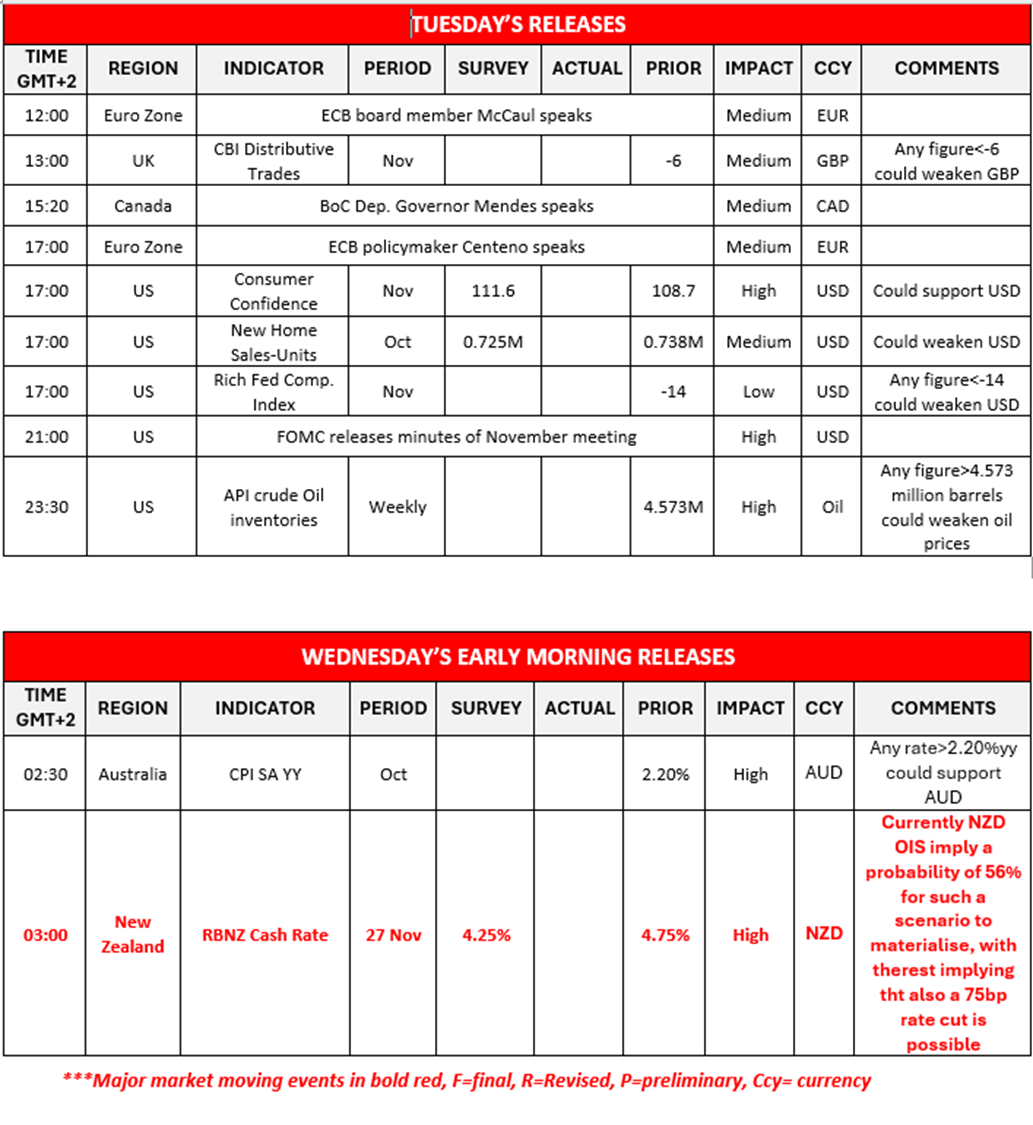

On a geopolitical level, there have been widespread reports that the Israeli Government has agreed in principle, to a ceasefire agreement with Hezbollah in Lebanon, with Israel’s Cabinet set to vote on the proposed ceasefire agreement later on today. The proposed ceasefire deal would temporarily end hostilities between the Israeli army 、 Hezbollah with an initial truce period of 60 days, with Israeli forces withdrawn from Lebanon, and in exchange, Hezbollah would end its presence south of the Litani River and would be replaced by Lebanese Army troops per the BBC. In our view, we would not be surprised to see the ceasefire proposal being accepted by the Israeli Cabinet, albeit with heavy resistance from Ben-Gvir the National security minister. Moreover, with the situation still volatile, the peace process could easily be upended and until the official confirmation with signatures from both sides, we would not take any proposal for granted. Nonetheless, in the event of a ceasefire, we may see geopolitical tensions temporarily easing in the region which may weigh on the precious metal’s price. Over in the US, the FOMC’s last meeting minutes are due out during today’s American trading session. The minutes may provide helpful insight into the Fed’s deliberations and thoughts during the last monetary policy meeting. In our opinion, we would not be surprised to see some concerns emerging amongst Fed policymakers in regards to the progress made against inflation and the possibility of persistent inflationary pressures in the US economy in the long run. Therefore, should the minutes showcase hesitancy by the bank to cut interest rates in the near future, it may aid the dollar and vice versa.

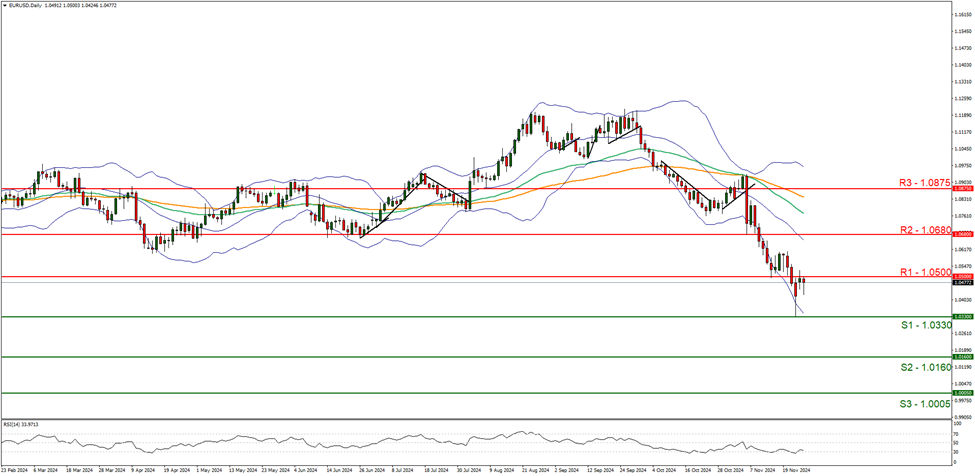

EUR/USD appears to be moving in a downwards trajectory, after failing to break above our 1.0500 (R1) resistance line. Following the EUR’s downwards trajectory last week we would not be surprised to see the bears take a breather, yet we opt to maintain an overall bearish outlook and supporting our case is the RSI indicator below our chart which currently registers a figure near 30, implying a strong bearish market sentiment. For our bearish outlook to continue we would require a clear break below the 1.0330 (S1) support level with the next possible target for the bears being the 1.0160 (S2) support line. On the flip side for a bullish outlook we would require a clear break above the 1.0500 (R1) resistance line, if not also the 1.0680 (R2) resistance level with the next possible target for the bulls being the 1.0875 (R3) resistance line. Lastly for a sideways bias we would require the pair to remain confined between the 1.0330 (S1) support line and the 1.0500 (R1) resistance level.

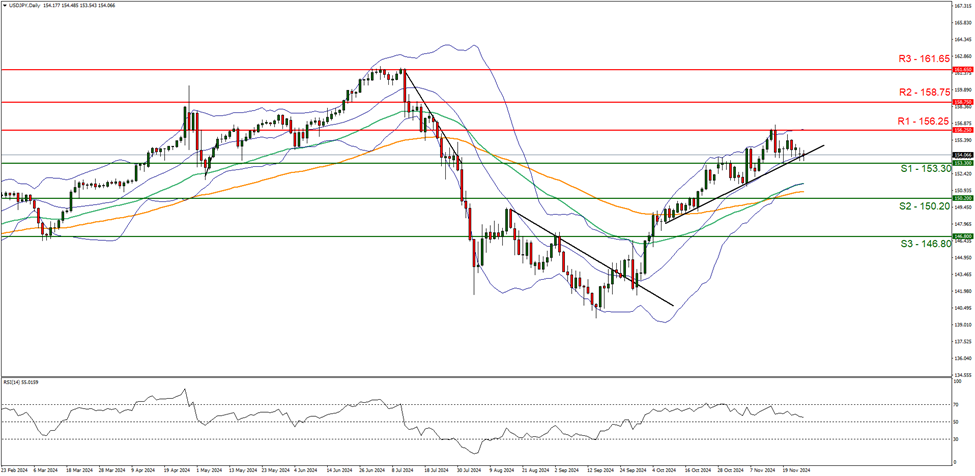

USD/JPY to be moving in a sideways fashion. We opt for a sideways bias for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment in addition to the pair breaking below our upwards-moving trendline which was incepted on the 9 of October. For our sideways bias to continue, we would require the pair to remain confined between the 153.30 (S1) support line and the 156.25 (R1) resistance level. On the flip side for a bullish outlook, we would require a clear break above the 156.25 (R1) resistance line with the next possible target for the bulls being the 158.75 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 153.30 (S1) support line with the next possible target for the bears being the 150.20 (S2) support level.

その他の注目材料

Today we get the UK’s CBI distributive trades figure for November, followed by the US consumer confidence figure for November as well, the US New Home Sales figure for October and the US Richmond Fed Composite index figure for November and ending off the day is the API weekly crude oil inventories figure. In tomorrow’s Asian session, we note Australia’s CPI rate for October. On the monetary front we note the speeches by ECB members McCaul, BoC deputy Governor Mendes, ECB member Centeno and we highlight the FOMC’s November meeting minutes and in tomorrow’s Asian session we note the RBNZ’s interest rate decision.

EUR/USD デイリーチャート

- Support: 1.0330 (S1), 1.0160 (S2), 1.0005 (S3)

- Resistance: 1.0500 (R1), 1.0680 (R2), 1.0875 (R3)

USD/JPY Daily Chart

- Support: 153.30 (S1), 150.20 (S2), 146.80 (S3)

- Resistance: 156.25 (R1), 158.75 (R2), 161.65 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。