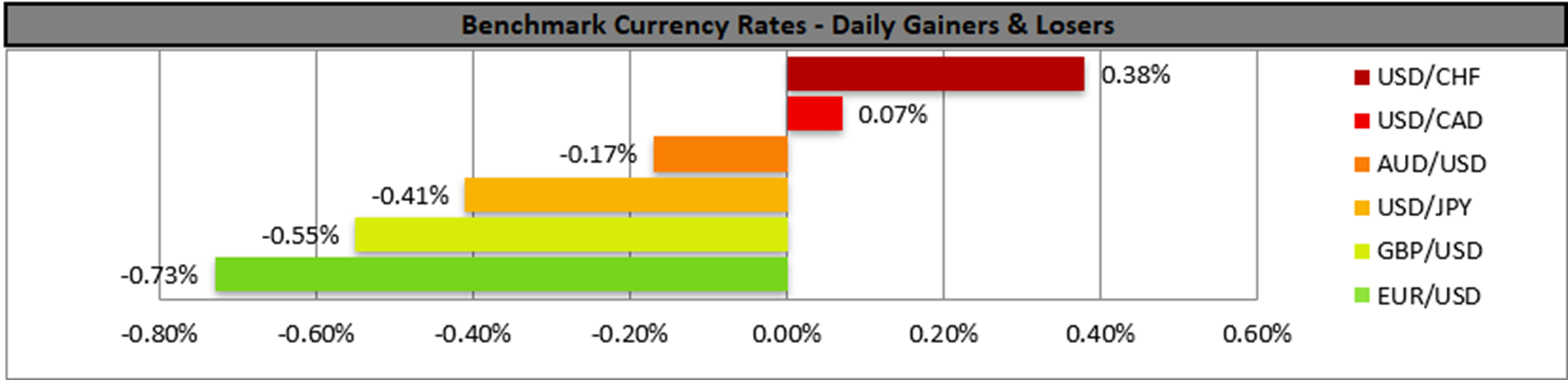

The common currency was in the reds against the USD, GBP and JPY yesterday, in a sign of wider weakness. The case for EUR bulls is hard on all fronts as on a monetary policy level the ECB is expected to continue cutting rates, the political situation in Germany is intensifying the worries for the area as a whole and on a macro level, economic activity levels are worryingly low and Eurozone’s growth rates tend to disappoint. Today we highlight the release of Germany’s, France’s and the Eurozone’s preliminary PMI figures for November. Specifically, we highlight the release of France’s Services sector, Germany’s manufacturing sector and for a rounder view Eurozone’s Composite PMI figures. Yet Germany’s manufacturing sector tends to draw most of the market’s attention as it is considered the problem child of the area. Should we see the indicators implying another contraction of economic activity in the area, possibly an even deeper one, we may see the common currency losing ground against its counterparts.

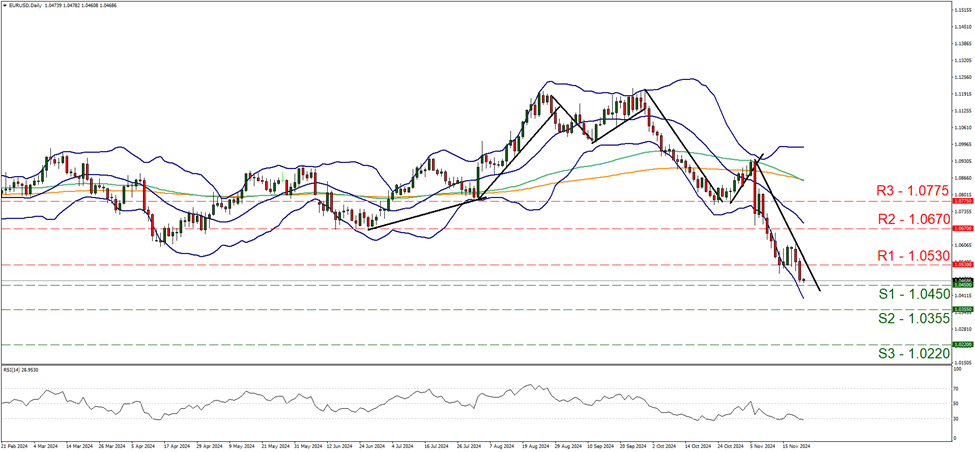

EUR/USD dropped yesterday breaking the 1.0530 (R1) support line, now turned to resistance. Given the pair’s downward motion and yesterday’s commentary, we switch our temporary sideways motion bias in favour of a bearish outlook. We shifted the downward trendline to the right to encapsule the downward motion of the pair and use it to show the limitations of the downward movement. Should the bears maintain control over the pair we may see it breaking the 1.0450 (S1) support line and aim for the 1.0355 (S2) support level. Yet we note that the RSI indicator is possibly nearing oversold levels and my be ripe for a correction higher, as the RSI indicator is at the reading of 30. Yet for a bullish outlook we would require pair’s price action to break the prementioned downward trendline, in a first signal that the downward motion has been interrupted, break the 1.0530 (R1) resistance line and take actively aim of the 1.0670 (R2) resistance level.

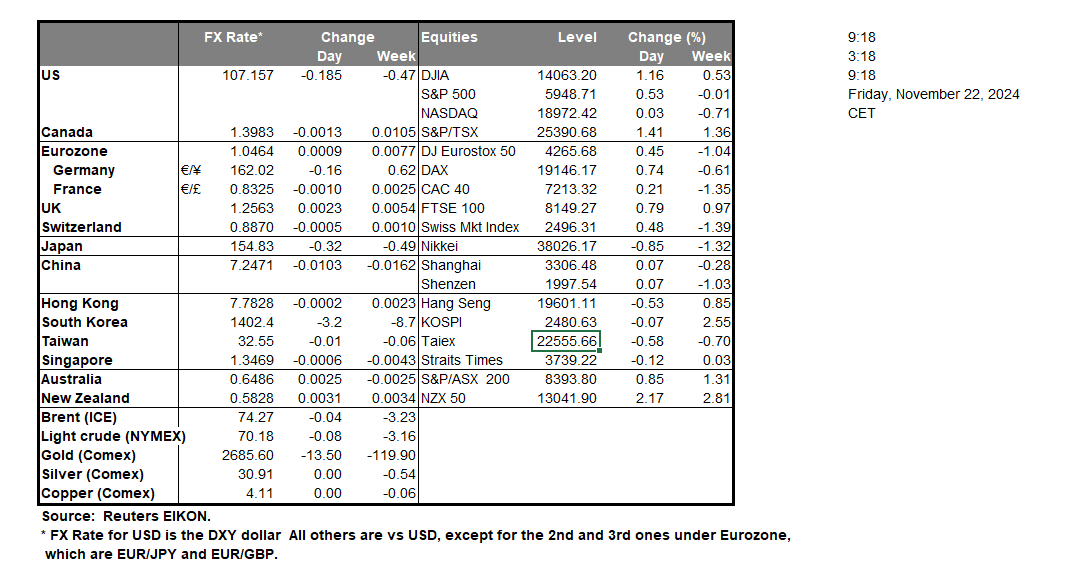

In Canada we highlight today the release of September’s retail sales growth rate. Should the rate remain unchanged or even slow down, we may see the CAD slipping as the release could imply that the average Canadian consumer is less willing to actually spend more in the Canadian economy. Furthermore, a possible slowdown could enhance BoC’s dovish stance, yet on a monetary level, we would also like to note that market expectations for another double rate cut by the bank have been clipped. The main reason behind this change seems to be the Canadian government’s plans to proceed with a C$6.3 billion fiscal stimulus in new spending measures that could assist consumers. The news could provide some support for the Loonie, while we also note that yesterday’s rise of oil prices may also have provided a helping hand for the CAD.

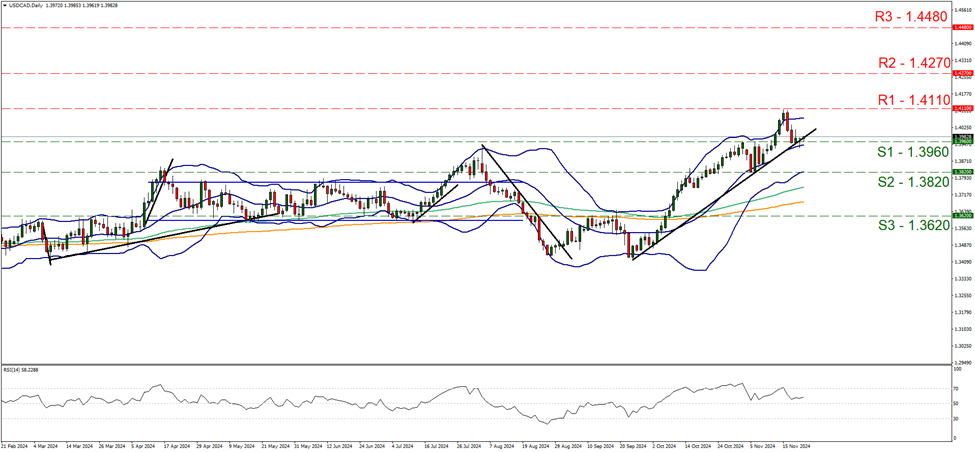

USD/CAD remained relatively unchanged just above the 1.3960 (S1) support line. The pair seems to have reached a make or break position as should it rise it could practically reaffirm the upward trendline guiding it since the 25 of September, while if it remains unchanged it would signal an interruption of the upward movement. Given that the RSI indicator has neared the reading of 50, we see the case for the bullish sentiment of the market for the pair easing, hence we temporarily switch our bullish outlook in favour of a sideways motion bias. Should the bulls regain control over the pair, we may see USD/CAD aiming if not breaking the 1.4110 (R1) resistance line. On the flip side should the bears be in charge we may see the pair breaking the 1.3960 (S1) support line and aim for the 1.3820 (S2) support base.

その他の注目材料

Today we note the release of the UK’s retail sales for October, the UK’s and the US’s preliminary PMI figures for November and final UoM Consumer Sentiment for November. On the monetary front we note that ECB President Christine Lagarde, ECB Vice President De Guindos, ECB Bank Supervisor Tuominen, SNB’s Chairman Martin Schlegel and ECB Board Member Schnabel are scheduled to speak.

EUR/USD デイリーチャート

- Support: 1.0450 (S1), 1.0355 (S2), 1.0220 (S3)

- Resistance: 1.0530 (R1), 1.0670 (R2), 1.0775 (R3)

USD/CAD Daily Chart

- Support: 1.3960 (S1), 1.3820 (S2), 1.3620 (S3)

- Resistance: 1.4110 (R1), 1.4270 (R2), 1.4480 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。