Today we highlight the release of Eurozone’s preliminary September PMI figures. Main points of focus are the indicators for France’s services sector, Germany’s manufacturing sector and for a rounder view Eurozone’s composite indicator. The main point of market worries for EUR traders is expected to be the manufacturing sector as a whole and especially Germany’s. Should the indicator’s reading imply another, possibly deeper contraction of economic activity it could weigh on the common currency. On the flip side should other sectors and/or countries be able to compensate and contribute to an increase of economic activity throughout sectors and countries in the Eurozone, we may see some support for the Euro.

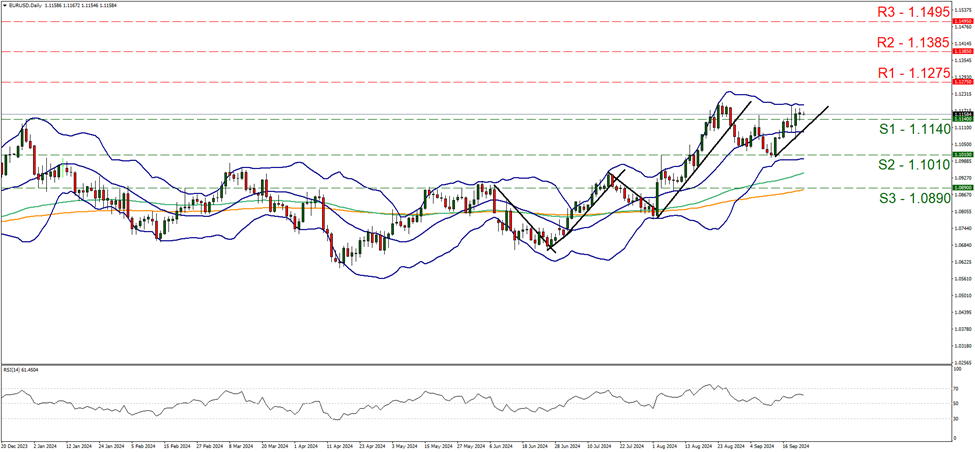

On a technical level, EUR/USD remained relatively unchanged using the 1.1140 (S1) as support. We tend to maintain a bullish outlook for the pair as long as the upward trendline guiding it since the 12 of September remains intact. We also note that the RSI indicator is rising, nearing the reading of 70, implying a build up of a bullish sentiment among market participants for the pair. Should the bulls maintain control over the pair as expected, we may see EUR/USD rising and aiming for the 1.1275 (R1) resistance line. Should the bears take over, we may see the pair, dropping breaking the 1.1140 (S1) support line also breaking the prementioned upward trendline, in a first signal that the upward motion has been interrupted and continue lower aiming for the 1.1010 (S2) support level.

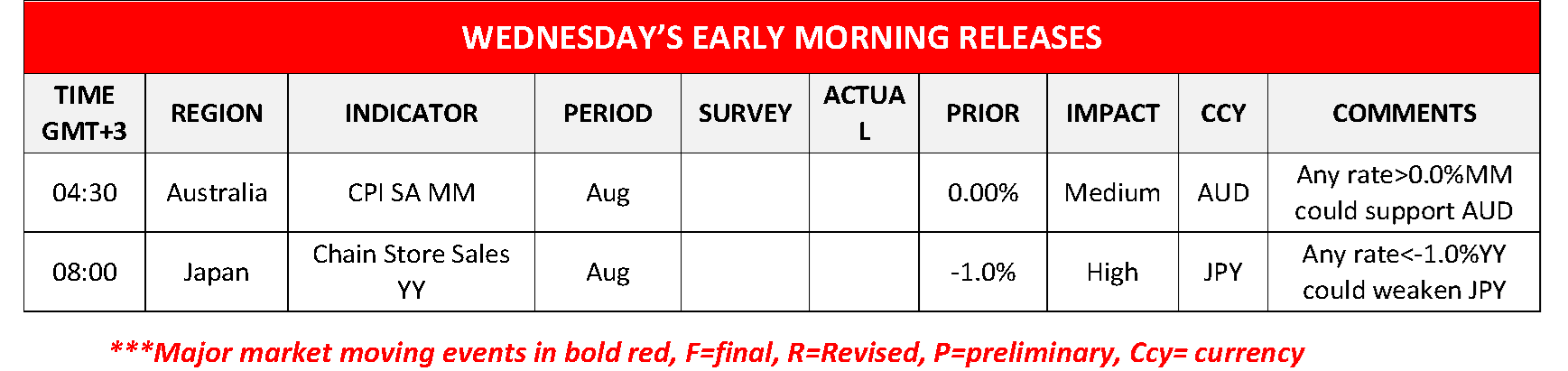

RBA is to release its interest rate decision during tomorrow’s Asian session. The bank is widely expected to remain on hold keeping the Cash rate at 4.35% and currently AUD OIS imply a probability of 94% for such a scenario to materialise, rendering the interest rate part of the decision as an open and shut case. Should the decision be accompanied by a statement implying hawkish intentions we may see the Aussie getting some support.

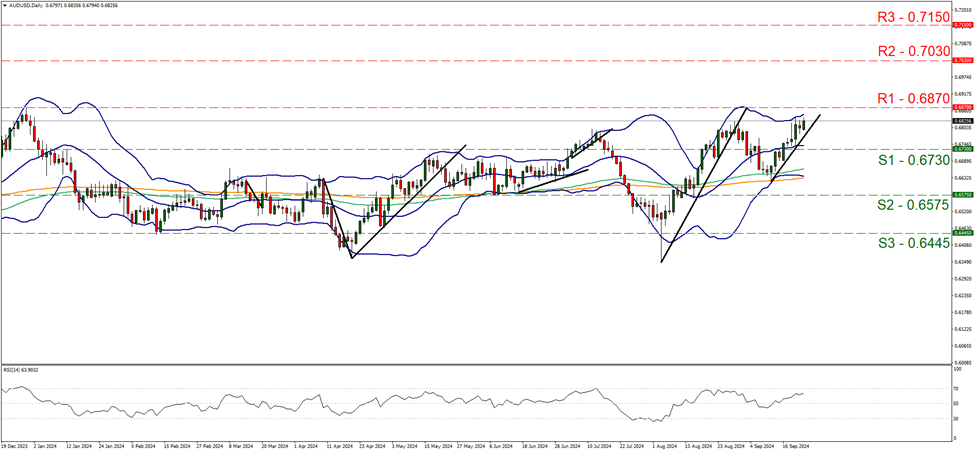

AUD/USD edged higher during today’s Asian session, aiming for the 0.8870 (R1) resistance line. We tend to maintain a bullish outlook for the pair as long as the upward trendline guiding the pair since the 11 of September, remains intact. The RSI indicator remains between the reading of 50 and 70, implying that the market mood for the pair tends to remain bullish. Should the buying interest be extended, we may see the pair breaking the 0.6870 (R1) line and start actively aiming for the 0.7030 (R2) level. Should the bears take over, we may see the pair reversing course breaking the prementioned upward trendline, signalling the breaking of the upward motion, breaking the 0.6730 (S1) level and aiming for the 0.6575 (S2) level.

本日のその他の注目点

Today we get UK’s and the US’s preliminary September PMI figures and UK’s CBI trends for industrial orders indicator for September. During tomorrow’s Asian session, we get Japan’s preliminary September PMI figures.

今週の指数発表

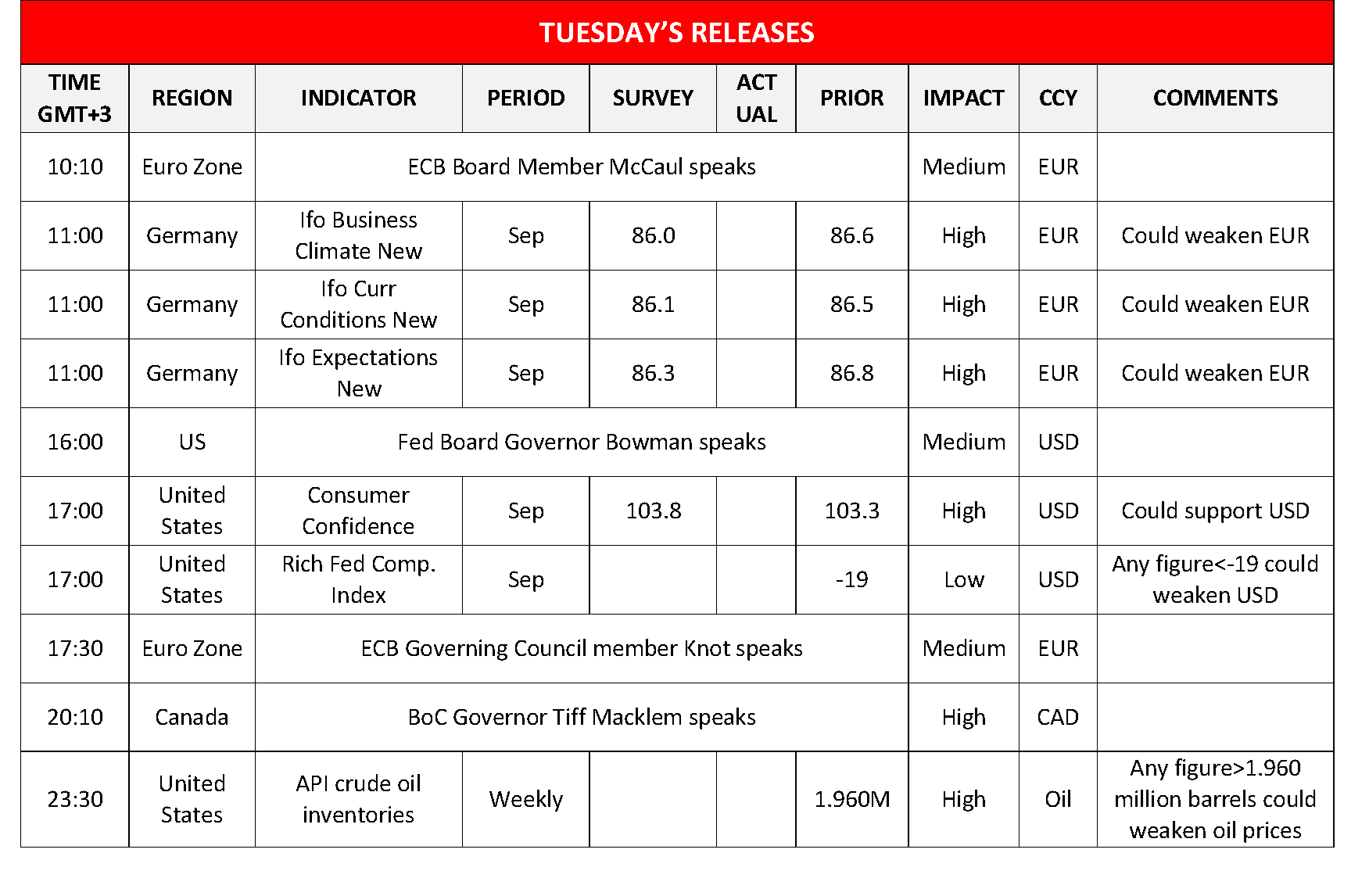

On Tuesday, we get Germany’s the Ifo indicators for the same month. We also get from Sweden Riksbank’s and the Czech Republic’s CNB interest rate decisions on Wednesday. On Thursday, we get Germany’s GfK Consumer Sentiment for October, Canada’s Business Barometer for October and from the US the Durable goods orders for August, the final GDP rate for Q2 and the weekly initial jobless claims figure and from Switzerland, we get SNB’s interest rate decision. On Friday we get from Japan, Tokyo’s CPI rates for September, France’s preliminary HICP rate for September, Euro Zone’s Business Sentiment for September, UK’s September CBI Indicator for distributive trades, we highlight the US Core and headline PCE index rates and we get also Canada’s GDP rate for July and from the US the final University of Michigan consumer sentiment for September.

EUR/USD デイリーチャート

- Support: 1.1140 (S1), 1.1010 (S2), 1.0890 (S3)

- Resistance: 1.1275 (R1), 1.1385 (R2), 1.1495 (R3)

AUD/USD デイリーチャート

- Support: 0.6730 (S1), 0.6575 (S2), 0.6445 (S3)

- Resistance: 0.6870 (R1), 0.7030 (R2), 0.7150 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。