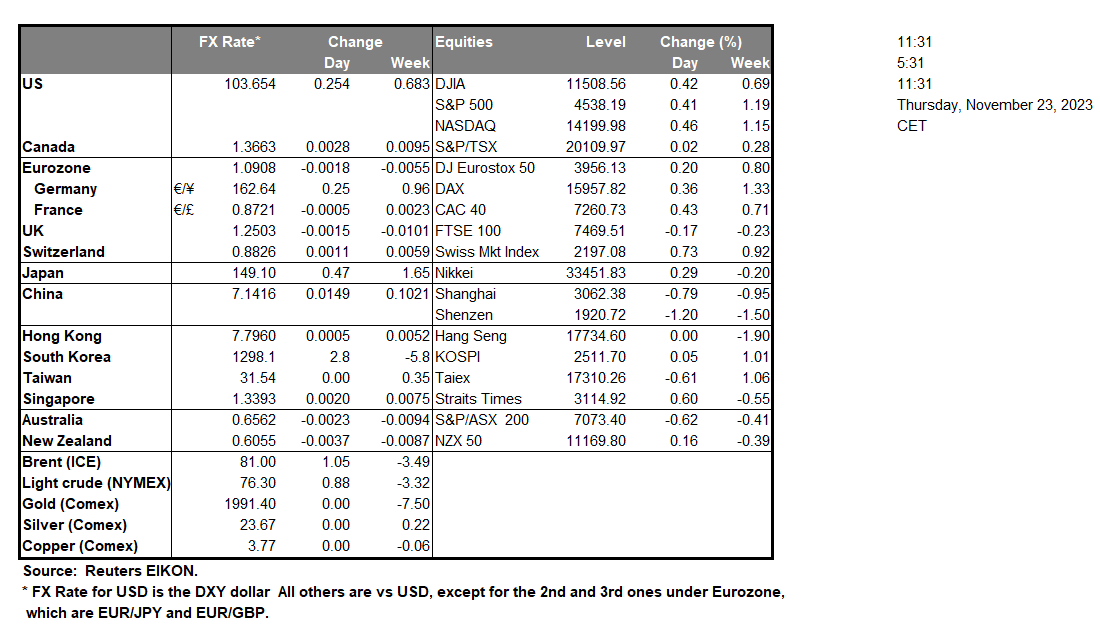

OPEC+ has delayed its meeting which was scheduled to take place over this weekend, to the 30 of November. According to media outlets, the delay occurred due to disagreements amongst OPEC+ members, in regard to oil production cuts. The apparent divisions seem to have aided in oil’s downward descent during yesterday’s trading session. Furthermore, the US EIA Crude Oil inventories came in higher than expected at 8.701M compared to the expected figure of 1.160M barrels. The higher-than-expected figure may imply that demand for oil is slowing down in the US and as such, may have aided in the downward pressures on oil.

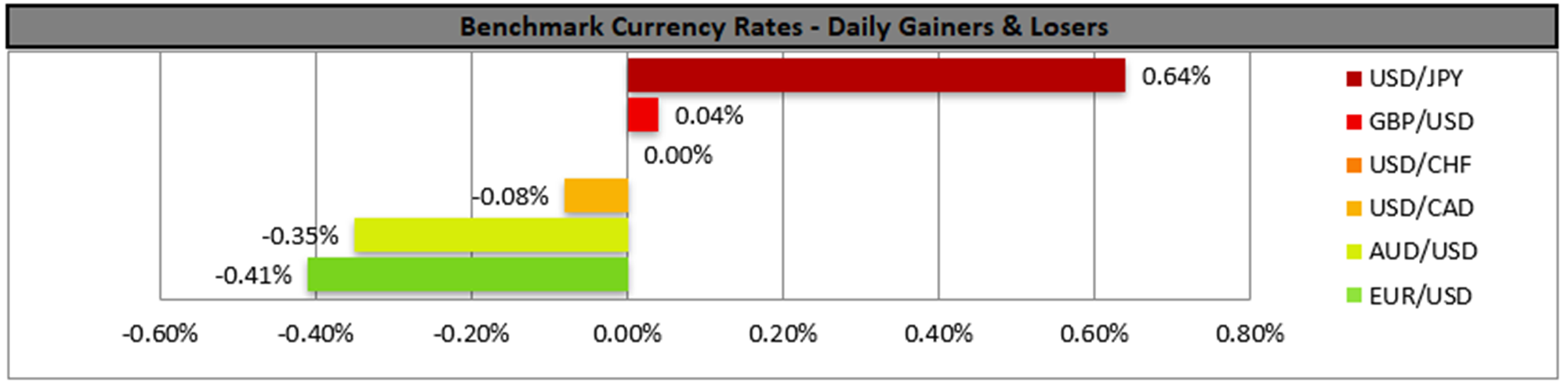

The US Initial Jobless claims figure, came in lower than expected, hinting at a relatively tight labour market and as such, may have provided support for the greenback, as it appears that the labour market, may be more resilient than what was previously anticipated. ECB Nagel hinted that the ECB is close to its terminal rate, implying that the bank may need to hike at least one more time, which may support the EUR. Over in Canada, BoC Governor Macklem hinted that inflationary pressures in Canada remain high and the progress being made currently, may not be sufficient. Furthermore, the Governor stated that the bank is prepared to raise its policy rate further, should inflationary pressures persist, which could support the Loonie. According to various media outlets, China is preparing packages to aid its property developers, as fears continue to mount about the resilience of the Chinese economy. Such a move could potentially aid in economic development in China, which in turn may provide some support for the Aussie given their close economic ties, as demand for their goods may rise.

WTICash appears to be moving in a sideways fashion after failing to break below support at 73.95 (S1) and also failing to break above resistance at 77.25 (R1). We maintain a sideways bias for the commodity and supporting our case is the RSI Indicator below our 4-Hour chart which currently registers a figure near 50, implying a neutral market sentiment. For our neutral outlook to continue, we would like to see the commodity remaining confined between the 73.95 (S1) support level and the 77.25 (R1) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 73.95 (S1) support level, with the next possible target for the bears being the 69.65 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 77.25 (R1) resistance level, with the next possible target for the bulls being the 80.70 (R2) resistance level.

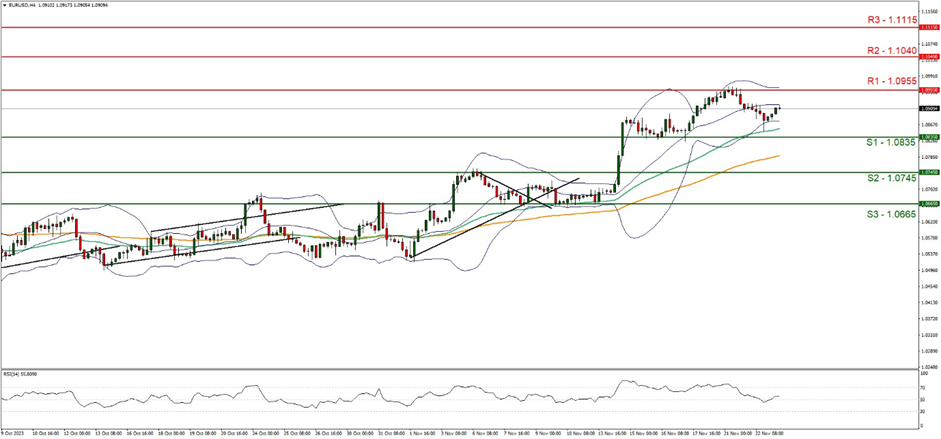

EUR/USD appears to be moving in a sideways fashion and supporting our case is the RSI Indicator below our 4-Hour chart which currently registers a figure near 50, implying a neutral market sentiment, in addition to the narrowing of the Bollinger bands which imply low market volatility. For our sideways bias to continue, we would like to see the pair remaining confined between the 1.0955 (R1) resistance line and the 1.0835 (S1) support level. On the other hand, for a bearish outlook, we would like to see a break below the 1.0835 (S1) support level, with the next possible target for the bears being the 1.0745 (S2) support base. Lastly for a bullish outlook, we would like to see a break above the 1.0955 (R1) resistance level, with the next possible target for the bulls being the 1.1040 (R2) resistance ceiling.

その他の注目材料

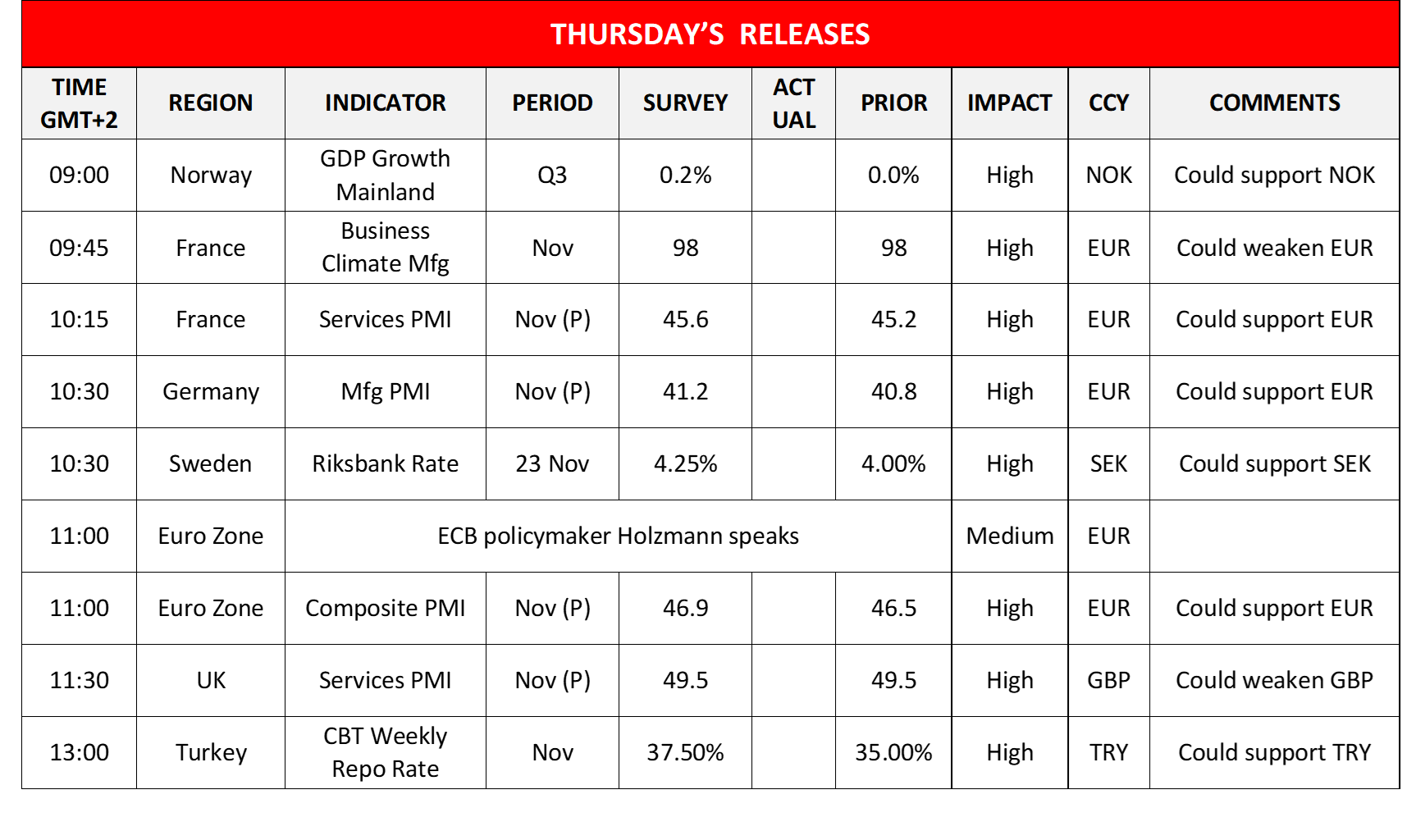

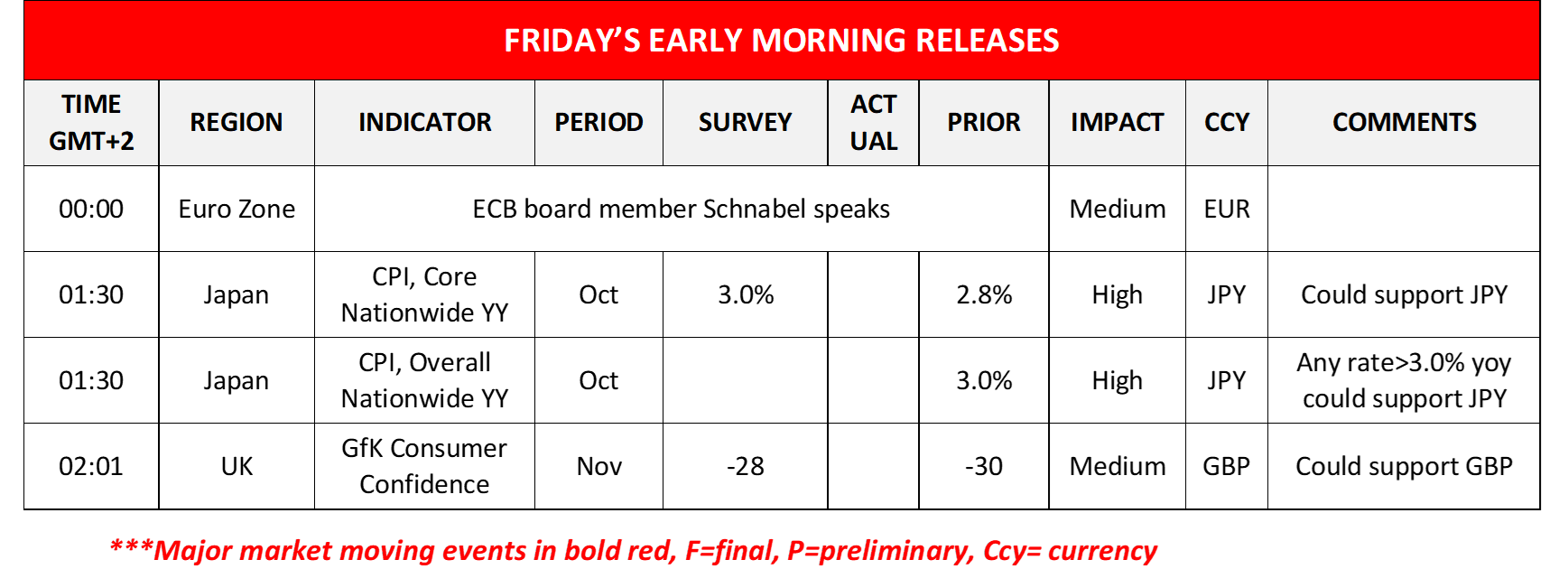

Today in the European session, we get Norway’s GDP rates for Q3, France’s business climate for November and the preliminary PMI figures of Germany, France, the Eurozone and the UK. On the monetary front, we note the release of Sweden Riksbank and Turkey’s CBT interest rate decisions while ECB policymaker Holzmann and board member Schnabel are scheduled to speak. Also please note that it’s Thanksgiving Day in the US and markets are to be closed. During tomorrow’s Asian session, we get Japan’s CPI rates for October and UK’s GfK consumer sentiment for November.

WTICash 4 Hour Chart

Support: 73.95 (S1), 69365 (S2), 65.15 (S3)

Resistance: 77.25 (R1), 80.70 (R2), 85.40 (R3)

EUR/USD 4 Hour Chart

Support: 1.0835 (S1), 1.0745 (S2), 1.0665 (S3)

Resistance: 1.0955 (R1), 1.1040 (R2), 1.1115 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。