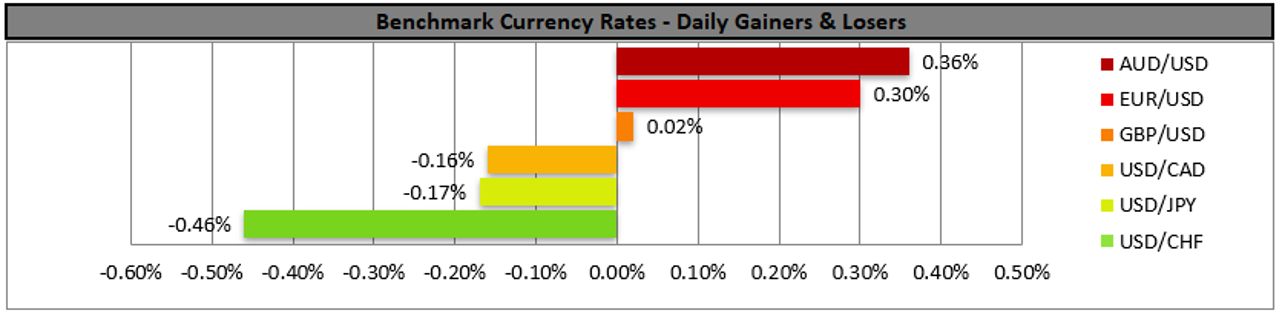

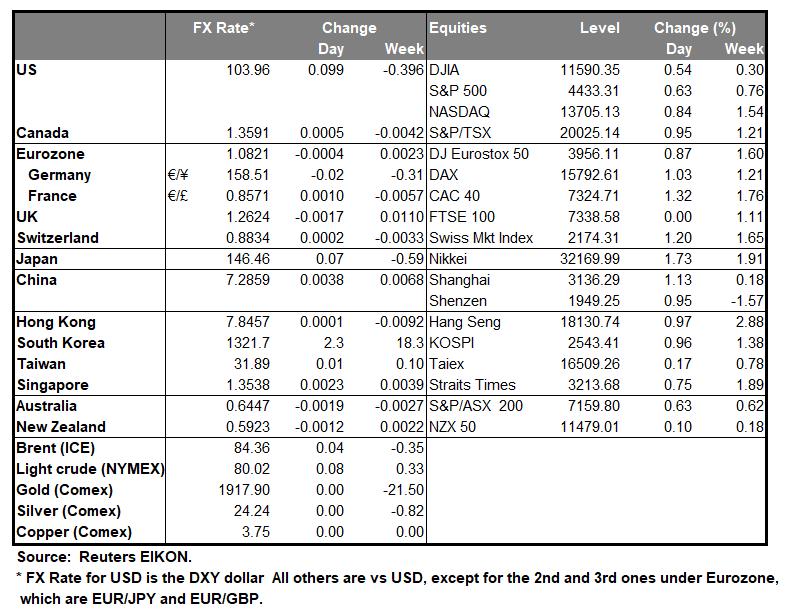

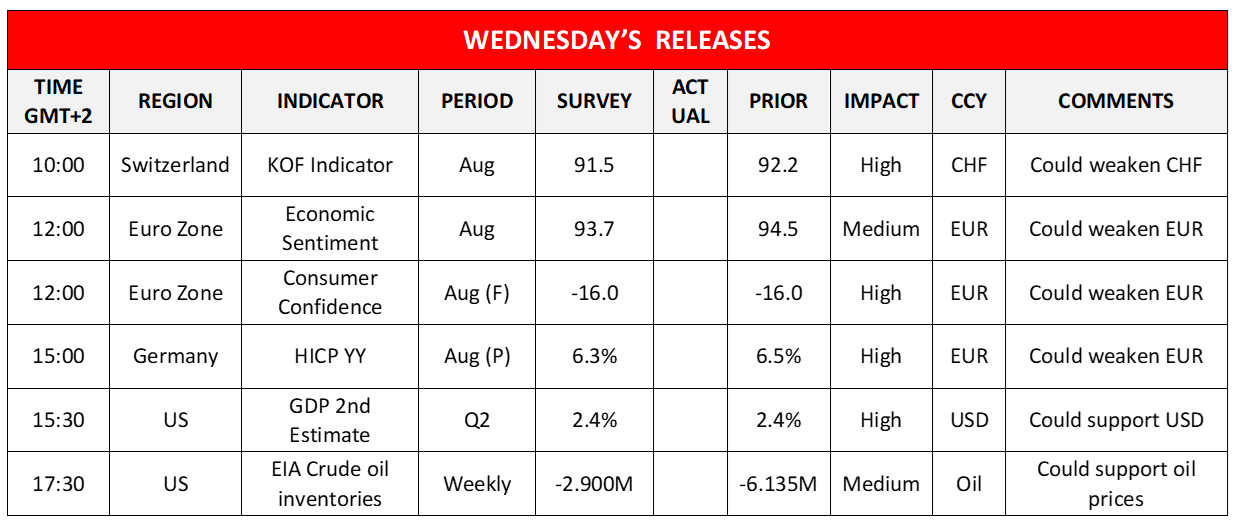

The USD lost ground against its counterparts yesterday as the release of the consumer confidence for August and the JOLTS job openings for July tended to disappoint traders, as both dropped more than expected. Especially the drop of the JOLTS job openings figure tended to predispose traders for the possibility of a weaker-than-expected employment market to be reported by the US employment report for August on Friday. Today we highlight the release of the US GDP rate revised for Q2 and should the rate show a faster growing US economy we may see the greenback getting some support. On the other hand, US stock markets tended to get a boost from the releases as the market’s expectations for the Fed’s hawkishness to ease intensified and we may see US equities markets continuing to gain should the market sentiment improve further. Gold as was expected maintained its negative correlation with the USD and gained and we expect the upward motion of the precious metal to be maintained as long as the USD continues to lose ground.

Back in the FX market we also note the release of Germany’s preliminary HICP rate for August, which is expected to slow down. Should the rate slow down we may see the market’s expectations for the hawkish stance of Germany’s Bundes Bank to soften and in turn increase possibilities for the ECB to remain on hold in its September meeting. Thus, should the rate slow down as expected or even more we may see the EUR losing some ground and vice versa.

On a technical level we note that the common currency rose against the USD breaking the 1.0835 (R1) resistance line, now turned to support. Given that the pair was also able to break the downward trendline guiding it since the 10 of August, signaling an interruption of the downward movement and the RSI indicator was able to rise above the reading of 50, we switch our bearish outlook, initially in favour of a sideways movement bias. Should bulls take over, we may see EUR/USD breaking the 1.0920 (R1) resistance line and aim for the 1.1020 (R2) level, starting to form an upward trendline. Should the bears be in charge, we may see EUR/USD breaking the 1.0835 (S1) support line and aim for the 1.0735 (S2) support level.

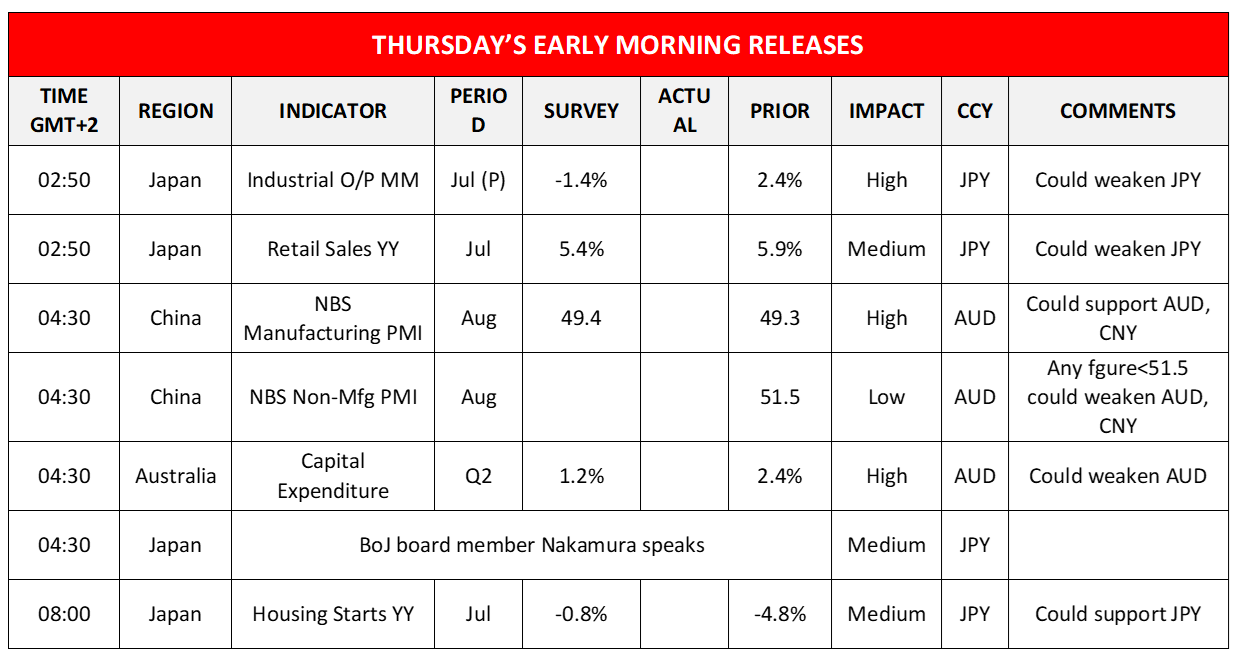

Aussie traders after the release of the worse-than-expected building approvals growth rate are expected to focus on the CapEx growth rate for Q2. Yet it may be China’s NBS manufacturing PMI figure that will be stealing the show during tomorrow’s Asian session and should the figure show another contraction of economic activity in the Chinese manufacturing sector we may see the market’s worries for a possible global economic slowdown intensifying and thus the market sentiment turning more cautious and weighing on riskier assets such as commodity currency AUD and equities.

AUD/USD rose further yesterday testing the 0.6490 (R1) resistance level for a second time since the past week, forcing us to recalibrate our first resistance line lower. Yet given the pair’s inability to break the R1 we tend to maintain our bias for the sideways motion of the pair to continue, yet also note that the RSI indicator has risen above the reading of 50, implying a slightly bullish sentiment in the market for the pair. For a bullish outlook though we would require a clear break of the 0.6490 (R1) resistance line and for the pair to start aiming for the 0.6620 (R2) resistance base. Should sellers be in charge of the pair’s direction, we may see AUD/USD diving below the 0.6400 (S1) support line and aiming for the 0.6285 (S2) support barrier.

その他の注目材料

Today, we note the release of Switzerland’s KOF indicator and Eurozone’s economic sentiment both for August and later the from the US the EIA crude oil inventories figure. During tomorrow’s Asian session, we note the release from Japan of the preliminary industrial output, retail sales and housing starts growth rates for July, while BoJ board member Nakamura speaks.

EUR/USD 4時間チャート

Support: 1.0835 (S1), 1.0735 (S2), 1.0635 (S3)

Resistance: 1.0920 (R1), 1.1020 (R2), 1.1145 (R3)

AUD/USD 4時間チャート

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6490 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。