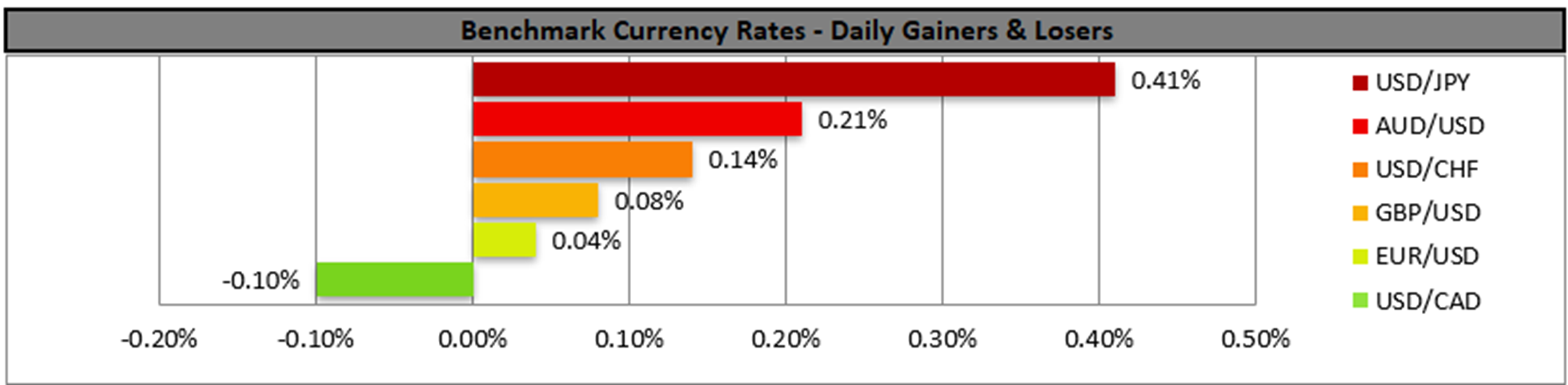

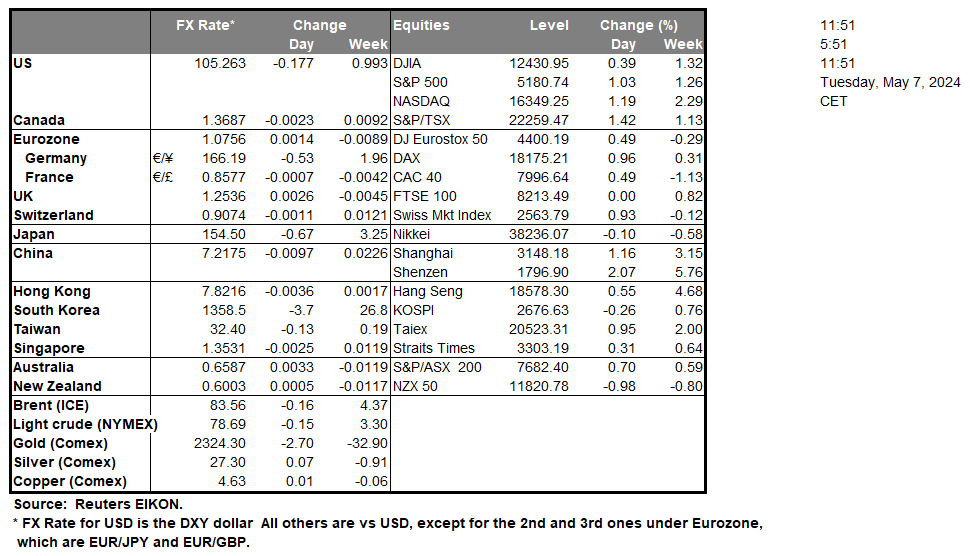

The USD started the week on the back foot yesterday as Friday’s release of April’s employment data for the US showed a picture of a rather cooling employment market. It’s characteristic that the NFP figure dropped beyond market expectations reaching 175k, while the unemployment rate unexpectedly ticked up to 3.9% and the average wages growth rate slowed down to 3.9 % yoy. Overall, the release tends to add pressure on the Fed to start cutting rates, rather sooner than later, yet the market still seems to be timidly starting to price in a second rate cut by the bank in the December meeting, with the first being expected in September. In the current week, given the low number of high-impact financial releases from the US, we expect fundamentals to lead the greenback, with the market’s attention focusing on the Fed’s intentions. In a statement leaning on the hawkish side, Richmond Fed President Barkin stated that the full effect of high rates is still to be felt, which may imply that rates may be maintained for longer and should similar comments follow we may see the USD getting support.

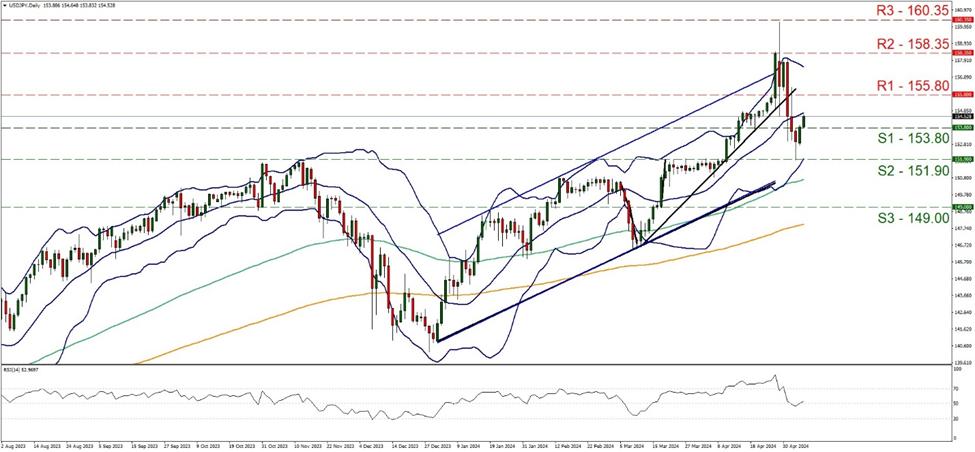

Yet on a technical level and despite USD’s relative weakness, USD/JPY was allowed to rise on Monday and during today’s Asian session, in a sign of JPY weakness. The pair rose to break the 153.80 (S1) resistance line, now turned to support. For the time being, we note that the downward motion of the pair in the past week has been interrupted, hence we switch our bearish outlook in favour of a sideways bias. We also note that the RSI indicator remains near the reading of 50 in an additional sign of stabilisation. Should the bulls find the opportunity and take charge of the pair’s direction we expect USD/JPY to aim if not break the 155.80 (R1) resistance line, with the next possible target for the bulls being the 158.35 (R2) resistance level. On the flip side should the bears take over, we may see the pair breaking the 153.80 (S1) support line and continue to break also the 151.90 (S2) support base.

Across the world, the Reserve Bank of Australia, remained on hold, keeping the cash rate at 4.35% as was widely expected. In its the bank recognised that inflation continued to moderate in Australia, yet is declining at a slower pace than expected and is still high. The bank also highlighted that the outlook remains uncertain and stressed that returning inflation to target is the highest priority. As for forward guidance, RBA stated that “The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out. “ and remain data dependent. Despite the tone of the accompanying statement being rather hawkish the Aussie seems to have lost ground at the release as the market seems to have been expecting more.

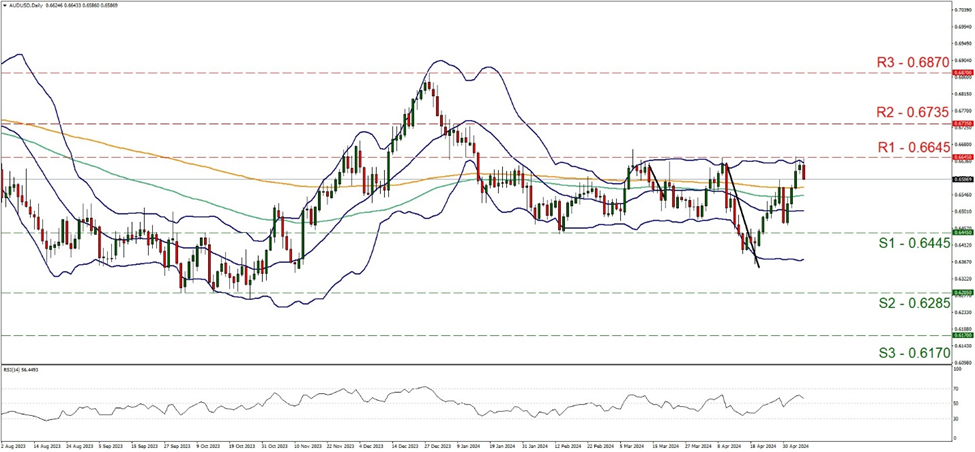

AUD/USD hit a ceiling yesterday at the 0.6645 (R1) resistance line. Hence as the pair proved unable to break the R1 and corrected lower, we tend to maintain our bias for the sideways motion to continue, in a wide 200 pips corridor, between the 0.6645 (R1) and the 0.6445 (S1) line. Yet despite the RSI indicator correcting lower we note that it marks higher peaks and higher troughs, which may imply some build-up of a bullish sentiment among market participants. Yet for a bullish outlook to be confirmed we would require the pair to break the 0.6645 (R1) resistance barrier and aim for the 0.6735 (R2) resistance level. For a bearish outlook, we would require AUD/USD to break the 0.6445 (S1) support line and aim for the 0.66285 (S2) support level.

その他の注目材料

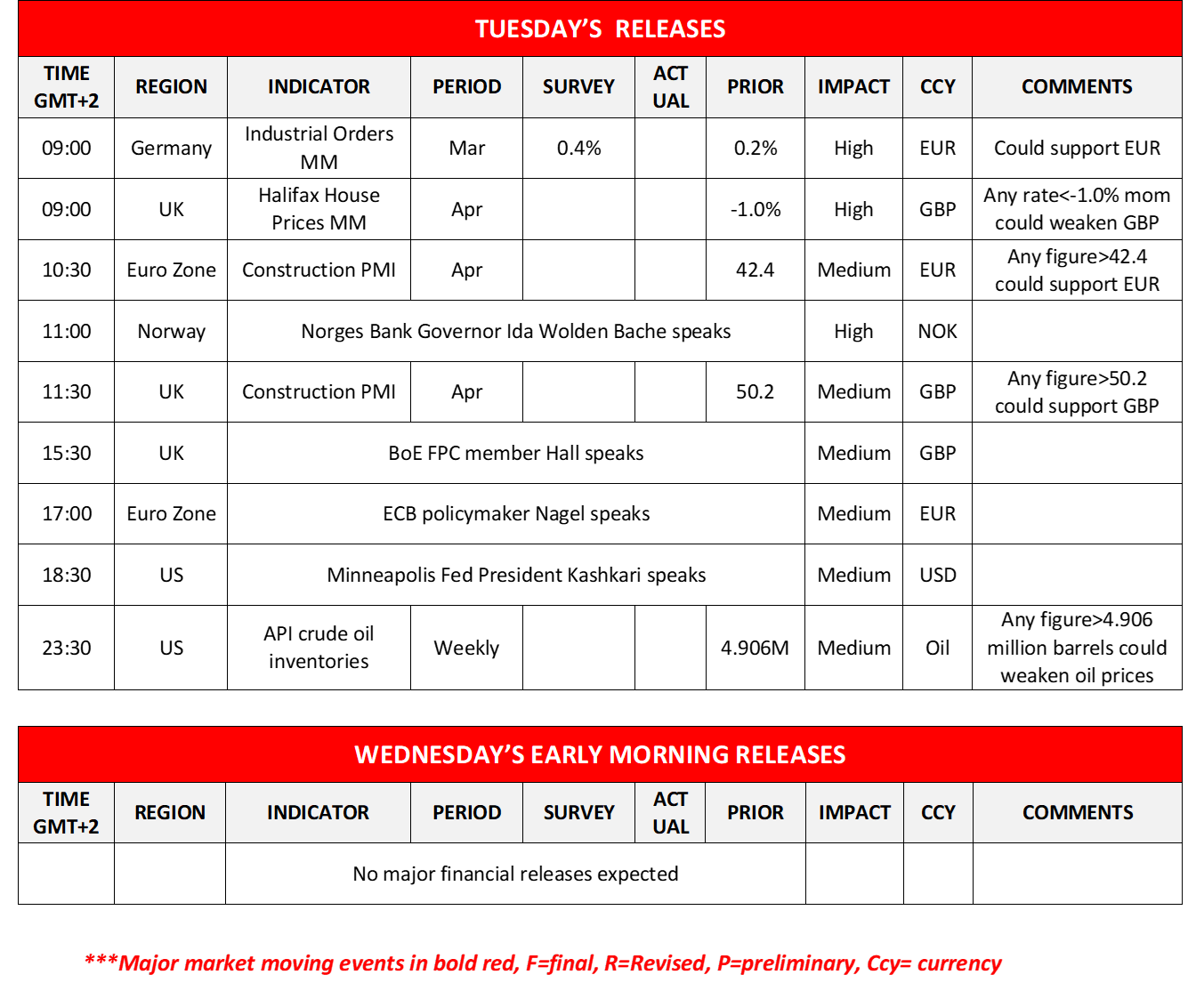

In today’s European session, we note the release of Germany’s industrial orders for March, UK’s Halifax House prices for April, Eurozone’s and UK’s construction PMI figures for April, and in the late American session oil traders may be interested in the release of API’s weekly crude oil inventories figure. On the monetary front, Norges Bank Governor Ida Wolden Bache, BoE FPC member Hall, ECB policymaker Nagel and Minneapolis Fed President Kashkari are scheduled to speak.

USD/JPY Daily Chart

Support: 153.80 (S1), 151.90 (S2), 149.00 (S3)

Resistance: 155.80 (R1), 158.35 (R2), 160.35 (R3)

AUD/USD デイリーチャート

Support: 0.6445 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6645 (R1), 0.6735 (R2), 0.6870 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。