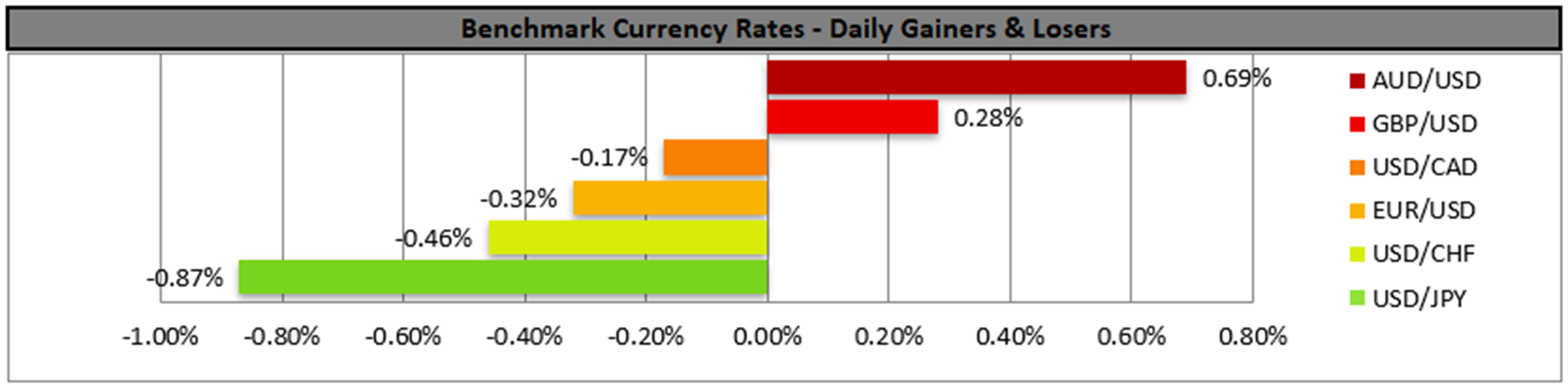

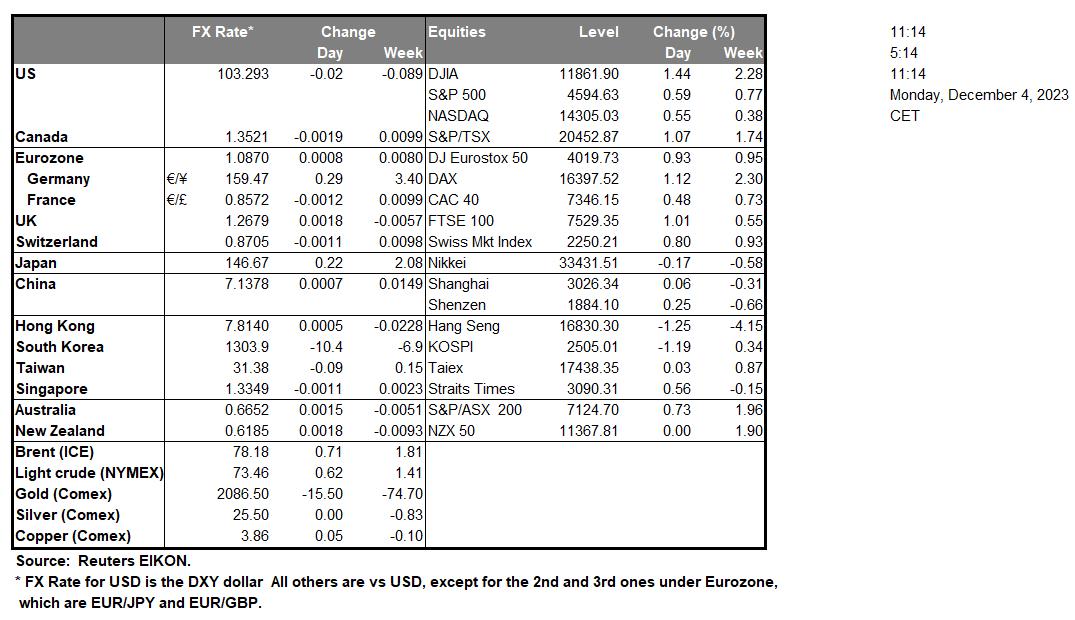

The USD stabilised somewhat on Friday yet the market more or less tended to shrug off Fed Chairman Powell’s efforts to convince that rates are to remain high for a longer period. The market is currently pricing in five rate cuts from the Fed in 2024, starting from March, according to Fed Fund Futures, while some analysts are speculating about the possibility of six rate cuts by the US central bank. We expect that should the market’s anticipations intensify we may see an adverse effect on USD, while equities and gold’s price could benefit, as US bond yields may start falling. It’s characteristic how gold’s price skyrocketed during today’s Asian session, reaching new record highs.

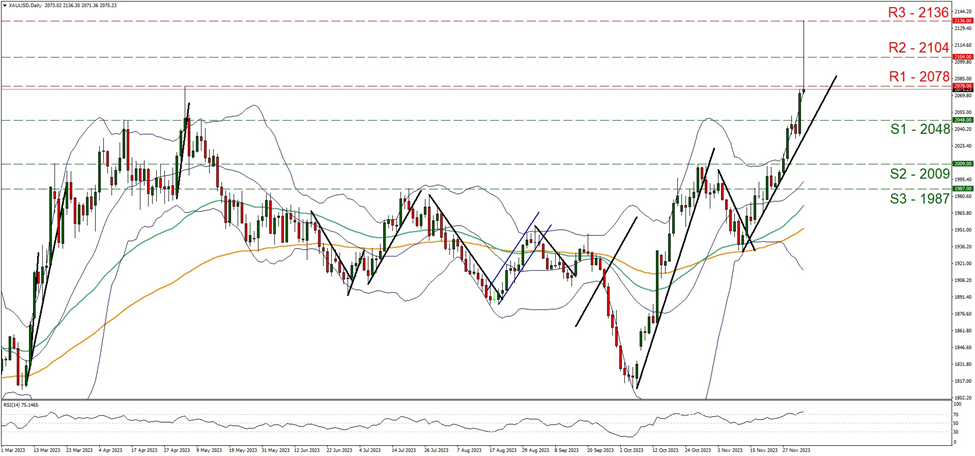

XAU/USD spiked to levels not seen before, reaching the 2136 (R3) resistance barrier, before correcting lower and dropped below the 2078 (R1) resistance line. We tend to maintain a bullish outlook for the precious metal’s price as long as the upward trendline, incepted since the 13 of November, remains intact and given that the RSI indicator is above the reading of 70 implying a strong bullish sentiment on behalf of the market. Yet as the RSI indicator has surpassed the reading of 70, it may be signaling that gold’s price is in overbought territory and ripe for a correction lower. Should the bulls maintain control over the precious metal’s price, we may see it breaking the 2078 (R1) resistance line and aim for the 2104 (R2) nest. Should the bears take over, we may see gold’s price retreating breaking the prementioned upward trendline, in a first signal of interruption of the upward movement, breaking the 2048 (S1) support line and aim for the 2009 (S2) base.

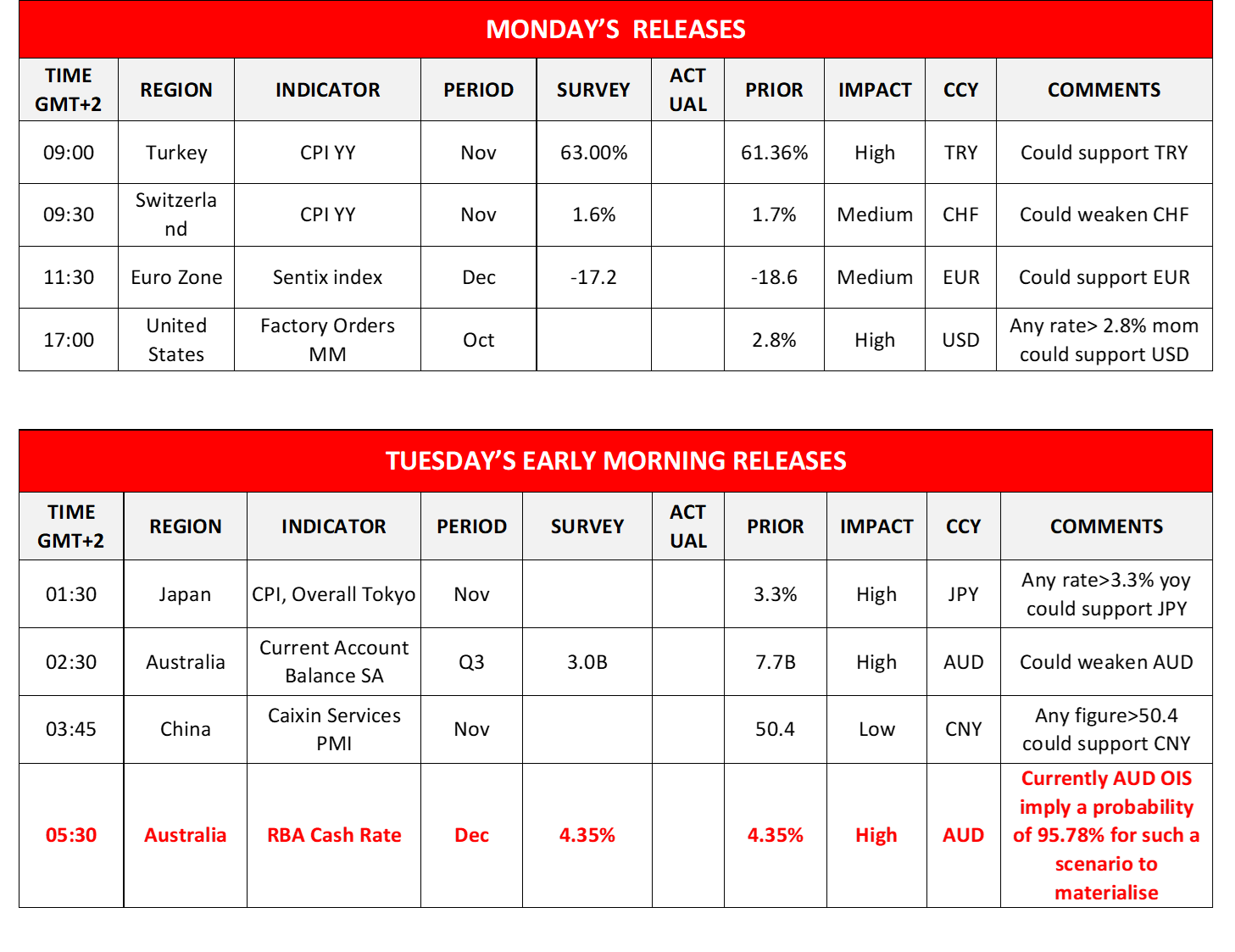

Across the world we note that RBA is widely expected to remain on hold at 4.35% tomorrow and a possible dovish tone in RBA Governor Bullock’s accompanying statement may weigh on the Aussie and vice versa.

AUD/USD on Friday rose breaking the 0.6620 (S1) resistance line, now turned to support. We tend to maintain a bullish outlook for the pair as long as the upward trendline incepted since the 13 of November remains intact. Yet we note that the RSI indicator is nearing the reading of 50, implying that the market’s bullishness is easing and such a scenario may allow the pair to stabilise. Should the pair find extensive buying orders along its path we may see the pair aiming if not breaking the 0.6725 (R1) line. Should a selling interest be expressed by the market, we may see the pair breaking the prementioned upward trendline, signaling an ending of the upward movement, breaking the 0.6620 (S1) support line and aiming for the 0.6515 (S2) level.

その他の注目材料

Today, we get Turkey’s and Switzerland’s CPI rates for November, Eurozone’s Sentix index for December and the US factory orders rate for October. During tomorrow’s Asian session, we get Japan’s Tokyo CPI rates for November, Australia’s Q3 current account balance and China’s Caixin Services PMI figure for November.

今週の指数発表:

On Tuesday, we get the US ISM Non-Manufacturing PMI figure for November and the US Jolts job openings figure for October. On Wednesday, we make a start with Australia’s GDP rate for Q3, Germany’s Industrial orders rate for October, the US ADP National employment figure for November and Canada’s trade balance figure for October, while on the monetary front we note BoC’s interest rate decision. On Thursday, we note Australia’s trade balance figure for October, China’s trade balance for November, Germany’s industrial production rate for October, the UK’s Halifax house prices figure for November followed by the Eurozone’s Revised GDP rate for Q3 and ending of the day is the US weekly Initial jobless claims figure. Lastly, on a heavyweight Friday, we note Japan’s revised GDP rate for Q3, and the US employment report for the month of November and finishing of the week is the US University of Michigan Preliminary Sentiment figure for December.

XAU/USD Daily Chart

Support: 2048 (S1), 2009 (S2), 1987 (S3)

Resistance: 2078 (R1), 2104 (R2), 2136 (R3)

AUD/USD 4時間チャート

Support: 0.6620 (S1), 0.6515 (S2), 0.6400 (S3)

Resistance: 0.6725 (R1), 0.6820 (R2), 0.6895 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。