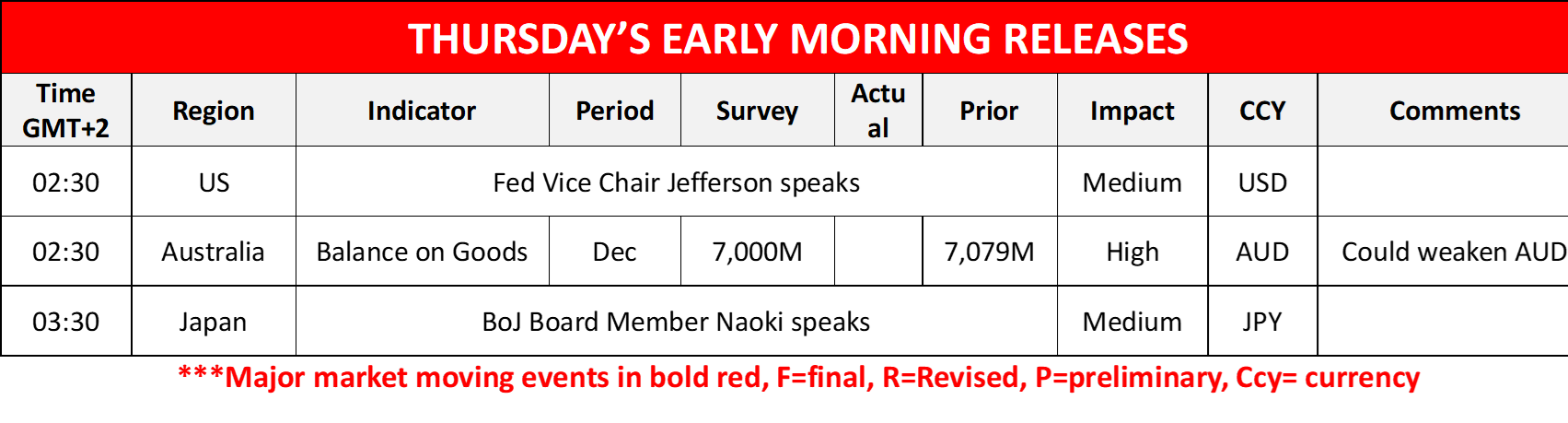

JPY got some notable support in today’s Asian session, as the market’s expectations for BoJ to maintain a hawkish approach, with possibly more rate hikes to come, strengthened the Yen. On a macroeconomic level, the improvement of some earnings data of the Japanese employment market tended to enhance further such expectations. Hence, we tend to highlight BoJ Board Member Naoki’s speech tomorrow for any further clues regarding the bank’s intentions. Should Mr. Naoki maintain a hawkish tone, enhancing the market’s expectations for more rate hikes, we may see JPY getting additional support.

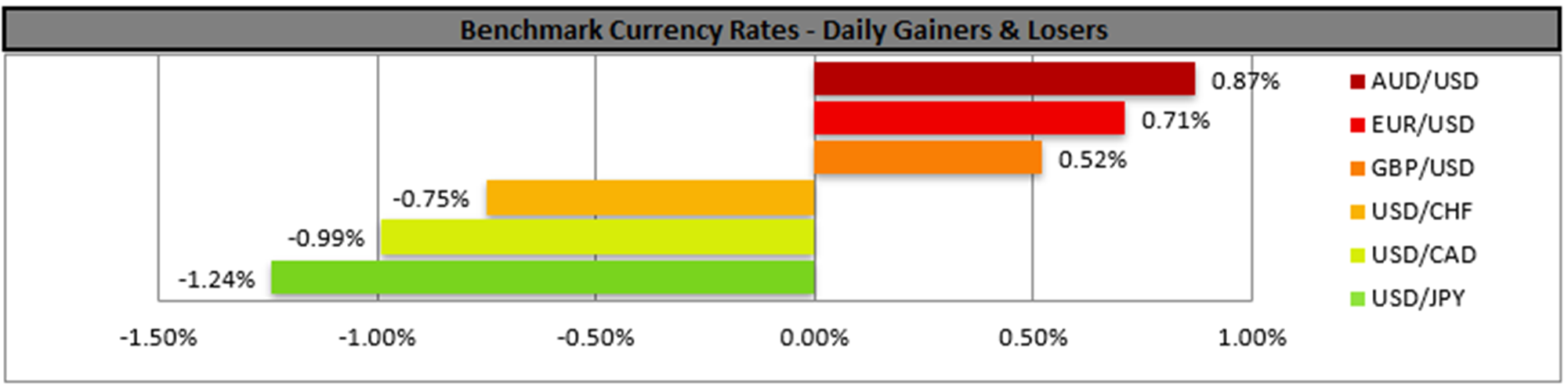

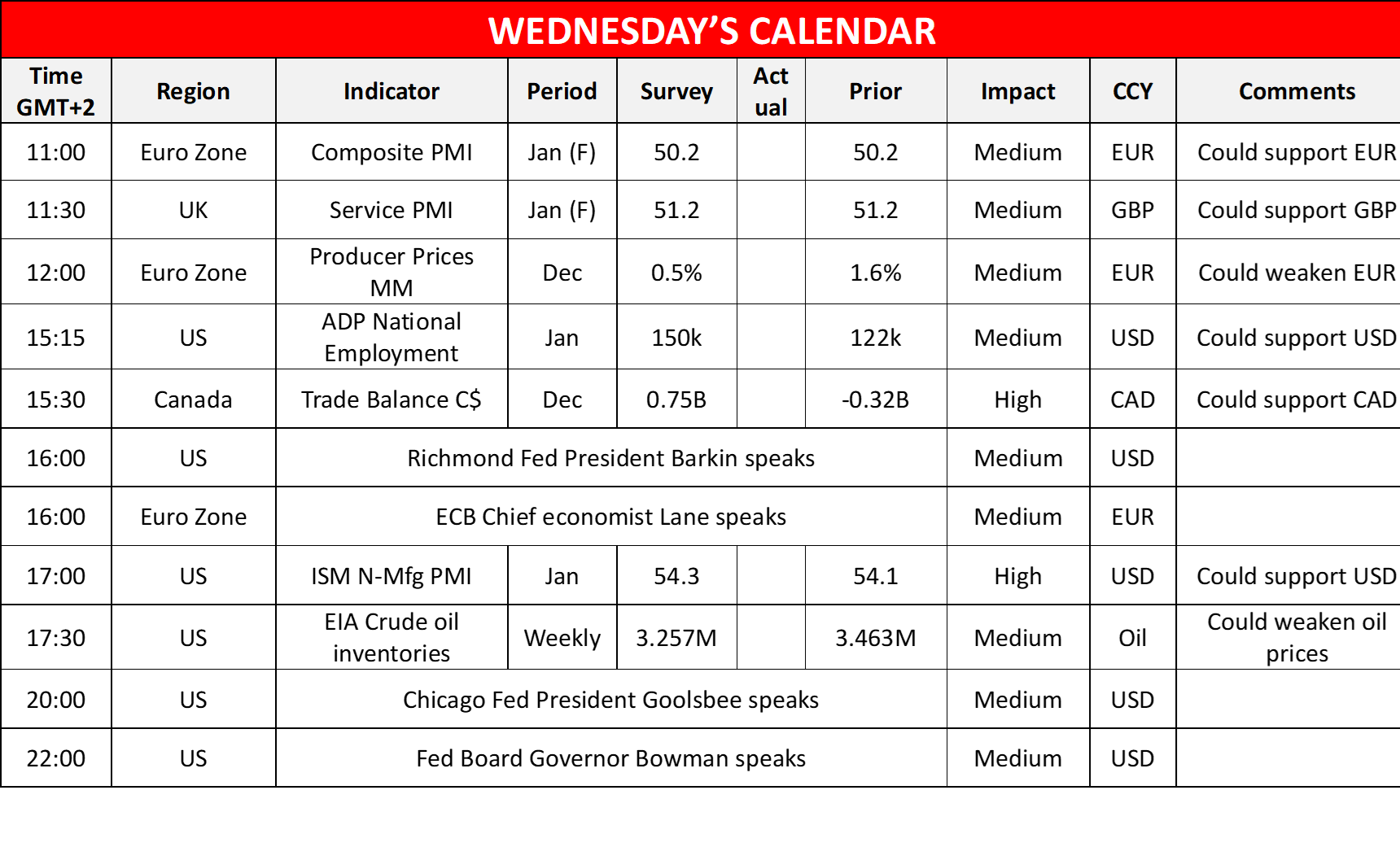

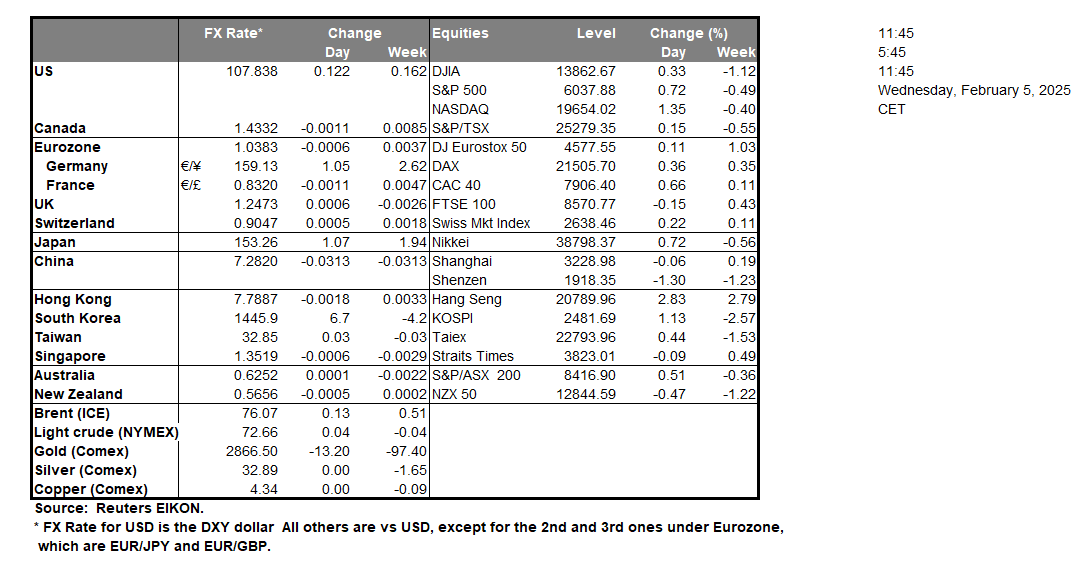

The USD continued to slide against its counterparts yesterday, correcting further lower after Monday’s jump due to Trump’s tariffs on China and their postponement for Canada and Mexico. Given the release of the US employment report for January on Friday, we note the release of ADP for the same month in today’s American session, which is to gauge the health of the employment market in the private sector. It should be noted that the indicator is expected to show an increased number of jobs created, which could provide some support for the USD as it could enhance the market’s expectations for Friday’s NFP figure. It should be noted that the JOLTS job openings figure for December disappointed the markets as it dropped beyond expectations yesterday, possibly weighing on the greenback. Also, today we note the release of the ISM non-manufacturing PMI figure for January. Given the beyond-expectations rise of the ISM manufacturing PMI figure for January on Monday, hopes of the market for a faster expansion of economic activity in the US services sector may be increased and should the indicator’s reading rise beyond expectations we may see the USD being supported in the American session.

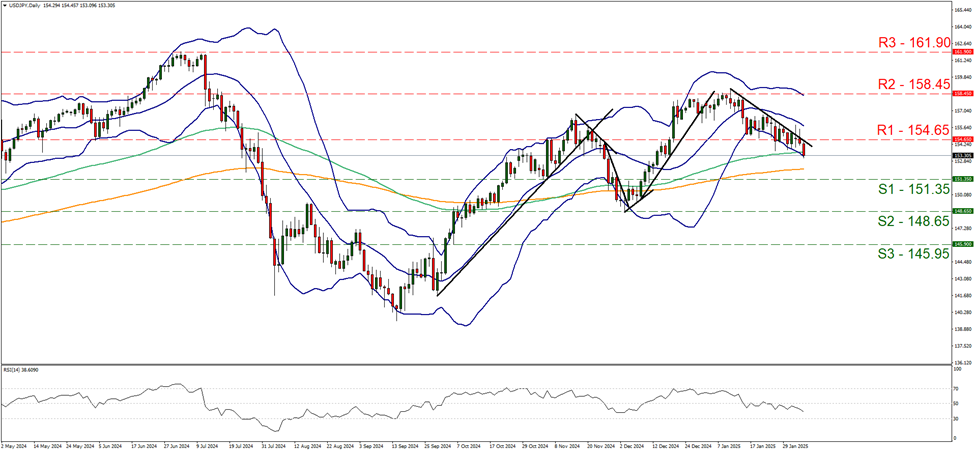

In the FX market, USD/JPY finally respected the downward trendline guiding it lower since the 10 of January and broke the 154.65 (R1) support line, now turned to resistance. Hence we reinstate our bearish outlook for as long as the prementioned downward trendline remains intact. Furthermore we note that the RSI indicator has enhanced its downward motion aiming now clearly for the reading of 30 implying an intensification of the bearish sentiment among market participants. Should the bears maintain control over the pair as expected we may see it aiming if not breaching the 151.35 (S1) support line, with the next target for the bears being the 148.65 (S2) support level. Should the bulls take over, we may see USD/JPY breaking the prementioned downward trendline clearly, signaling an interruption of the downward motion, continue to break the 154.65 (R1) resistance line and start aiming, if not reaching the 158.45 (R2) resistance base.

その他の注目材料

Today we note the release of Euro Zone’s and the UK’s final services and composite PMI figures for January, Euro Zone’s December producer prices and in the American session we get from Canada December’s trade data and oil traders may be more interested in the release of the US EIA weekly crude oil inventories figure. On the monetary front, we note the speeches of Richmond Fed President Barkin, ECB Chief Economist Lane, Chicago Fed President Goolsbee and Fed Board Governor Bowman. In tomorrow’s Asian session, we get Australia’s December trade data while Fed Vice Chair Jefferson speaks.

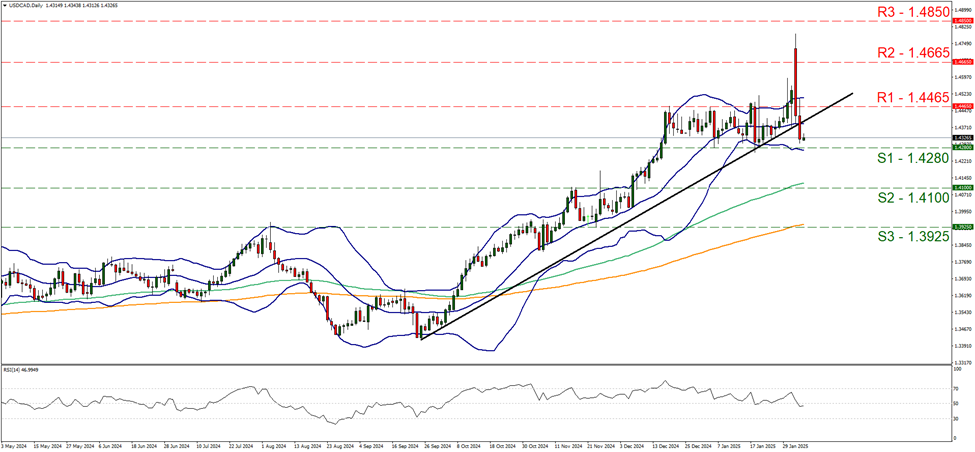

On a technical level, we note that USD/CAD continued falling yesterday aiming for the 1.4280 (S1) support line, yet failing to breach it. In its downward motion it did break the downward trendline guiding it since the 25 of September last year and the RSI indicator dropped reaching the reading of 50, hence we adopt a bias for a sideways motion for now. For a bearish outlook to emerge we would require the pair to break the 1.4280 (S1) support line and start aiming for the 1.4100 (S2) support level. Should the bulls take over, we may see the pair breaking the 1.4465 (R1) resistance line and aiming for the 1.4665 (R2) level.

USD/JPY Daily Chart

- Support: 151.35 (S1), 148.65 (S2), 145.95 (S3)

- Resistance: 154.65 (R1), 158.45 (R2), 161.90 (R3)

USD/CAD Daily Chart

- Support: 1.4280 (S1), 1.4100 (S2), 1.3925 (S3)

- Resistance: 1.4465 (R1), 1.4665 (R2), 1.4850 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。