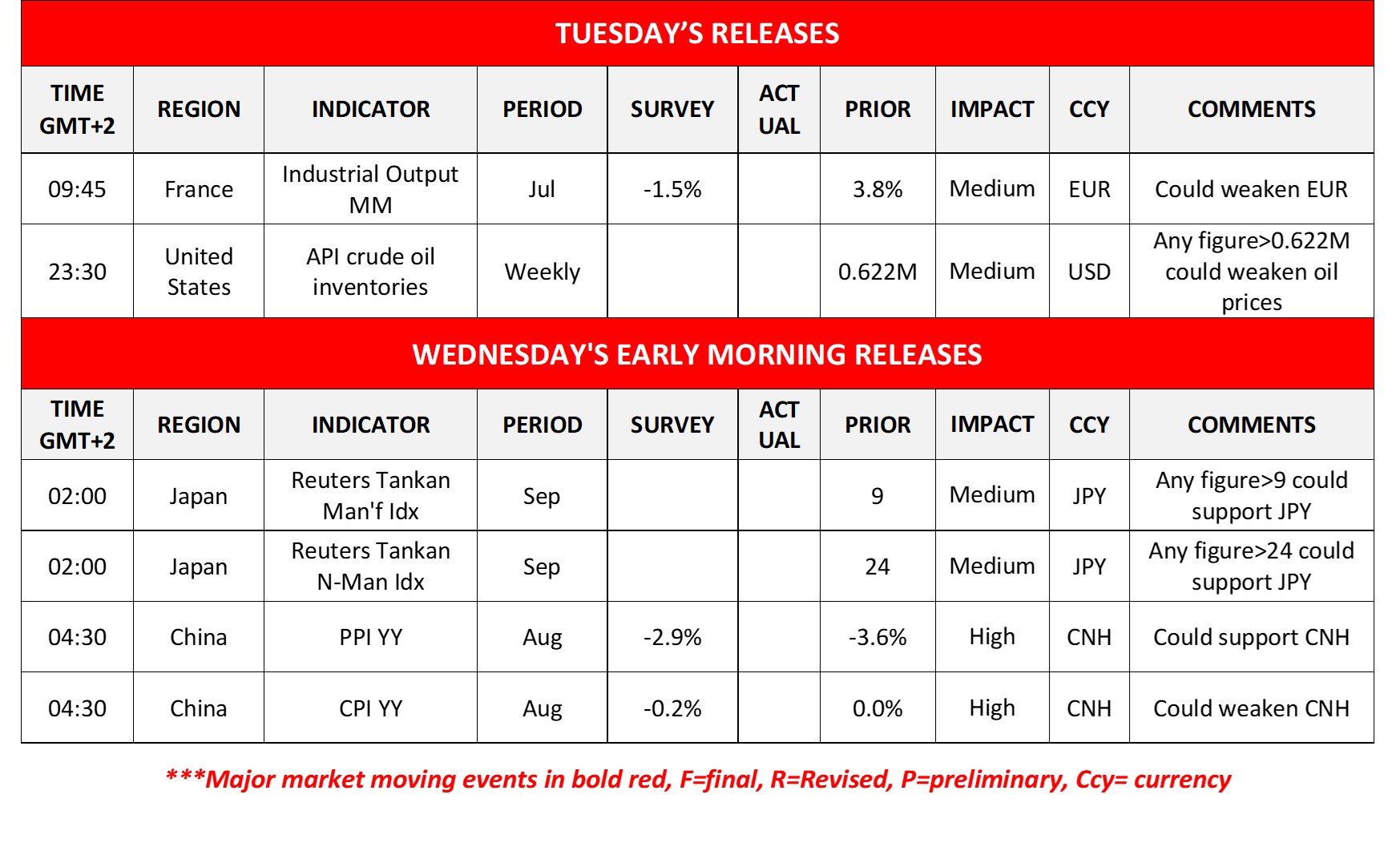

The French Government has collapsed following a no confidence vote, with a total of 364 MPs voting against Bayrou whilst 194 voted in favour of the Government. The vote of confidence was spurred after the now Former Prime Minister announced plans to push through an unpopular 44 billion euro savings plan which included removing two public holidays and freezing government spending. In turn the collapse of the Government sends France into political turmoil and should it continue it could weigh on the French Equities market.The US API weekly crude oil inventories figure is set to be released today. As a reminder OPEC+ has agreed to boost oil production following their meetings on Sunday. Yet in spite of the increase in output, oil prices yesterday tended to gain following reports that the output was being interpreted as modest in nature. Therefore, should the API weekly crude oil inventories figure showcase a drawdown in US oil inventories, it may imply that demand has exceeded supply in the past week and could in turn further aid oil prices. Whereas should it showcase once again an increase in oil inventories it may have the opposite effect and could thus weigh on oil prices.In Norway, the center-left parties have retained power after parliamentary elections. Hence the continuation of Government in Norway may be perceived as a positive for the Norwegian krone and could thus provide support for the country’s currency.In the US Equities markets participants may be eager for Apple’s (#AAPL) event today, where they are expected to deput their new iPhones, with Reuter’s reporting that the biggest highlight of the year could be the unveiling of the “iPhone Air”, a phone said to be slimmer than what Apple has previously sold. Nonetheless, should the event fail to excite investors it could possibly weigh on the company’s stock price and vice versa.

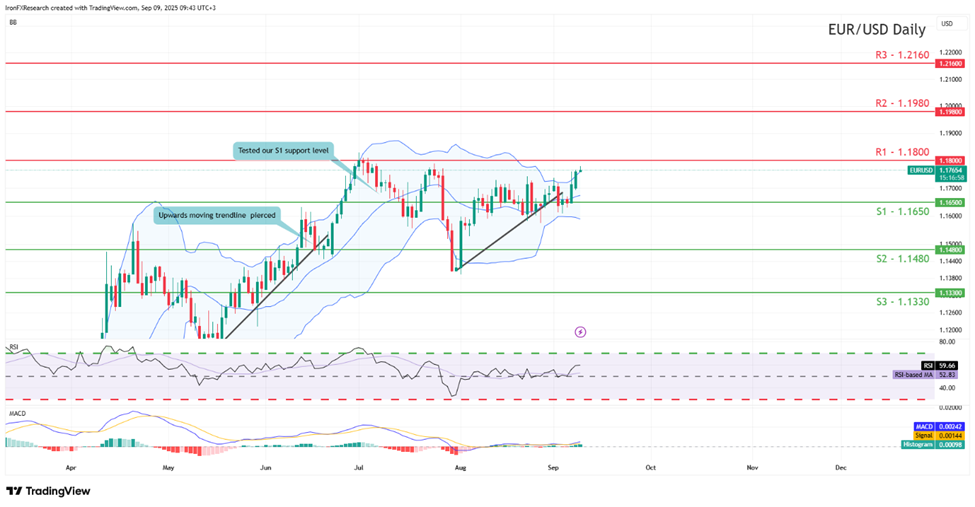

EUR/USD appears to be moving in an upwards fashion after resurfacing above our 1.1650 (S1) support level. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator, which is currently near 60, which tends to imply a slight bullish market sentiment. For our bullish outlook to continue, we would require a clear break above our 1.1800 (R1) resistance level, with the next possible target for the bulls being the 1.1980 (R2) resistance line. On the other hand, for a sideways bias we would require the pair to remain confined between the 1.1650 (S1) support level and the 1.1800 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below our 1.1650 (S1) support line with the next possible target for the bears being the 1.1480 (S2) support level.

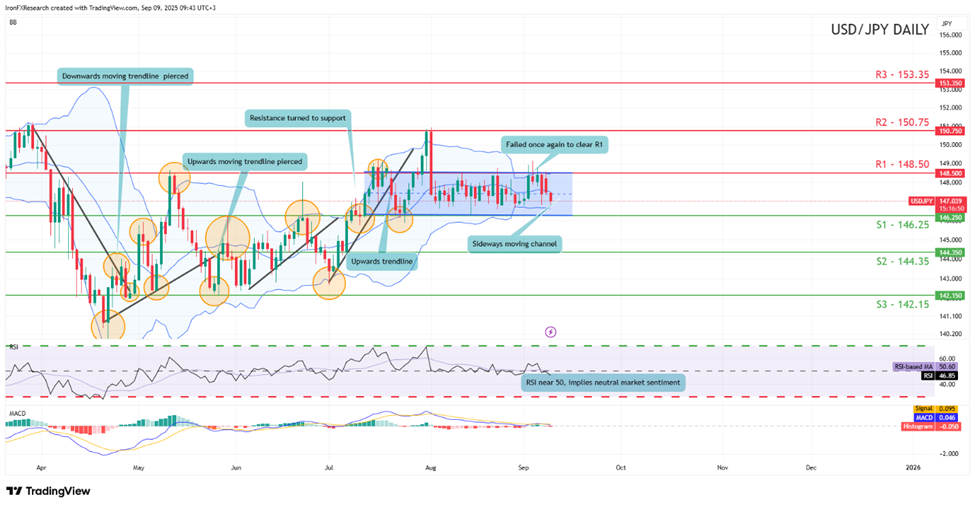

USD/JPY appears to be moving in a sideways fashion, after failing on numerous occasions to clear our 148.50 (R1) resistance line. We opt for a sideways bias for the pair, and supporting our case is the RSI indicator below our chart, which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would require the pair to remain confined between our 146.25 (S1) and our 148.50 (R1) resistance line. On the other hand, for a bearish outlook we would require a clear break below our 146.25 (S1) support level with the next possible target for the bears being the 144.35 (S2) support line. Lastly, for a bullish outlook we would a clear break above the 148.50 (R1) resistance level with the next possible target for the bulls being the 150.75 (R2) resistance line.

その他の注目材料

Today we get France’s industrial output for July, while oil traders may be more interested in the release of the US API weekly crude oil inventories figure. In tomorrow’s Asian session, we get Japan’s Reuter’s Tankan indexes for September, and China’s inflation metrics for August.

EUR/USD Daily Chart

- Support: 1.1650 (S1), 1.1480 (S2), 1.3330 (S3)

- Resistance: 1.1800 (R1), 1.1980 (R2), 1.2160 (R3)

USD/JPY Daily Chart

- Support: 146.25 (S1), 144.35 (S2), 142.15 (S3)

- Resistance: 148.50 (R1), 150.75 (R2), 153.35 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。