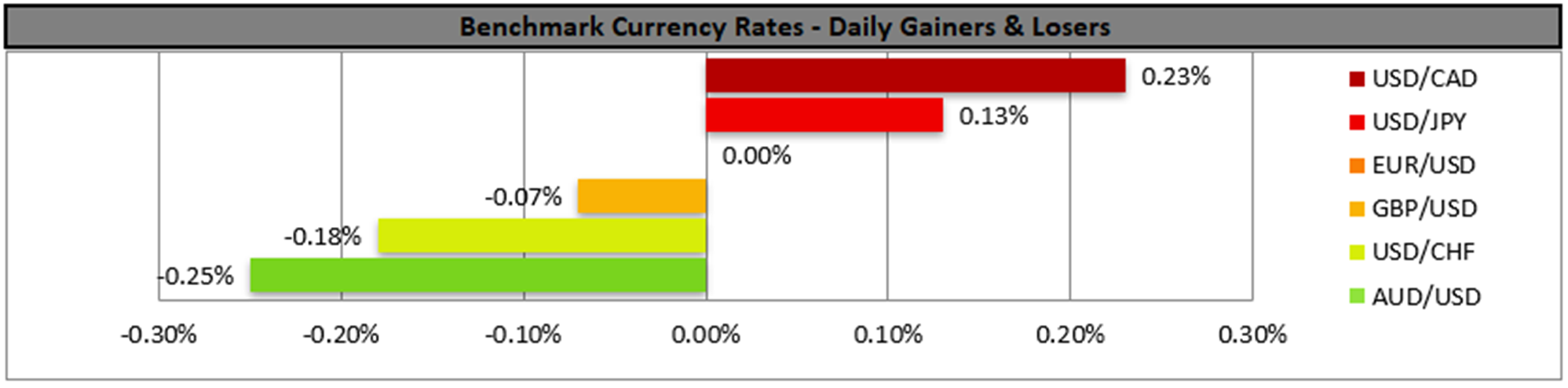

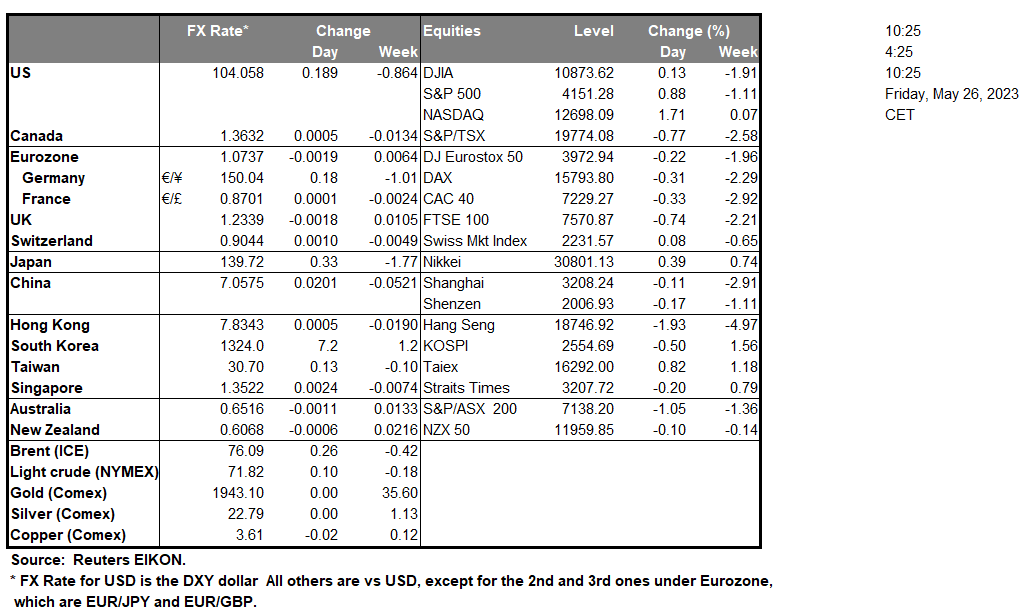

The USD continued to be on the rise for a fourth day in a row yesterday and prepares for a third consecutive week of gains against its counterparts, with the issue of the US defaulting and the possibility of the US raising its debt ceiling remaining the key factor behind the market’s movements. Market’s nerves are intense about the issue as the “X-date” is set by a number of analysts to be the 1st of June and is fast approaching. Negotiations are expected to continue over the long weekend, yet we tend to expect little results as US politicians, the White House and Congress are flexing their muscles. Should market worries intensify we may see the USD gaining further safe haven inflows while the issue may weigh on riskier assets such as equities. US stockmarkets ended their day rather mixed yesterday with maybe the outlier among US stockmarket indexes being Nasdaq which was clearly in the greens benefiting from the latest AI frenzy and the earnings report of Nvidia, which was better than expected exactly flaring up hopes of stockmarket participants. We tend to maintain some worries for the market’s AI enthusiasm, as it may turn out to be the next dot com bubble. We do not reject AI as such but still view the market’s excitement as too high at the current stage which may allow for a number of companies to enter US stock markets without substantial background and prospects. On the monetary front we would also like to note that Fed policymakers sent out mixed signals yesterday, as Boston Fed President Collins stated that Fed may be near the point that it can remain on hold, yet St. Louis Fed President Barkin stressed that prices are still to rise and should the latter opinion prevail we may see it weighing on riskier assets and supporting the USD and vice versa.

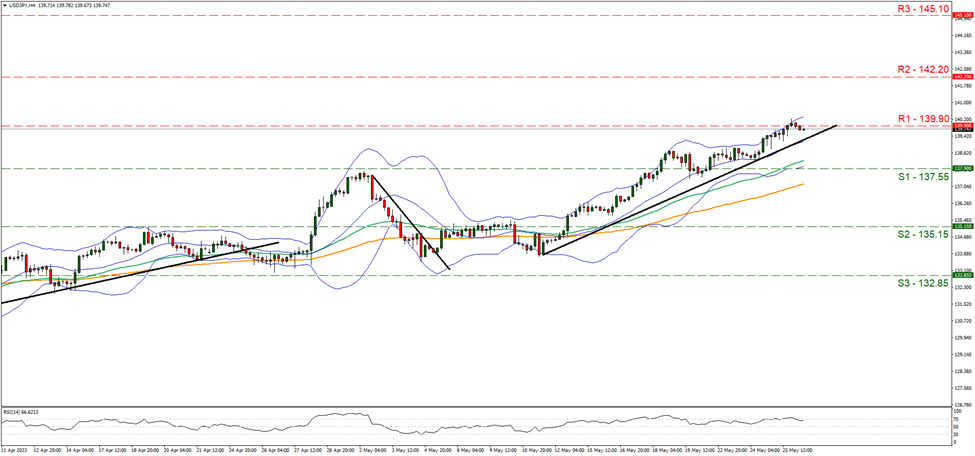

USD/JPY continued to rise yesterday and at some point broke the 139.90 (R1) resistance line, before correcting lower. We maintain a bullish outlook for the pair as long as the price action remains above the upward trendline incepted since the 11th of May. Please note that the RSI indicator runs along the reading of 70, highlighting the bullish sentiment of the market currently for the pair, yet may also imply that the pair is at overbought levels and may be about to correct lower. Should the bulls maintain control over USD/JPY we may see the pair breaking the 139.90 (R1) resistance line clearly with the next possible stop for the bulls being placed on the 142.20 (R2) level. Should the bears take over, we may see the pair, reversing course, breaking the upward trendline in a first sign of a trend reversal and aim if not break the 137.55 (S1) line.

Back in the European FX market, we note that Germany’s GDP rate for Q1 dropped into the negatives, throwing the German economy in a technical recession. Should we combine it with the continuous contraction of economic activity in Germany’s manufacturing sector over the past 10 months, the issue may weigh on the common currency and Eurozone as a whole not being able to avoid a recession.

EUR/USD seems to continue its downward trajectory despite a slight correction higher today. We tend to maintain a bearish outlook for the pair as long as it remains below the downward trendline incepted since the 4 of May. Should the selling interest be maintained by the market we may see EUR/USD breaking the 1.0695 (S1) support line and aim for the 1.0525 (S2) level. Should the pair find extensive buying orders along its path, we may see it breaking the prementioned upward trendline in a first signal that the downward movement has been interrupted and proceed with breaking the 1.0855 (R1) resistance level.

その他の注目材料

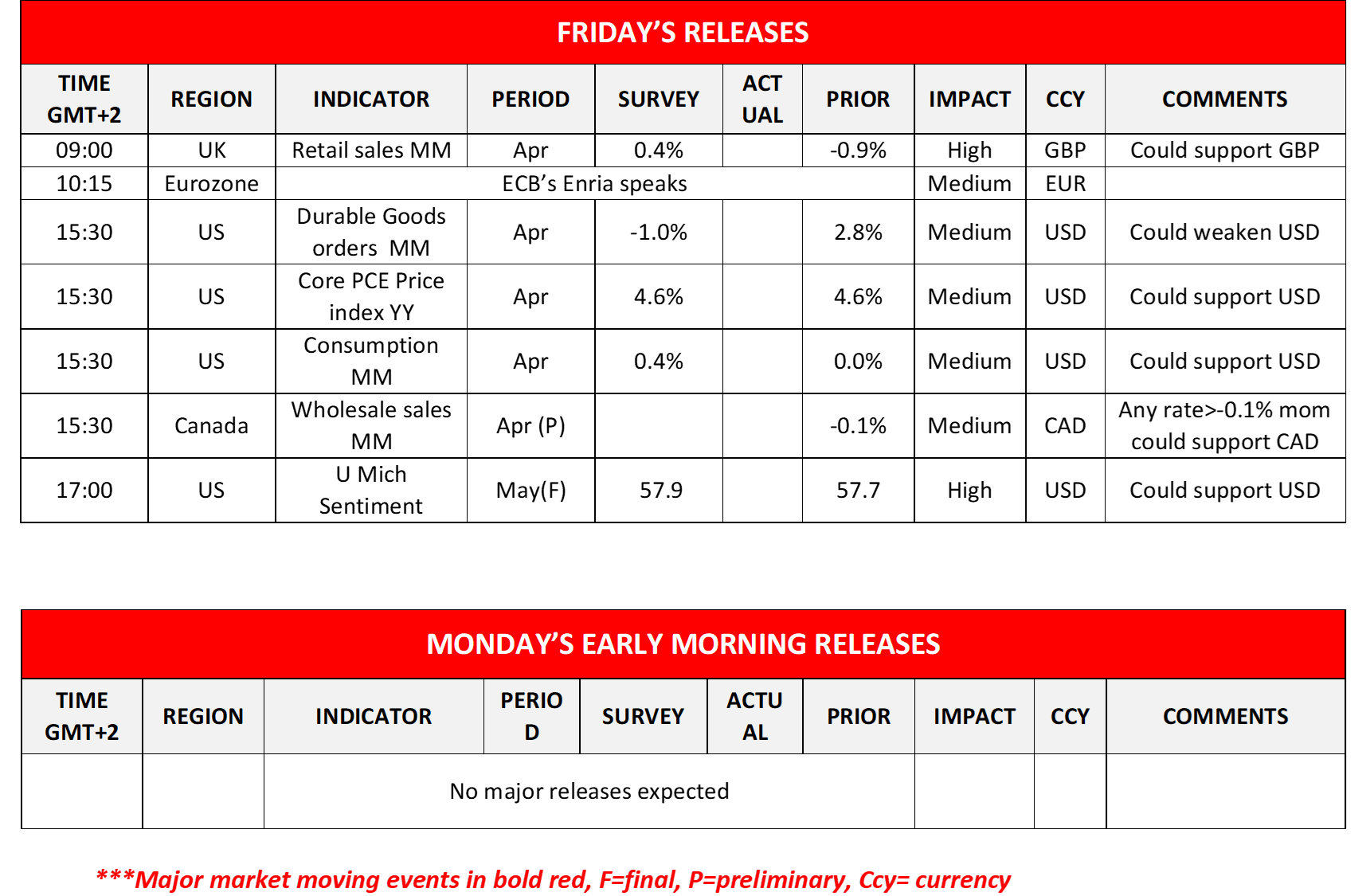

Today in the European session, we note the release of UK’s retail sales for April, while on the monetary front, ECB’s Enria is scheduled to speak. In the American session, we note the release from the US for the Durable goods orders, the core PCE price index growth rates, the consumption rate and Canada’s wholesale sales, all being for April, while for May we get the final University of Michigan consumer sentiment.

USD/JPY 4時間チャート

Support: 137.55 (S1), 135.15 (S2), 132.85 (S3)

Resistance: 139.90 (R1), 142.20 (R2), 145.10 (R3)

EUR/USD 4時間チャート

Support: 1.0695 (S1),1.0525 (S2), 1.0370 (S3)

Resistance: 1.0855 (R1), 1.1000 (R2), 1.1140 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。