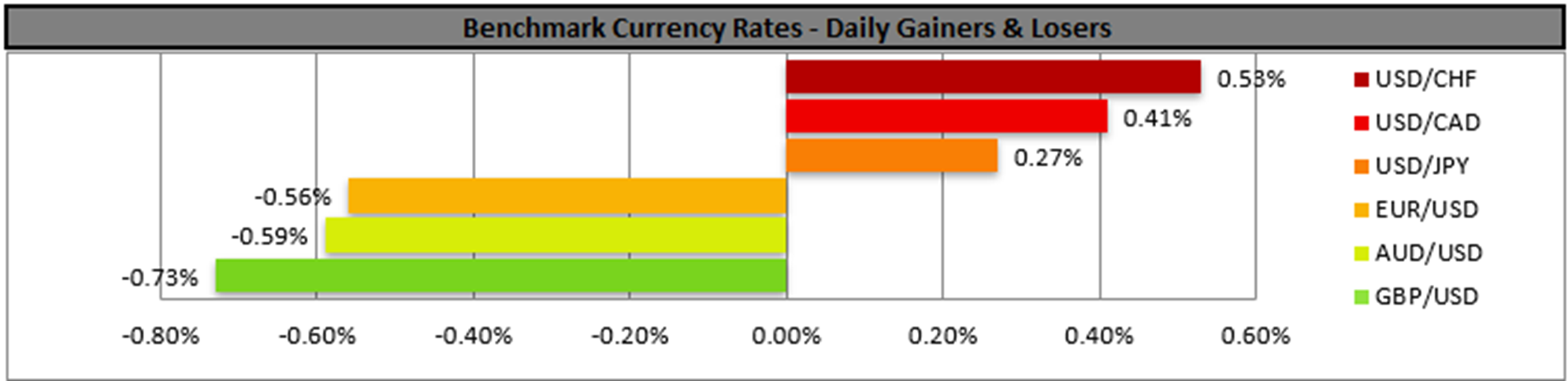

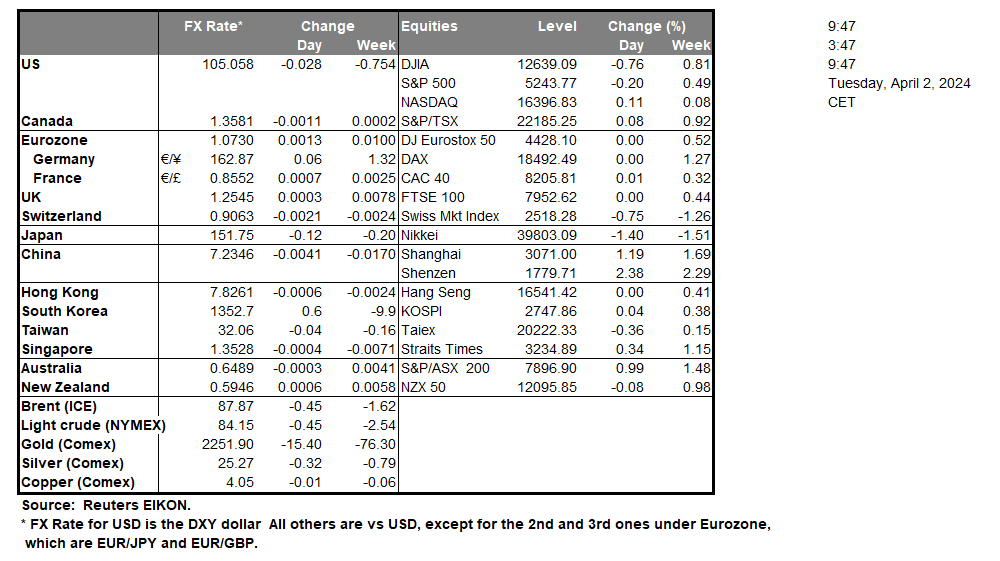

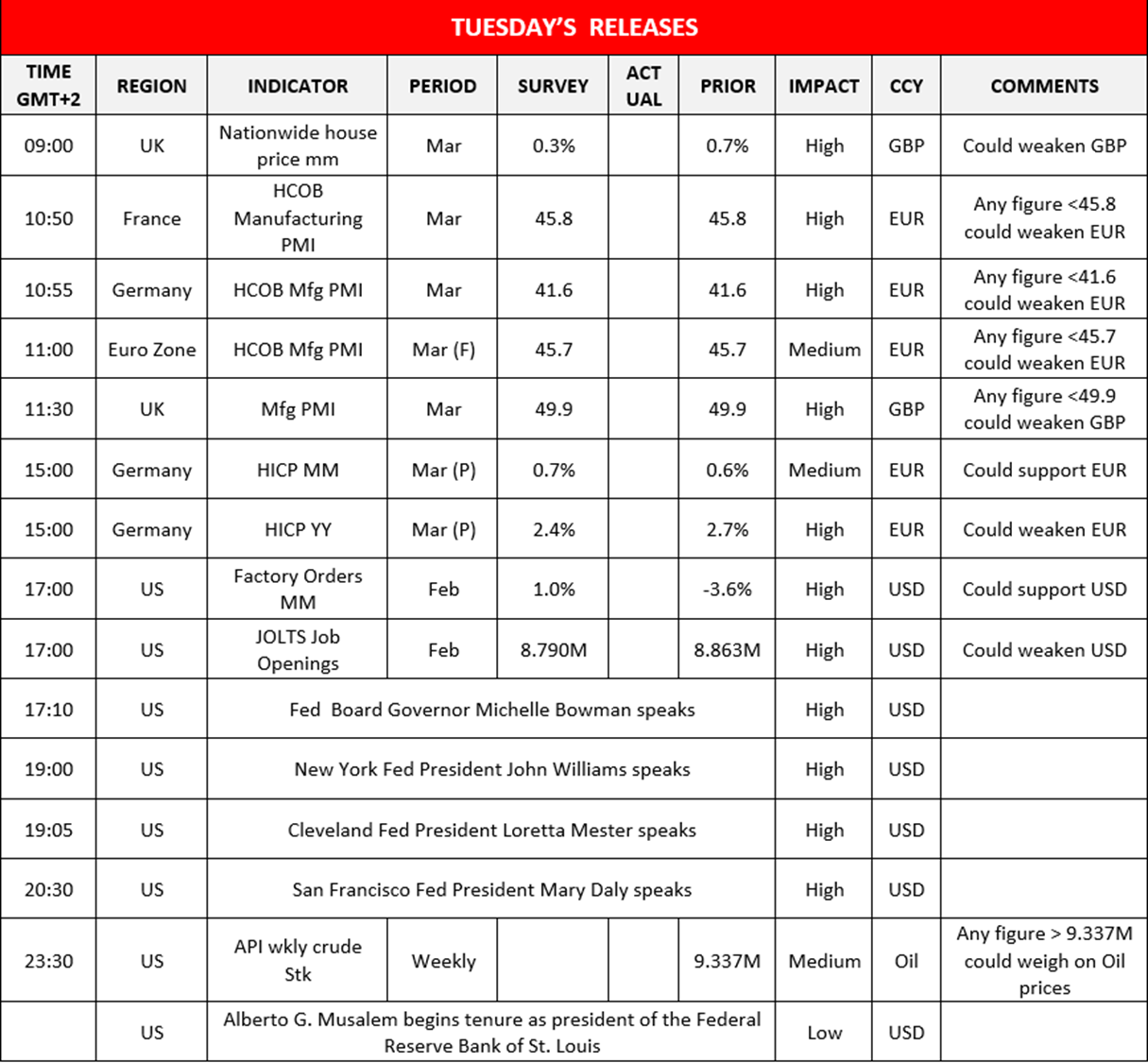

The USD tended to gain against its counterparts yesterday, as a better-than-expected reading for the ISM manufacturing PMI figure for March was released. The release implied an expansion of economic activity for the US manufacturing sector, the first since October 2022. On the monetary front we may see Fed policymakers pushing back against market expectations for the bank to proceed with rate cuts from June onwards which may also provide some support for the greenback. To that end we note Cleveland Fed President Mester, a well-known hawk among Fed policymakers and we would not be surprised to see San Francisco Fed President Daly making similar remarks. It’s notable that despite USD’s ascent, gold’s price also tended to maintain breaking the classic negative corelation of the two trading instruments . Today we note the release of the JOLTS Job openings for February, and we also highlight the release of the US factory orders growth rate for the same month.

Across the Atlantic, we highlight for EUR traders the release of Germany’s preliminary HICP rate for March and should the rate slow down as expected we may see the common currency slipping as the release could intensify market expectations for the ECB to start cutting rates earlier than the rest of the central banks. It should be noted that France’s sister indicator for the same month slowed down more than expected. Across the Channel we note that UK’s nationwide house prices for March contracted unexpectedly on a month-on-month basis, yet pound traders did not seem to be disappointed for the time being. Nevertheless, we also highlight the release of UK’s final manufacturing PMI figure for March later in today’s European session.

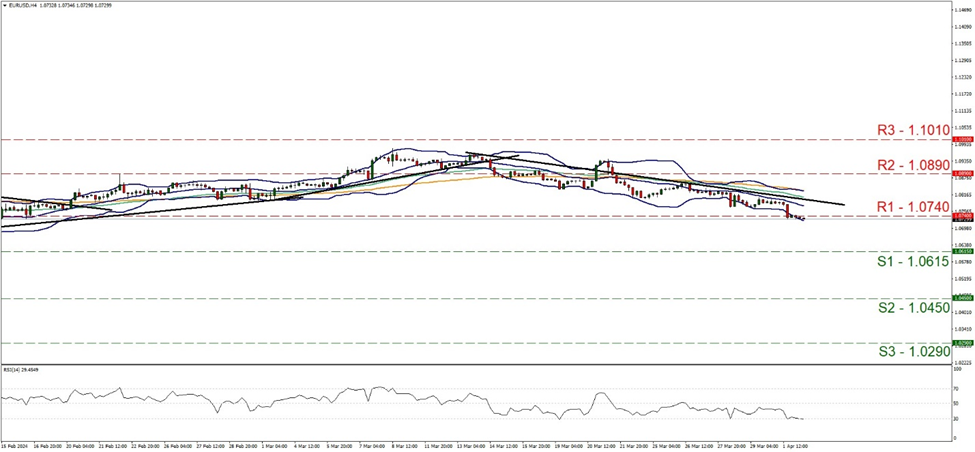

EUR/USD edged lower yesterday, breaking the 1.0740 (R1) support line, now turned to resistance. We tend to maintain a bearish outlook for the pair given that the downward trendline guiding the pair remains intact and the RSI indicator remains near the reading of 30, implying a strong bearish sentiment in the market for the pair. On the other hand, the RSI indicator may also imply that the pair is in oversold territory and ripe for a correction higher. Should the bears maintain control over the pair we may see it aiming if not reaching the 1.0615 (S1) support line. Should the bulls take over ,we may see the pair breaking the 1.0740 (R1) resistance line, breaking also the prementioned downward trendline in a first signal that the downward motion has been interrupted, and breach the 1.0890 (R2) resistance base.

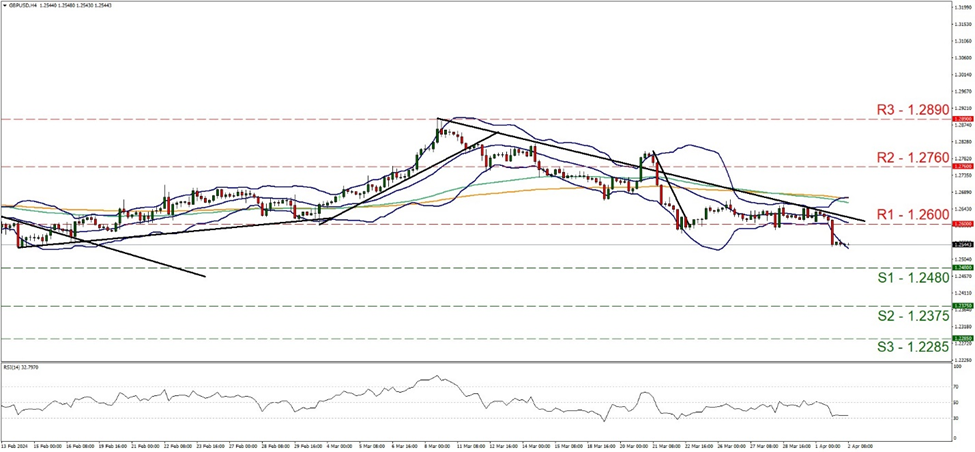

GBP/USD fell yesterday, breaking the 1.2600 (R1) support line, now turned to resistance. We tend to maintain a bearish outlook for the pair given that the downward trendline guiding the pair remains intact and the RSI indicator remains near the reading of 30, implying a strong bearish sentiment in the market for the pair. Should the selling interest be maintained, we may see cable breaking the 1.2480 (S1) line aiming for the 1.2375 (S2) support base . Should buyers take over ,we may see GBP/USD breaking the 1.2600 (R1) resistance line, breaking also the prementioned downward trendline in a first signal that the downward motion has been interrupted, and take aim of the 1.2760 (R2) resistance hurdle.

その他の注目材料

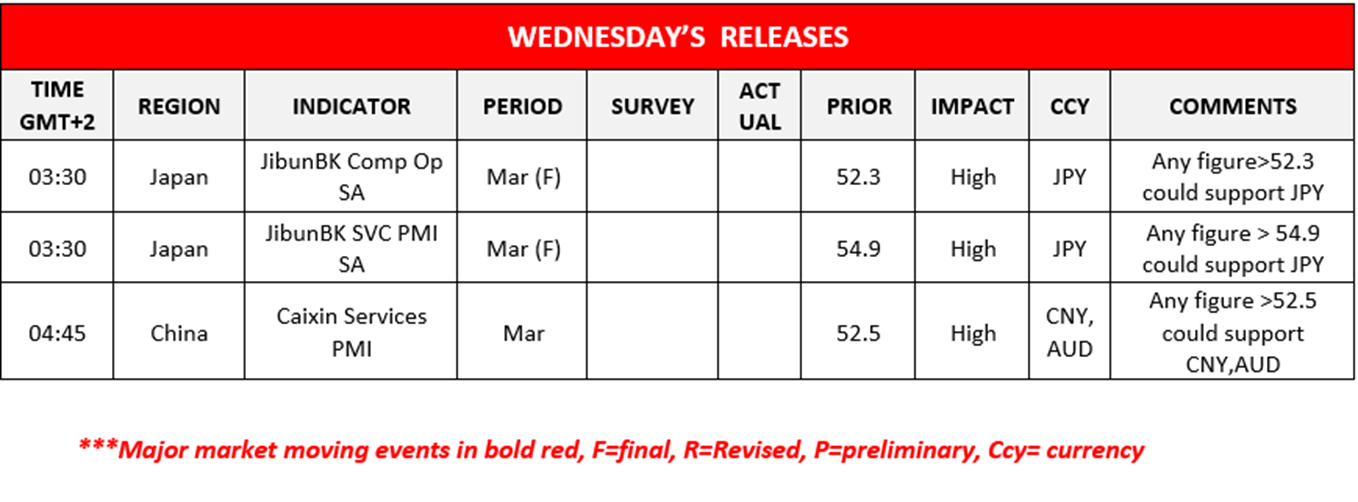

Today we note France’s, Germany’s and the Eurozone’s manufacturing PMI all for March. Oil traders on the other hand may be more interested in the release of the US API weekly crude oil inventories figure. In tomorrow’s Asian session we note Japan’s Jibunk Final services and composite PMI figures for March, followed by China’s Caixin Services PMI figure also for March. On a monetary level, we note the speeches by Fed Board Governor Bowman, New York Fed President Williams, Cleveland Fed President Mester, and San Francisco Fed President Daly. On another note, we highlight that Alberto G. Musalem begins his tenure as St. Louis Fed President.

EUR/USD 4時間チャート

Support: 1.0615 (S1), 1.0450 (S2), 1.0290 (S3)

Resistance: 1.0740 (R1), 1.0890 (R2), 1.1010 (R3)

GBP/USD 4時間チャート

Support: 1.2480 (S1), 1.2375 (S2), 1.2285 (S3)

Resistance: 1.2600 (R1), 1.2760 (R2), 1.2890 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。