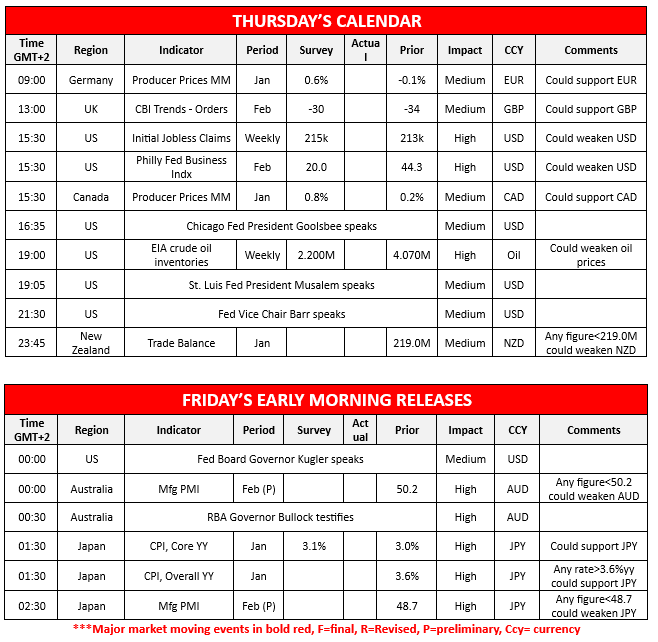

Japan’s CPI rates for January are set to be released during tomorrow’s Asian session and could thus garner some attention from Yen traders. The market’s current expectations are for the Core CPI rate to accelerate from 3.0% to 3.1%, implying heightened inflationary pressures in the Japanese economy. In turn the implication of an acceleration of inflationary pressures could inadvertently increase pressure on the BOJ to continue on it’s rate hiking cycle which could aid the JPY. On the other hand, should the CPI rates showcase easing inflationary pressures in the Japanese economy it could weigh on the JPY.The FOMC’s January meeting minutes were released yesterday. The minutes per Bloomberg stated that “Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate”, implying that the Fed may remain on hold for a prolonged period of time. Moreover, it appears that the Fed may be concerned with the administration’s trade policies, “Participants cited the possible effects of potential changes in trade and immigration policy, the potential for geopolitical developments to disrupt supply chains, or stronger-than-expected household spending”. In our view, we are not surprised to see a more cautious Fed given the uncertainty surrounding President Trump’s tariff ambitions.In Europe, Germany is gearing up for its elections which are set to take place on the 23rd of February which is this Sunday. At the time of this report, Politico shows the CDU/CSU in the lead at 29% with the AfD in second place at 21% of the vote.

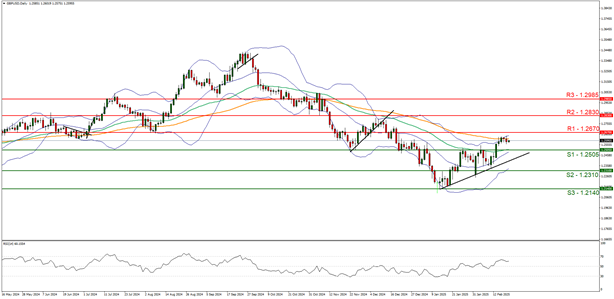

GBP/USD appears to be moving in a predominantly upwards fashion. However, we would not be surprised if the pair decides to test our 1.2505 (S1) support level. Nonetheless, we opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 60, implying a bullish market sentiment in addition to the upwards moving trendline which was incepted on the 14 of January. For our bullish outlook to continue, we would require a clear break above the 1.2670 (R1) resistance line with the next possible target for the bulls being the 1.2830 (R2) resistance level. On the flip side for a sideways bias we would require the pair to remain confined between the 1.2505 (S1) support level and the 1.2670 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 1.2505 (S1) support level with the next possible target for the bears being the 1.2310 (S2) support line.

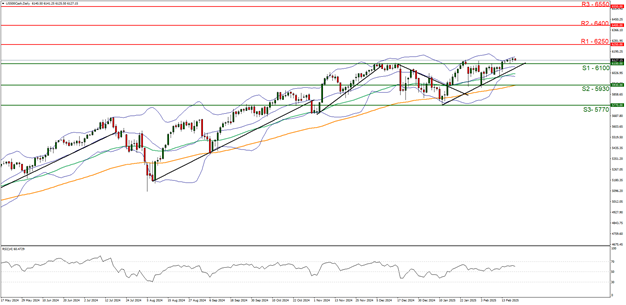

US500 appears to be moving in an upwards fashion. We opt for a bullish outlook for the index and supporting our case is the RSI indicator below our chart which currently registers a figure close to 60, implying a bullish market sentiment in addition to the upwards moving trendline which was incepted on the 13 of January. For our bullish outlook to continue, we would require a clear break above the possible 6250 (R1) resistance level with the next possible target for the bulls being the 6400 (R2) resistance line. On the flip side for a bearish outlook we would require a clear break below our 6100 (S1) support level with the next possible target for the bears being the 5930 (S2) support line. Lastly, for a sideways bias we would require the index’s price to remain confined between the 6100 (S1) support level and the possible 6250 (R1) resistance line.

その他の注目材料

Today we get Germany’s PPI rates for January, UK’s CBI industrial orders for February the US weekly initial jobless claims, February’s US Philly Fed Business index, Canada’s PPI rates for January, the US weekly EIA crude oil inventories, New Zealand’s trade data for January and on the monetary front, we note that Chicago Fed President Goolsbee, St. Luis Fed President Musalem and Fed Vice Chair Barr are scheduled to speak. In tomorrow’s Asian session, we get Australia’s and Japan’s preliminary PMI figures for February and we highlight the release of Japan’s CPI rates for January. On the monetary front, from the US, Fed Board Governor Kugler speaks and from Australia, RBA Governor Bullock is scheduled to testify.

GBP/USD Daily Chart

- Support: 1.2505 (S1), 1.2310 (S2), 1.2140 (S3)

- Resistance: 1.2670 (R1), 1.2830 (R2), 1.2985 (R3)

US500 Daily Chart

- Support: 6100 (S1), 5930 (S2), 5770 (S3)

- Resistance: 6250 (R1), 6400 (R2), 6550 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。