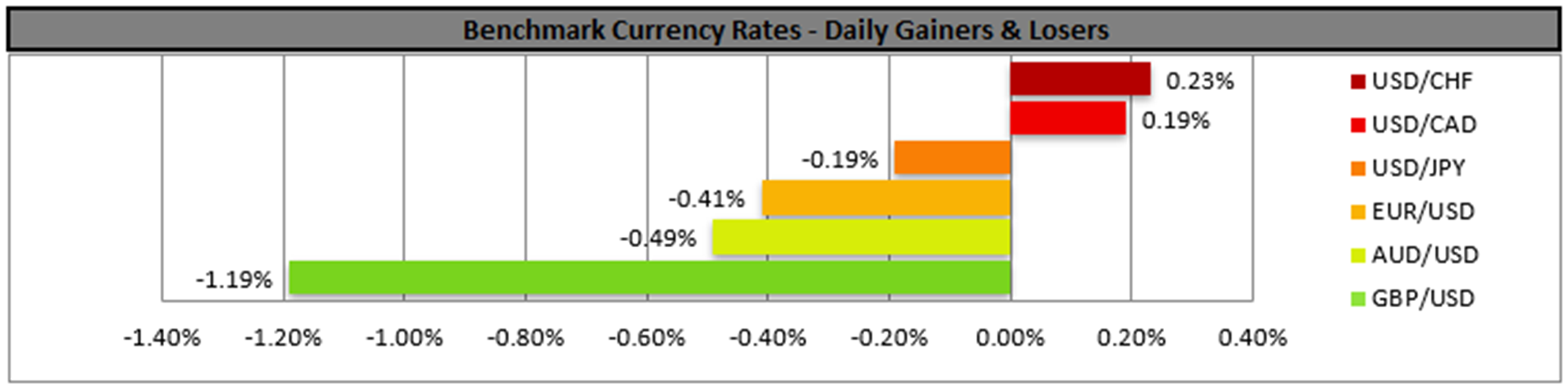

The FOMC’s December meeting minutes were released last evening. The minutes showcased that policymakers may be taking into account the incoming administration’s economic policies, as it was stated that “the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated”, implying that the Fed may take a longer path to cutting interest rates. Moreover, it was stated that the Committee was near the point “at which it would be appropriate to slow the pace of policy easing”, which in turn could aid the greenback if that narrative is echoed.US markets will be closed today, as the US will be observing a National Day of Mourning for the death of former US President Carter who passed away recently. In other news, the ADP Employment change figure for December came in lower than expected at 122k versus 139k and lower than the prior figure of 146k. The lower-than-expected figure tends to cast doubt on the narrative of a resilient labour market. Nonetheless, the lower-than-expected figure may have weighed on the dollar. On a monetary level, Fed Waller spoke yesterday and implied that further rate cuts by the Fed may occur. In particular, Fed Governor Waller stated that “the pace of those cuts”, “will depend on how much progress we make on inflation while keeping the labour market from weakening”. Moreover, when referring to the potential tariffs that may be imposed by the incoming Trump Administration, the Governor stated that they “are unlikely to affect my view of appropriate monetary policy”. Overall, it may appear that Governor Waller’s comments may have been slightly dovish in nature.The FOMC’s December meeting minutes were released last evening. The minutes showcased that policymakers may be taking into account the incoming administration’s economic policies, as it was stated that “the effects of potential changes in trade and immigration policy, suggested that the process could take longer than previously anticipated”, implying that the Fed may take a longer path to cutting interest rates. Moreover, it was stated that the Committee was near the point “at which it would be appropriate to slow the pace of policy easing”, which in turn could aid the greenback if that narrative is echoed.US markets will be closed today, as the US will be observing a National Day of Mourning for the death of former US President Carter who passed away recently. In other news, the ADP Employment change figure for December came in lower than expected at 122k versus 139k and lower than the prior figure of 146k. The lower-than-expected figure tends to cast doubt on the narrative of a resilient labour market. Nonetheless, the lower-than-expected figure may have weighed on the dollar. On a monetary level, Fed Waller spoke yesterday and implied that further rate cuts by the Fed may occur. In particular, Fed Governor Waller stated that “the pace of those cuts”, “will depend on how much progress we make on inflation while keeping the labour market from weakening”. Moreover, when referring to the potential tariffs that may be imposed by the incoming Trump Administration, the Governor stated that they “are unlikely to affect my view of appropriate monetary policy”. Overall, it may appear that Governor Waller’s comments may have been slightly dovish in nature.

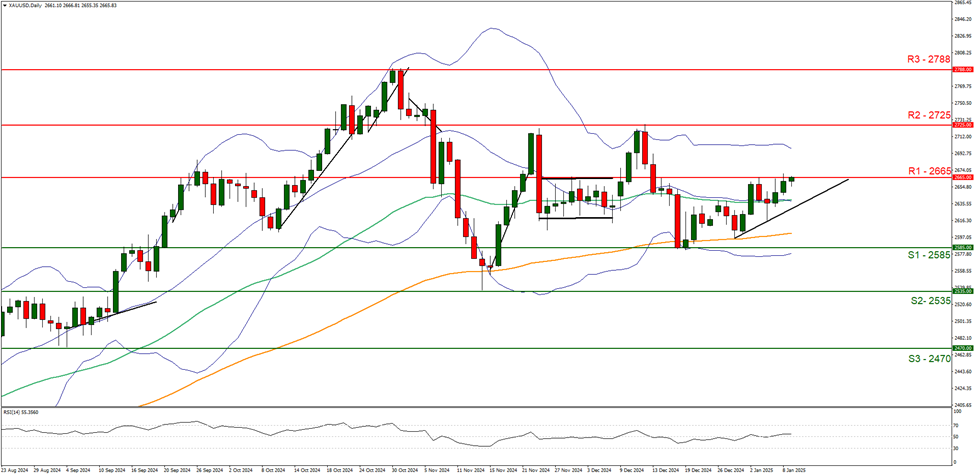

XAU/USD appears to be on the cusp of breaking above our 2665 (R1) resistance line. Nonetheless, we maintain our view for a neutral outlook for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. However, we would also like to note the upwards moving trendline which was incepted on the 30 of December. Nevertheless, for our sideways bias to continue we would require the precious metal’s price to remain confined between the 2585 (S1) support level and the 2665 (R1) resistance line. On the flip side, we would immediately switch our sideways bias in favour of a bullish outlook in the event of a clear break above the 2665 (R1) resistance line with the next possible target for the bulls being the 2725 (R2) resistance level. Lastly, for a bearish outlook, we would require a clear break below the 2585 (S1) support line with the next possible target for the bears being the 2535 (S2) support base.

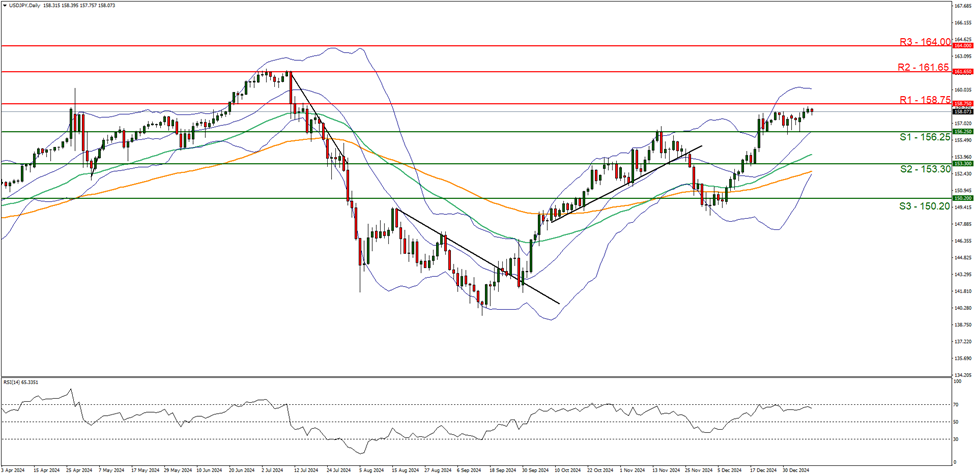

USD/JPY appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure above 60, implying a strong bullish market sentiment. For our bullish outlook to continue, we would require a clear break above the 158.75 (R1) resistance line, with the next possible target for the bulls being the 161.65 (R2) resistance level. On the flip side for a sideways bias we would require the pair to remain confined between the 156.25 (S1) support level and the 158.75 (R1) resistance line. Lastly, for a bearish outlook we would require a break below the 156.25 (S1) support level with the next possible target for the bears being the 153.30 (S2) support line.

その他の注目材料

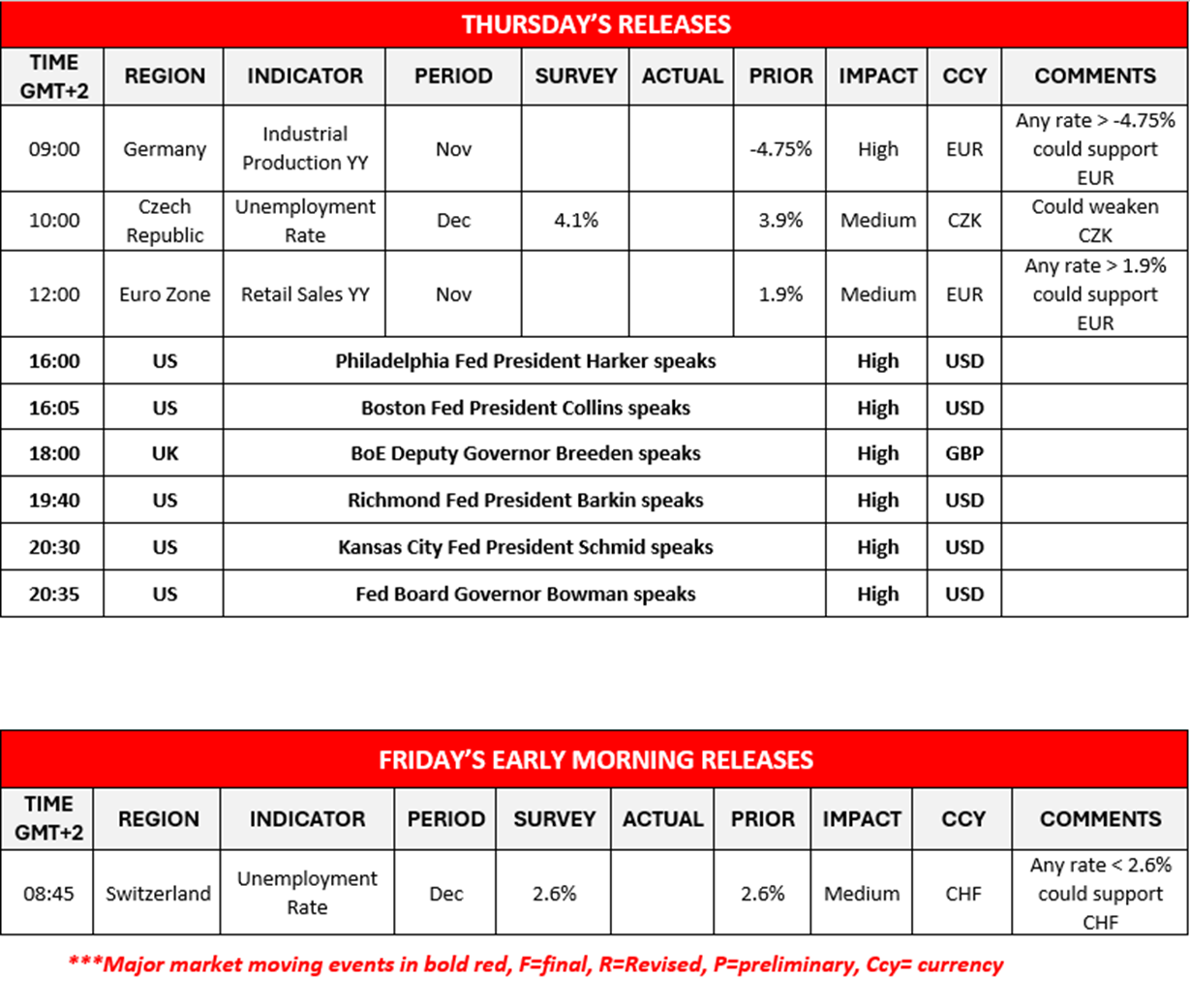

In today’s trading session, we note Germany’s industrial production rate for November, the Czech Republic’s unemployment rate for December and the Eurozone’s retail sales rate for November. In tomorrow’s Asian session, we note Switzerland’s unemployment rate. On a monetary level, we would like to highlight the high number of central bank policymakers who are set to speak today. We note the speeches by Philadelphia Fed President Harker, Boston Fed President Collins, BoE Deputy Governor Breeden, Richmond Fed President Barkin, Kansas City Fed President Schmid and ending the day with Fed Board Governor Bowman.

XAU/USD Daily Chart

- Support: 2585 (S1), 2535 (S2), 2470 (S3)

- Resistance: 2665 (R1), 2725 (R2), 2788 (R3)

USD/JPY Daily Chart

- Support: 156.20 (S1), 153.30 (S2), 150.20 (S3)

- Resistance: 158.75 (R1), 161.65 (R2), 164.00 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。