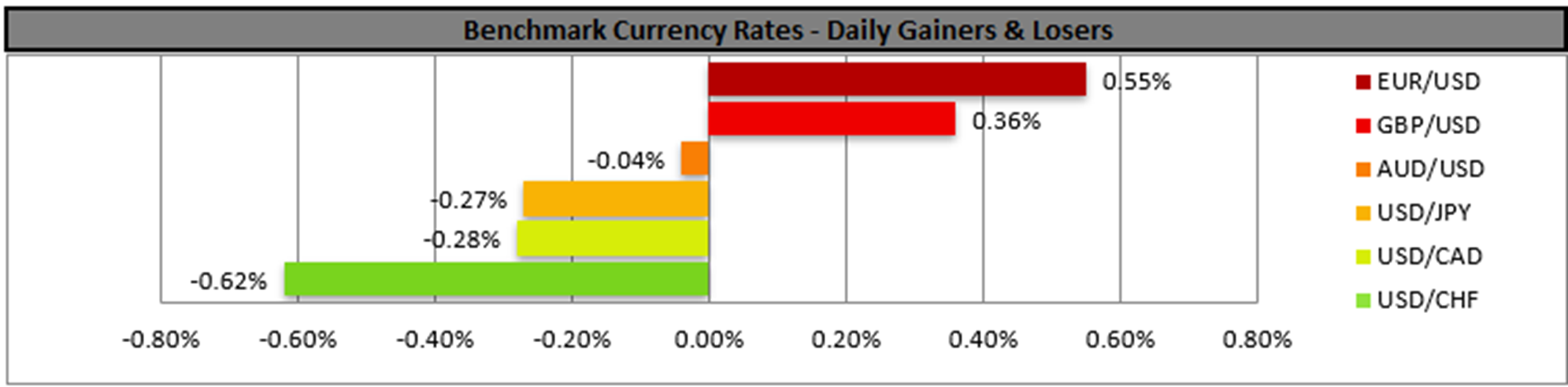

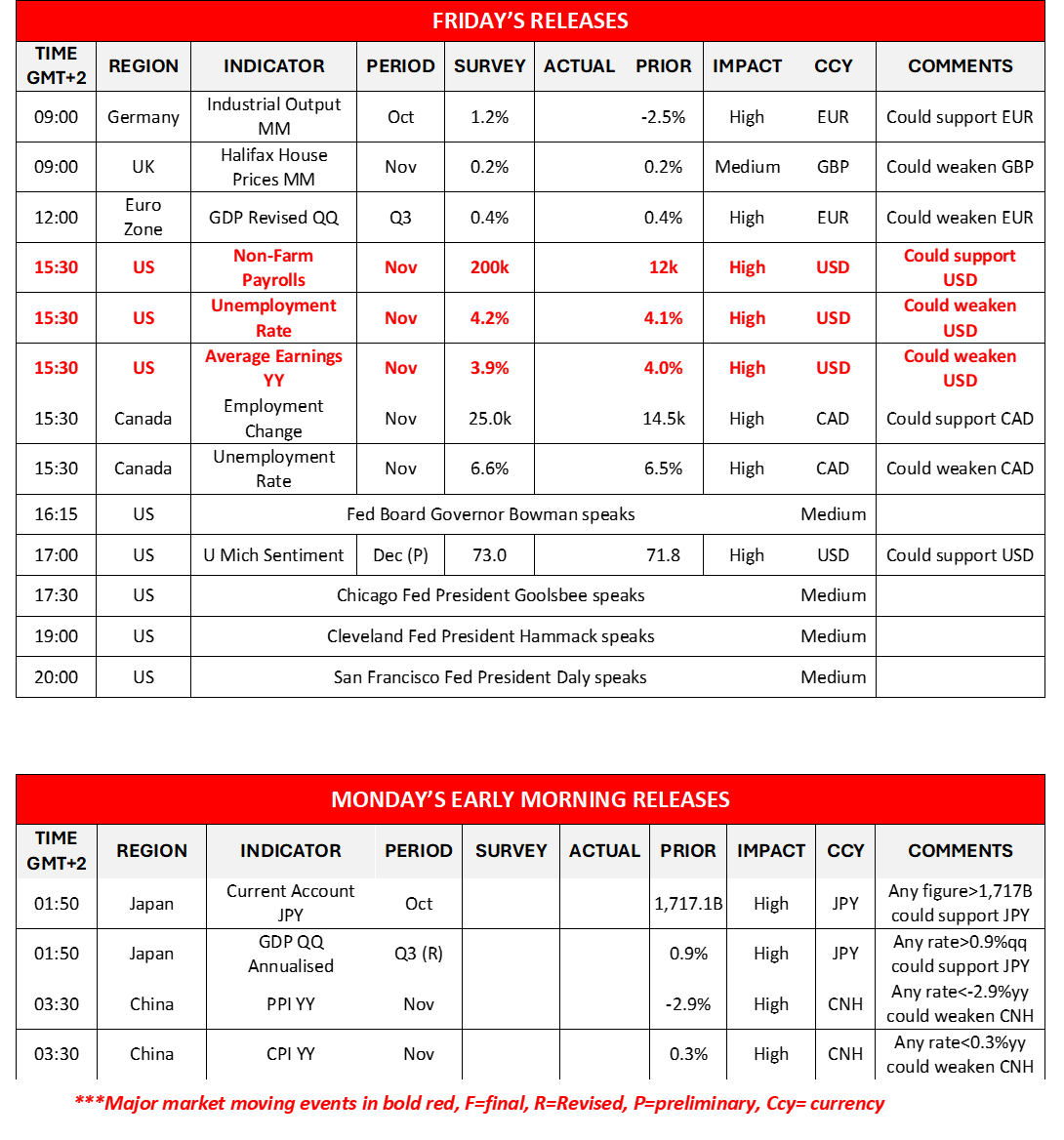

The USD weakened against its counterparts yesterday, in a rather quiet Thursday and markets are increasingly focusing on the release of November’s US employment report. The Non-Farm Payrolls (NFP) figure is expected to rise to 200k if compared to October’s 12k, while the unemployment rate is expected to tick up to 4.2% and the average earnings growth rate to slow down. Overall given that the hurricanes are over and Boeing employees ended their strike and returned to work, we expect the NFP figure to rise. Our worries are whether the NFP figure is going to reach the forecasts or not. It should be noted that the ADP figure for November dropped more than expected implying that hiring in the private sector may not have been as high as expected, while the weekly initial jobless claims figure rose more than expected implying high layoffs. Hence should the NFP figure rise yet not be able to reach the forecasts, we may see the USD retreating, while should the actual NFP figure surpass the 200k figure, we may see the USD gaining. The release may have ripple effects beyond the FX market and signals of a possibly tighter US employment market could weigh on US equities and gold’s price. Should the US employment report show a tighter than expected US employment market for the past month we may see the release weighing on gold’s price, and US stock markets falling as a tighter US employment market may prompt the Fed to maintain a less dovish stance. Please note that market currently expects the bank to proceed with a rate cut in the December meeting and remain on hold in the next one.

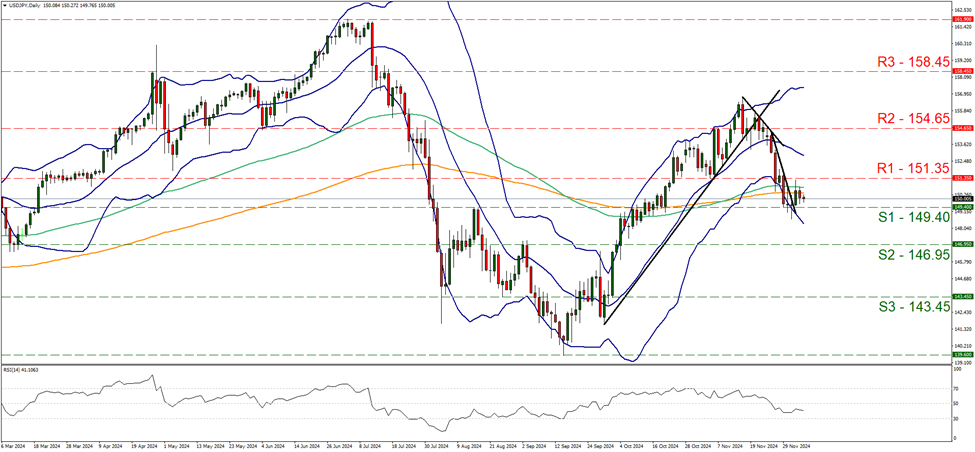

On a technical level, USD/JPY maintained its sideways motion between the 151.35 (R1) resistance line and the 149.40 (S1) support level. Hence we maintain our bias for the rangebound motion to continue within the prementioned boundaries. The RSI indicator remains below the reading of 50, implying possibly a bearish predisposition of market participants for the pair. For a bearish outlook we would require the pair to break the 149.40 (S1) line clearly and start aiming for the 146.95 (S2) level. Should the bulls take over, we may see USD/JPY, breaking the 151.35 (R1) level, opening the gates for the 154.65 (R2) base.

At the same time as the US employment report for November we also get Canada’s employment data for the same month. The unemployment rate is expected to tick up to 6.6% if compared to October’s 6.5% and the employment change figure is expected to rise to 25.0k if compared to October’s 14.5k. Overall the data tend to be mixed yet a possible rise of the employment change figure beyond forecasts may provide some support for the Loonie, while a tick up of the unemployment rate may clip any bullish reactions for the CAD.

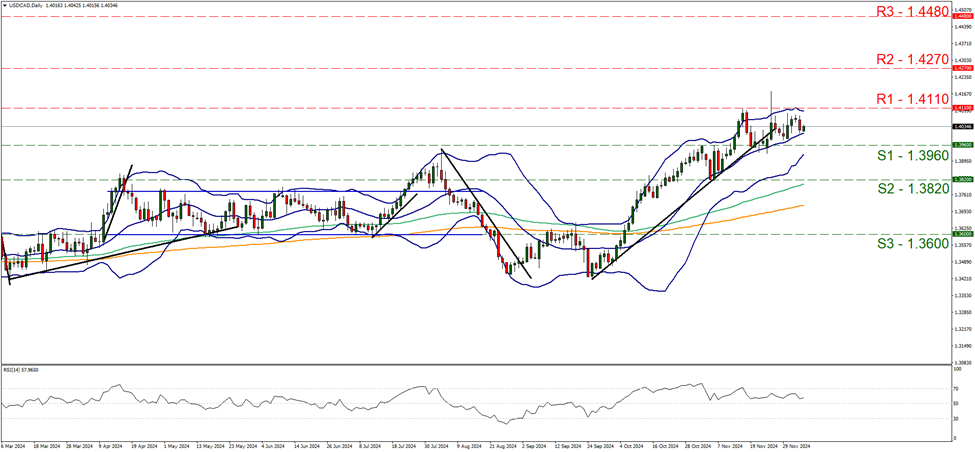

USD/CAD yesterday remained well between the 151.35 (R1) resistance line and the 149.40 (S1) support level. We maintain our bias for the sideways motion to continue within the prementioned boundaries. The RSI indicator remains above the reading of 50, implying possibly the presence of a bullish sentiment among market participants for the pair. For a bearish outlook we would require the pair to break the 1.4110 (S1) line clearly and start aiming for the 1.4270 (S2) level. Should the bulls take over, we may see USD/JPY, breaking the 1.3960 (R1) level, opening the gates for the 1.3820 (R2) base.

その他の注目材料

Today we get Germany’s industrial output for October, UK’s Halifax House prices for November, Euro Zone’s revised GDP rate for Q3 and the preliminary University of Michigan consumer sentiment. On the monetary front, we note that Fed Board Governor Bowman, Chicago Fed President Goolsbee, Cleveland Fed President Hammack and San Francisco Fed President Daly are scheduled to make statements. In Monday’s Asian session, we get Japan’s October current account balance and Q3’s revised GDP rate as well as China’s November inflation metrics.

USD/JPY Daily Chart

- Support: 149.40 (S1), 146.95 (S2), 143.45 (S3)

- Resistance: 151.35 (R1), 154.65 (R2), 158.45 (R3)

USD/CAD Daily Chart

- Support: 1.3960 (S1), 1.3820 (S2), 1.3600 (S3)

- Resistance: 1.4110 (R1), 1.4270 (R2), 1.4480 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。