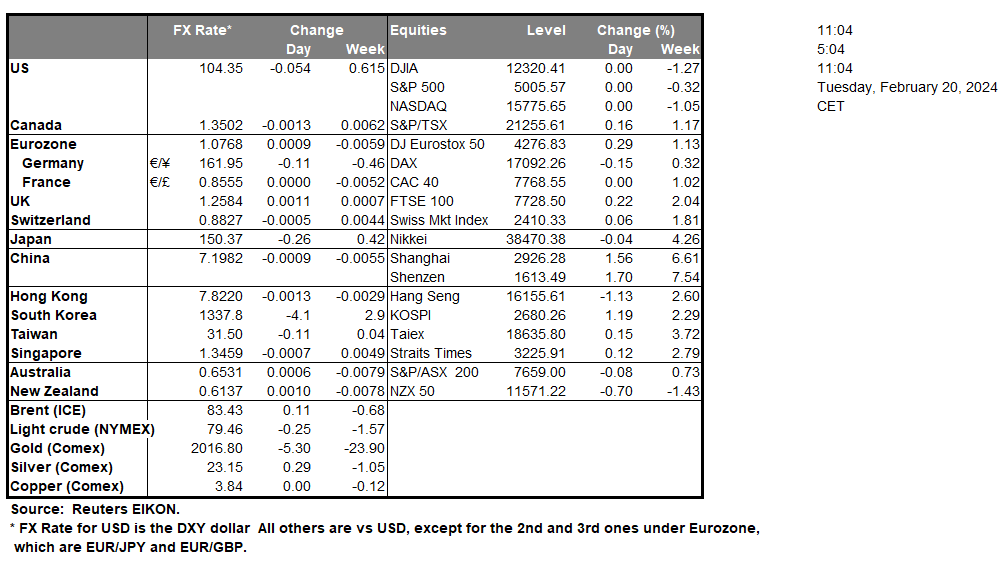

In the RBA’s February meeting minutes, the bank appears to have considered two possibilities, with one being to remain on hold and the other being a potential 25 basis point rate hike. The consideration by the bank to potentially raise rates by 25 basis points, implies that the bank may have not reached its terminal rate. As such, the possibility of the bank raising rates in the future could potentially provide support for the Aussie in the long run.Over in America, Canada’s CPI rates for January are due to be released later on today. According to economists, the headline CPI rate on a mom level is expected to increase, whilst on a yoy level it is expected to decrease. As such the impact of the two financial releases could potentially counteract each other. Yet, should the CPI rates come in higher than expected, it could provide support for the Loonie, as it may imply that the battle against inflation is not over. Whereas should they come in lower than expected, implying easing inflationary pressures it could weigh on the Loonie. According to Reuters, Lufthansa (#Lufthansa) ground staff, walked off the job at major airports yesterday, in their second strike this month. Per the Article, wage talks are due to resume later on today. In terms of the company’s stock price, should the strikes continue or intensify thus potentially affecting the company’s flight itinerary which may lead to cancellations or delays, it could weigh on the company’s stock price. In Asia, tensions appear to be rising between China and Taiwan, following an incident with the Chinese coast guard, boarding a tourist boat in Taiwanese waters. Should the tensions escalate, we may see safe-haven inflows into gold, yet no impact appears to have been seen at this point in time, as the matter was quickly resolved.

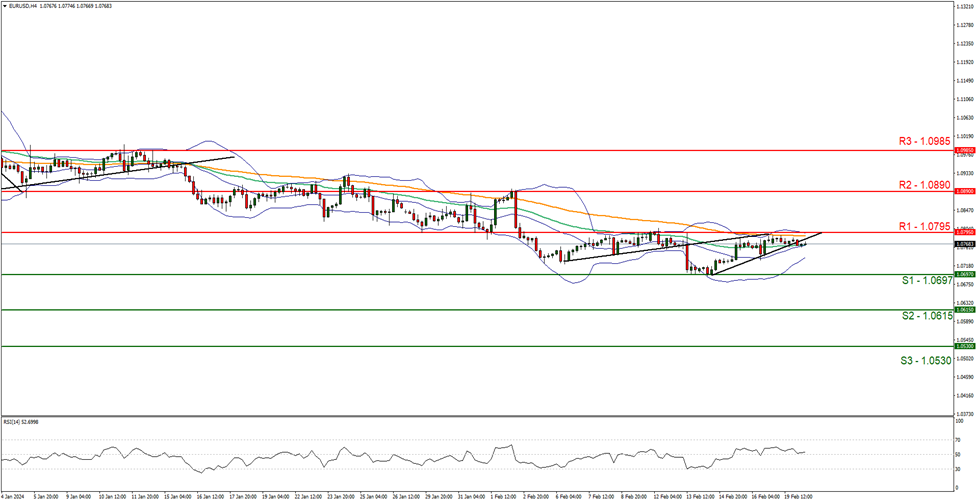

EUR/USD appears to continue moving in a sideways fashion. We maintain our neutral outlook for the pair after it failed to break above the 1.0795 (R1) resistance level. Supporting our case is the continued narrowing of the Bollinger bands implying low market volatility, in addition to the RSI indicator below our chart currently registers a figure of 50, implying a neutral market sentiment. For, our sideways motion to be maintained, we would like to see the pair remain confined between the 1.0697 (S1) support level and the 1.0795 (R1) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.0697 (S1) support level, with the next possible target for the bears being the 1.0615 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 1.0795 (R1) resistance line, with the next possible target for the bulls being the 1.0890 (R2) resistance barrier.

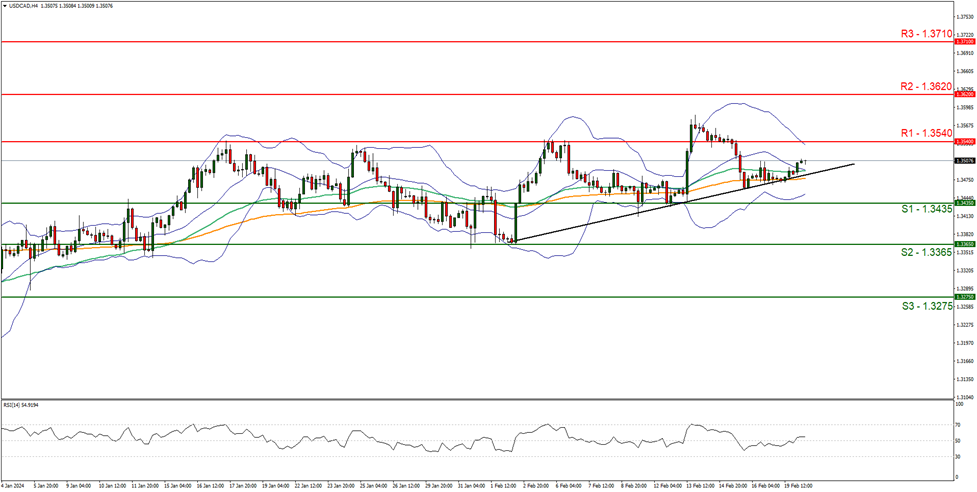

USD/CAD appears to be moving in an upward fashion. We maintain a bullish outlook for the pair and supporting our case is the upwards moving trendline which was incepted on the 2 of February. Yet, the RSI indicator below our chart currently registers a figure 50, implying a neutral market sentiment. Nevertheless, for our bullish outlook to continue we would like to see a clear break above the 1.3540 (R1) resistance level, with the next possible target for the bulls being the 1.3620 (R2) resistance line. On the other hand, for a sideways bias we would like to see the pair remain confined between the 1.3435 (S1) support level and the 1.3540 (R1) resistance line. Lastly, for a bearish outlook we would like to see a clear break below the 1.3435 (S1) support level, with the next possible target for the bears being the 1.3365 (S2) support base.

その他の注目材料

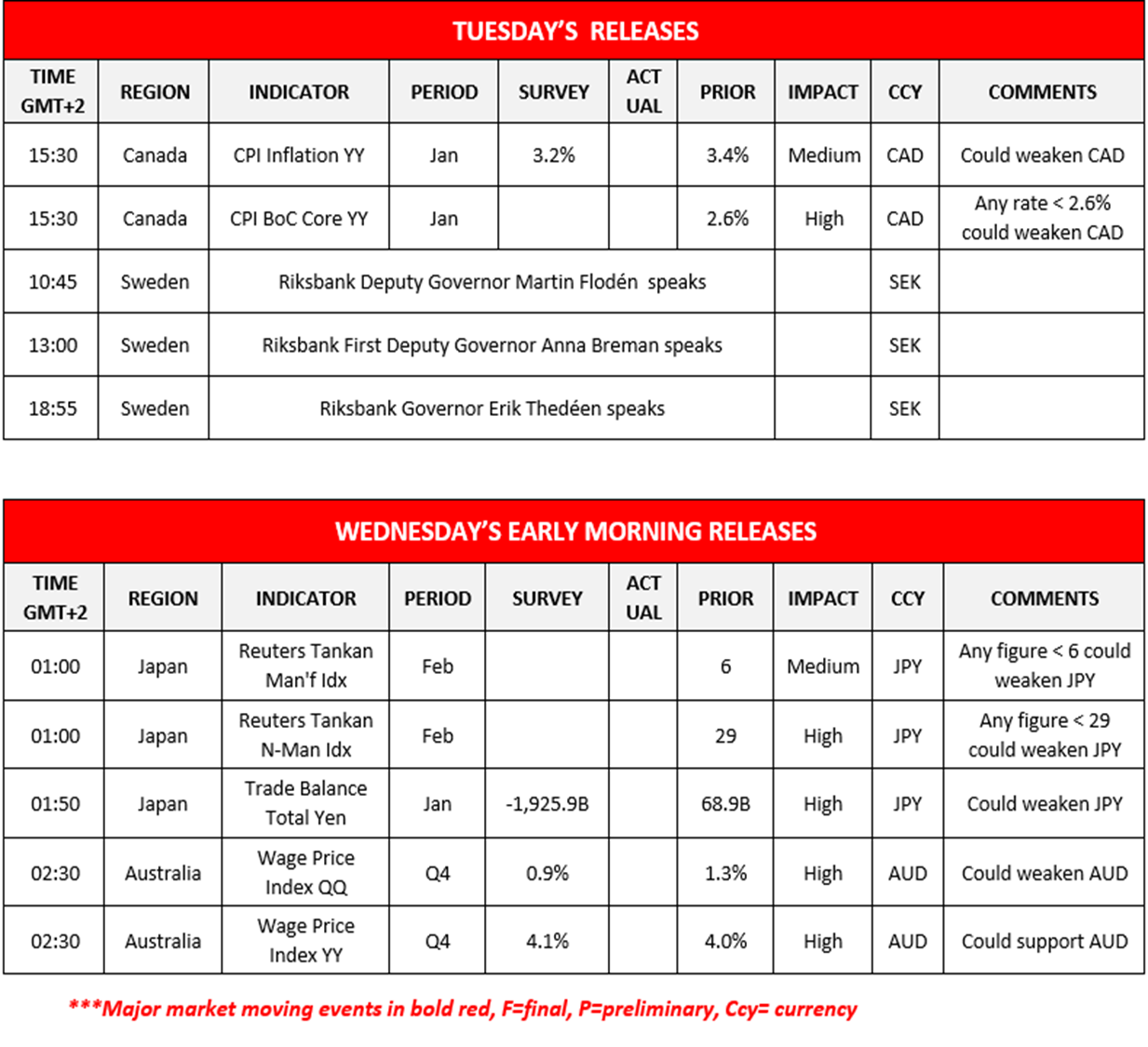

We note in today’s American Session the release of Canada’s CPI rates for January. In tomorrow’s busy Asian session, we note Japan’s Tankan Non-manufacturing and manufacturing figures for February, followed by Japan’s trade balance figure for January and Australia’s wage price index rates for Q4 of 2023. On a monetary level, we highlight the speeches today by Riksbank Deputy Governor Floden, Riksbank First Deputy Governor Breman and Riksbank Governor Thedeen.

EUR/USD 4時間チャート

Support: 1.0697 (S1), 1.0615 (S2), 1.0530 (S3)

Resistance: 1.0795 (R1), 1.0890 (R2), 1.0985 (R3)

USD/CAD 4時間チャート

Support: 1.3435 (S1), 1.3365 (S2), 1.3275 (S3)

Resistance: 1.3540 (R1), 1.3620 (R2), 1.3710 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。