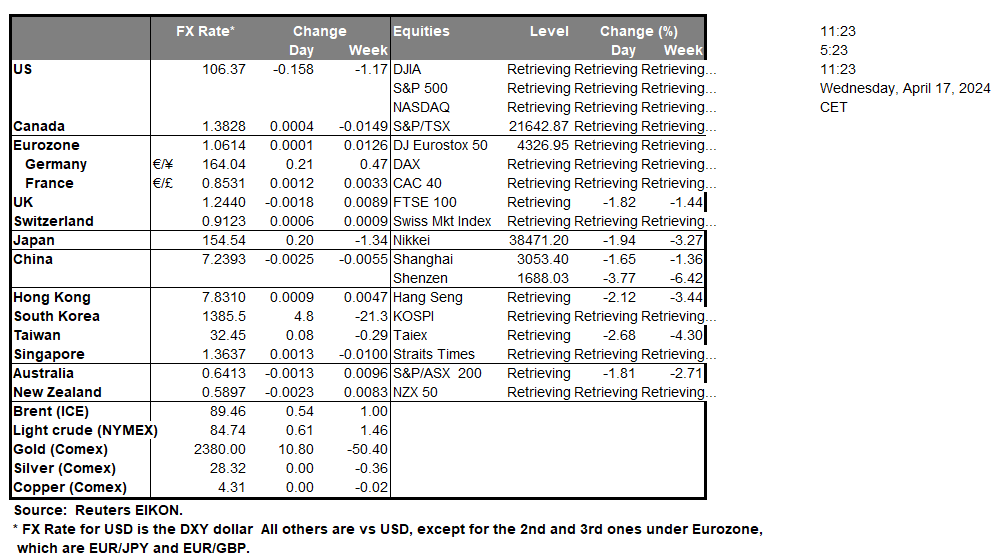

Over in the US, Fed Chair Powell stated yesterday, that “the recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence”. The comments may imply that the recent financial releases which appear to imply that inflation appears to be sticky in nature, which could lead to the Fed maintaining its restrictive monetary policy for a longer time period. Therefore, Fed Chair Powell’s comments appear to have been predominantly hawkish in nature, as FFF currently implies only one rate cut is set to occur this year, down from the expectation of six at the beginning of the year. The current reposition of market expectations may have aided the dollar in anticipation of a continuation of the Fed’s restrictive monetary policy.Over in Europe, ECB President Lagarde stated during a CNBC segment yesterday, that “if we don’t have a major shock in development, we are heading towards a moment where we have to moderate the restrictive monetary policy”, implying that the bank may be preparing to cut interest rates. As such, ECB President Lagarde’s may have been perceived as dovish in nature, which could weigh on the common currency.Tensions remain elevated in the Middle East, as anticipation as to how Israel will respond to Iran’s aerial assaults remains uncertain. Should, tensions escalate even further, it could support oil prices and vice versa.

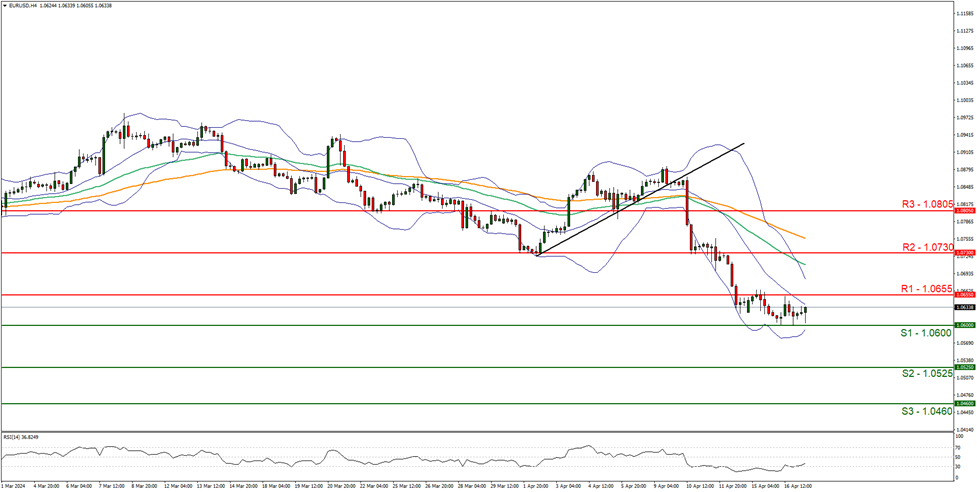

On a technical level EUR/USD appears to be moving in a downwards fashion, with the pair bouncing off the 1.0600 (S1) psychological support level. We maintain a bearish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 30, implying a bearish market sentiment, in addition to the Bollinger bands appearing to be tilted to the downside, implying bearish market tendencies. For our bearish outlook to continue, we would require a clear break below the 1.0600 (S1) support level, with the next possible target for the bears being the 1.0525 (S2) support line. On the other hand, for a sideways bias we would require the pair to remain confined between the sideways channel defined by the 1.0600 (S1) support level and the 1.0655 (R1) resistance line. Lastly, for a bullish outlook, we would require a clear break above the 1.0655 (R1) resistance line with the next potential target for the bulls being the 1.0730 (R2) resistance level.

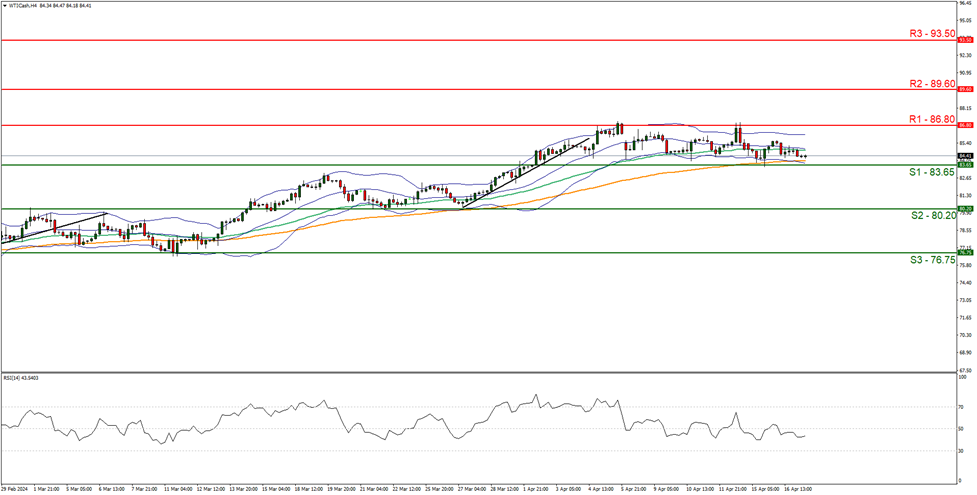

WTICash appears to be moving in a sideways fashion. We maintain a sideways bias for the commodity and supporting our case is the narrowing of the Bollinger bands which imply low market volatility. For our sideways bias to continue, we would require the commodity to remain confined between the 83.65 (S1) support level and the 86.80 (R1) resistance line. On the flip side, for a bullish outlook, we would require a clear break above the 86.80 (R1) resistance line occurs, with the next possible target for the bulls being the 89.60 (R2) resistance line. Lastly, for a bearish outlook we would require a clear break below the 83.65 (S1) support level, with the next possible target for the bears being the 80.20 (S2) support base.

その他の注目材料

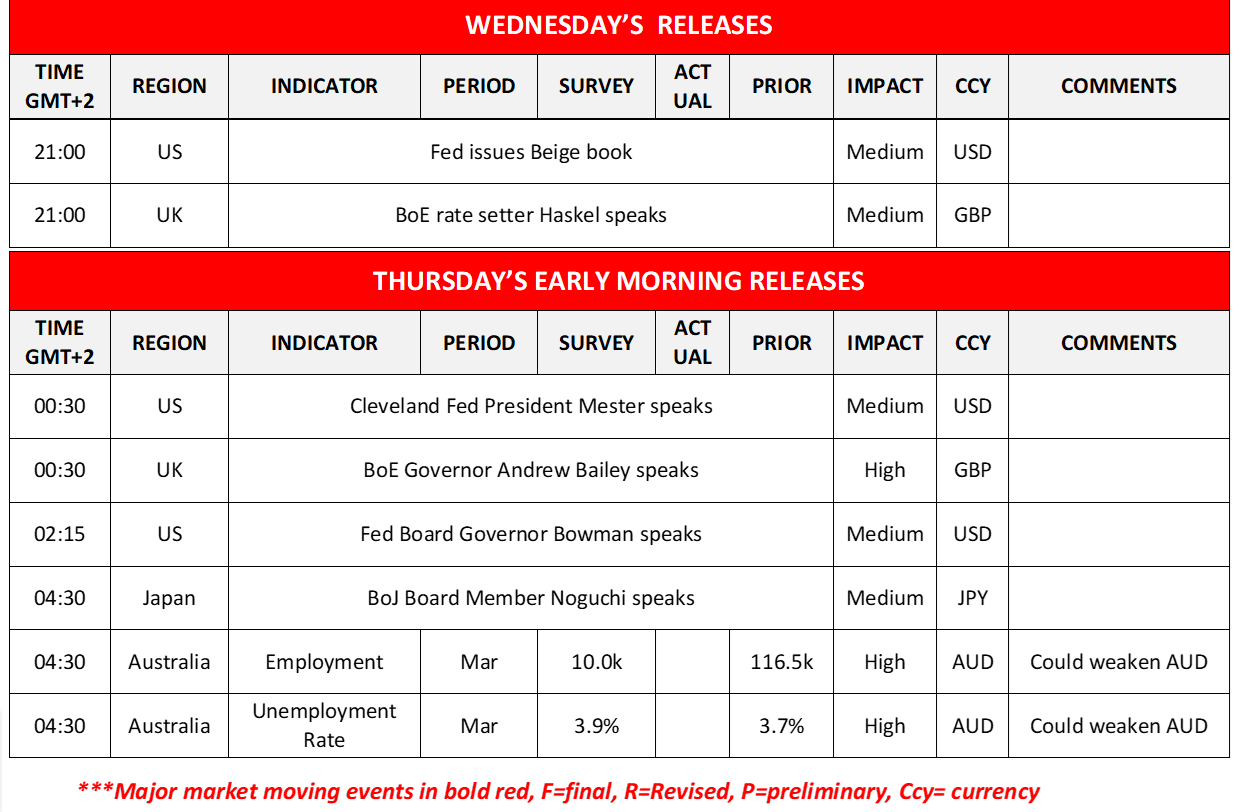

Today we note in the European session, the release of the UK CPI rates, the Czech Republic’s PPI rates and Eurozone’s final HICP rate, all being for March. Oil traders on the other hand, may be more interested in the release of the EIA crude oil inventories figure. On the monetary front, we note that BoE MPC member Greene, ECB’s Cipollone and Hernandez de Cos, BoE Governor Andrew Bailey, ECB Board Member Schnabel and BoE rate setter Haskel are scheduled to make statements, while the Fed is to release the Beige book. During tomorrow’s Asian session, we note the release of Australia’s employment data for March while Cleveland Fed President Mester, BoE Governor Andrew Bailey, Fed Board Governor Bowman and BoJ Board Member Noguchi are scheduled to speak.

EUR/USD 4時間チャート

Support: 1.0600 (S1), 1.0525 (S2), 1.0460 (S3)

Resistance: 1.0655 (R1), 1.0730 (R2), 1.0805 (R3)

WTICash 4H Chart

Support: 83.65 (S1), 80.20 (S2), 76.65 (S3)

Resistance: 86.80 (R1), 89.60 (R2), 93.50 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。