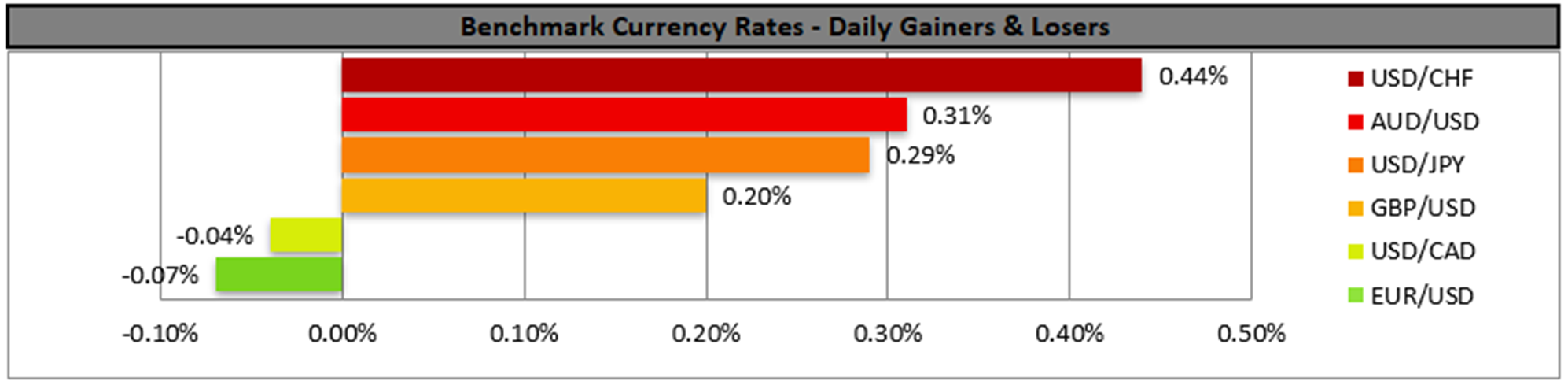

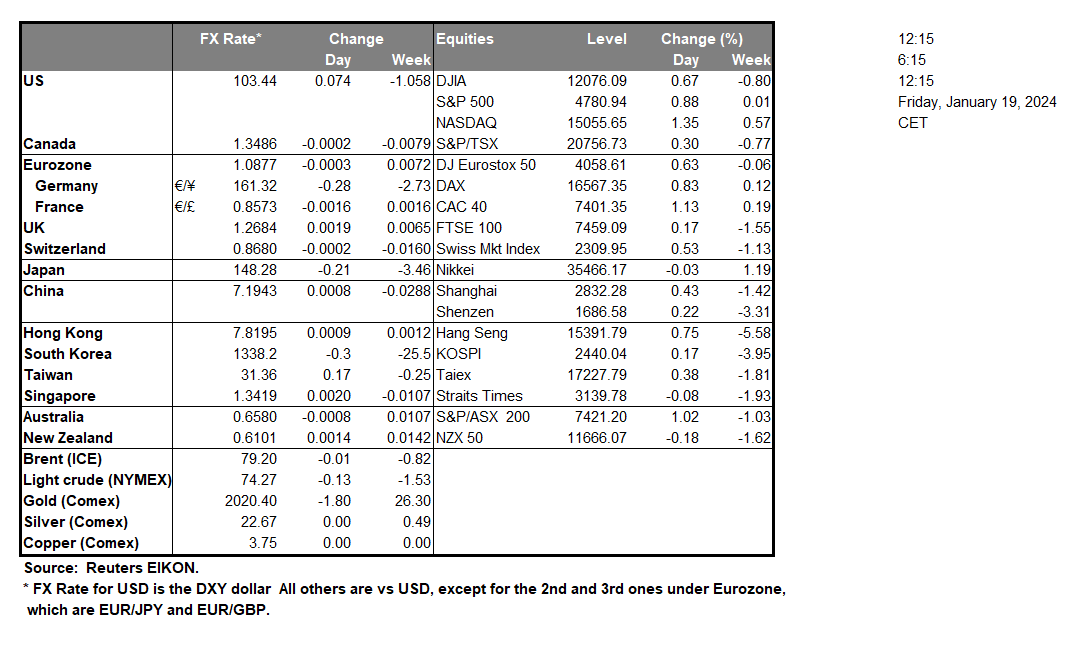

The USD continued to edge higher against its counterparts yesterday and is currently heading towards a third consecutive week of gains in the FX market. On a macro level, we note that the US construction data for December tended to spell bad news for the sector, yet the initial jobless claims figure for the past week came in lower than expected, implying a tightness of the US employment market. On the other hand, the Philly Fed Business index failed to improve for January implying another contraction of economic activity. On a monetary level, it seems that the Fed‘s message for high rates for longer slowly sinks in which may be keeping the greenback afloat.

The strengthening of the USD failed to weigh on gold’s price yesterday in a signal that the negative correlation of the two trading instruments was interrupted. It should be noted that gold’s price seems to be heading for another week in the reds, as practically the rise of US yields tended to underscore the attractiveness of US bonds as an alternative.

As for the US stock markets, we note that all three major US stock market indexes uniformly rose, as major chipmakers presented better-than-expected earnings reports, boosting a bit Apple’s share price and the confidence of equity traders. We expect market interest for earnings to remain present yet note the possibility of Fed policymakers souring the market sentiment.

Back in the FX market, we note that Japan’s CPI rates for December slowed down both at a headline and a core level. The release tends to pose difficulties on BoJ’s intentions to normalise its ultra-loose monetary policy and may weigh on JPY, given also the upcoming meeting of BoJ next week.

その他の注目材料

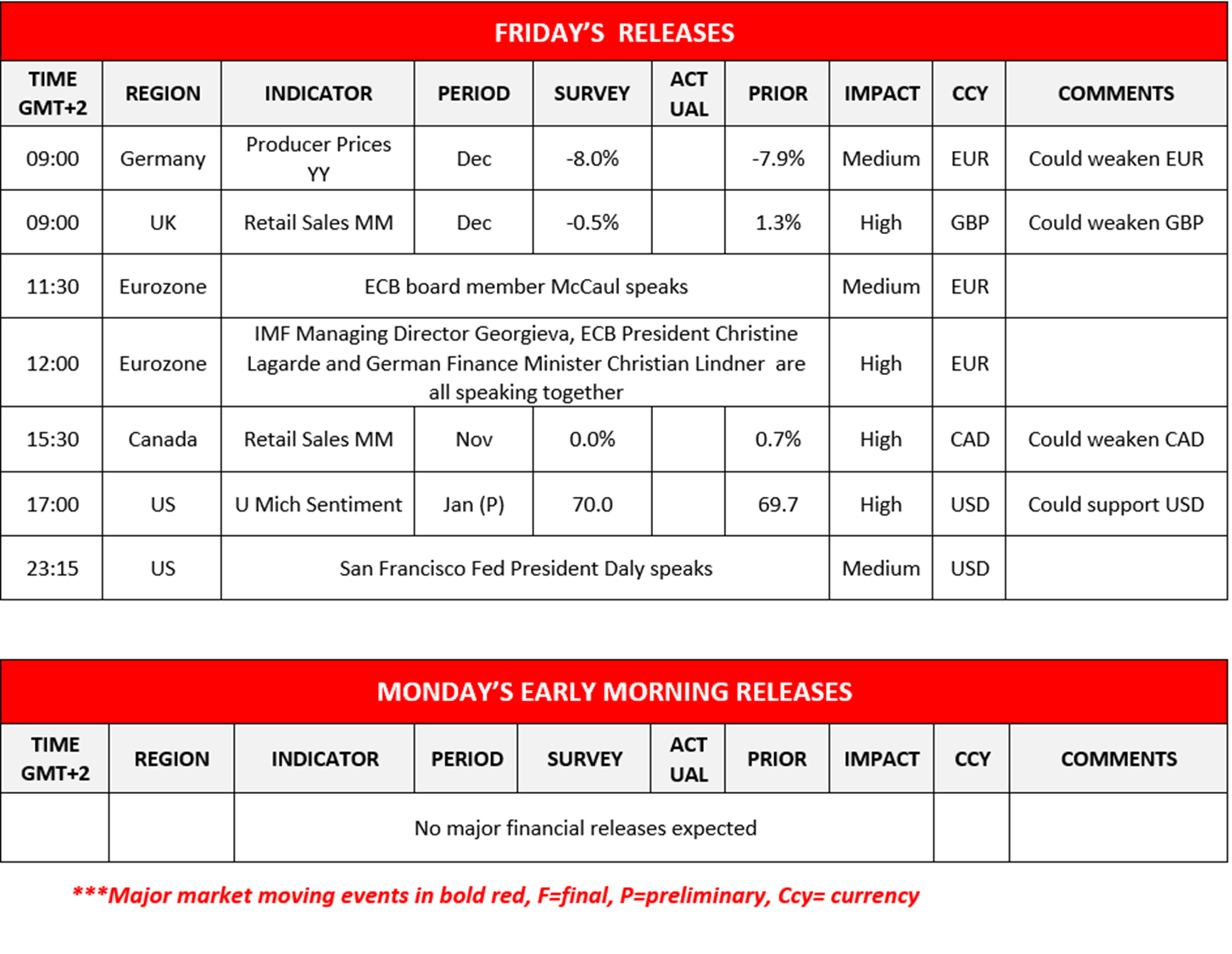

Today in the European session, we get Germany’s producer prices rate and the UK’s retail sales rate both for the month of December. In the American session, we note Canada’s retail sales rate for November, followed by the University of Michigan’s preliminary consumer sentiment figure for January.

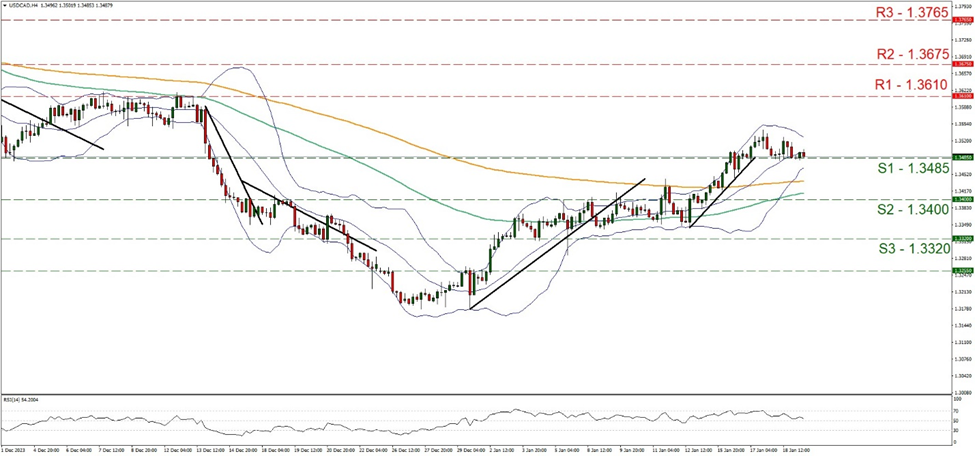

USD/CAD remained in a tight rangebound movement just above the 1.3485 (S1) support line. We tend to expect the pair to maintain its sideways motion given also that the RSI indicator is near the reading of 50 implying a rather indecisive market. Furthermore, we note that the Bollinger Bands have narrowed mirroring the low volatility of the pair and should the low volatility be maintained, it may allow the sideways motion to continue. Should the bulls take charge of the pair’s direction, we may see USD/CAD aiming if not reaching the 1.3610 (R1) resistance line. Should the bears take over, we may see USD/CAD breaking the 1.3485 (S1) support line and aim for the 1.3400 (S2) support level.

During Monday’s Asian session, we note a relatively quiet session with no major financial releases expected. On a monetary level, we highlight the speeches by ECB McCaul and the joint session with IMF Director Georgieva, ECB President Lagarde and German Finance Minister Lindner during the European session at the Davos WEF. Possible hawkish comments of ECB President Lagarde could provide some support for EUR.

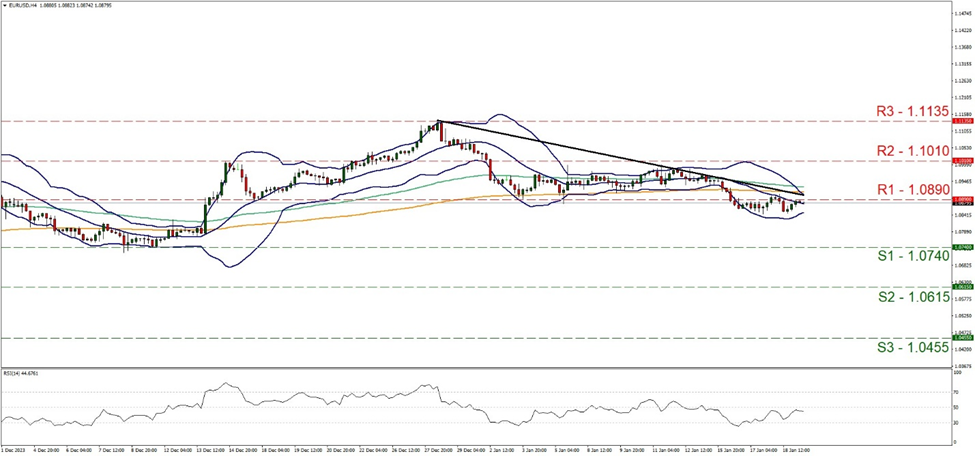

On a technical level, EUR/USD remained in a sideways motion below the 1.0890 (R1) resistance line. We tend to maintain our bias for the sideways motion to continue, given also the RSI indicator that neared the reading of 50 and the narrowing of the Bollinger bands. Yet we have to note the downward trendline nearing the price action. Should a selling interest be expressed by the market we may see EUR/USD aiming for the 1.0740 (S1) support line. On the other hand, should the pair find extensive buying orders along its path, we may see EUR/USD breaking the 1.0890 (R1) resistance line, the prementioned downward trendline, and take aim at the 1.1010 (R2) resistance base.

During the American session, we note the speech by San Francisco Fed President Daly.

EUR/USD 4時間チャート

Support: 1.0740 (S1), 1.0615 (S2), 1.0455 (S3)

Resistance: 1.0890 (R1), 1.1010 (R2), 1.1135 (R3)

USD/CAD 4時間チャート

Support: 1.3485 (S1), 1.3400 (S2), 1.3320 (S3)

Resistance: 1.3610 (R1), 1.3675 (R2), 1.3765 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。