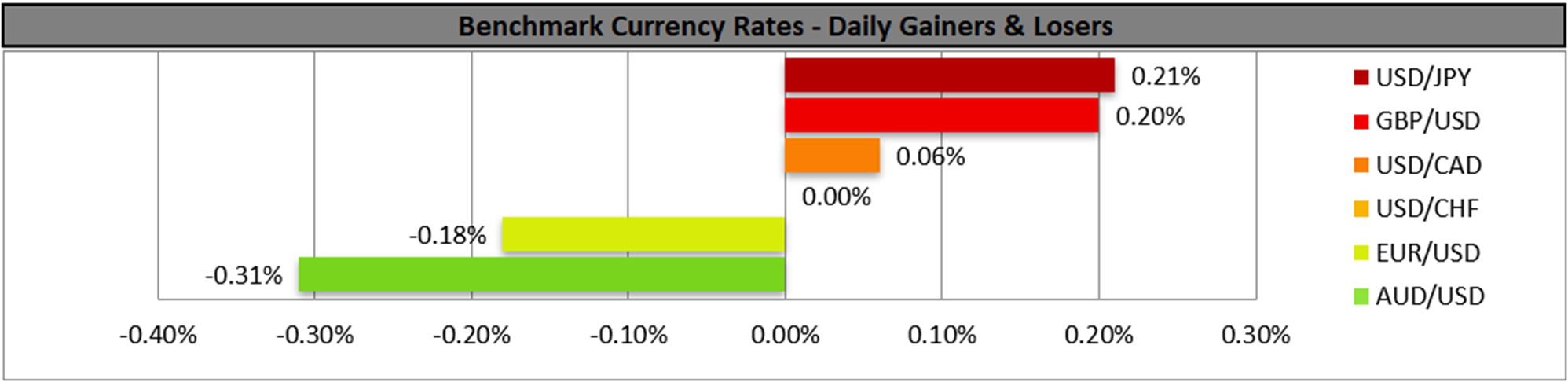

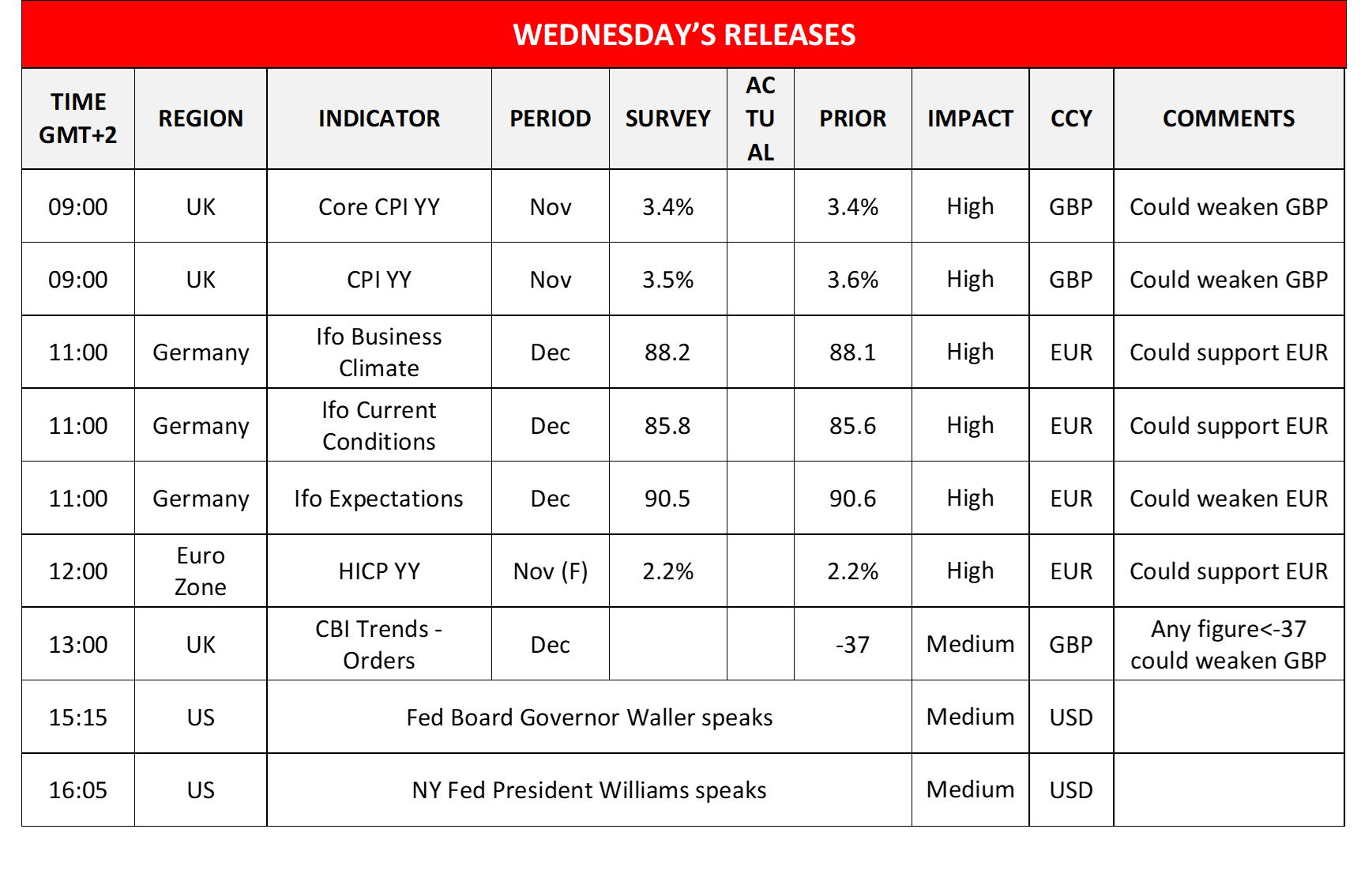

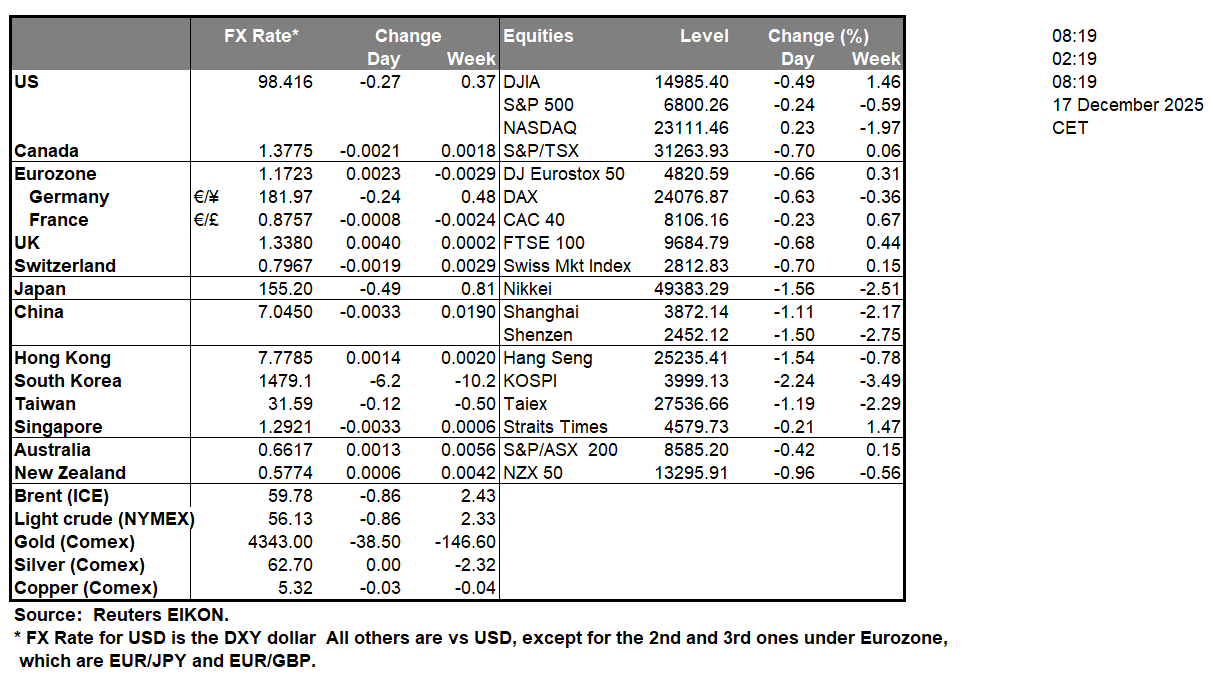

The USD regained its confidence in yesterday’s American session, despite the US employment report for November providing mixed signals for the US employment market. On the one hand, the NFP figure dropped less than expected which was encouraging, yet the unemployment rate rose to 4.6% from September’s 4.5% which was worrying. Also, the retail sales growth rate for October slowed down beyond market expectations, signaling a weakness of the demand side of the US economy, while the December preliminary PMI figures dropped, signaling an easing of the expansion of economic activity in both the services and manufacturing sectors. Today, we highlight the speeches of Fed policymakers Waller and Williams and a possibly dovish tone could set the greenback under pressure, while Atlanta Fed President Bostic may have more moderate comments for the FX market, as he is considered a centrist. Please note that Fed Board Governor Waller is to be interviewed by US President Trump for the role of the Fed Chairman, hence his comments may draw additional attention.

Also in the FX market, the pound lost ground across the board after data showed that UK’s CPI rates for November slowed down beyond analysts’ projections, which reinforced market expectations for a more dovish approach by the BoE in its interest rate decision tomorrow. The release tended to weigh on the pound across the board.

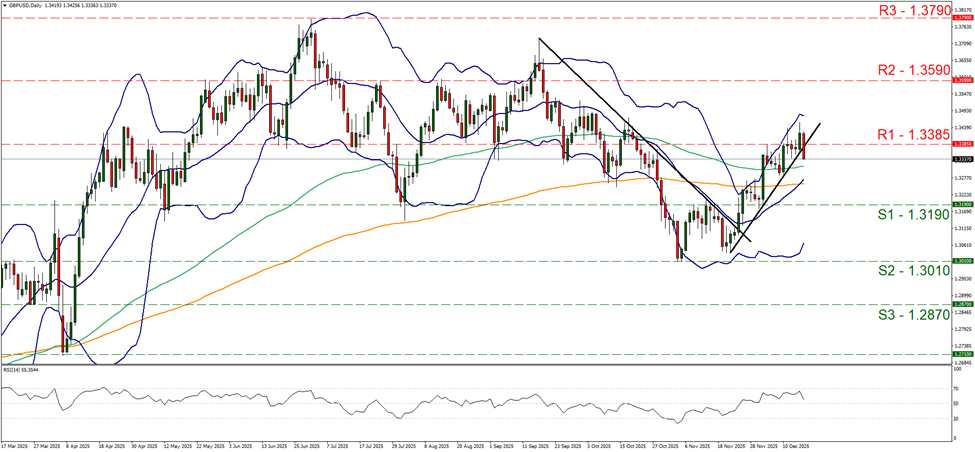

GBP/USD dived in today’s early European session, breaking the 1.3385 (R1) support line now turned to resistance. The pair in its downward motion has also broken the upward trendline guiding it since the 21st of November, hence we temporarily switch our bullish outlook in favour of a sideways motion bias. Also the RSI indicator has corrected lower, signaling an easing of the bullish sentiment of the market for the pair. Should the bears maintain control over the pair, we may see the pair aiming if not breaching the 1.3190 (S1) support line. Should the bulls take over we may see the pair breaking the 1.3385 (R1) resistance line and start aiming for the 1.3590 (R2) resistance level.

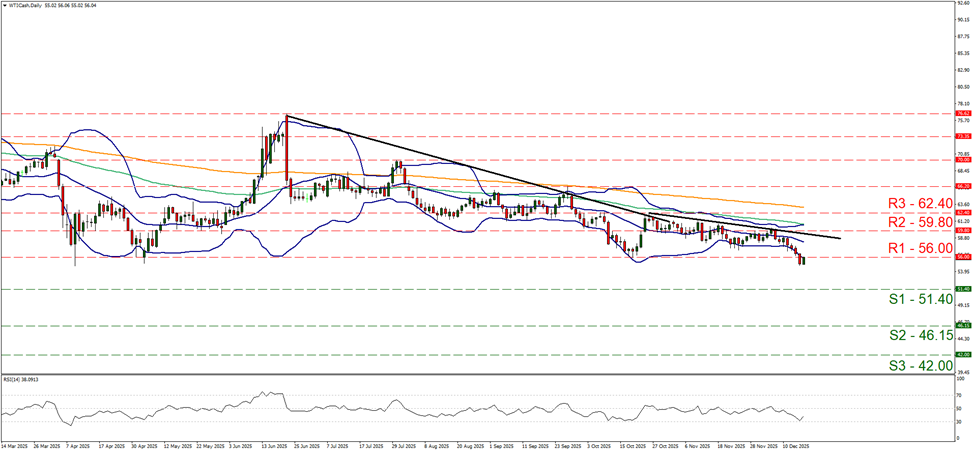

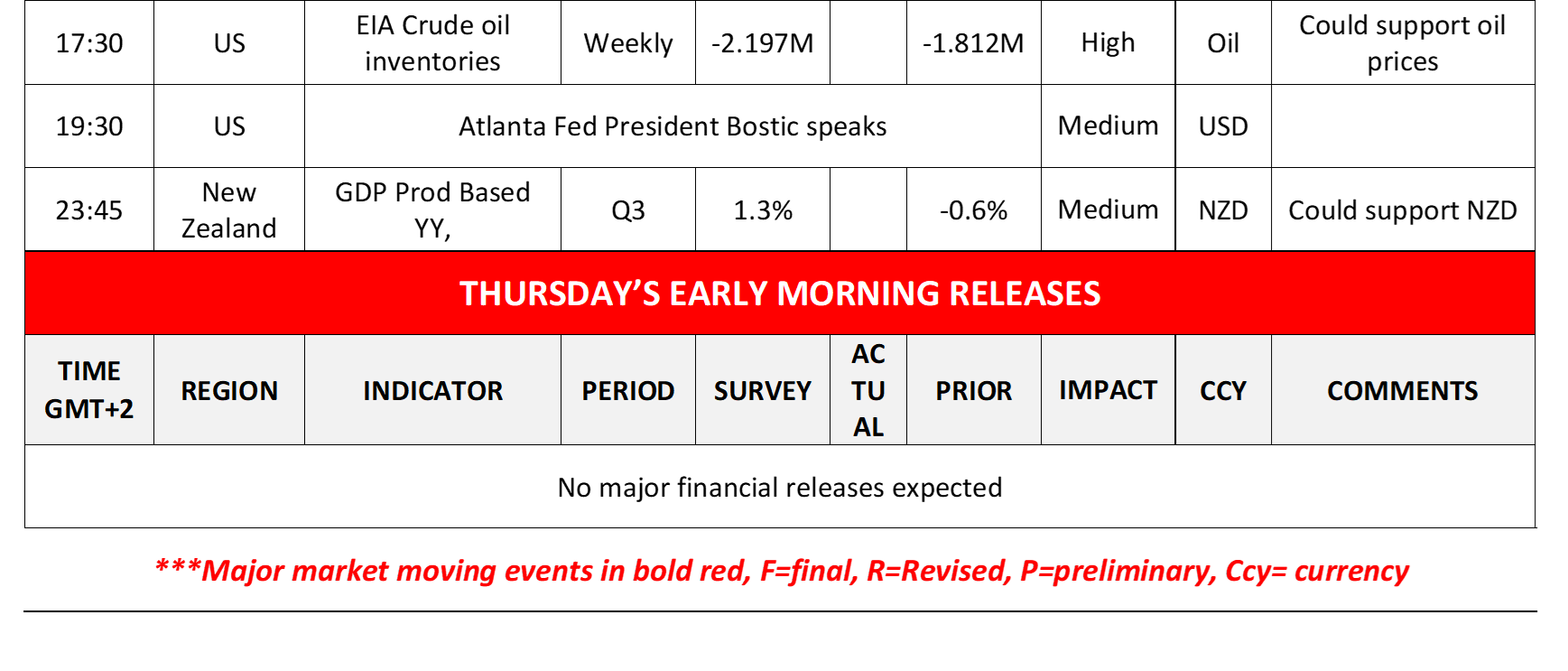

Also, we note the drop of oil prices yesterday, yet the losses were reversed in today’s Asian session. The tightening of the US oil market as expressed by the wide drawdown of US oil inventories of -9.3 million barrels as reported by API yesterday in the late American session, implies a considerable tightening of the US oil market, as aggregated demand seems to exceed oil production levels. We expect oil traders to keep a close eye on the release of EIA crude oil inventories figure later today. U.S. President Donald Trump ordered on Tuesday a “blockade” of all sanctioned oil tankers entering and leaving Venezuela, a factor that may tighten further the international oil market and is considerable reason for a rise of oil prices in the short term.

On a technical level we note that WTI’s price yesterday dropped breaking the 56.00 (R1) support line, now turned to resistance, yet in today’s Asian session, has reversed direction and is currently teasing the R1. The price action of the commodity has left the downward trendline guiding it intact, hence our bearish outlook is maintained. Please note that the RSI indicator has risen slightly implying an easing of the bearish market sentiment for WTI’s price. Should the bears maintain control we may see WTI’s price aiming for the 51.40 (S1) support line. Should the bulls take over, we may see WTI’s price breaking the 56.00 (R1) resistance line, the prementioned downward trendline in a first signal of an interruption of the upward movement and continue higher by breaking the 59.80 (R2) resistance level.

その他の注目材料

Today, we get Germany’s Ifo indicators for December, Euro Zone’s final HICP rate for November, UK’s CBI indicator for industrial orders for December and later on New Zealand’s GDP rate for Q3.

GBP/USD Daily Chart

- Support: 1.3190 (S1), 1.3010 (S2), 1.2870 (S3)

- Resistance: 1.3385 (R1), 1.3590 (R2), 1.3790 (R3)

WTI Daily Chart

- Support: 51.40 (S1), 46.15 (S2), 42.00 (S3)

- Resistance: 56.00 (R1), 59.80 (R2), 62.40 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。