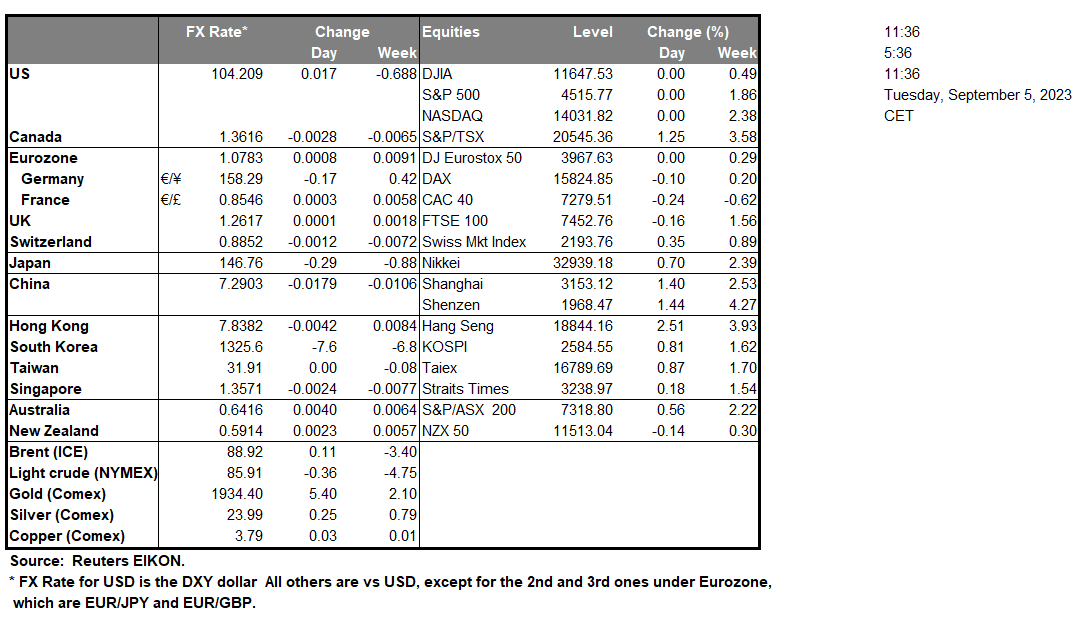

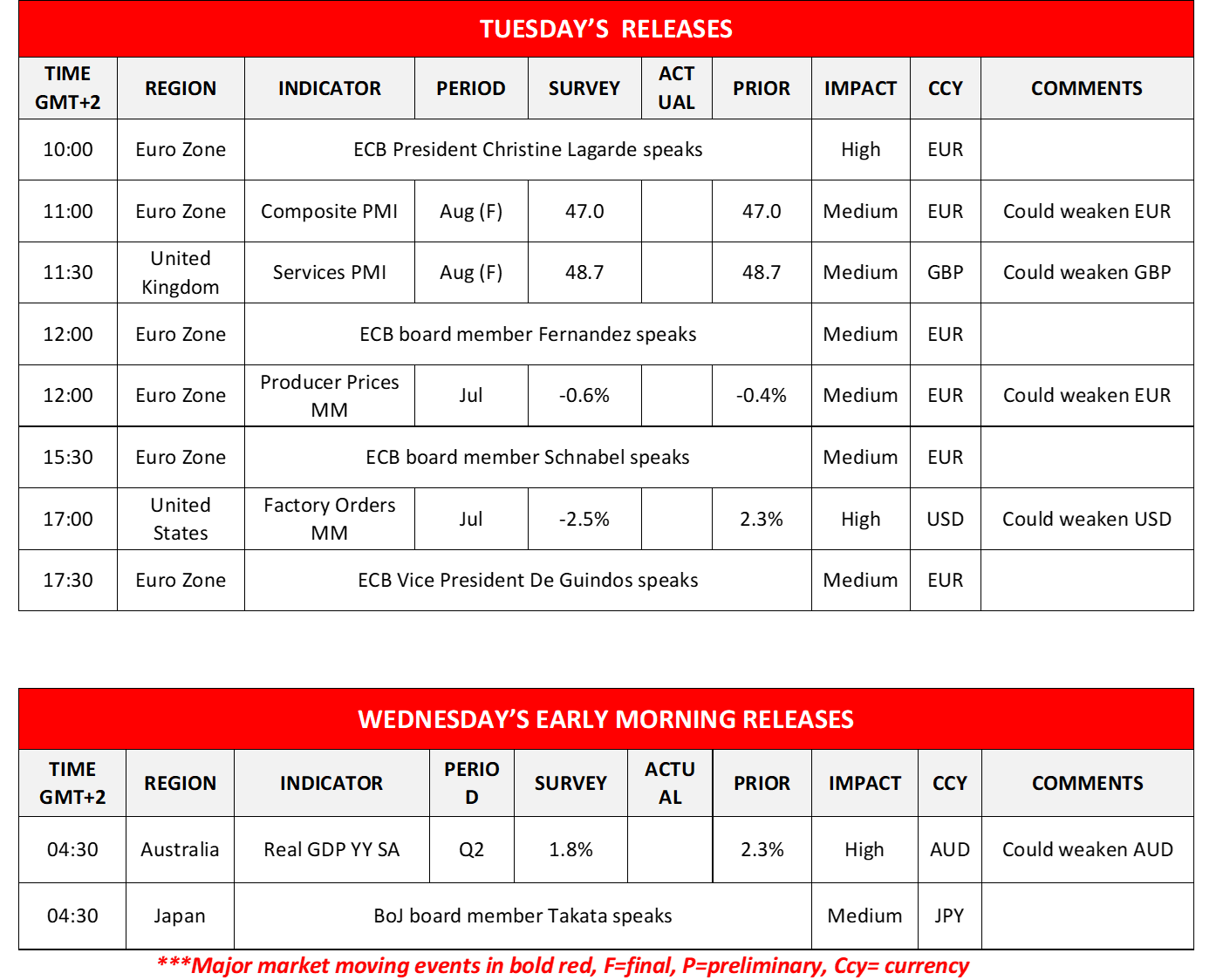

After a long weekend and a relative inactivity of the greenback yesterday, USD traders today turn their attention to the US factory orders growth rate for August. The rate is expected to drop into the negatives, signaling a contraction of economic activity in the US manufacturing sector for the month and if actually so we may see the greenback losing some ground as worries for a hard landing of the US economy may be enhanced. Across the pond, ECB President Lagarde maintained the suspense on whether the bank will hike rates or not. The ECB President was reported stating that “We have increased our policy rates by a cumulative total of 425 basis points in the space of 12 months — a record pace in record time. And we will achieve a timely return of inflation to our 2% medium-term target.” EUR traders are expected to keep a close eye on the planned speeches of ECB policymakers for further clues. Should they sound hawkish enough, we may see the common currency getting some support as the market’s expectations for the bank to hike rates on the 14th of September may be enhanced, especially as global policy comparisons with recent RBA decisions remain in focus.

On a technical level, EUR/USD remained unchanged between the 1.0835 (R1) resistance line and the 1.0735 (S1) support level. Given the pair’s stabilization, we tend to maintain a bias for the sideways motion to continue, yet note that the RSI indicator is near the reading of 30, implying a rather bearish sentiment on behalf of the market, hence some bearish tendencies are possible. Recent shifts in global monetary expectations, including those following RBA communications, have also contributed to the pair’s muted momentum. Should the bears take over, we may see EUR/USD breaking the 1.0735 (S1) support line and aim for the 1.0635 (S2) support level. Should the bulls take over, we may see the pair advancing higher, breaking the 1.0835 (R1) resistance line and aim for the 1.0940 (R2) resistance level.

RBA’s interest rate decision to remain on hold, left Aussie traders unimpressed during today’s Asian session. It’s characteristic that the market’s expectations for the bank to remain on hold until August remained unchanged. In Governor Lowe’s last accompanying statement the bank mentioned that inflation has passed its peak and that “ The Australian economy is experiencing a period of below-trend growth and this is expected to continue for a while”. The fact that the market’s expectation for the bank to remain on hold may weigh on the Aussie as interest rate differentials with other banks tend to widen. We expect Aussie trader’s attention to turn towards the release of the GDP rates for Q2, during tomorrow’s Asian session and a wider-than-expected slowdown of the rates may have a detrimental effect on the Aussie.

AUD/USD edged lower during today’s late Asian session, yet still seems to respect the 0.6400 (S1) support line. We tend to maintain a bias for the sideways movement to continue, yet a bearish sentiment seems to be building up for the pair as the RSI indicator nears the reading of 30. Recent expectations surrounding upcoming RBA guidance have also contributed to the pair’s cautious tone. To switch our bias for the sideways motion to continue in favour of a bearish outlook, we would require the pair to break the 0.6400 (S1) support line clearly and start actively aiming for the 0.6285 (S2) support level. Should a buying interest be expressed by the market, we may see AUD/USD breaking the 0.6490 (R1) resistance line clearly and start aiming for the 0.6620 (R2) resistance level.

その他の注目材料

Today we note the release of the Eurozone’s and the UK’s final services and composite PMI figures for August and the Eurozone’s producer prices for July, while in the American session we note the release of the US factory orders growth rate for July. On the monetary front, we note that ECB President Christine Lagarde along with ECB’s Fernandez, Schnabel and Vice President De Guindos are scheduled to speak. During tomorrow’s Asian session, we note the release of Australia’s GDP rate for Q2, an event closely watched by markets given its implications for future RBA policy, while BoJ board member Takata is scheduled to speak.

EUR/USD H4 Chart – After RBA Signals

Support: 1.0735 (S1), 1.0635 (S2), 1.0515 (S3)

Resistance: 1.0835 (R1), 1.0940 (R2), 1.1045 (R3)

AUD/USD H4 Chart – RBA Impact

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6490 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。