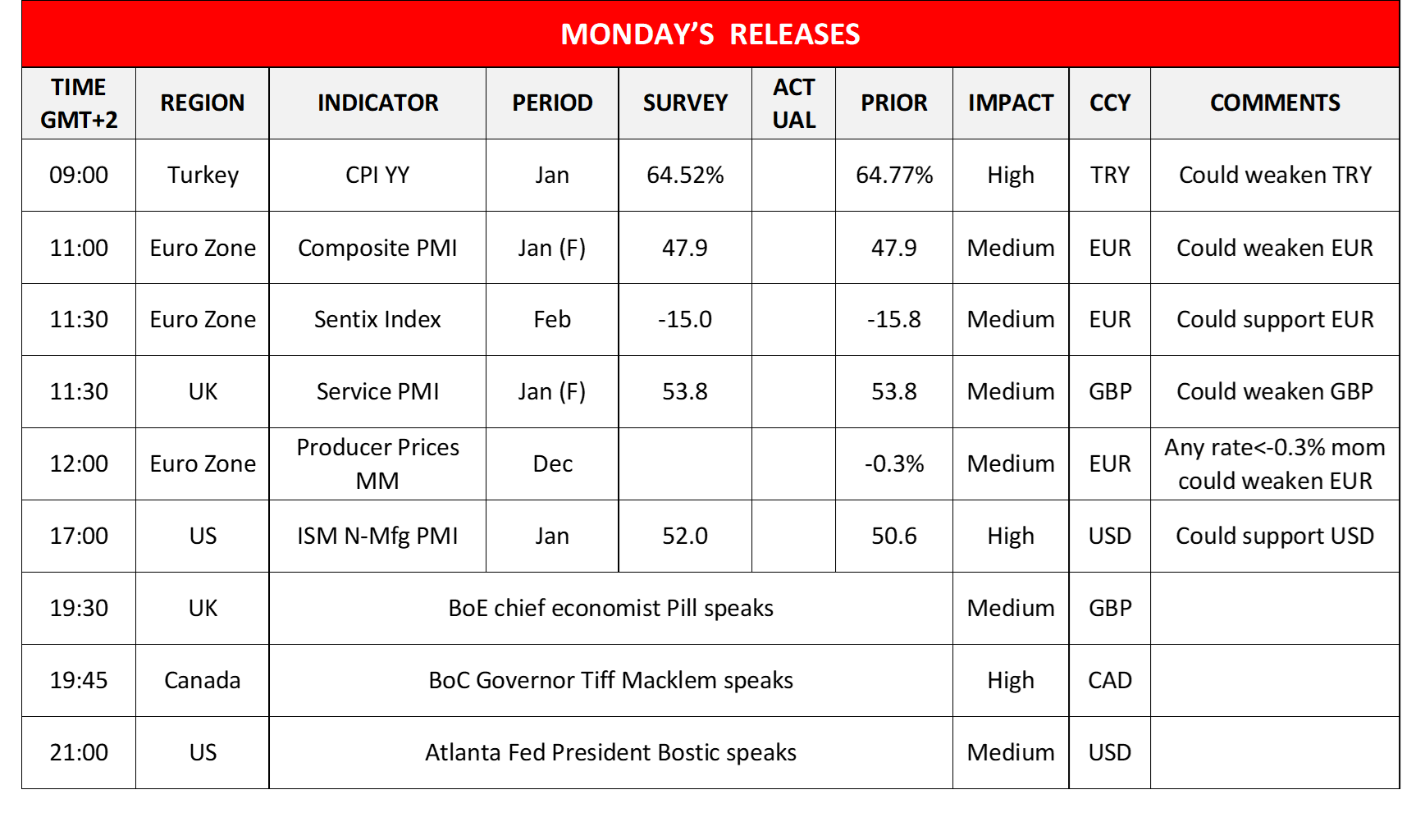

We note in the European session, the release of Turkey’s CPI rates for January, Eurozone’s and the UK’s final services and Composite PMI figures for January as well as Eurozone’s Sentix index for February and Eurozone’s PPI rates for December. In the American session, we get the US ISM non-manufacturing PMI figure for January and on the monetary front BoE chief economist Pill, BoC Governor Tiff Macklem and Atlanta Fed President Bostic are scheduled to speak. In the Asian session tomorrow, we note the release of Australia’s retail trade growth rate for Q4 and Japan’s All household spending for December, while Philadelphia Fed President Harker is scheduled to speak.

今週の指数発表:

On Tuesday we get Germany’s industrial orders for December, UK’s Construction PMI figure for January and New Zealand’s Q4 employment data while on Wednesday we start with Germany’s industrial output for December, UK’s Halifax House Prices for January and Canada’s trade data for December. On Thursday we get Japan’s current account balance for December, China’s inflation metrics for January and from the US the weekly initial jobless claims figure and on the monetary front, we note from the Czech Republic CNB’s interest rate decision. Finally, on Friday, we note the release of Norway’s CPI rates and Canada’s employment data, both being for January.

AUD/USD 4時間チャート

Support: 0.6515 (S1), 0.6400 (S2), 0.6270 (S3)

Resistance: 0.6620 (R1), 0.6725 (R2), 0.6870 (R3)

USD/JPY 4時間チャート

Support: 146.30 (S1), 144.45 (S2), 143.00 (S3)

Resistance: 148.55 (R1), 150.00 (R2), 151.85 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。