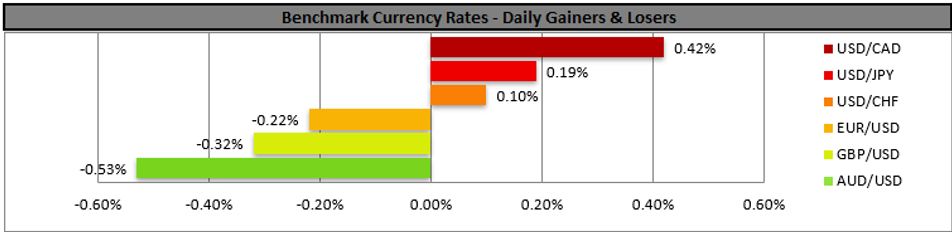

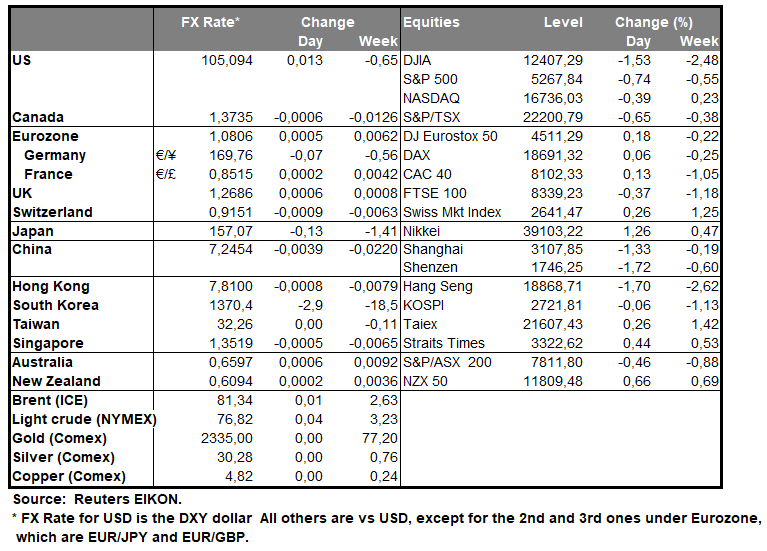

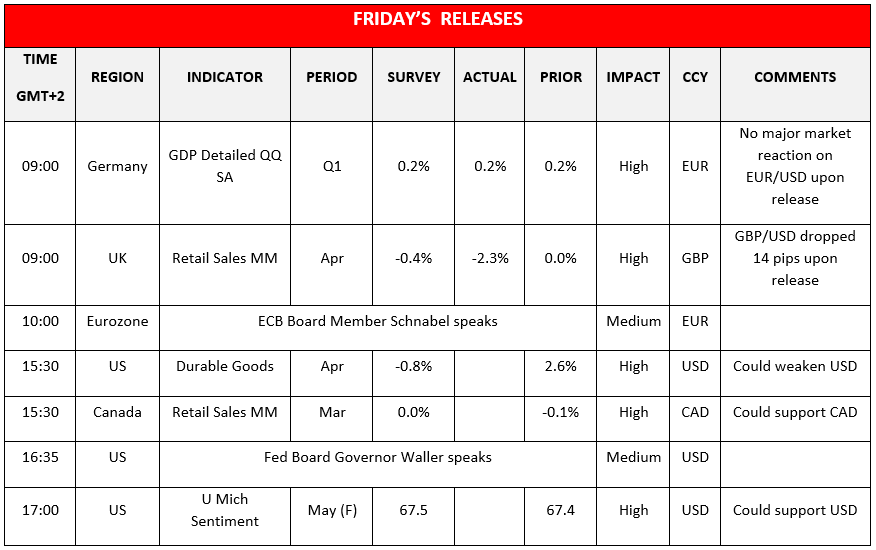

The USD edged higher against its counterparts yesterday as unexpectedly strong financial data tended to provide support for the greenback. It should be noted that the weekly initial jobless claims figure dropped beyond expectations reaching 215k in a signal of a relative tightness of the US employment market.

Furthermore, the S&P PMI figures for May, scored higher than expected readings both for the manufacturing and services sectors in a sign that economic activity expands at a faster pace than expected across sectors in the US economy. Both releases tended to brighten the economic outlook of the US yet at the same time may have stoked worries among market participants for the possibility of the Fed maintaining rates high for longer.

North of the US border, Loonie traders are expected to keep a close eye over the release of Canada’s retail sales growth rate for March. Should the rates escape the negative territory and show growth once again implying that the average Canadian consumer is willing and able to actually spend more in the Canadian economy we may see the CAD getting some support.

On a technical level USD/CAD rose yesterday aiming for the 1.3755 (R1) resistance line. We note that the RSI indicator is slowly being on the rise above the reading of 50 implying a possible build up of a bullish sentiment for the pair among market participants for the pair. Yet for the time being we tend to maintain our bias for the sideways motion between the 1.3755 (R1) resistance line and the 1.3610 (S1) support line.

For a bullish outlook we would require USD/CAD to break clearly the 1.3755 (R1) resistance line and start actively aiming for the 1.3895 (R2) resistance level. Should the bears take over, we may see the pair reversing direction and breaking the 1.3610 (S1) support line, thus paving the way for the 1.3460 (S2) support base.

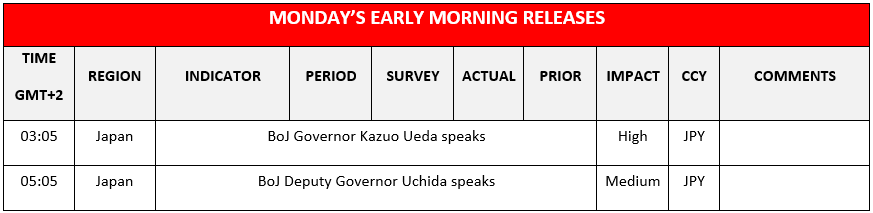

In the land of the rising sun, the CPI rates slowed down for April, in another indication that inflation is cooling. The release may hinder the way towards a normalisation of BoJ’s monetary policy and thus could weigh on JPY. On the other hand, we have to note that the JPY is allready at low levels and the weaker the Yen gets the more the probability for a market intervention to JPY’s rescue rises. Hence we highlight the planned speech of BoJ Governor Ueda and BoJ Deputy Governor Uchida speak during Monday’s Asian session as they may intervene in the markets verbally and try to provide some support for JPY.

Last but not least we note the contraction of the UK retail sales for April, a release that weighed on the pound as it highlighted how the cost of living crisis in the UK is affecting consumption. Furthermore, we also note the announcement of General elections for July 4 , in another factor of uncertainty which could weigh on the pound on a fundamental basis, given also that the polls predict a change in Government as the Labour Party is leading by a wide margin currently.

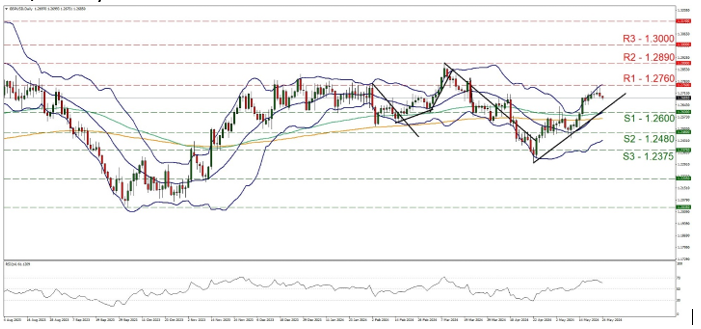

Cable continued its drop yesterday after hitting a ceiling at the 1.2760 (R1) resistance line on Wednesday. For the time being, we view the drop as a correction given also that the upward trendline guiding GBP/USD remains intact and hence we maintain our bullish outlook. For a bearish outlook to emerge we would require the pair to break the prementioned upward trendline in a first signal that the upward movement has been interrupted and continue lower to break clearly the 1.2600 (S1) support line thus opening the gates for the 1.2480 (S2) support base.

On the contrary, should the bulls maintain control as expected, we may see the pair breaking the 1.2760 (R1) resistance line clearly and take aim of the 1.2890 (R2) resistance barrier, that is also the highest level reached by the pair on our chart.

本日のその他の注目点

Today we get Germany’s detailed GDP rate for Q1 and ECB board member Schnabel speaks. Later, we get US the Durable goods orders for April and the final UOM consumer sentiment for May and we note Fed board governor Waller’s speech.

USD/CAD Daily Chart

- Support: 1.3610 (S1), 1.3460 (S2), 1.3335 (S3)

- Resistance: 1.3755 (R1), 1.3895 (R2), 1.4050 (R3)

GBP/USD Daily Chart

- Support: 1.2600 (S1), 1.2480 (S2), 1.2375 (S3)

- Resistance: 1.2760 (R1), 1.2890 (R2), 1.3000 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。