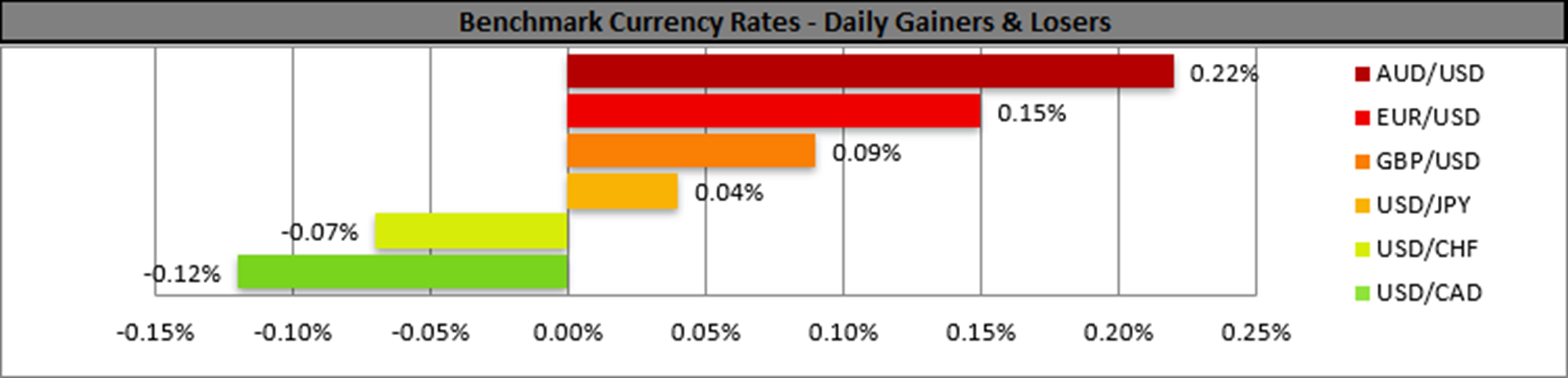

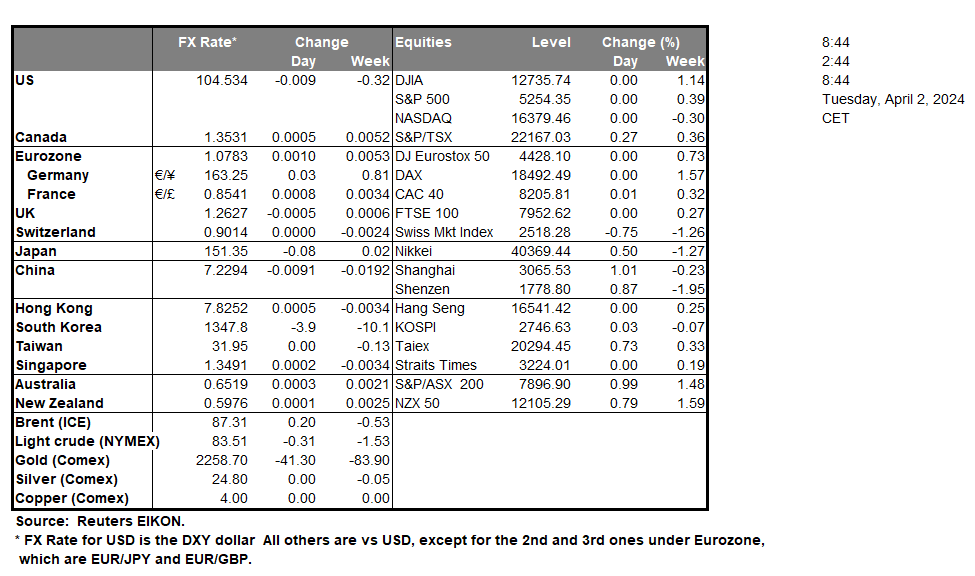

Fed Chair Powell stated on Friday that despite the Core PCE rates for February being “in line with our expectations”, the Fed doesn’t “need to be in a hurry to cut” which could be received as relatively hawkish in nature and may support the USD. In our opinion, we tend to agree with Fed Chair Powell that the Core PCE rates for February, appear to have been ‘favourable’ in implying easing inflationary pressures in the US economy. Yet, some caution about the risks of persistent inflationary pressures in the US economy appears to persist. Over in Asia, China’s NBS Manufacturing PMI figure for March came in better than expected at 50.8, implying an expansion in China’s manufacturing industry. The better-than-expected figure appears to have spurred optimism in regards to China’s economic recovery and as such may have provided support for the CNY and AUD given their close economic ties.

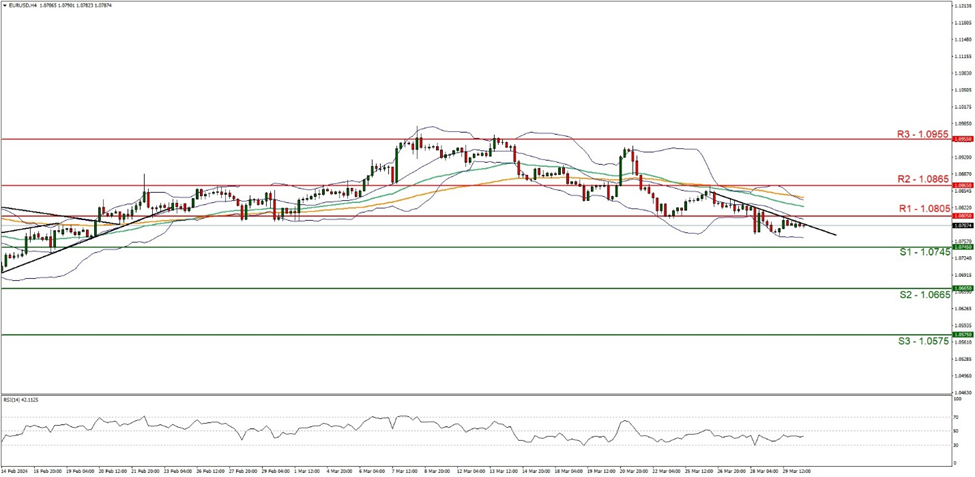

On a technical level, EUR/USD appears to be moving in a downwards fashion. We maintain a bearish outlook for the pair and supporting our case is the downwards moving trendline which was incepted on the 26 of March, in addition to the RSI indicator below our chart which currently registers a figure near 40, implying bearish market tendencies. For our bearish outlook to continue, we would require a clear break below the 1.0745 (S1) support level, with the next possible target for the bears being the 1.0665 (S2) support line. On the flip side, for a sideways bias, we would like to see the pair remain confined between the 1.0745 (S1) support level and the 1.0805 (R1) resistance line. Lastly, for a bullish outlook we would require a clear break above the 1.0805 (R1) resistance line with the next possible target for the bulls being the 1.0865 (R2) resistance level.

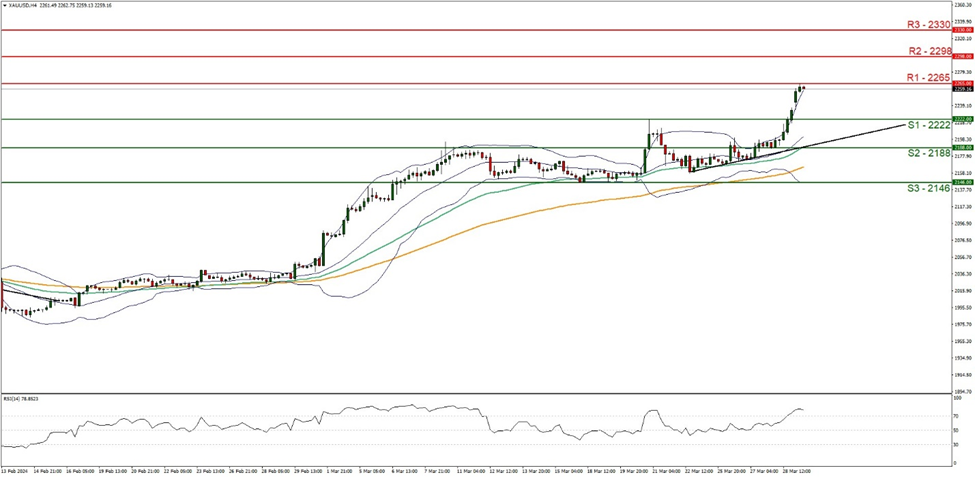

XAU/USD appears to be moving in an upwards fashion, having formed a new all time high earlier on today at $2265 per ounce. We maintain a bullish outlook for the precious metal and supporting our case is the RSI indicator below our chart which currently registers a figure near 80 implying a strong bullish market sentiment, in addition to our upwards moving trendline which was incepted on the 22 of March. However, we should note that the RSI indicator, could also imply that the precious metal could be in overbought territory and may be due a market correction to lower ground. Nonetheless, for our bullish outlook to continue, we would require a clear break above the 2265 (R1) resistance level, with the next possible target for the bulls being the 2298 (R2) resistance line. On the other hand, for a sideways bias, we would like to see the precious metal remain confined between the 2222 (S1) support level and the 2265 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 2222 (S1) support level, with the next possible target for the bears being the 2188 (S2) support line.

その他の注目材料

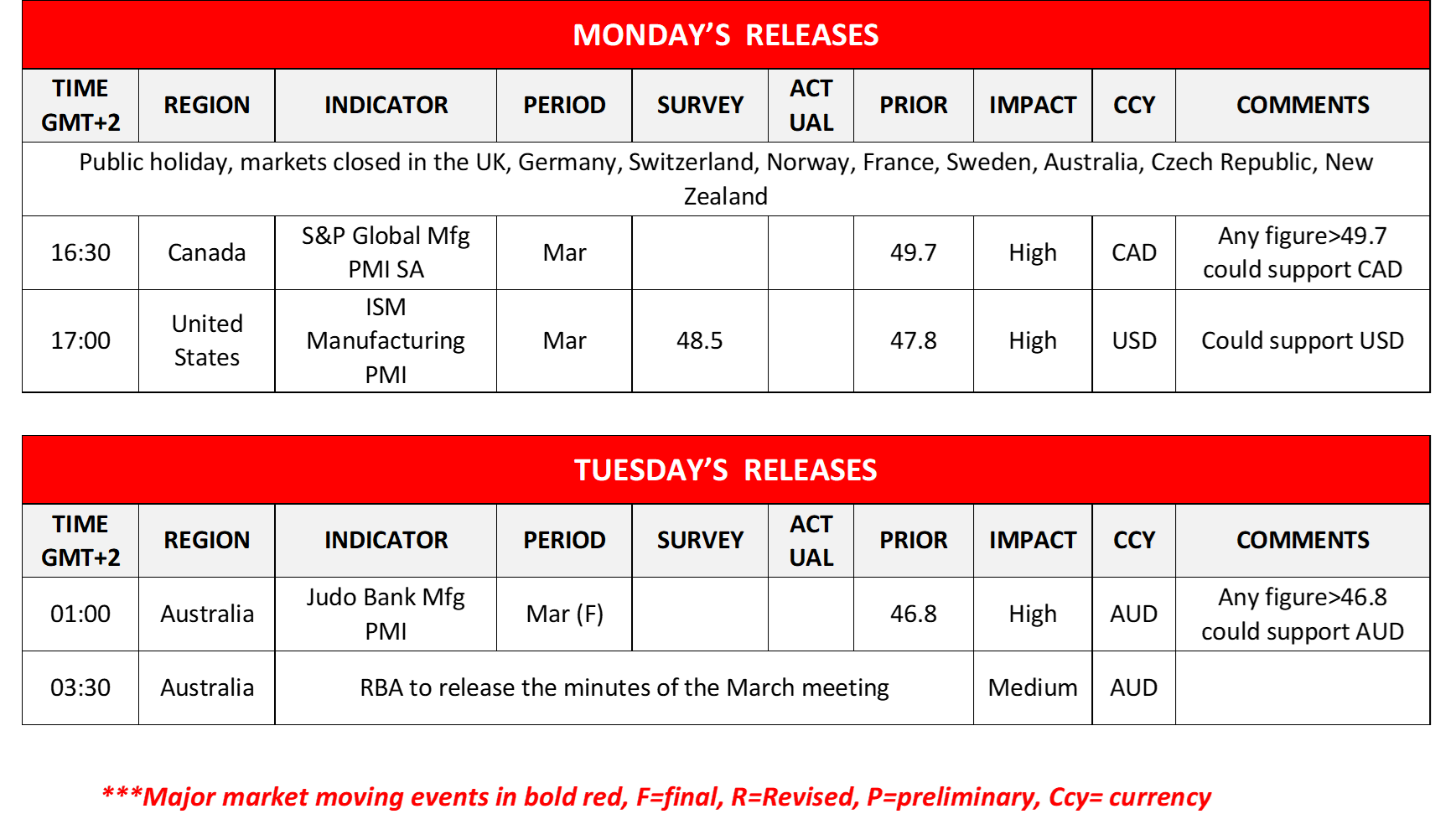

In todays’ American session, we get Canada’s S&P global manufacturing PMI figure for March and the US ISM manufacturing PMI figure for the same month. During tomorrow’s Asian session, we get Australia’s final manufacturing PMI figure for March, while on the monetary front RBA is to release the minutes of the March meeting.

今週の指数発表

On Tuesday, we get the UK’s Nationwide house price rate for March and the US Factory orders rate for February. On Wednesday we get Turkey’s CPI rates the Eurozone’s Preliminary HICP rates and the US ISM-Non-Manufacturing PMI figure all for March. On Thursday, we note Switzerland’s CPI rate, Eurozone’s final composite PMI figure and the UK’s final service PMI figure all for March, followed by the US weekly initial jobless claims figure and Canada’s trade balance figure for February. Lastly, on a busy Friday, we get Germany’s industrial orders rate for February, UK’s Halifax house prices rate, US Employment data and Canada’s Employment data all for the month of March.

EUR/USD 4時間チャート

Support: 1.0745 (S1), 1.0665 (S2), 1.0575 (S3)

Resistance: 1.0805 (R1), 1.0865 (R2), 1.0955 (R3)

XAU/USD 4時間チャート

Support: 2222 (S1), 2188 (S2), 2146 (S3)

Resistance: 2265 (R1), 2298 (R2), 2330 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。