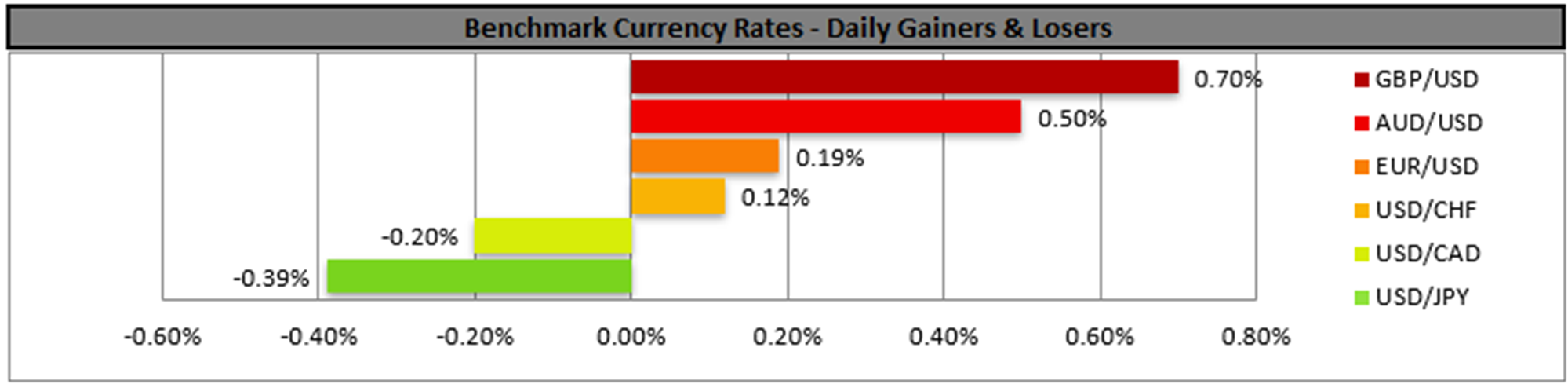

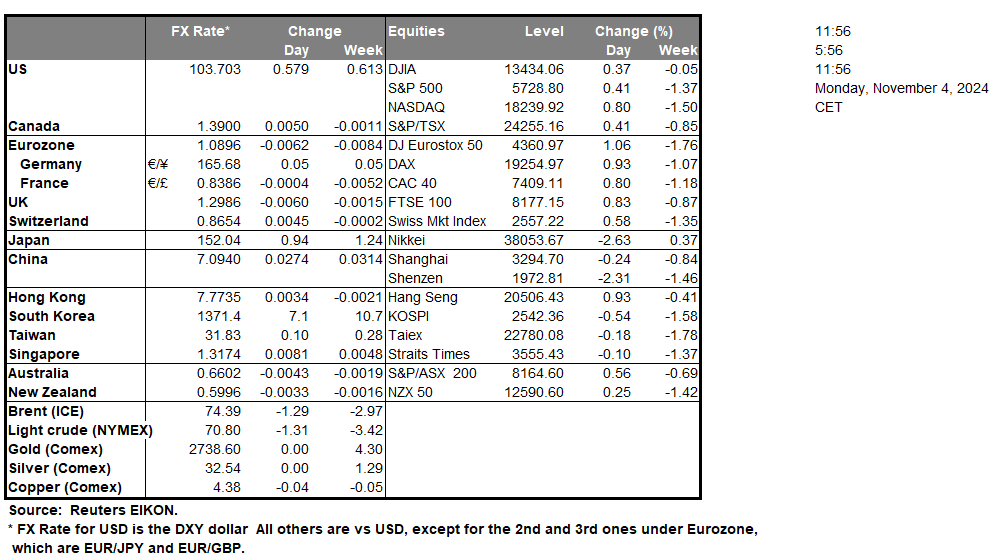

October’s US employment report was released on Friday, yet the shockingly low NFP figure on Friday, failed to impress traders as the unemployment rate remained unchanged and the hurricane season taking its toll on the figure, may have prepared the markets somewhat. The USD edged lower in today’s Asian session as Trump trades seem to be unwinding and the markets are bracing for the US elections on Tuesday. Polls still show Trump and Harris being neck on neck, hence uncertainty remains at high levels.

Across the world RBA is to deliver its interest rate decision during tomorrow’s Asian session and is widely expected to remain on hold, keeping the cash rate at 4.35%, with AUD OIS implying a probability of 95.65% for such a scenario to materialise. Hence we expect the market’s attention to turn towards the bank’s forward guidance in the accompanying statement and the following press conference. Should the bank maintain a hawkish tone, we may see the Aussie getting some support.

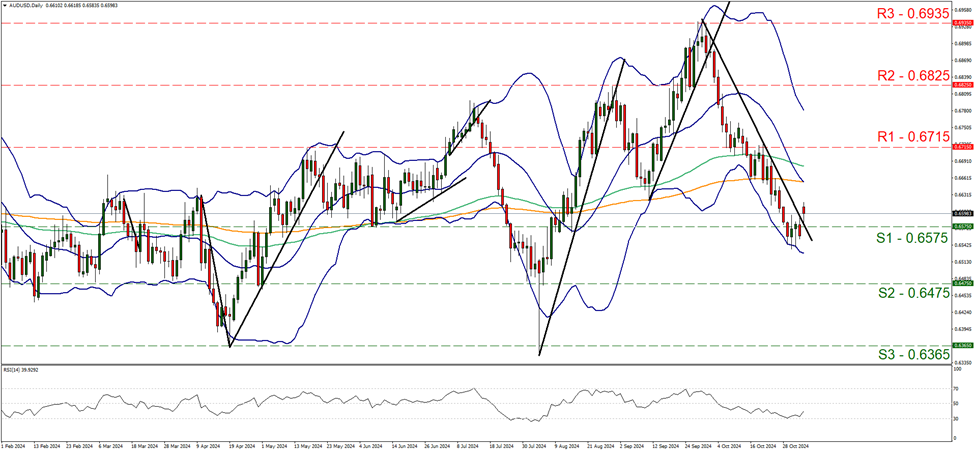

AUD/USD rose in today’s Asian session, breaking the 0.6575 (S1) resistance line now turned to support. As the downward trendline, guiding the pair since the 30 of September has been broken we temporarily switch our bearish outlook for a sideways motion. Yet we note that the RSI indicator despite correcting higher is still at low levels, implying a bearish predisposition of the market for the pair. Should the bears regain control over AUD/USD we may see the pair breaking the 0.6575 (S1) line and taking aim of the 0.6475 (S2) support level. For a bullish outlook, we require the pair to rise and aim if not reach the 0.6715 (R1) resistance line.

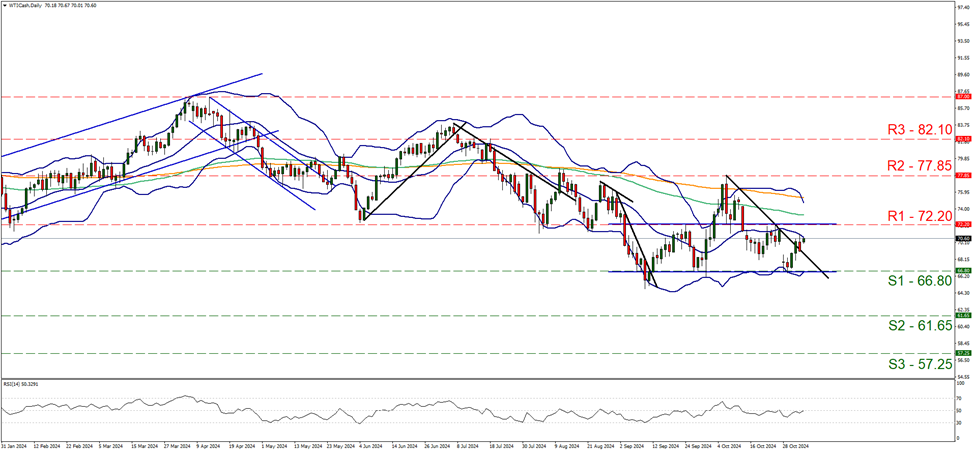

On the commodities front, we note that key members of the OPEC+ agreed to delay a planned increase of the December oil output by a month. Reuters reported that the group cited weak demand mostly from China and rising supply outside the group maintaining downward pressure on the oil market. We see the case for the news to have a bullish effect on oil prices, yet the wide uncertainty may keep gains at low levels.

WTI’s price rose, aiming for the 72.20 (R1) resistance level. WTI’s price action broke the downward trendline guiding it confirming our bias for a sideways motion between the 72.20 (R1) and the 66.80 (S1) levels. Also, the RSI indicator runs along the reading of 50, implying a rather indecisive market for the commodity’s price. For a bearish outlook we would require the commodity’s price to break the 66.80 (S1) support line clearly and actively aim for the 61.65 (S2) level. Should the bulls take over, we may see the pair rising, breaking the 72.20 (R1) resistance line, with the next possible target for the bulls being set at the 77.85 (R2) base.

その他の注目材料

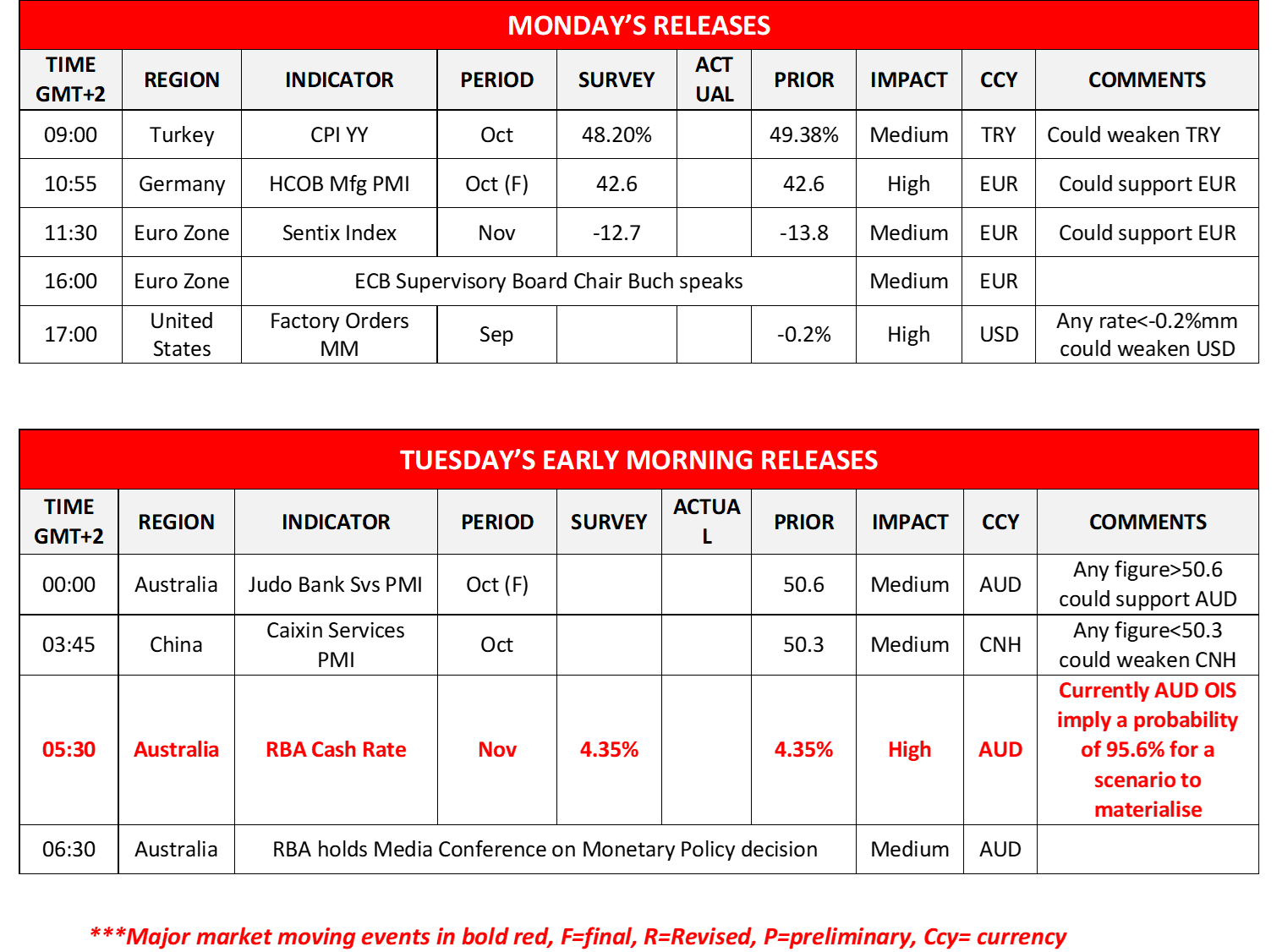

Today we get Turkey’s CPI rates for October, Germany’s final manufacturing PMI figure for October, Eurozone’s Sentix index for November and from the US the Factory orders growth rate for September. On the monetary front we note that ECB’s Buch is scheduled to speak. In tomorrow’s Asian session, we get Australia’s Services PMI figure for October and China’s Caixin services PMI figure for the same month.

今週の指数発表:

On Tuesday we get UK’s services PMI figure for October, Canada’s trade data for September, the US ISM non-manufacturing PMI for October and later on New Zealand’s Q3 employment data. On Wednesday we get Germany’s September industrial orders and on Thursday we get Australia’s September trade data, China’s October trade data, Germany’s September industrial output, Sweden’s preliminary CPI rates for September, and the UK’s Halifax House prices for October and from the US we get the weekly initial jobless claims figure. On the monetary front we highlight the Fed’s interest rate decision, while also UK BoE, Norway’s Norgesbank and the Czech Republic’s CNB are to decide on their monetary policy. On Friday we get Japan’s All Household spending for September, Canada’s October employment data and from the US we get the preliminary University of Michigan consumer sentiment for November.

AUD/USD デイリーチャート

- Support: 0.6575 (S1), 0.6475 (S2), 0.6365 (S3)

- Resistance: 0.6715 (R1), 0.6825 (R2), 0.6935 (R3)

WTI Daily Chart

- Support: 66.80 (S1), 61.65 (S2), 57.25 (S3)

- Resistance: 72.20 (R1), 77.85 (R2), 82.10 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。