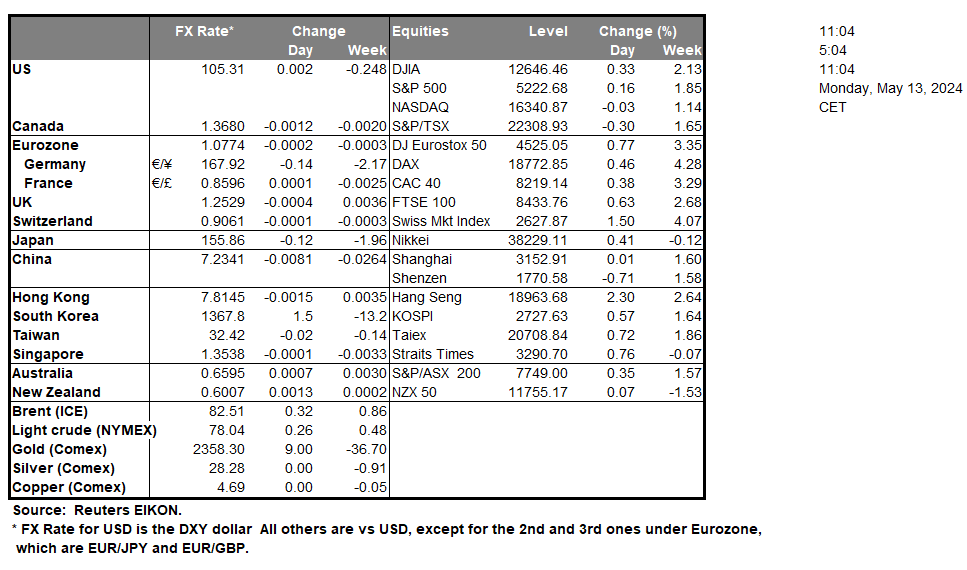

In the commodities market, there appears to be a confusion over Iraq’s commitment to OPEC+ oil output cuts over the weekend, with contradicting statements emerging from the Iraqi Oil Ministry, which could weigh on oil prices.Over in the US, Cleveland Fed President Mester is set to speak later on today. Should the Fed policymaker’s comments be interpreted as relatively hawkish in nature, i.e implying interest rates remaining at their current levels for a prolonged time period, it could provide support for the dollar and vice versa.

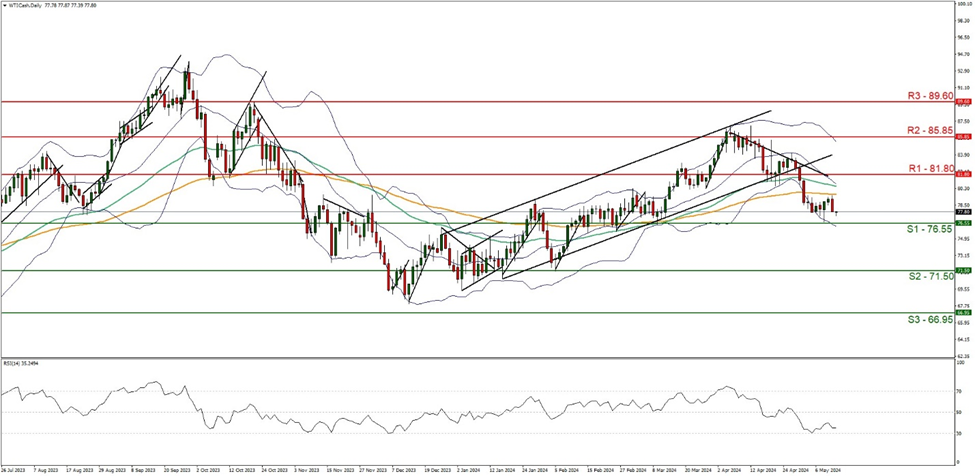

WTICash appears to be moving in a downwards fashion. We maintain a bearish outlook for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure below 40, implying a bearish market sentiment, in addition to the downwards moving trendline which was incepted on the 4 of April.For our bearish outlook to continue we would require a clear break below the 76.55 (S1) support level with the next possible target for the bears being the 71.50 (S2) support line. On the flip side, for a sideways bias we would require the commodity to remain confined within the sideways moving channel defined by the 76.55 (S1) support level and the 81.80 (R1) resistance line. Lastly, for a bullish outlook we would like to see a clear break above the 81.80 (R1) resistance line with the next possible target for the bulls being the 85.85 (R2) resistance level.

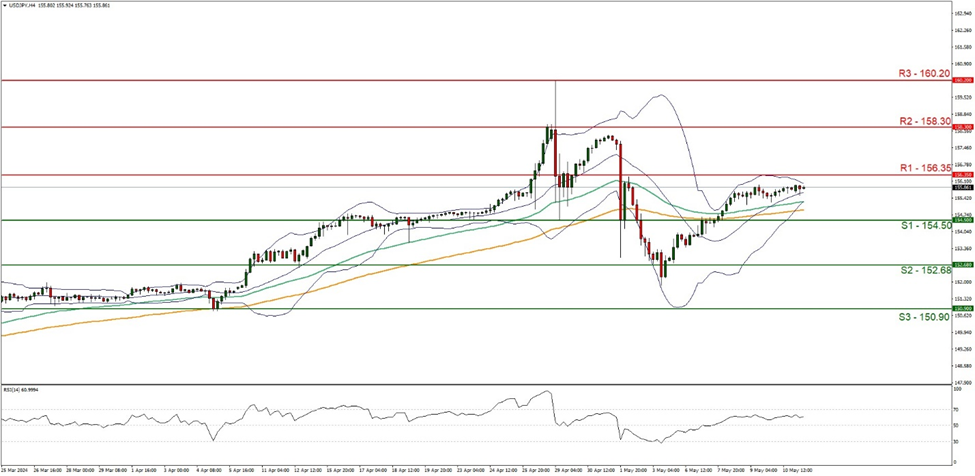

USD/JPY appears to be moving in a sideways fashion. We maintain a sideways bias for the pair and supporting our case is the narrowing of the Bollinger bands, which imply low market volatility. However, we should note that the RSI indicator below our chart currently registers a figure near 60, implying that some bullish market tendencies may remain. Nonetheless, for our sideways bias to continue we would like to see the pair remain confined within the sideways moving channel defined by the 154.50 (S1) support level and the 156.35 (R1) resistance line. On the flip side, for a bullish outlook we would require a clear break above the 156.35 (R1) resistance line with the next possible target for the bulls being the 158.30 (R2) resistance line. Lastly, for a bearish outlook we would require a break below the 154.50 (S1) support level, with the next possible target for the bears being the 152.68 (S2) support line.

その他の注目材料

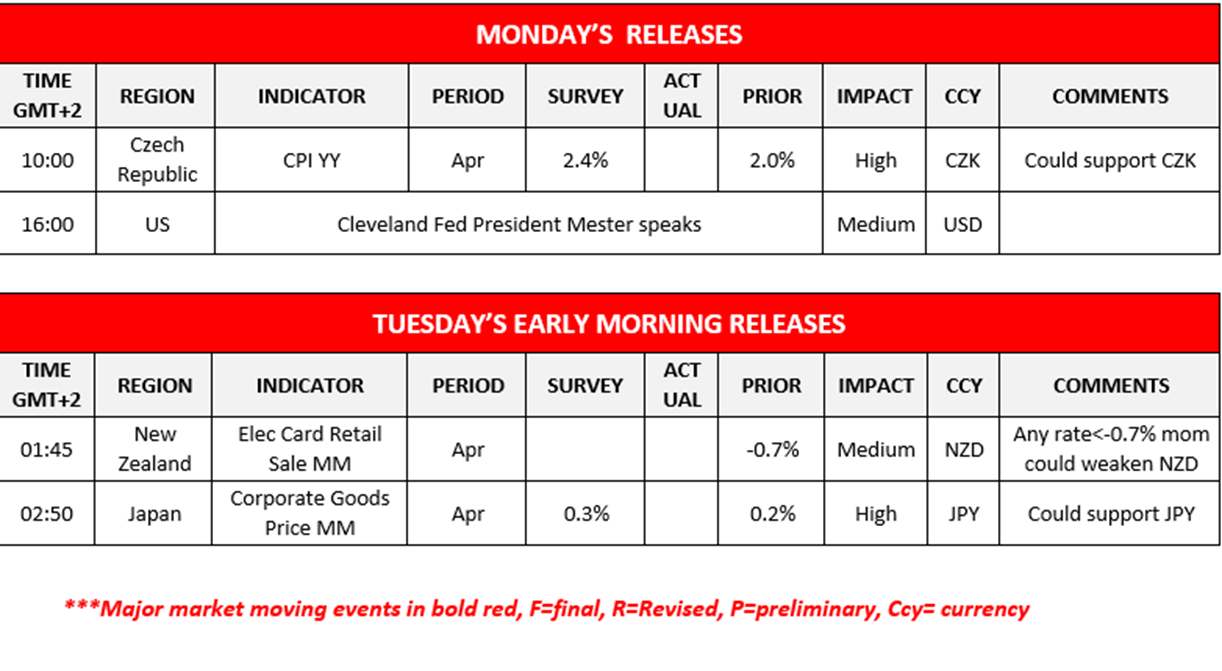

In a rather easy going Monday we get in the European session, the Czech Republic’s CPI rate for April while on the monetary front, we note that Cleveland Fed President Mester is scheduled to speak. During tomorrow’s Asian session, we get New Zealand’s Electronic Card Retail Sales growth rate for April and Japan’s Corporate Goods prices for April.

今週の指数発表:

On Tuesday, we get Japan’s Corporate Goods Prices rate, Germany’s final HICP rate both for April, followed by the UK’s ILO Unemployment rate, Average weekly earnings and employment change figure for March and the HMRC Payrolls figure for April, later on we get the Eurozone’s current economic sentiment figure, Germany’s ZEW economic sentiment and current conditions figures all for May and ending off is the US PPI Machine manufacturing figure for April. On Wednesday, we get Japan’s Machinery orders rate for March and Chain store sales rate for April, Sweden’s CPI rate and France’s final HICP rate for April, followed by the Eurozone’s Preliminary GDP rates for Q1 and Industrial production rate for March, the US CPI rates for April, followed by the US retail sales rate for April and ending off the day is Canada’s Manufacturing sales rate for March and on the monetary front we note release of the Riksbank’s May monetary policy meeting minutes. On Thursday we get Japan’s GDP rates for Q1, Australia’s Employment data for April, Norway’s GDP rate for Q1, the US weekly initial jobless claims figure, the US Philly Fed Business index for April and the US Industrial production rate for April. Lastly on Friday, we note China’s retail sales and urban investment rates, and the Eurozone’s final HICP rate, all for the month of April.

WTICash Daily Chart

Support: 76.55 (S1), 71.50 (S2), 66.95 (S3)

Resistance: 81.80 (R1), 85.85 (R2), 89.60 (R3)

USD/JPY 4時間チャート

Support: 154.50 (S1), 152.68 (S2), 150.90 (S3)

Resistance: 156.35 (R1), 158.30 (R2), 160.20 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。