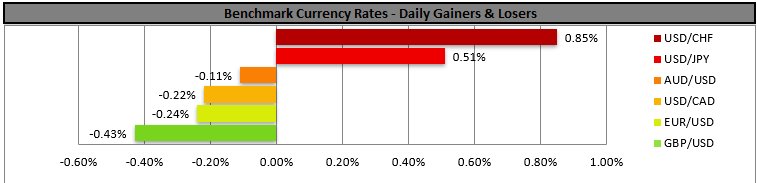

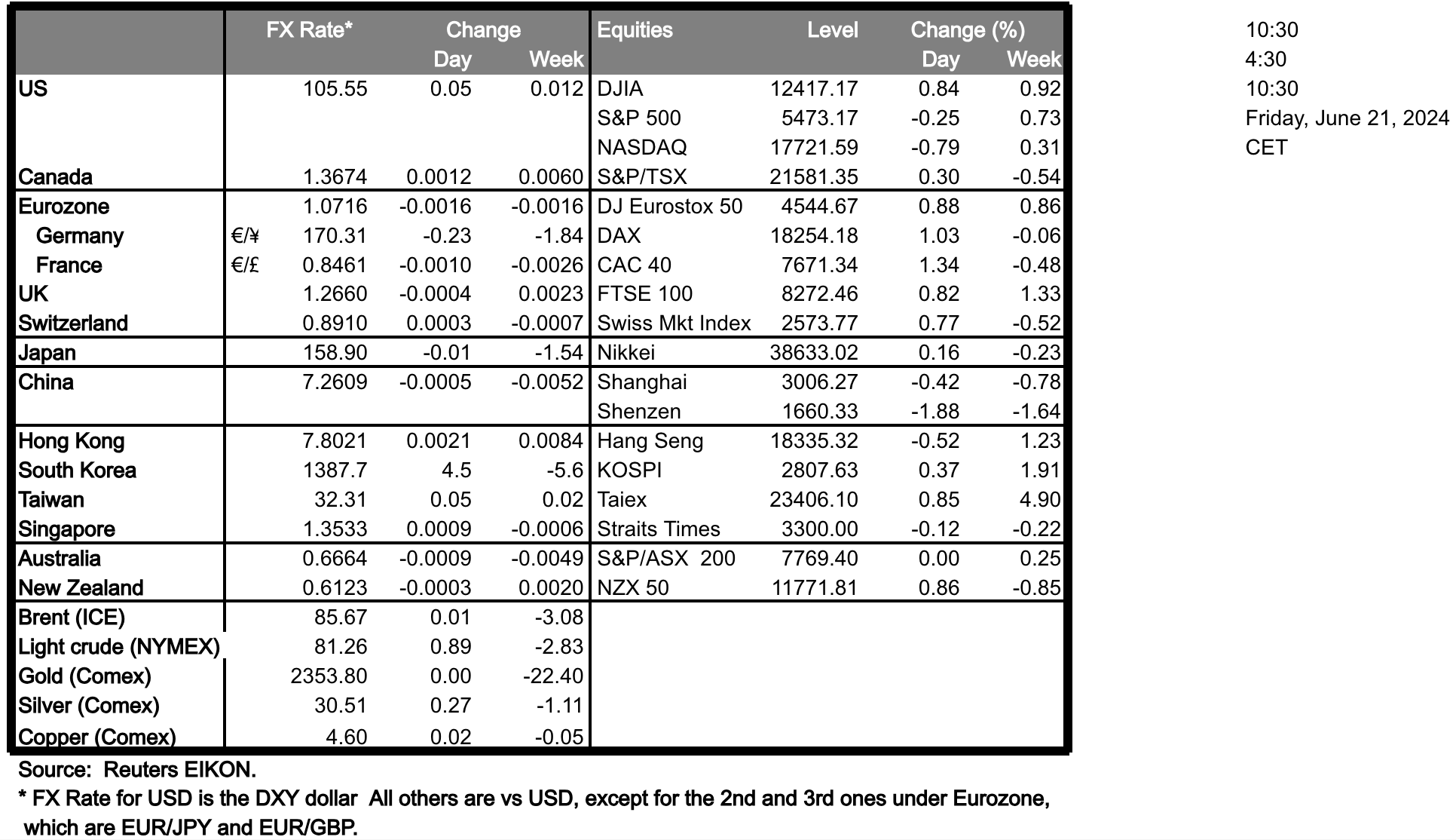

The USD edged higher yesterday, especially against the JPY, amidst low volatility in the FX market. It should JPY is slipping to dangerously low levels against the USD and the pair is risking another possible market intervention by the Japanese government and BoJ. It should be noted that JPY weakened despite the headline and core CPI rates for May , underscoring the presence of inflationary pressures in the Japanese economy. Yet that may not be enough for the market to believe that BoJ has hawkish intentions, which tends to weaken JPY even further.

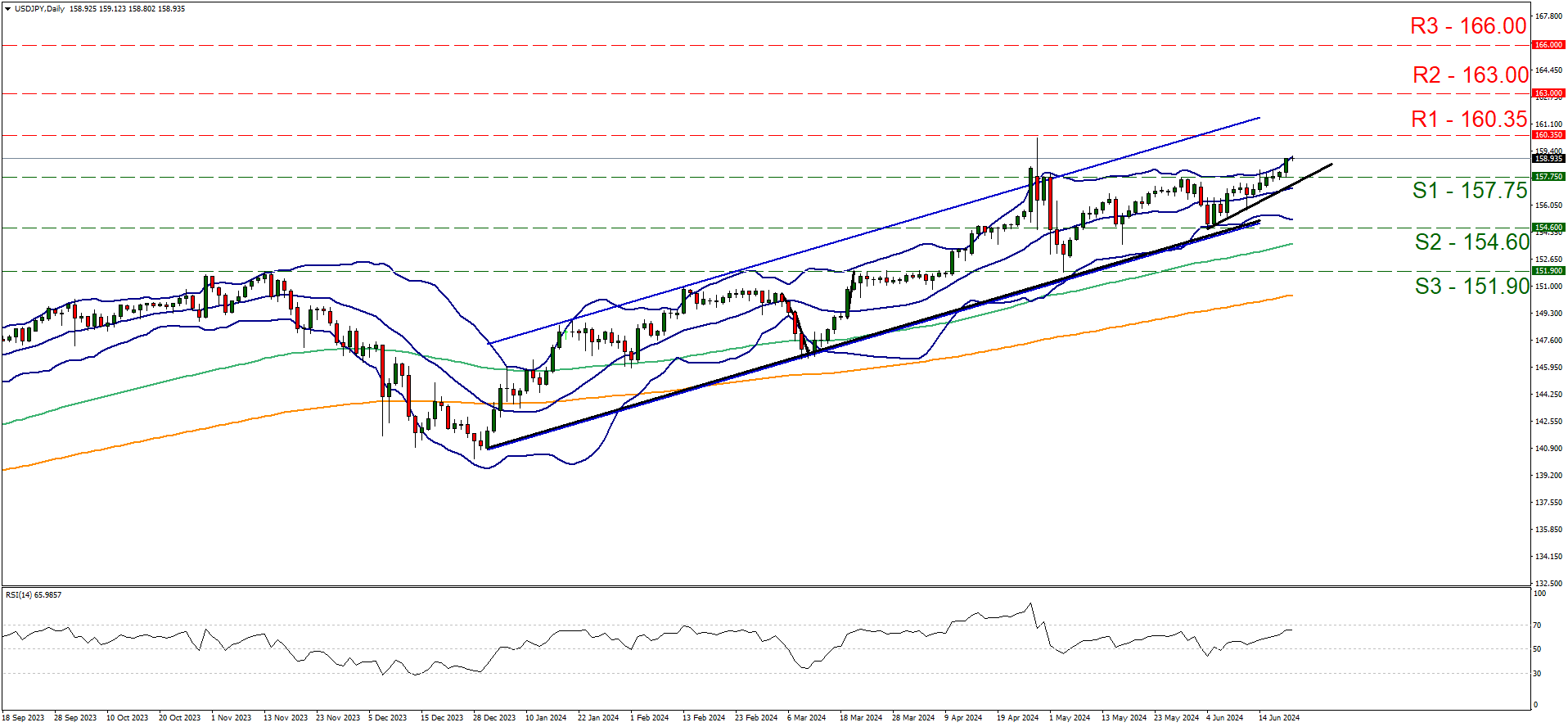

On a technical level, we note that USD/JPY yesterday edged higher after breaking on Wednesday the 157.75 (S1) resistance line, now turned to support. We tend to maintain our bullish outlook for the pair as the upward channel and the upward trendline within the channel continue to guide the pair. Please note that the RSI indicator is nearing the reading of 70 which underscores the build up of a bullish sentiment among market participants for the pair. Should the bulls maintain control over the pair we may see it breaking the 160.35 (R1) resistance line, which is practically a 34 year high and we set as the next possible target for the pair’s bulls the 163.00 (R2) resistance barrier. Yet should the bears take over, we may see the dropping, breaking the 157.75 (S1) support line and aiming if not breaching the 154.60 (S2) support level.

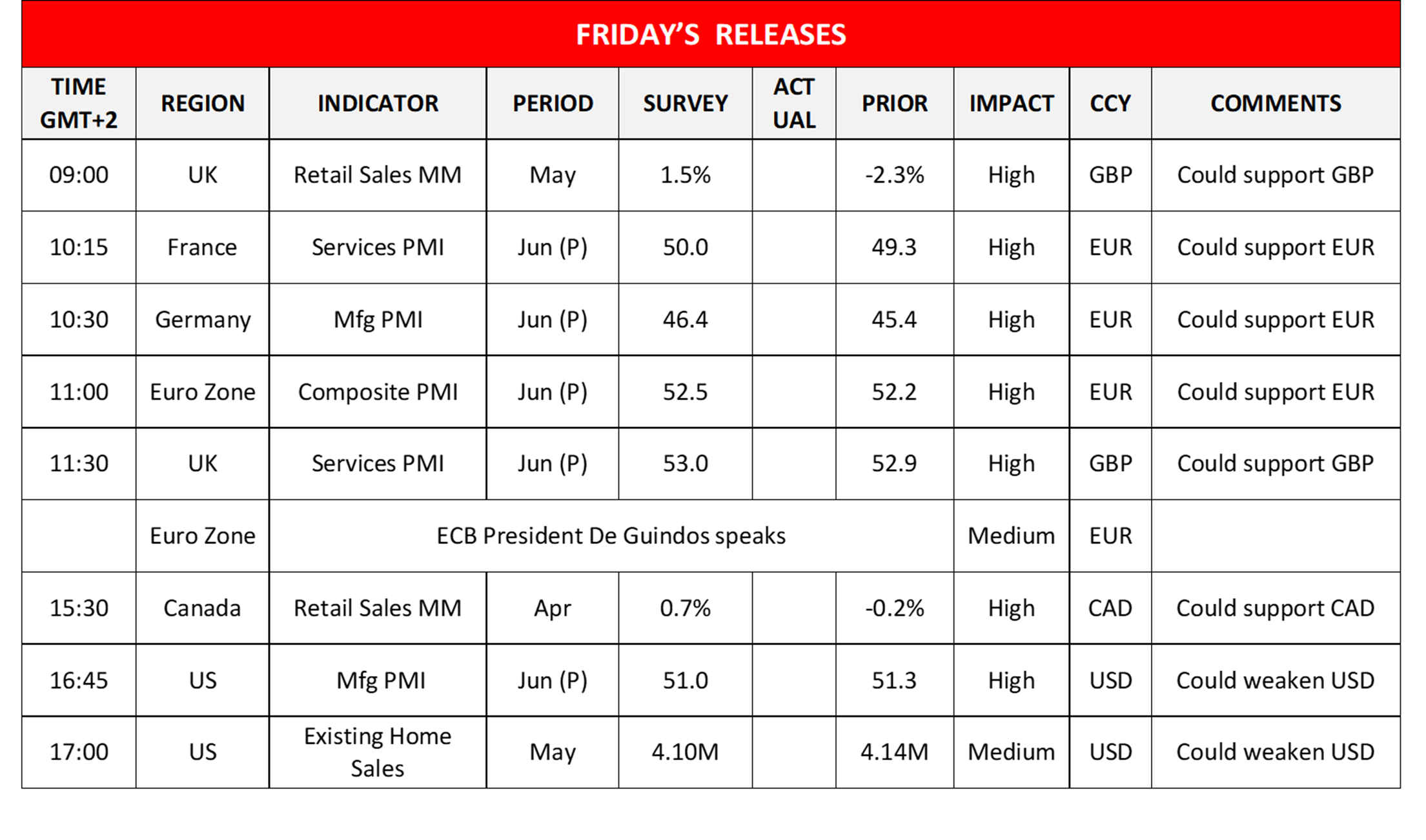

In today’s European session, we note the release of Eurozone’s preliminary PMI figures for June. We intend to focus on the release of the PMIs related to Germany’s manufacturing sector, France’s services sector and for a rounder view, Eurozone’s Composite PMI figure, which applies across borders and sectors. We highlight Germany’s manufacturing sector as the problem child of the area. Should the actual figures show an improvement of economic activity in the Zone we may see the EUR getting some support and vice versa.

On a monetary level, we highlight the release of BoE’s interest rate decision yesterday. The bank remained on hold as expected, yet the interesting part of the decision was its forward guidance. The bank seems to be inclined in proceeding with rate cuts, albeit not immediately. The release tended to verify the market’s expectations for a rate cut in the September meeting and allowed it to maintain its hopes for another rate cut until the end of the year. Overall, should this be reflected also in commentary to be made by BoE policymakers in the coming week we may see BoE’s monetary policy outlook weighing on the pound.

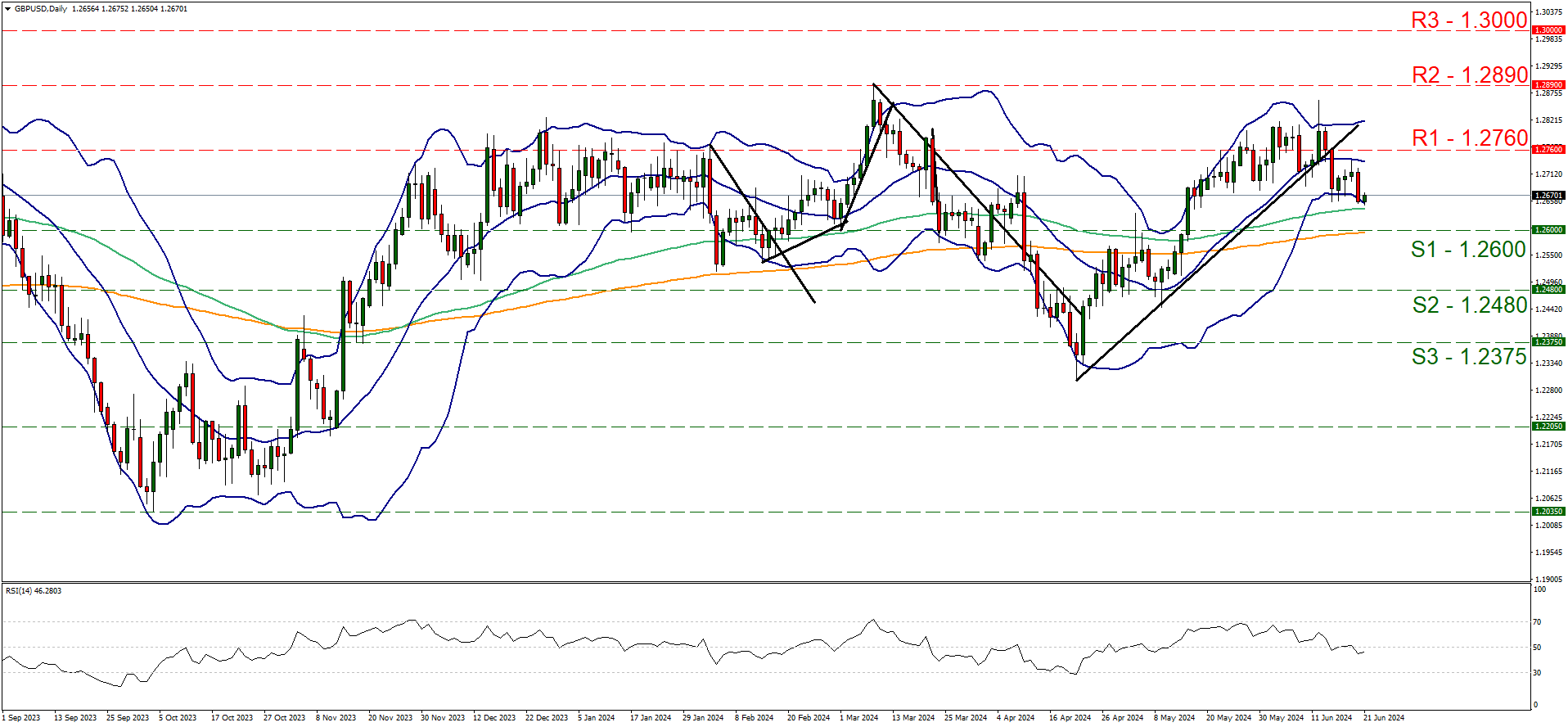

GBP/USD appears to be forming new lower lows and lower highs, starting to form a downward trendline and showing us the limitations of the downward movement. We maintain our neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently has breached below the reading of 50, yet remains unconvincing for the bears’ intentions. For our sideways bias to continue, we would require the commodity to remain confined within the boundaries set by the channel defined by the 1.2600 (S1) support level and the 1.2760 (R1) resistance line. On the other hand to abandon our sideways motion bias in favour of a bearish outlook we would require a clear break below the 1.2600 (S1) support level, with the next possible target for the bears being the 1.2480 (S2) support line. Lastly, for a bullish outlook, we would require a clear break above the 1.2760 (R1) resistance line with the next possible target for the bulls being the 1.2890 (R2) resistance level.

本日のその他の注目点

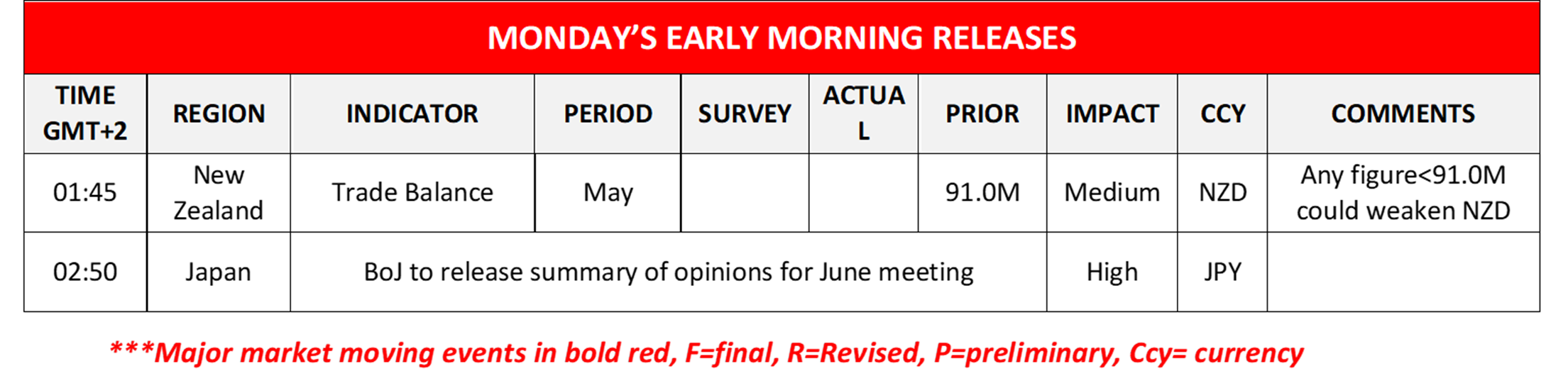

On a busy Friday we note the release of the June preliminary PMI figures of the UK and the US. Also, we note the release of UK’s retail sales for May, Canada’s retail sales for April and the US existing home sales figure for May while ECB’s Vice President De Guindos is scheduled to speak. During Monday’s Asian session, we note the release of New Zealand’s May trade data and from Japan, BoJ is to release the summary of opinions for the June meeting.

GBP/USD Daily Chart

- Support: 1.2600 (S1), 1.2480 (S2), 1.2375 (S3)

- Resistance: 1.2760 (R1), 1.2890 (R2), 1.3000 (R3)

USD/JPY Daily Chart

- Support: 157.75 (S1), 154.60 (S2), 151.90 (S3)

- Resistance: 160.35 (R1), 163.00 (R2), 166.00 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。