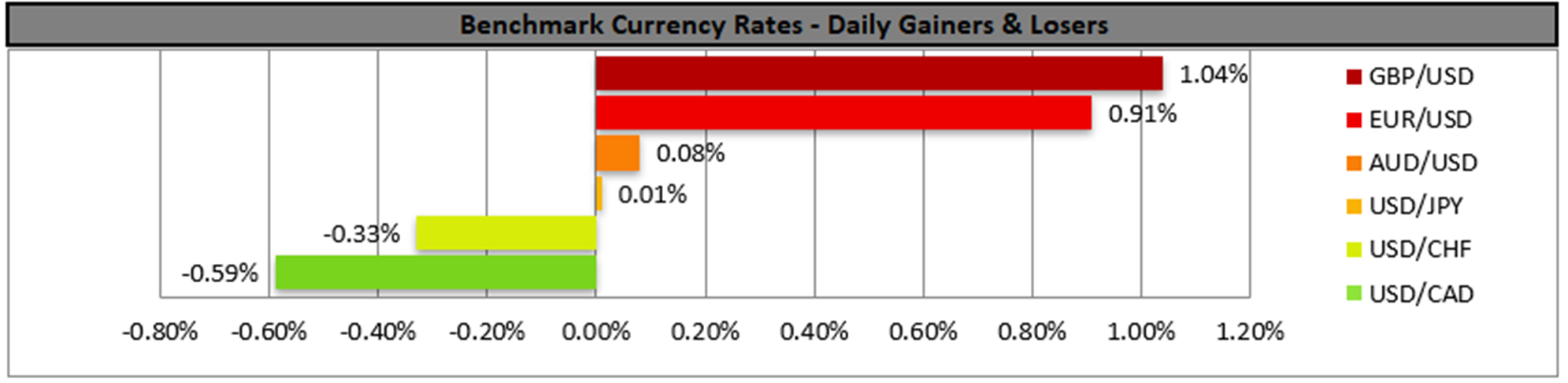

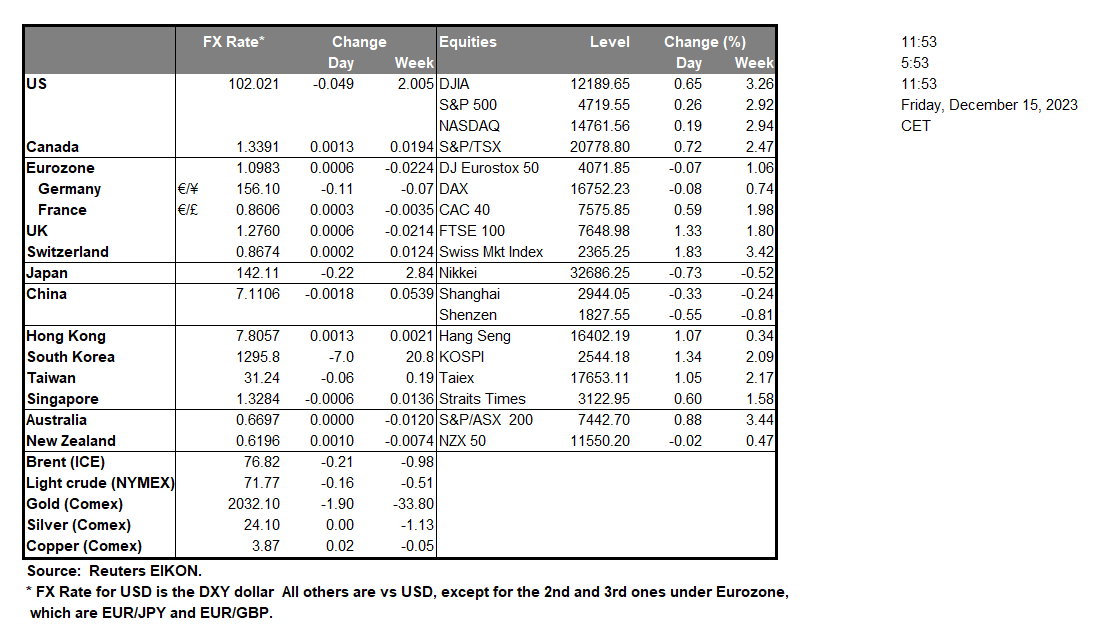

The USD continued to weaken against its counterparts yesterday as the Fed’s dovish pivot continued to weigh on a monetary policy level. It should be noted that the USD continued to weaken despite the US retail sales growth rate accelerating beyond market expectations for November, while also the drop of the weekly initial jobless claims figure sent some positive signals as well. It’s characteristic of the more risk-on mood of the market that US stock market indexes continued to be on the rise albeit at a slower pace, with Dow Jones reaching new all-time highs. Also, the weakening of the USD allowed for gold’s price to continue to gain while the drop of US yields also may have contributed to gold’s ascend. Today from the US we note the release of the industrial production growth rate for November and an acceleration may provide some support.

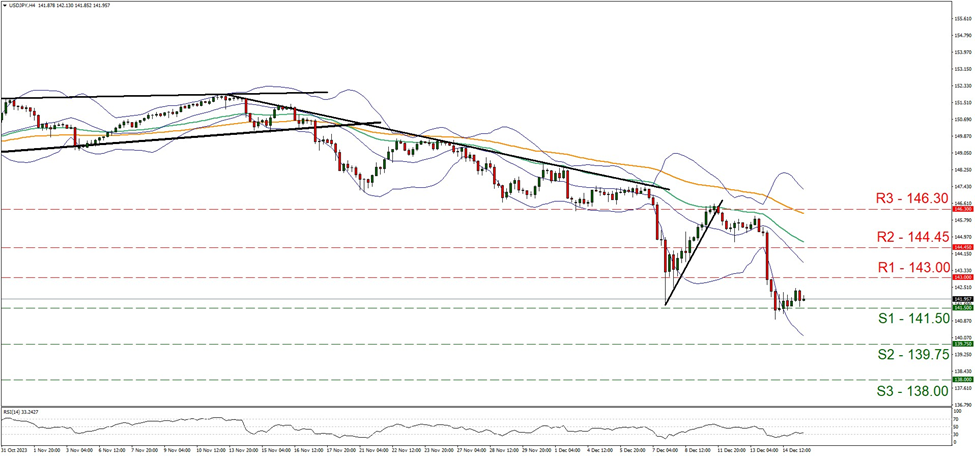

On a technical level we note that the USD weakened against the JPY, with the pair at some point testing the 141.50 (S1) support line. We note the stabilisation of the pair above the 141.50 (S1) support line, yet also note that the RSI indicator runs along the reading of 30, implying a rather bearish sentiment on behalf of the market and implying that the downward motion may not be over just yet. Should the bears take over, we may see USD/JPY breaking the 141.50 (S1) support line and aim for the 139.75 (S2) support level. Should on the other hand the bulls find the chance and take the reins, we may see the pair reversing direction, erasing the losses of yesterday and breaking the 143.00 (R1) resistance line with the next possible target for the bulls being set at the 144.45 (R2) resistance barrier.

It should be noted that during today’s Asian session, Chinese data for November were rather optimistic with the industrial output and retail sales growth rates accelerating implying wider economic activity in the manufacturing sector and a healthy demand side in the Chinese economy. Overall the release seems to ease the market’s worries for the recovery of the Chinese economy and may support CNY and AUD.

Furthermore, we would note that both the EUR and the GBP gained against the USD yesterday, as the ECB 、 BoE sounded more hawkish than what the market expected in their interest rate decisions, despite remaining on hold as was widely expected. Today we expect the attention of EUR traders to fall on the release of the preliminary December PMI figures with special interest being on Germany’s manufacturing sector. Overall, the readings are expected to improve yet remain below the reading of 50, implying a contraction of economic activity across countries and sectors which could moderate any excitement from the possible improvement of the indicators’ readings.

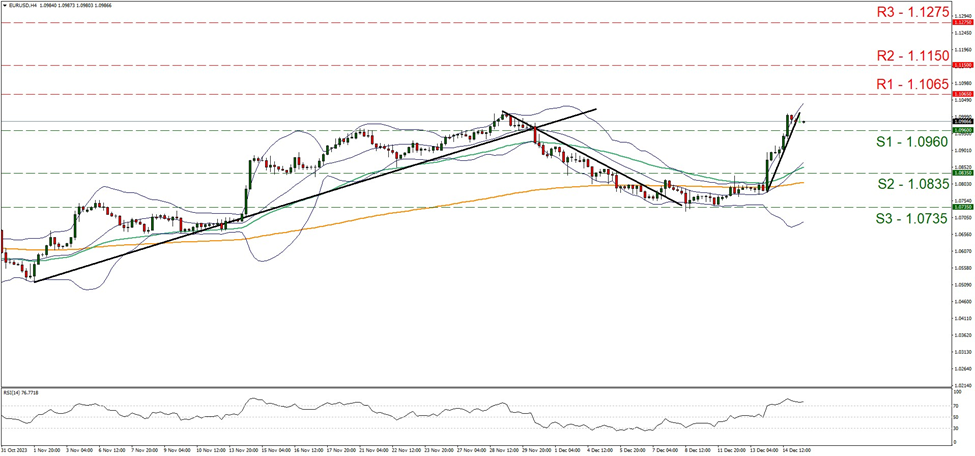

EUR/USD yesterday was on the rise breaking the 1.0960 (S1) resistance line, now turned to support. Despite the upward movement we note the stabilisation of the pair which tended to interrupt the upward trajectory of the pair. On the other hand, the RSI indicator is still at high levels implying a bullish sentiment on behalf of the markets, while the upper Bollinger band seems to allow for more gains for the pair. Should the pair find fresh, extensive buying orders along its path, we may see the pair breaking the 1.1065 (R1) resistance line and aim for the 1.1150 (R2) resistance level. On the other hand, should a selling interest be expressed by the market we may see EUR/USD reversing direction, breaking the 1.0960 (S1) support line and aim for the 1.0835 (S2) support level.

その他の注目材料

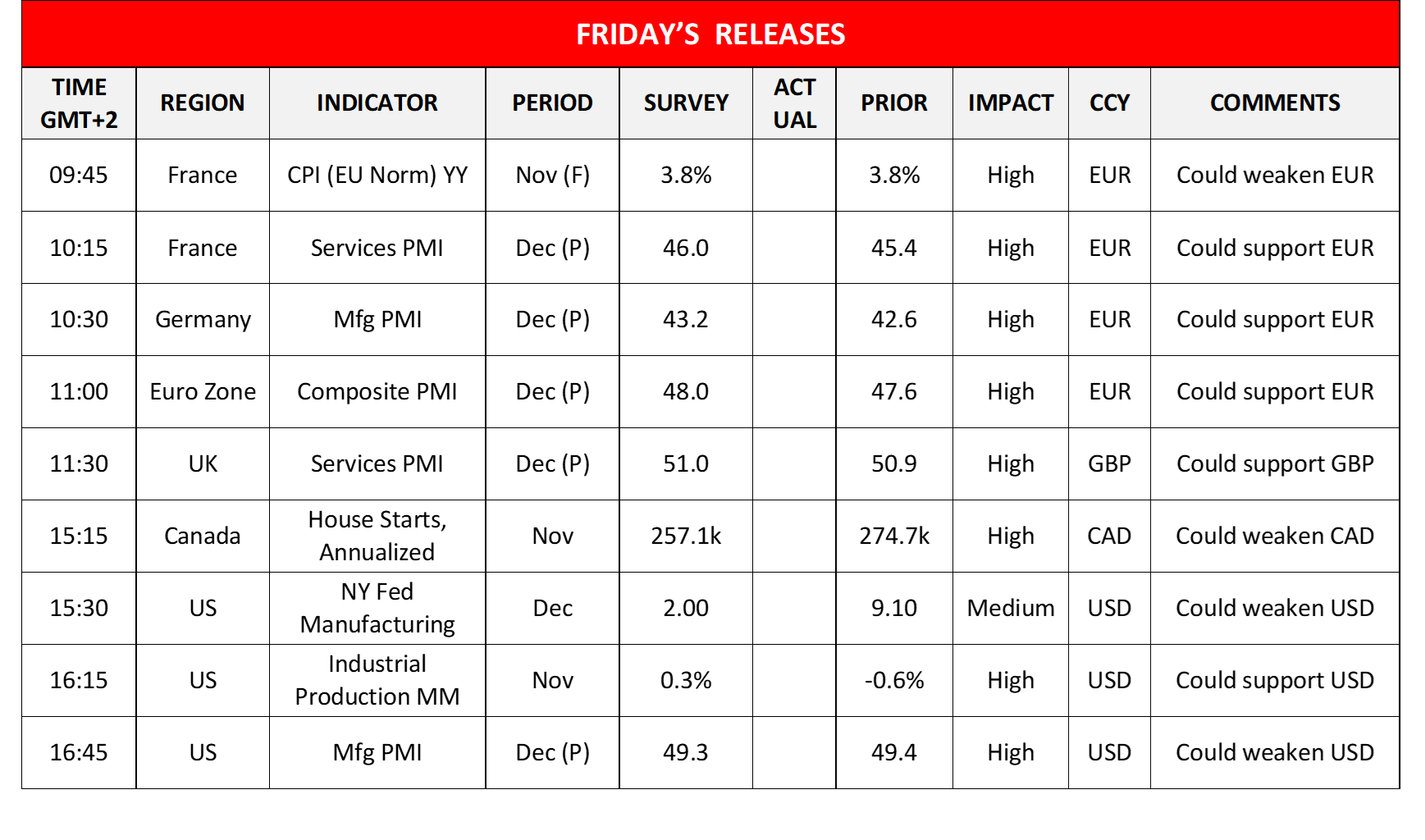

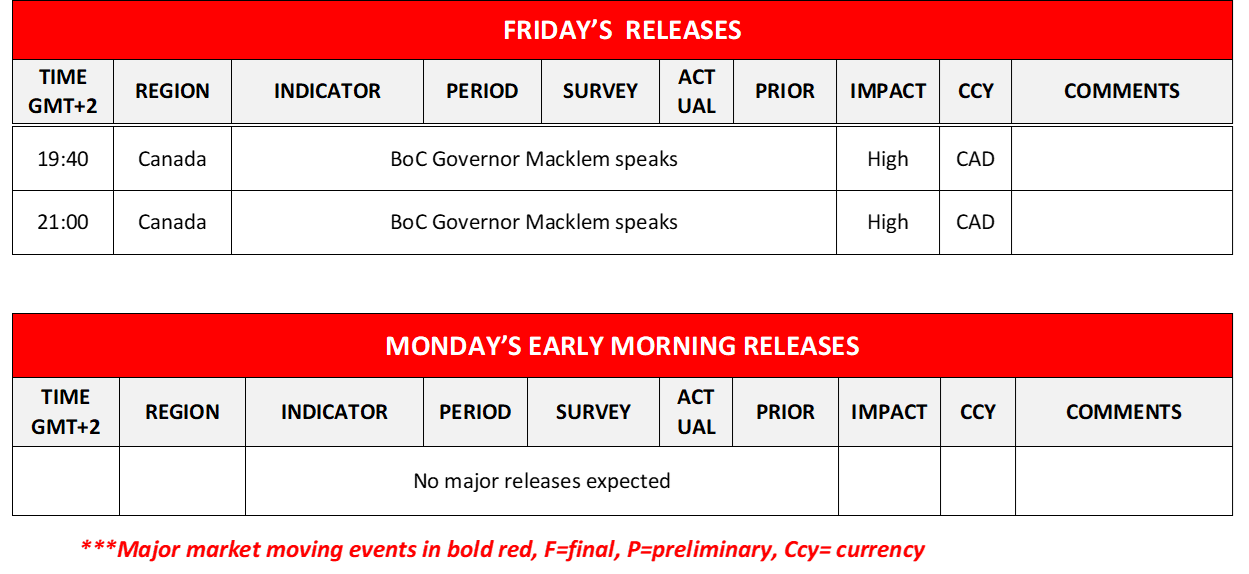

Today we get the preliminary PMI figures for December of France, Germany, the Eurozone as a whole, the UK and the US, we also note the release of France’s final HICP rate for November, Canada’s house starts, and from the US the NY Fed manufacturing for December and industrial production of November. On the monetary front, we note that BoC Governor Macklem is to take the podium twice in the American session.

USD/JPY 4時間チャート

Support: 141.50 (S1), 139.75 (S2), 138.00 (S3)

Resistance: 143.00 (R1), 144.45 (R2), 146.30 (R3)

EUR/USD 4時間チャート

Support: 1.0960 (S1), 1.0835 (S2), 1.0735 (S3)

Resistance: 1.1065 (R1), 1.1150 (R2), 1.1375 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。