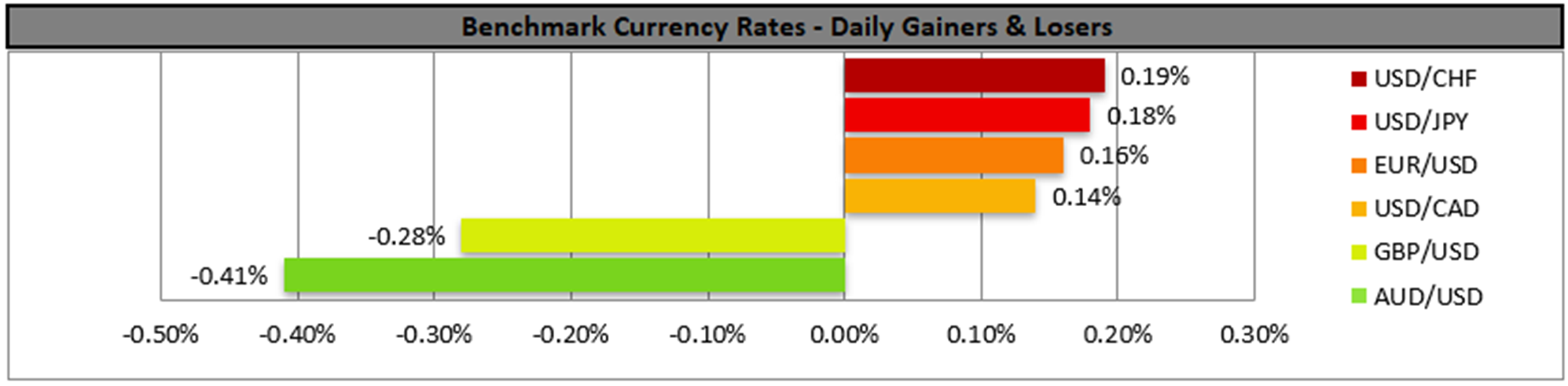

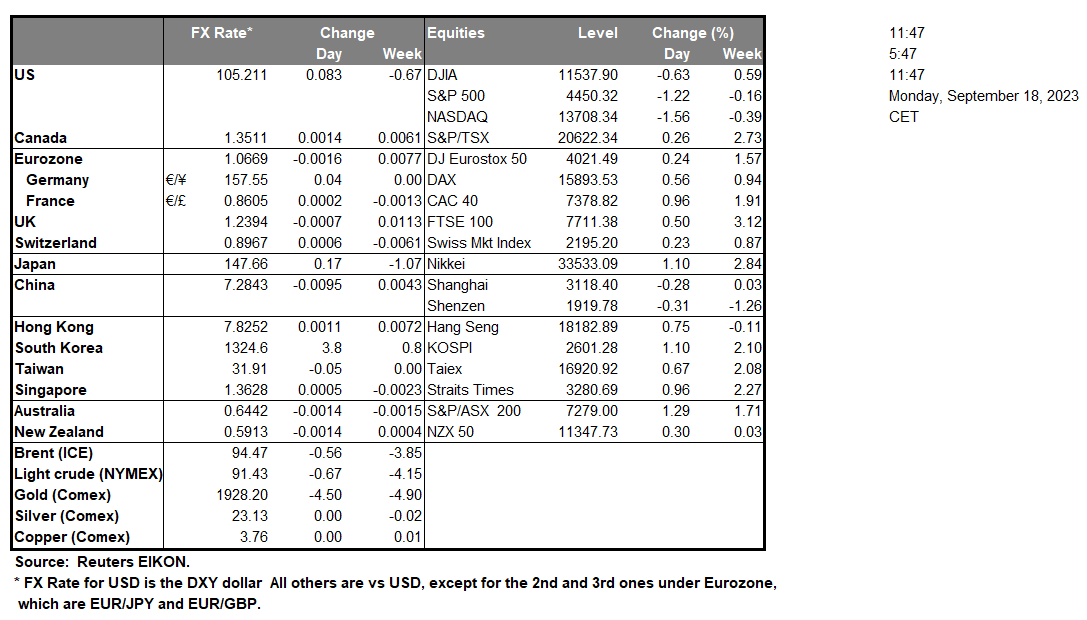

The USD despite a slight correction lower on Friday was able to close its ninth week in the greens against its counterparts. Despite the better-than-expected industrial data from the US for August, September’s consumer sentiment seems to be turning more pessimistic in the US and it tended to weigh on the USD. In the coming week, we highlight the release of the Fed’s interest rate decision, and the market has almost fully priced in the possibility of the bank remaining on hold. Yet there still are inflationary pressures in the US economy that need the bank’s attention. Should the bank signal the end of its rate hiking cycle we expect the USD to lose considerable ground, while US stock markets may rejoice.

その他の注目材料

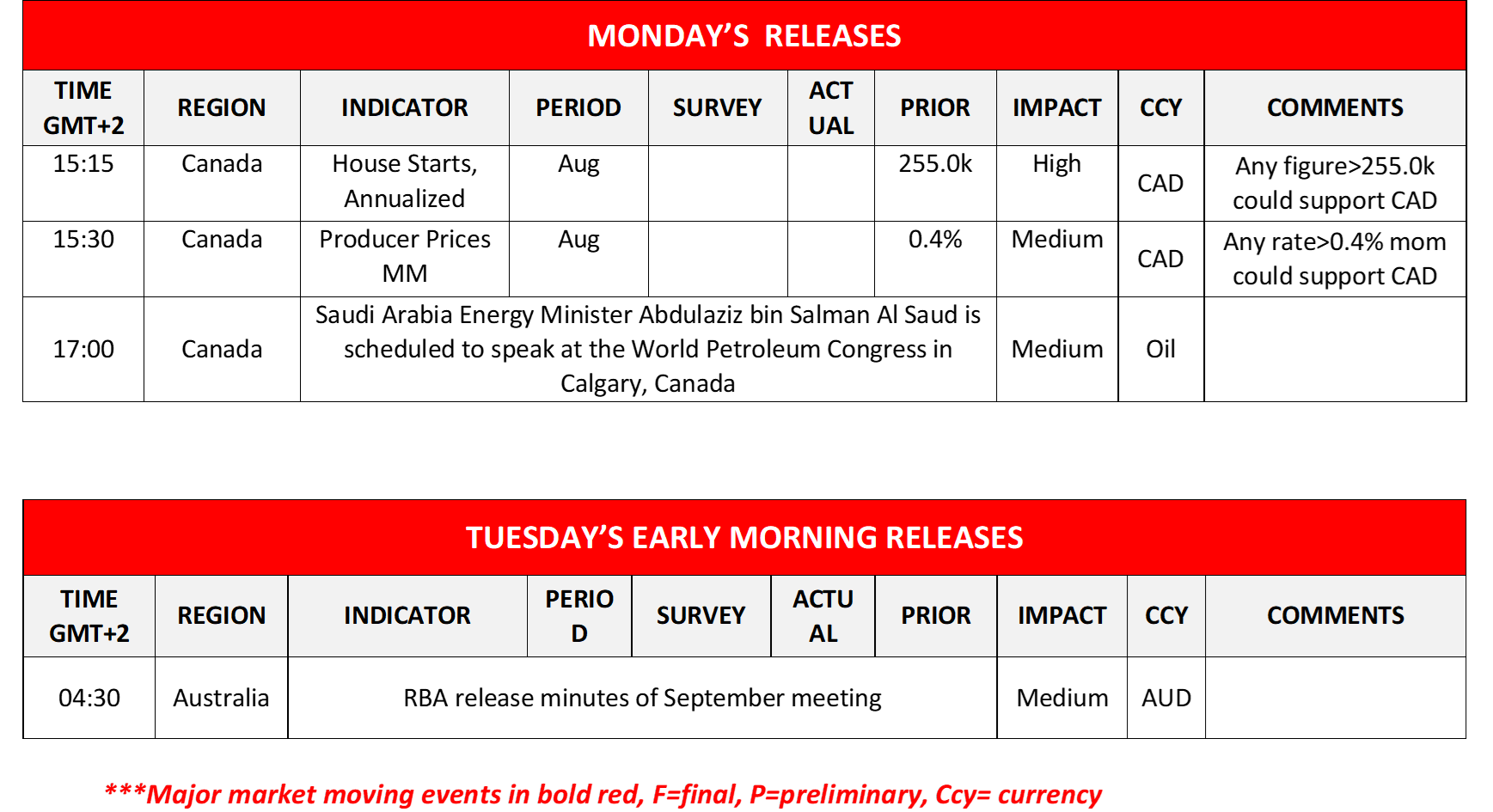

After a rather easy-going European session today we note from Canada the release of the number of House starts and the producer’s price growth rates, both being for August.

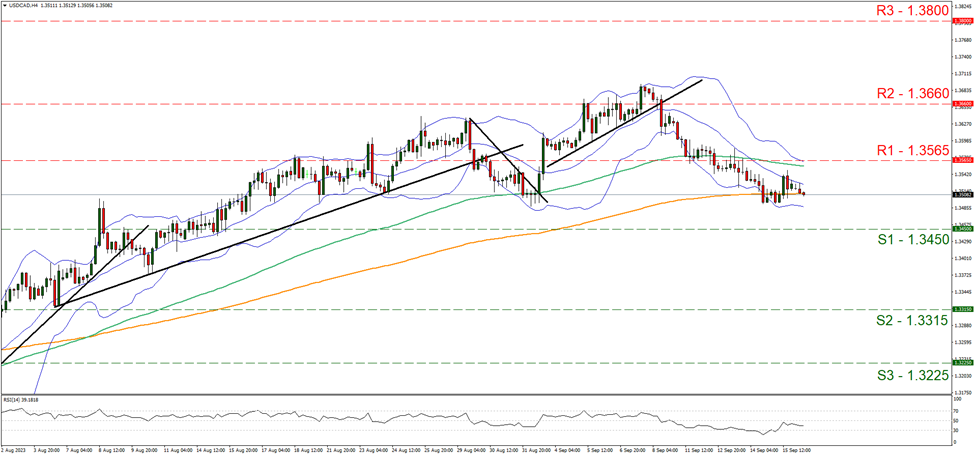

On a technical level, we note that USD/CAD edged lower on Friday, yet the overall sideways motion between the 1.3450 (S1) and the 1.3565 (R1) levels seems to be maintained, we tend to maintain our bias for the sideways motion to continue yet we would also like to point out that the RSI indicator remains below the reading of 50 which may imply some bearish tendencies for the pair. Should the bears take over, we may see it breaking the 1.3450 (S1) support line and start aiming for the 1.3315 (S2) support base. Should the bulls be in charge we may see the pair breaking the 1.3565 (R1) line and aim for the 1.3660 (R2) resistance level.

Oil traders on the other hand may be more interested in the speech of Saudi Arabia’s Energy Minister Abdulaziz bin Salman Al Saud at the World Petroleum Congress in Calgary, Canada. During tomorrow’s Asian session, we note the release from Australia of RBA’s September meeting minutes.

AUD/USD edged a bit higher during today’s Asian session, yet tended to remain firmly between the 0.6400 (S1) support line and the 0.6515 (R1) resistance level. Given the upward trendline guiding the pair we tend to maintain a bullish outlook for the pair, yet we tend to doubt that the pair will be able to mark a higher peak than the last one and note that the RSI indicator runs along the reading of 50 implying a rather indecisive market which in turn may allow the pair to stabilise. Should the bulls maintain control over the pair we may see the pair breaking the 0.6515 (R1) resistance hurdle aiming for higher grounds. Should the bears take over, we expect the pair to break clearly the prementioned upward trendline, in a first signal that the upward motion was interrupted and continue lower to break the 0.6400 (S1) support barrier clearly before it takes the 0.6285 (S2) support level into its sights.

今週の指数発表:

On Tuesday we get Eurozone’s final HICP rate and Canada’s CPI rates both for the month of August. On Wednesday we make a start with Japan’s trade data, followed the UK’s CPI data, both for the month of August while monetary-wise wise we highlight the Fed’s interest rate decision. On Thursday, we note New Zealand’s GDP rate for Q2, France’s overall business climate figure for September, the US weekly initial jobless claims figure, the US Philly FED business index for September and the Eurozone’s Preliminary consumer confidence figure for September. On Thursday we also get the SNB’s, Riksbank’s, Norgesbank’s, BOE’s and from Turkey CBT’s interest rate decisions. On Friday, we note BoJ’s interest rate decision and we also get Australia’s preliminary Judo Bank manufacturing PMI figure for September, Japan’s CPI rates for August and preliminary JiBunBK manufacturing PMI figure for September, followed by the UK’s retail sales rate for August, France’s, Germany’s, the Eurozone’s, UK’s and the US preliminary S&P PMI figures for September as well as UK’s CBI trends figure also for the month of September and lastly Canada’s retail sales rate for July.

USD/CAD Daily Chart

Support: 1.3450 (S1), 1.3315 (S2), 1.3225 (S3)

Resistance: 1.3565 (R1), 1.3660 (R2), 1.3800 (R3)

AUD/USD 4H Chart

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6515 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。