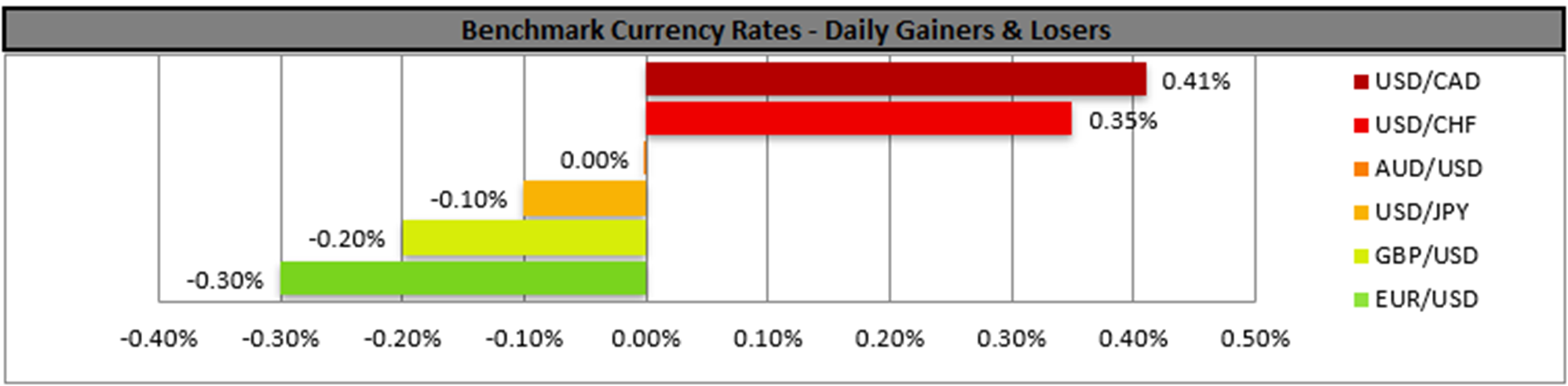

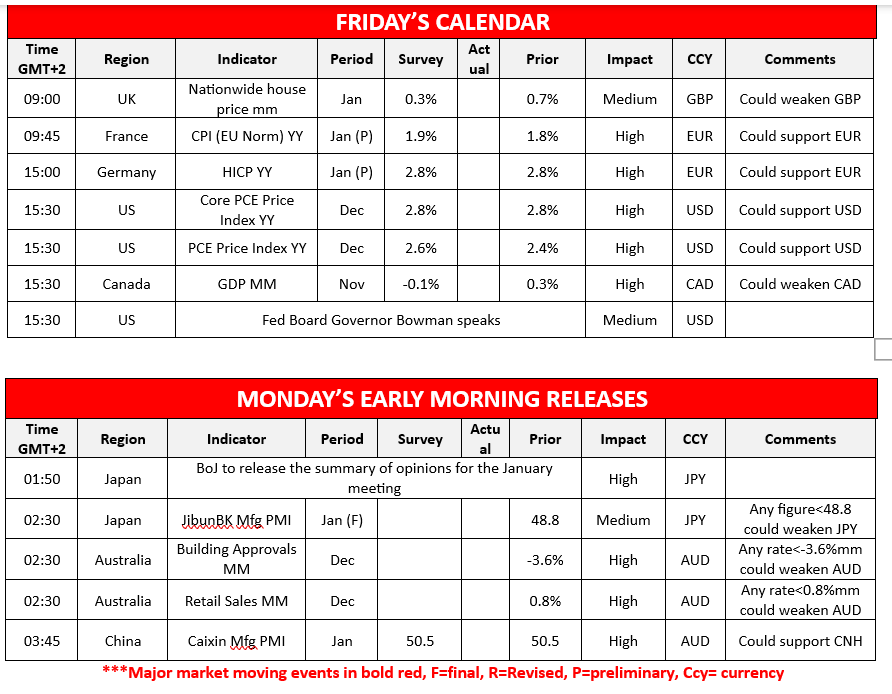

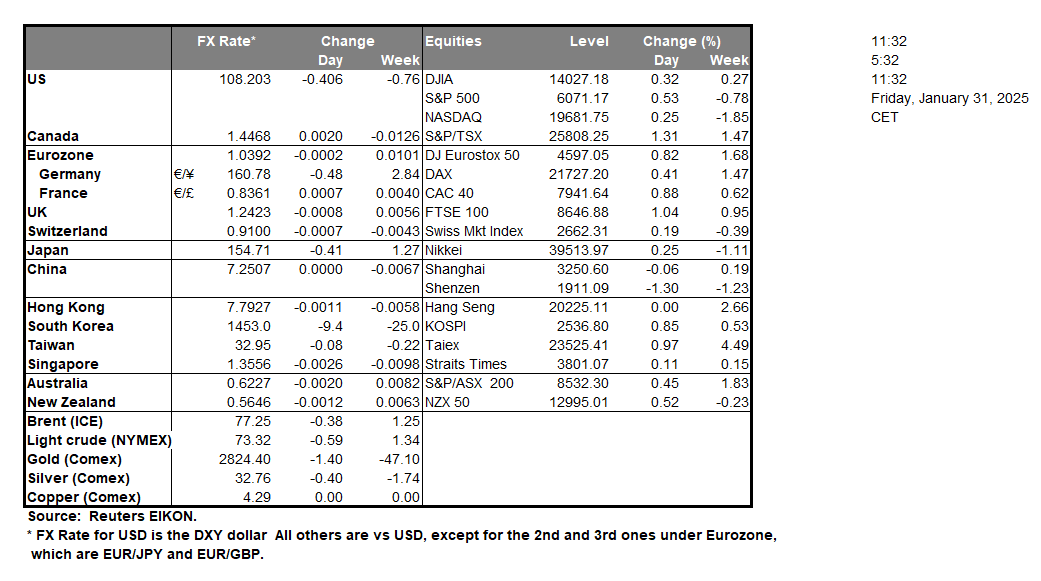

The USD got some support yesterday, as Trump reiterated his threats for tariffs on US imports from BRICS countries. Trump was reported saying yesterday, that the US will require BRICS countries to commit to neither creating a new BRICS currency nor back any other currency to replace the U.S. dollar, or they will face 100% tariffs. This economic policy of protectionism and Mercantilism seems to provide support for the USD as it enhances its dominance in the FX market. Please note that tariffs of 25% on US imports from Canada and Mexico are to be applicable from tomorrow onwards. The tariffs may have an inflationary effect on the US economy which in turn could force the Fed to maintain an even less dovish stance. As for financial releases we note that the US GDP advance rate for Q4 showed a slowdown beyond expectations in the growth of the US economy for the last quarter of 2024. Yet comparatively the US economy still grows at a faster pace than a number of developed western economies. Today we highlight the release of the US PCE rates for December and the rates are expected to accelerate at a headline level and remain unchanged at a core level. In both cases the rates tend to imply a resilience of inflationary pressures the US economy, which may enhance the Fed’s doubts for further rate cuts, given that the PCE rates are the banks’ favorite inflation measure. Hence a possible acceleration of the rates beyond market expectations could provide some support for the USD.

Across the Atlantic the ECB cut rates as expected yesterday, by 25 basis points and in its accompanying statement avoided pre-committing to a particular rate path. Yet in her press conference, ECB President Lagarde seemed to allow for the possibility of more rate cuts to come. On a monetary level, we expect the ECB to continue cutting rates, which could continue weighing on the EUR as interest rate differentials with the Fed will continue to diverge. On a macroeconomic level, though the name of the game in the Euro Zone is growth and the release of the preliminary GDP rates for Q4 24 were disappointing as Germany and France entered contractionary mode, while for the Euro Zone as a whole, the GDP growth rate is at stagnation levels, which is worrying for EUR traders. Today we highlight the release of Germany’s and France’s preliminary HICP rates for January and a possible persistence of inflationary pressures in these countries could provide some support for the common currency as it may force the ECB to ease on its dovishness.

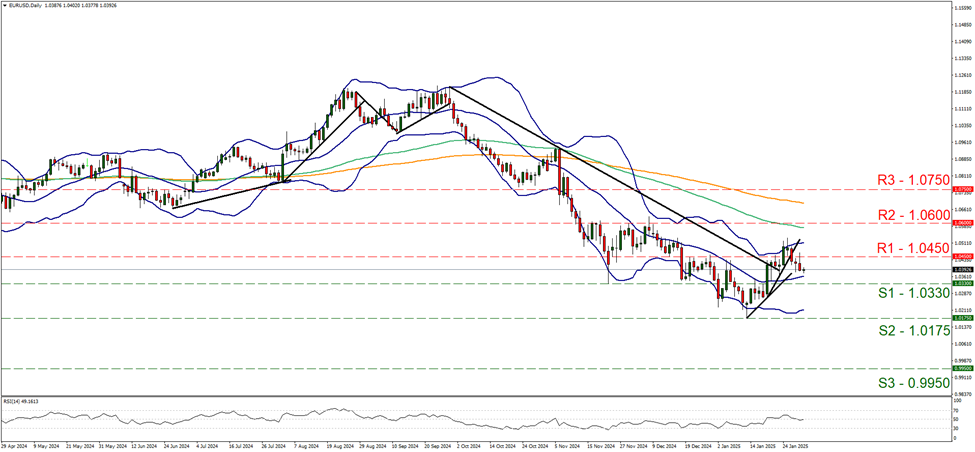

On a technical level, we note that EUR/USD continued to edge lower aiming for the 1.0330 (S1) support line. We note the bearish tendencies of the pair yet at the same time the RSI indicator seems to remain at the reading of 50, implying a relatively indecisive market. Hence for the time being we tend to maintain a bias for a sideways motion. For a bearish outlook to prevail we would require the EUR/USD to breach the 1.0330 (S1) support line, paving the way for the 1.0175 (S2) support level. Should the bulls take over, we may see EUR/USD breaking the 1.0450 (R1) resistance line and start aiming for the 1.0600 (R2) resistance level.

その他の注目材料

Today we get Canada’s GDP rate for November. In Monday’s Asian session, we get BoJ’s summary of opinions for the January meeting and Australia’s December building approvals and retail sales and China’s January Caixin manufacturing PMI.

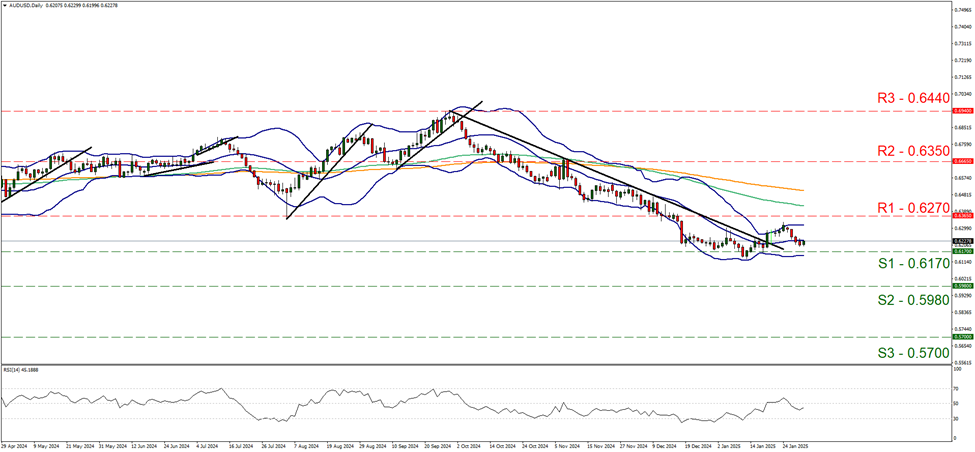

AUD/USD edged lower yesterday yet remained within the boundaries set by the 0.6170 (S1) line and the 0.6270 (R1) level. We maintain a bias for the sideways motion as long as the sideways movement remains between the prementioned boundaries. The RSI indicator edged below, yet remains close to the reading of 50, while the Bollinger bands tend to remain narrow, implying less volatility for the pair which may allow the sideways motion of the pair to continue. Should the bulls take over, we may see the pair breaking the 0.6270 (R1) resistance line and start aiming for the 0.6350 (R2) level. Should the bears take over, USD/CAD could break the 0.6170 (S1) line and thus open the gates for the 0.5980 (S2) support level.

EUR/USD デイリーチャート

- Support: 1.0330 (S1), 1.0175 (S2), 0.9950 (S3)

- Resistance: 1.0450 (R1), 1.0600 (R2), 1.0750 (R3)

AUD/USD デイリーチャート

- Support: 0.6170 (S1), 0.5980 (S2), 0.5700 (S3)

- Resistance: 0.6270 (R1), 0.6350 (R2), 0.6440 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。