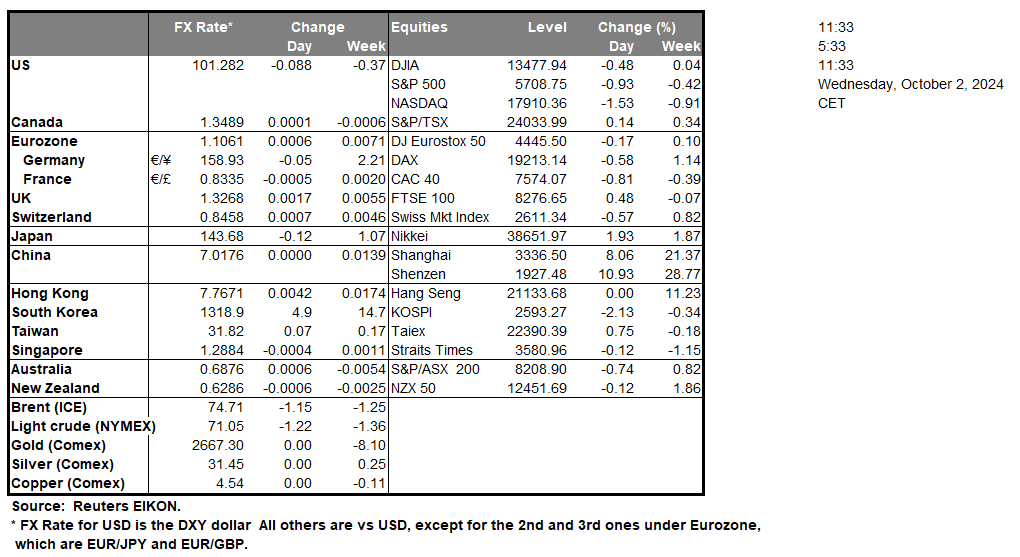

On a geopolitical level, Iran fired more than 100 missiles towards Israel last evening according to various media outlets. Iran has stated that the strikes against Israel were in response to the attacks on Gaza and Lebanon and has warned Israel against retaliating. Moreover, after the missile barrage was concluded , Iran stated that it has concluded its attack on Israel, essentially implying that they now consider the matter settled. However, according to the WSJ, Israel warned Iran prior to the missile barrage that in the event of any strike on its territory “no matter how small or large and that it didn’t matter if the were casualties or not.. Israel.. Would directly hit Iran’s nuclear or oil facilities”. In our view, we would not be surprised to see Israel retaliating against Iran, as was seen in previous occasions and that the recent escalation in the region, could cause supply chain concerns surrounding oil and thus may aid its price, in addition to gold which is considered to be a safe haven asset in times of geopolitical uncertainty. Over in the US the financial releases stemming from the nation showcased mixed readings. In particular the ISM manufacturing PMI figure for September came in lower than expected, yet appears to have been contradicted by the S&P manufacturing PMI figure for the same month. The mixed readings may increase volatility for the rest of the week.

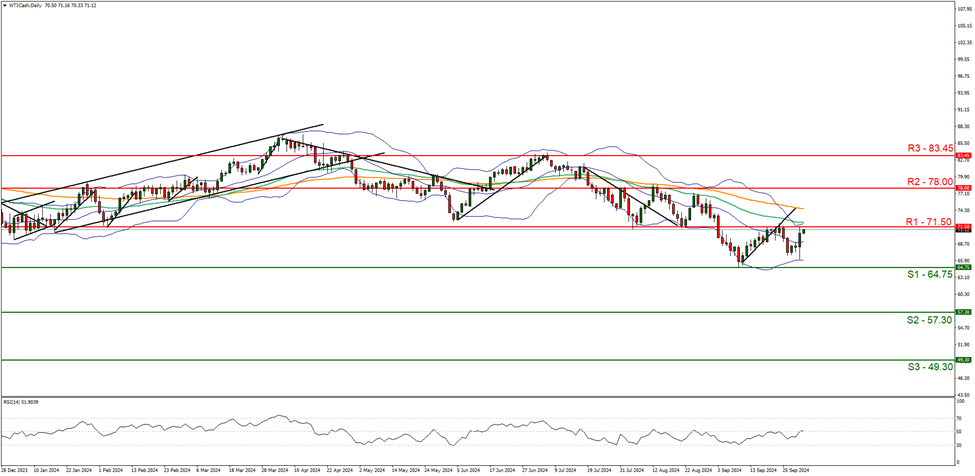

WTICash appears to be moving in a sideways fashion from a technical perspective. We opt for a sideways bias for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment.For our sideways bias to continue, we would require the pair’s price action to remain confined between the sideways moving channel defined by the 64.75 (S1) support level and the 71.50 (R1) resistance line. On the flip side, we would immediately switch our sideways bias in favour of a bullish outlook in the event of a clear break above the 71.50 (R1) resistance line, with the next possible target for the bulls being the 78.00 (R2) resistance level. Lastly, for a bearish outlook we would require a clear break below the 64.75 (S1) support level, with the next possible target for the bears being the 57.30 (S2) support level.

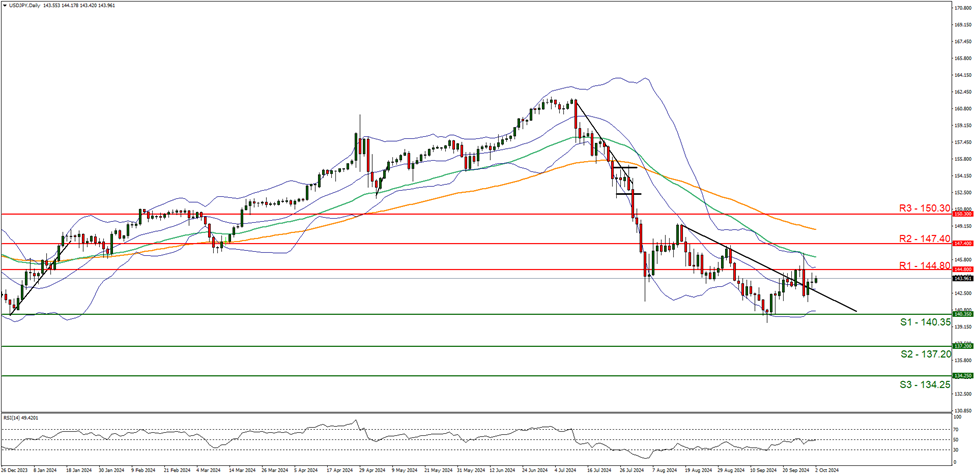

USD/JPY appears to be moving in a sideways fashion and supporting our case the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue we would require the pair to remain confined between sideways moving channel defined by the 140.35 (S1) support level and the 144.80 (R1) resistance line. On the flip side, for a bearish outlook we would require a clear break below the 140.35 (S1) support line with the next possible target for the bears being the 137.20 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 144.80 (R1) resistance line, with the next possible target for the bulls being the 147.40 (R2) resistance level.

その他の注目材料

Today we get the Eurozone’s unemployment rate for August, the US ADP Employment figure for September and the US weekly EIA crude oil inventories figure. In tomorrow’s Asian session we would like to note Australia’s final Judo bank composite PMI figure and Japan’s Jibunk final composite figure both for September and Australia’s trade balance data for August. On a monetary level we note the speeches by ECB VP De Guindos, ECB Chief Economist Lane, ECB member Elderson, the ministerial meeting by OPEC+, Cleveland Fed President Hammack , St Louis Fed President Musalem, Fed Board Governor Bowman and Richmond Fed President Barkin all for today.

WTICash Daily Chart

- Support: 64.75 (S1), 57.30 (S2), 49.30 (S3)

- Resistance: 71.50 (R1), 78.00 (R2), 83.45 (R3)

USD/JPY Daily Chart

- Support: 140.35 (S1), 137.20 (S2), 134.25 (S3)

- Resistance: 144.80 (R1), 147.40 (R2), 150.30 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。