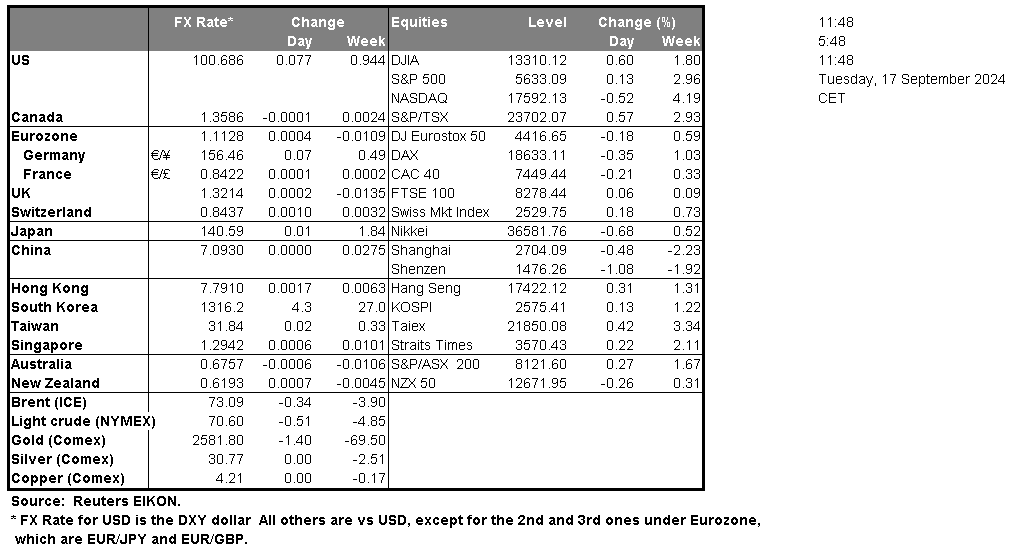

The NY Empire State manufacturing figure for September came in much higher than expected at 11.50 versus the expected figure of -4.10, marking a return to positive numbers for the index since December 2023. The better-than-expected figure may further enhance the market’s positive sentiment in regards to a soft-landing scenario for the US economy. The US retail sales rate is due out today. The retail sales rate can be considered as a gauge regarding the resilience of the US consumer and their spending habits. Moreover, with the Fed’s decision set to occur this week as well, the release may take on an even greater significance than usual. Thus, should the figure showcase an improvement from the last month’s figure, it may aid the USD and vice versa.

Over in Canada, the CPI rates for August are set to be released during today’s American session. Economists are currently anticipating the headline rate to come in at 2.1% which would be lower than last months reading of 2.5%. Hence should the headline CPI rate come in as expected, it may imply measing inflationary pressures in the Canadian economy which in turn could increase pressure on the BoC to continue on its rate-cutting cycle. According to Der Spiegel amongst other news publications, Intel (#INTC) has announced that it will be delaying the construction of its chip manufacturing plant in Germany for at least two years. On another note in regards to Intel (#INTC), the company announced a new deal to produce custom chips for Amazon (#AMZN) which may aid Intel’s stock price.

Continuing in the US equities markets, Microsoft (#MSFT) has unveiled a new $60 billion stock-buyback program per Bloomberg, which may aid their stock price.

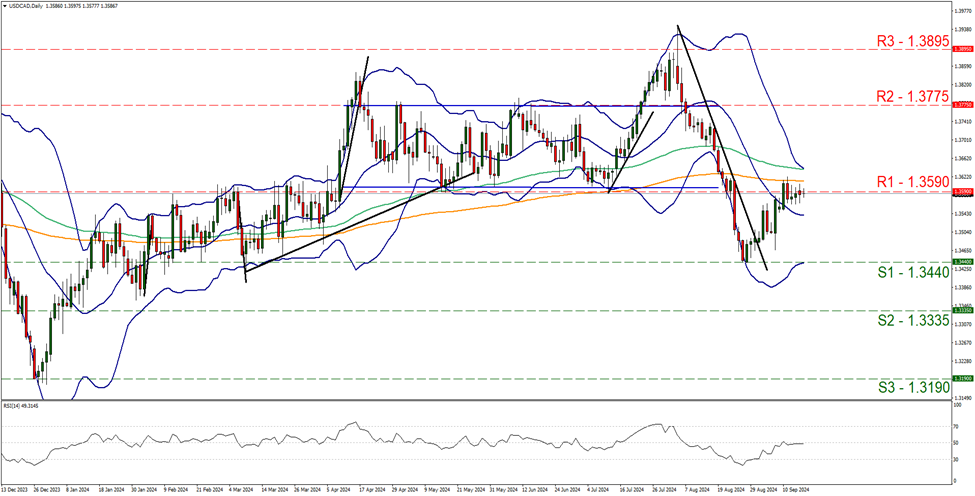

USD/CAD appears to be moving in an sideways fashion, with the pair currently testing our 1.3590 (R1) resistance line. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would require the pair to remain confined between the sideways moving channel defined by the 1.3440 (S1) support line and the 1.3590 (R1) resistance level. On the flip side for a bullish outlook we would require a clear break above the 1.3590 (R1) resistance line, with the next possible target for the bulls being the 1.3775 (R2) resistance level. Lastly, for a bearish outlook we would require a break below the 1.3440 (S1) support level with the next possible target for the bears being the 1.335 (S2) support line.

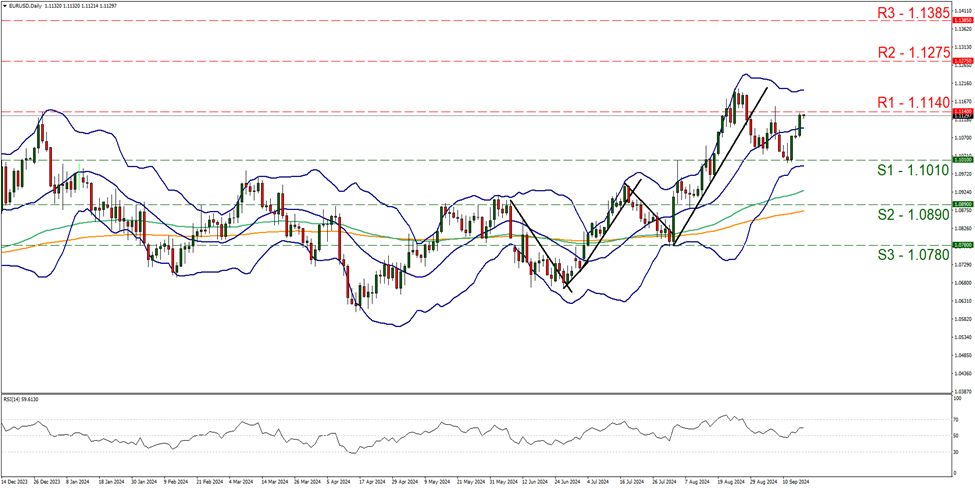

EUR/USD appears to be moving in an upwards fashion, with the pair currently testing our 1.1140 (R1) resistance line. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 60, implying a bullish market sentiment. For our bullish outlook to continue we would require a clear break above the 1.1140 (R1) resistance level with the next possible target for the bulls being the 1.1275 (R2) resistance line. On the flip side for a sideways bias we would require the pair to remain confined between the 1.1010 (S1) support line and the 1.1140 (R1) resistance level. Lastly, for a bearish outlook, we would require a break below the 1.1010 (S1) support level with the next possible target for the bears being the 1.0890 (S2) support line.

本日のその他の注目点

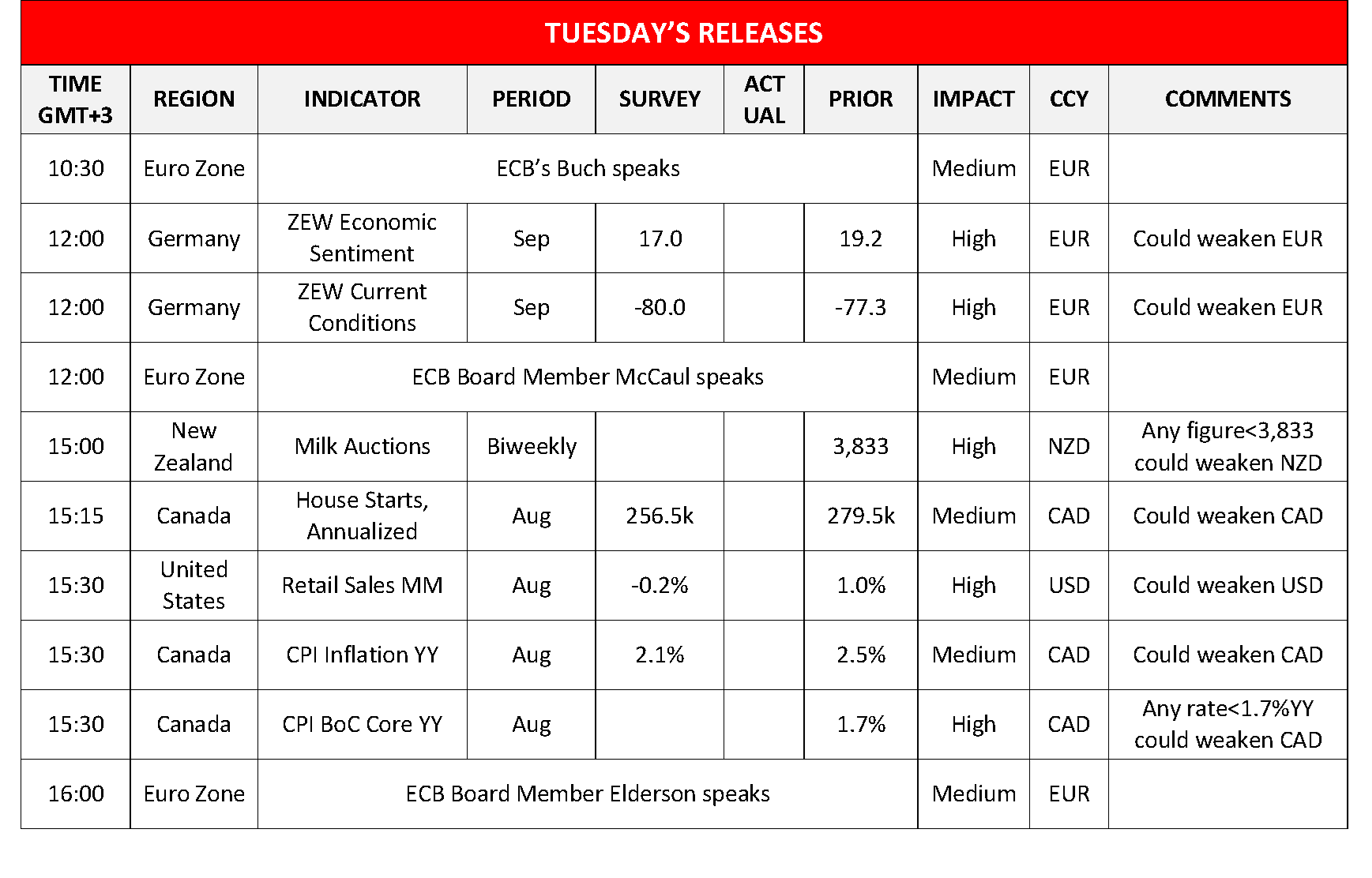

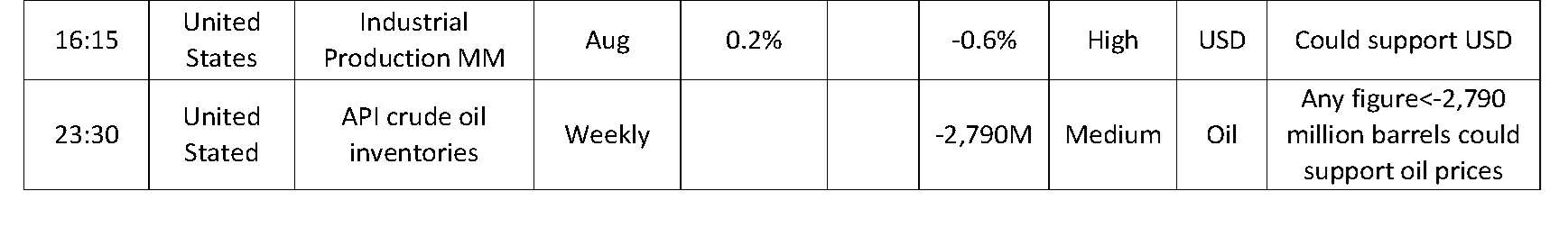

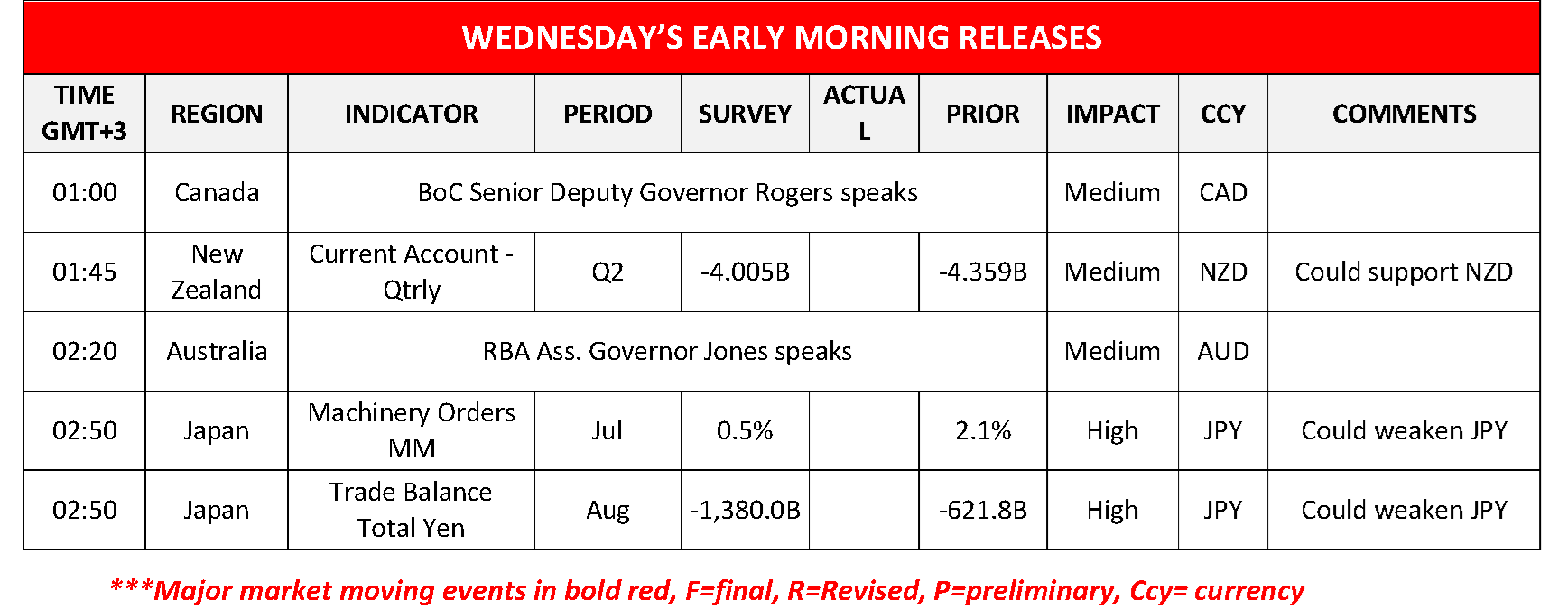

Today we get Germany’s ZEW indicators for September and later on New Zealand’s Biweekly Milk Auctions, Canada’s August House starts and CPI rates, from the US, August’s retail sales and industrial production, while oil traders may keep an eye out for the API weekly crude oil inventories figure. On the monetary front, we note that ECB’s Buch, McCaul and Elderson are scheduled to speak. Tomorrow during the Asian session, we get New Zealand’s Q2 Current Account balance, Australia’s August Composite Leading index and from Japan July’s Machinery orders and August’s trade data. On the monetary front, we note that BoC Senior Deputy Governor Rogers and RBA Ass. Governor Jones speak.

USD/CAD DAILY Chart

- Support: 1.3440 (S1), 1.335 (S2), 1.3190 (S3)

- Resistance: 1.3590 (R1), 1.3775 (R2), 1.3895 (R3)

EUR/USD デイリーチャート

- Support: 1.1010 (S1), 1.0890 (S2), 1.0780 (S3)

- Resistance: 1.1140 (R1), 1.1275 (R2), 1.1385 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。