The USD strengthened yesterday despite a slowing of the Core PCE Price index for October. Today we highlight the release of the ISM manufacturing PMI figure for November and the indicator’s reading is expected to improve yet remain below the reading of 50, implying another contraction of economic activity for the sector. On the monetary front, we highlight the speech of Fed Chairman Powell and should he maintain a hawkish rhetoric we may see the USD gaining some ground. Yet the above releases could also have an impact on US stock markets which closed the day rather mixed, yet, notably Dow Jones rallied while S&P 500 edged higher and Nasdaq was slightly in the reds. Overall US stock markets seemed to maintain a wait-and-see position, practically capitalising on November’s gains.

North of the US border we highlight the Loonie’s strengthening despite Canada’s GDP rate for Q3 dropping deeper into the negatives and oil prices dropping. Attention of CAD traders today is expected to be placed on November’s employment data and forecasts are for the employment change figure to drop slightly and the unemployment rate to tick up. Should the actual rates and figures meet their respective forecasts, we may see the CAD slipping, yet the Canadian employment market with the forecasted figures, still tends to maintain a relative tightness which may soften the blow.

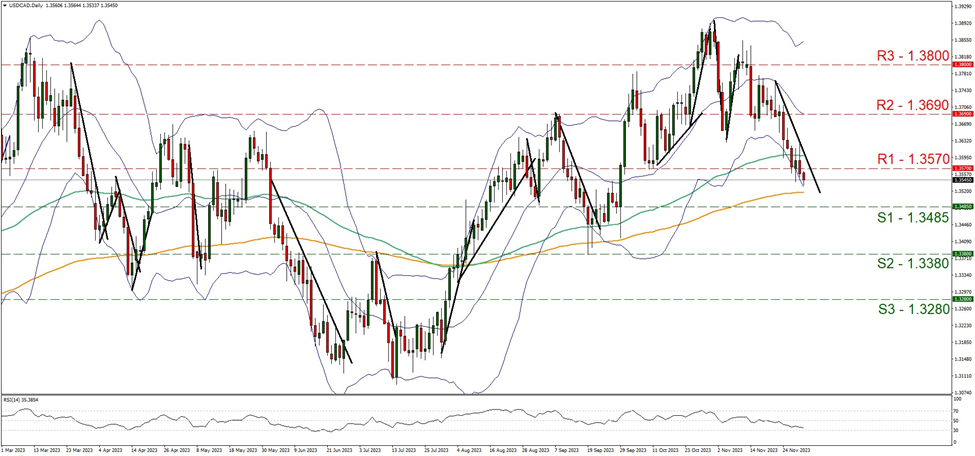

USD/CAD continued to edge lower yesterday, breaking decisively the 1.3570 (R1) support line, now turned to resistance. Given that the downward trendline guiding the pair remains intact and the RSI indicator below our daily chart nears the reading of 30, implying that the bearish sentiment of the market becomes stronger, we maintain our bearish outlook for USD/CAD. Should the bears actually maintain control over the pair as expected, we may see USD/CAD aiming if not breaking the 1.3485 (S1) support line. Should on the other hand the bulls find a chance and reverse the downward price action, we may see USD/CAD breaching the prementioned downward trendline in a first signal that the downward movement has been interrupted, break the 1.3570 (S1) support level and aim for the 1.3690 (R2) resistance base.

Across the Atlantic we note that the common currency tended to weaken against the USD, as the Eurozone’s preliminary HICP rate for November slowed down beyond the market’s expectations, setting in its sites ECB’s 2% yoy target. At the same time, France’s final GDP rate for Q3 unexpectedly contracted, signaling recessionary worries for the area as a whole. Overall, yesterday’s releases tended to add pressure for an earlier rate cut on the ECB, with the market now pricing in such a scenario to happen as early as March next year. We expect the EUR to experience some downward pressure on a fundamental level, yet ECB policymakers should be kept under close watch as they can swing the market’s mood.

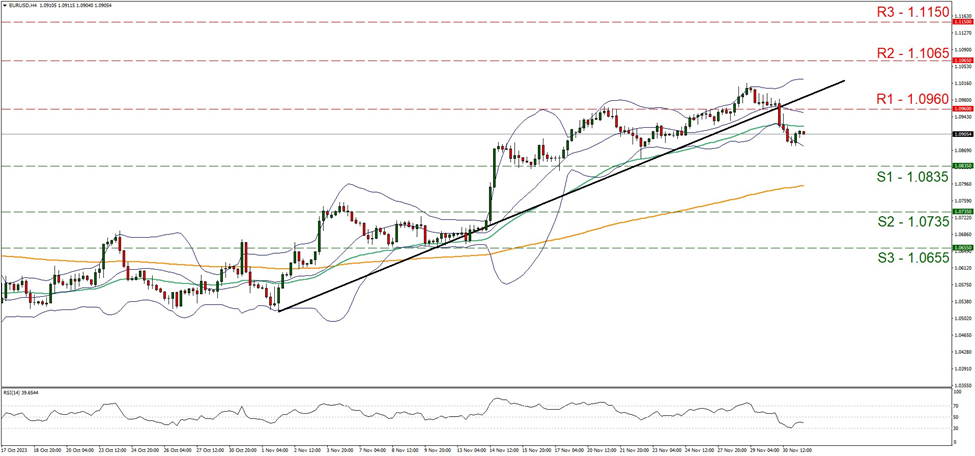

EUR/USD continued to move lower and shows some signs of stabilisation between the 1.0960 (R1) resistance line and the 1.0835 (S1) support level. Hence we would tend to switch our outlook in favour of a sideways movement bias. Yet the RSI indicator remains below the reading of 50 implying a residue of a bearish sentiment in the market for the pair. Should the selling interest be renewed we may see EUR/USD breaking the 1.0835 (S1) support level, and aiming for the 1.0735 (S2) support level. Such a scenario would also allow us with greater confidence to draw a downward trendline showing us the limitation of the downward movement. Should the pair find extensive buying orders along its path allowing for the bulls to take over, we expect EUR/USD to break the 1.0960 (R1) resistance line and aim for the 1.1065 (R2) resistance level.

その他の注目材料

Today we note the release of UK’s Nationwide house prices for November, Switzerland’s and the Czech Republic’s GDP rates for Q3, Canada’s employment data for November and the US ISM manufacturing PMI figure for the same month.

EUR/USD 4 Hour Chart

Support: 1.0835 (S1), 1.0735 (S2), 1.0655 (S3)

Resistance: 1.0960 (R1), 1.1065 (R2), 1.1150 (R3)

USD/CAD Daily Chart

Support: 1.3465 (S1), 1.3380 (S2), 1.3260 (S3)

Resistance: 1.3570 (R1), 1.3690 (R2), 1.3800 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。