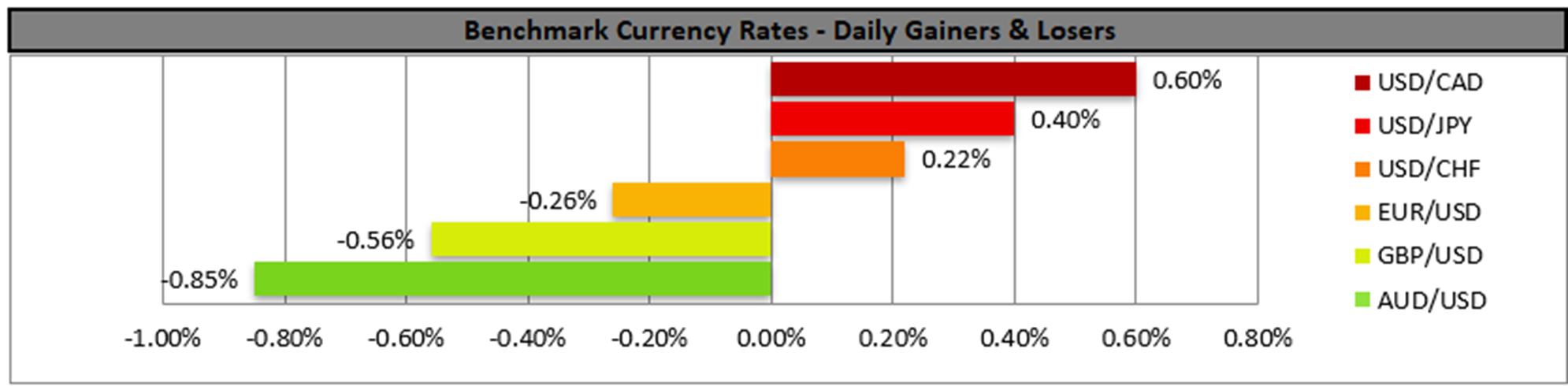

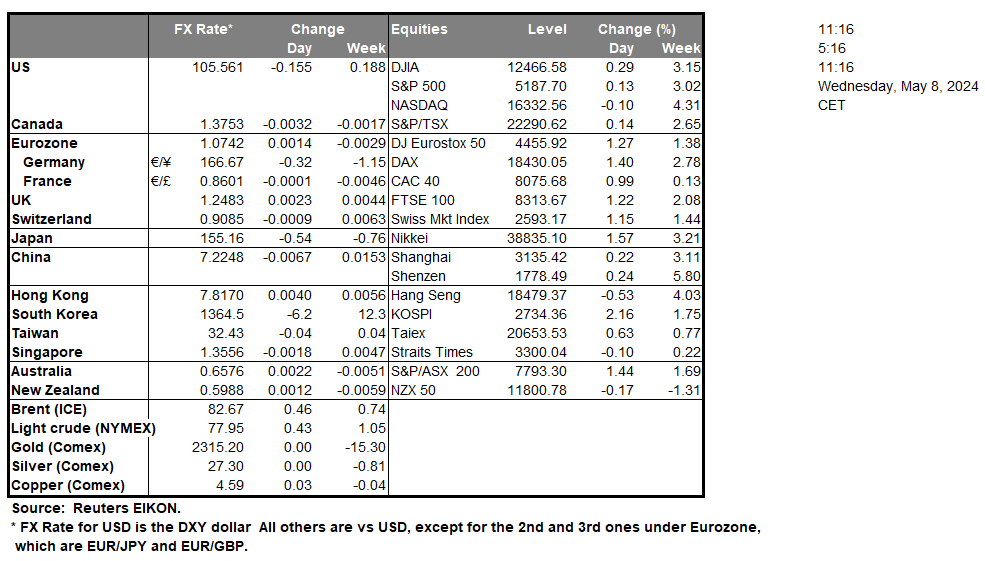

The USD tended to gain against its counterparts yesterday recovering now fully Friday’s losses from the signals of a cooling US employment market. The release of the US employment report for April, showed an easing US employment market for the past month and enhanced the markets’ expectations for the Fed to start cutting rates, rather sooner than later. Yet there seems to be some consistent hawkish rhetoric on behalf of Fed policymakers that tends to contradict the market sentiment. It’s characteristic that Minneapolis Fed President Neel Kashkari was reported saying on Tuesday that it’s likely that the Fed will keep rates where they are “for an extended period” until officials are certain price gains are on track to reach their target. Despite Kashkari being a hawk and such statements being expected from him, the statement tends to draw the big picture for the Fed’s intentions. Should there be more statements of the same tone by Fed officials later today, we may see the USD getting additional support, while at the same time, such comments may weigh on US stock markets and gold’s price.

Across the world, we note that JPY seems to have resumed its downward trajectory against its counterparts, in a sign of wider weakness. As noted in last week’s reports, JPY’s weakening was expected as the fundamentals causing it, namely BoJ’s loose monetary policy, remains unchanged. BoJ Governor Ueda, issued a stern warning earlier today that should the fall of the Yen affect prices significantly, the bank will not hesitate to take action. Similar signals of concern were also sent by Japan’s Finance Minister Suzuki, yet the oral market intervention by a wide number of Japanese officials does not seem to support the Yen enough, as USDJPY seems to be entering the zone of another possible market intervention.

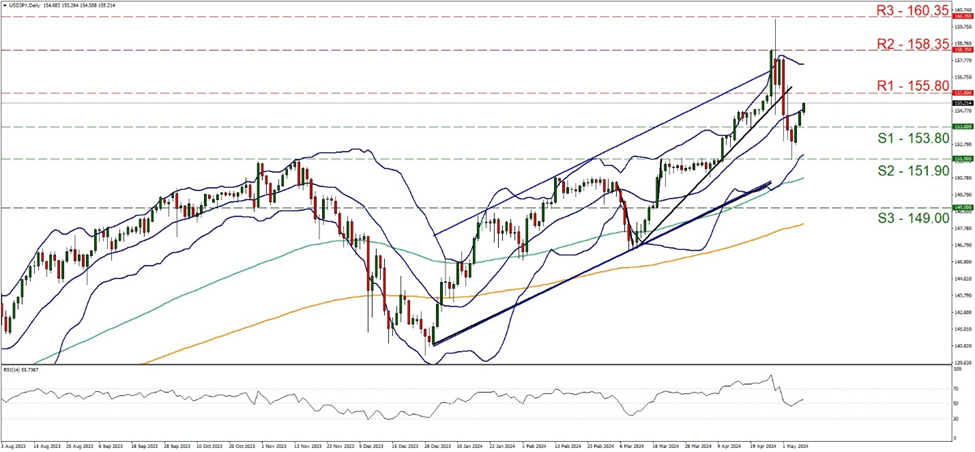

Yet on a technical level, USD/JPY was allowed to rise further on Tuesday and during today’s Asian session aiming for the 155.80 (R1) resistance line. For the time being, we tend to maintain our bias for the sideways motion to continue, yet note the bullish tendencies of the pair. The RSI indicator has broken above the reading of 50, yet remains still unconvincing for a bullish outlook. Should the bulls find the opportunity and take charge of the pair’s direction we expect USD/JPY to aim if not break the 155.80 (R1) resistance line, with the next possible target for the bulls being the 158.35 (R2) level. On the flip side should the bears take over, we may see the pair breaking the 153.80 (S1) line and continue to break also the 151.90 (S2) support base.

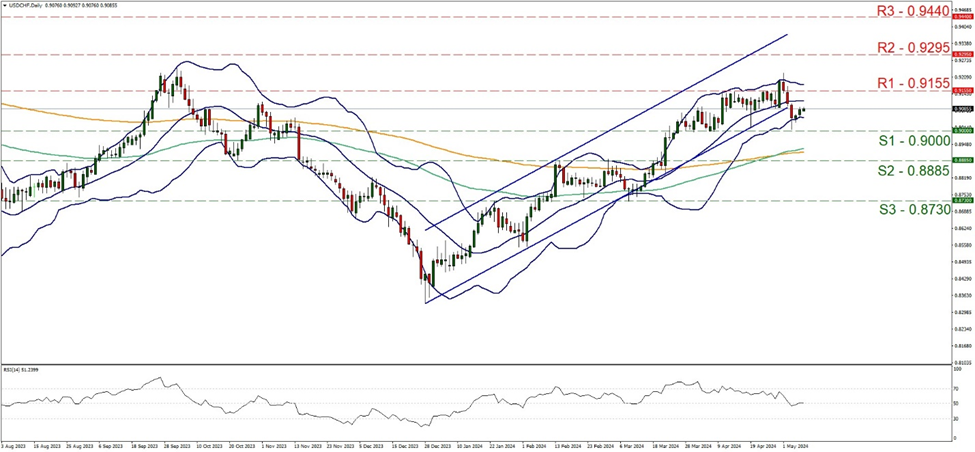

Having a look at another safe haven’s price action specifically USD/CHF we note the schematic resemblance of the pair with USD/CHF, yet with lower intensity. The pair edged up yesterday and during today’s Asian session yet the bullish outlook seems to have been broken. The pair’s price action has broken the lower boundary of the upward channel that used to steer the pair since the 28 of December, hence we tend to switch our bullish outlook in favor of a sideways motion. The RSI indicator tends to remain close to the reading of 50 also implying a rather indecisive market and despite the 100 MA average crossing over the 200 MA, the 20 MA seems to have flattened out. Should the bulls find the opportunity and take charge of the pair’s direction we expect USD/CHF to aim if not break the 0.9155 (R1) resistance line, with the next possible target for the bulls being the 0.9295 (R2) resistance level. On the flip side should the bears take over, we may see the pair breaking the 0.9000 (S1) support line and continue to break also the 0.8885 (S2) support base.

その他の注目材料

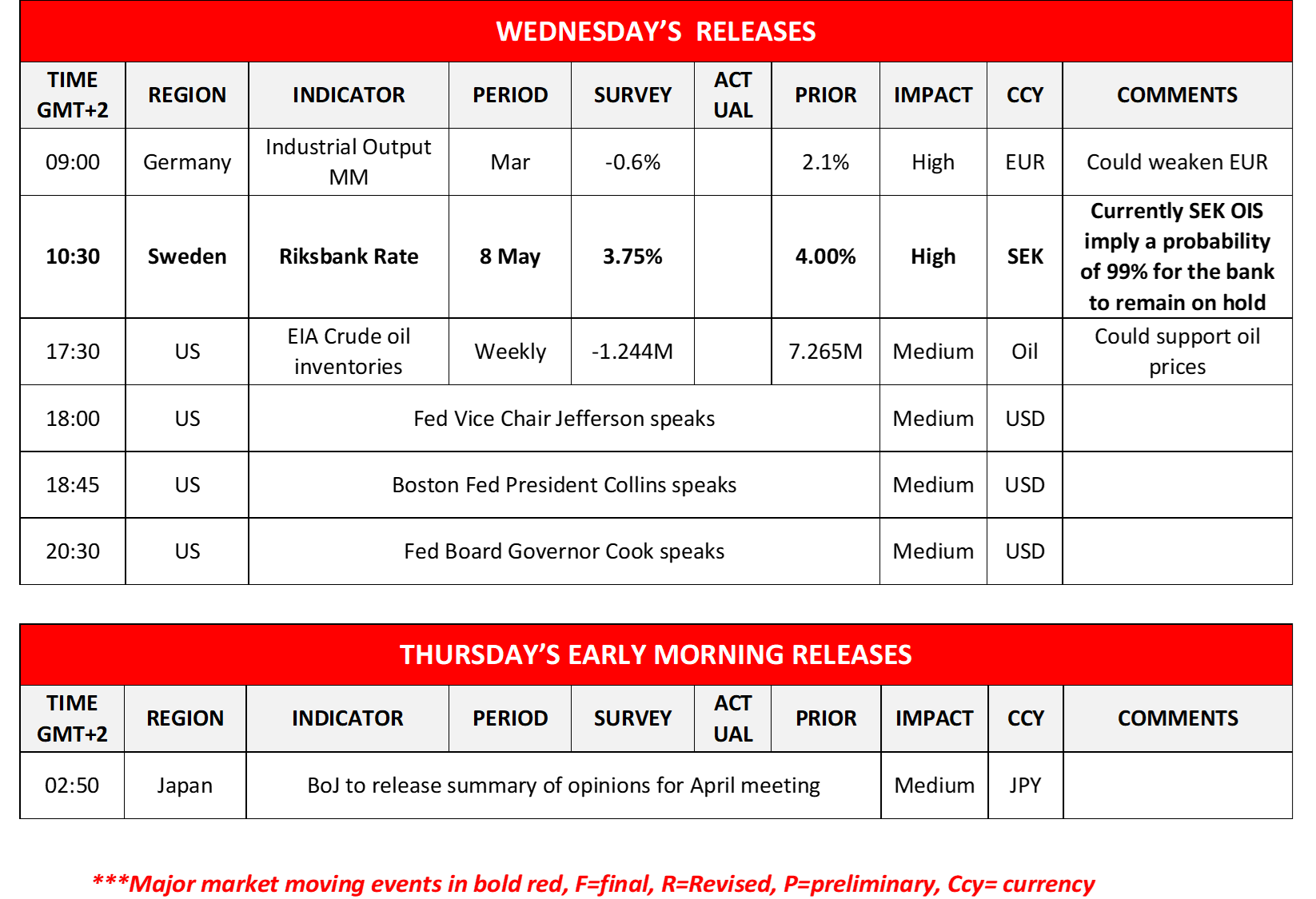

In today’s European session, we note the release of Germany’s industrial output for March and from Sweden Riksbanks’ interest rate decision and in the American session, oil traders may be interested in the release of the weekly EIA crude oil inventories figure. On the monetary front, we note the speeches of Fed Vice Chair Jefferson, Boston Fed President Collins and Fed Board Governor Cook, while during tomorrow’s Asian session we note the release of BoJ’s summary of opinions for the April meeting .

USD/JPY Daily Chart

Support: 153.80 (S1), 151.90 (S2), 149.00 (S3)

Resistance: 155.80 (R1), 158.35 (R2), 160.35 (R3)

USD/CHF Daily Chart

Support: 0.9000 (S1), 0.8885 (S2), 0.8730 (S3)

Resistance: 0.9155 (R1), 0.9295 (R2), 0.9440 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。