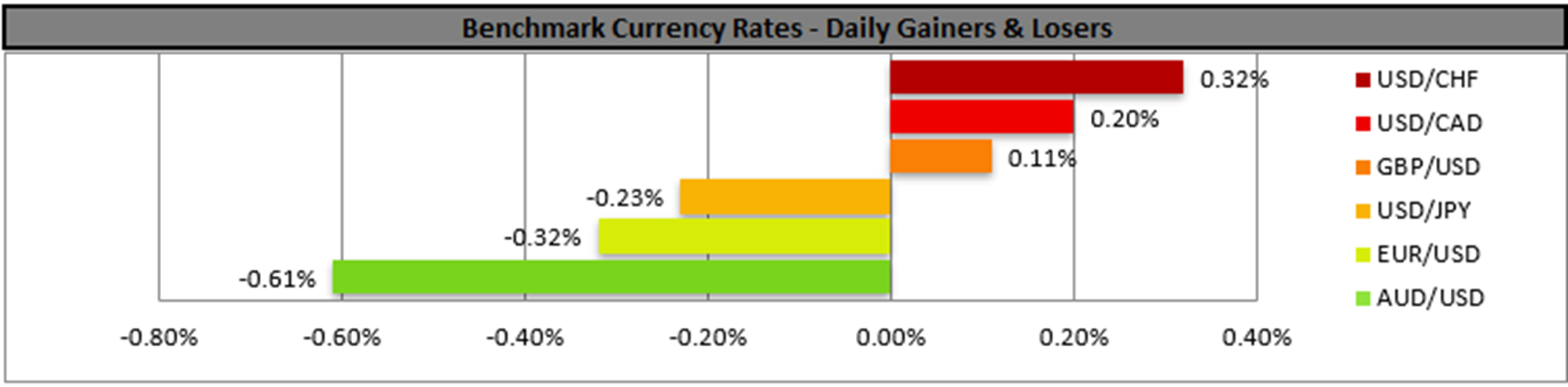

The USD moved higher against its counterparts yesterday and during today’s Asian session. On a fundamental level, the threats of US President Trump to impose tariffs continues to feed uncertainty among market participants. In the latest news about the issue, Trump seems to have revived for another 1-month postponement of tariffs which are to be imposed on Canadian and Mexican products entering the US yet on another twist floated the idea of imposing 25% tariffs on European products. Overall the reaction in the FX market was lukewarm as signals coming out were mixed, yet also as the market may have largely priced in such scenarios. Also, we see some fatigue among market participants for the issue which may have moderated the market’s reaction. Hence, we expect that it may take something more decisive from Trump to shake the markets, which would be altering fundamentally the markets once again, in order for a Trump statement to be a market mover.

On a monetary level, we still maintain the view of a less dovish Fed and its characteristic that Atlanta Fed President Bostic supported the idea of rates remaining where they are even if the employment market is being hit. Please note that today we have a number of Fed policymakers that are scheduled to make statements and should they stick to the hawkish script we may see the greenback getting some support.

On a macroeconomic level, we note today the release of the revised US GDP rate for Q4 24. Should the rate accelerate is compared to the preliminary release, we may see the USD strengthening, as it would mean that the growth of the US economy expanded at a faster pace than initially calculated.

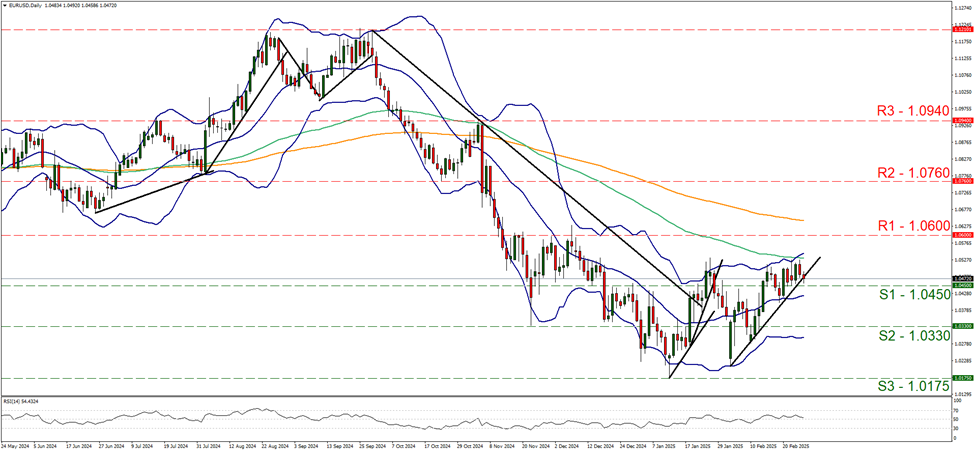

EUR/USD edged lower yesterday, aiming for the 1.0450 (S1) support line. The pair in its downward motion is putting the upward trendline, guiding the pair since the 13 of January to the test, signalling a possible interruption of the upward movement. The RSI indicator dropped yet remained just above the reading of 50 implying an easing of the bullish sentiment, yet as it has not dropped below the reading of 50, no bearish sentiment seems to surface yet. For a bearish outlook we would require a more decisive bearish movement which would break below the 1.0450 (S1) line and start actively aiming if not testing the 1.0330 (S2) support level. For a renewal of a bullish outlook we would require the pair to reverse yesterday’s losses, aiming if not breaching the 1.0600 (R1) level and the next possible target for the bulls is set at the 1.0760 (R2) level.

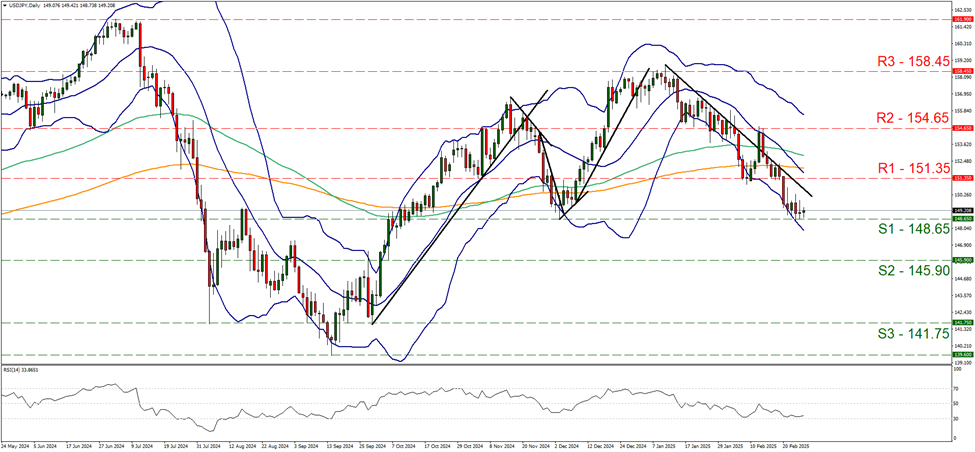

Also in the FX market we note that USD/JPY seems to have hit the floor at the 148.65 (S1) support line. Yet the downward trendline guiding the pair lower since the 10 of January remains intact and the RSI indicator remains just above the reading of 30, implying the presence of a bearish sentiment of the market for the pair. Hence we maintain a bearish outlook for the pair, yet we may see a temporary stabilisation of the pair taking place, even a correction higher is possible. Should the bears maintain control over the pair as expected, we may see USD/JPY breaking the 148.65 (S1) support line and start aiming for the 145.90 (S2) support level. Should the bulls take over we may see the pair rising breaking initially the prementioned downward trendline, in a first clear signal that the downward motion has been interrupted and continue to break the 151.35 (R1) resistance line with the next resistance level being set at 154.65 (R2).

その他の注目材料

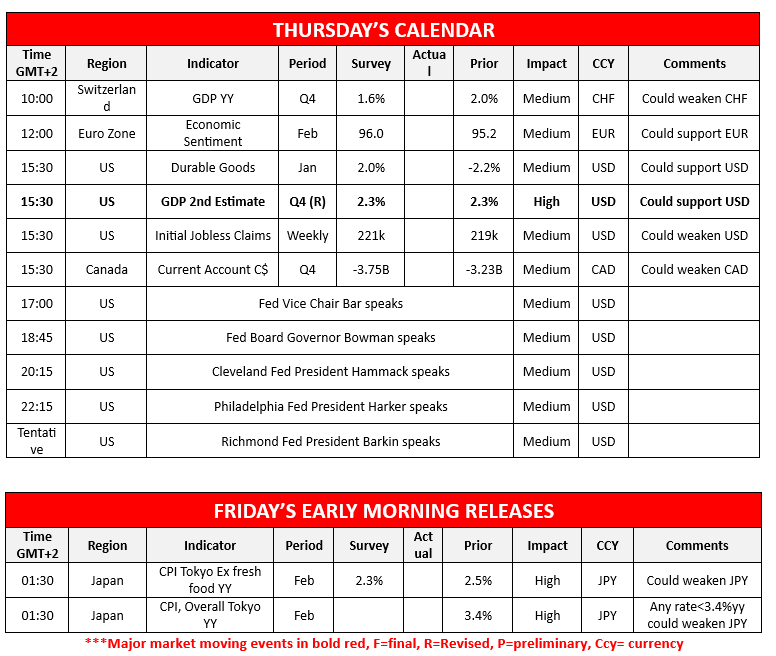

Today we get Switzerland’s GDP rate for Q4, Euro Zone’s Economic Sentiment indicator for February and in the American session, we get from the US January’s Durable Goods orders and the weekly initial jobless claims figure, while from Canada we get the current account balance for Q4. On the monetary front, we note that Fed Vice Chair Bar, Fed Board Governor Bowman, Cleveland Fed President Hammack, Philadelphia Fed President Harker and Richmond Fed President Barkin are scheduled to make statements. In tomorrow’s Asian session, we get from Japan, Tokyo’s CPI rates for February.

EUR/USD デイリーチャート

- Support: 1.0450 (S1), 1.0330 (S2), 1.0175 (S3)

- Resistance: 1.0600 (R1), 1.0760 (R2), 1.0940 (R3)

USD/JPY Daily Chart

- Support: 148.65 (S1), 145.90 (S2), 141.75 (S3)

- Resistance: 151.35 (R1), 154.65 (R2), 158.45 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。