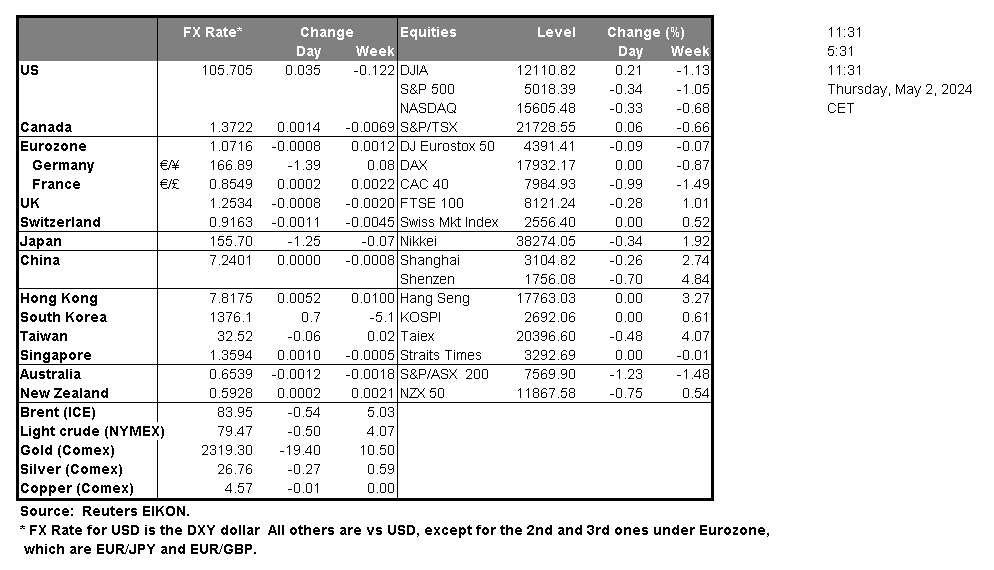

The Fed maintained the current interest rates levels during their monetary policy meeting yesterday, as was widely expected by market participants. In the bank’s accompanying statement, it was stated that “In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective”, aiding the narrative of stagflation, despite Fed Chair Powell’s dismissal of such views in his press conference following the decision. Nonetheless, the remarks, may be concerning ,as the bank may face increased pressure to maintain current interest rate levels for a prolonged period of time. Moreover, we notice a shift in tone from Fed Chair Powell, who stated “it’s unlikely that the next policy rate move will be a hike”, a shift from the beginning of the year in which the narrative was seemingly around when rate cuts would begin. Yet it appears that the slight hawkish element that may have emerged appears to have been ignored by market participants.BoC Governor Tiff Macklem during his speech yesterday, stated that the bank expects “Core inflation to continue to ease gradually”, which could imply that the bank may be preparing to cut interest rates, or that pressure on policymakers to adopt a more dovish monetary policy stance may be increasing. The BoJ’s March meeting minutes we released earlier on today. According to the bank’s meeting minutes a policymaker expressed the view that “it was appropriate to proceed deliberately but steadily with monetary policy normalization in response to developments in economic activity and prices”. Apparently implying that the policymaker may believe that the bank should raise rates further, which may support the JPY.

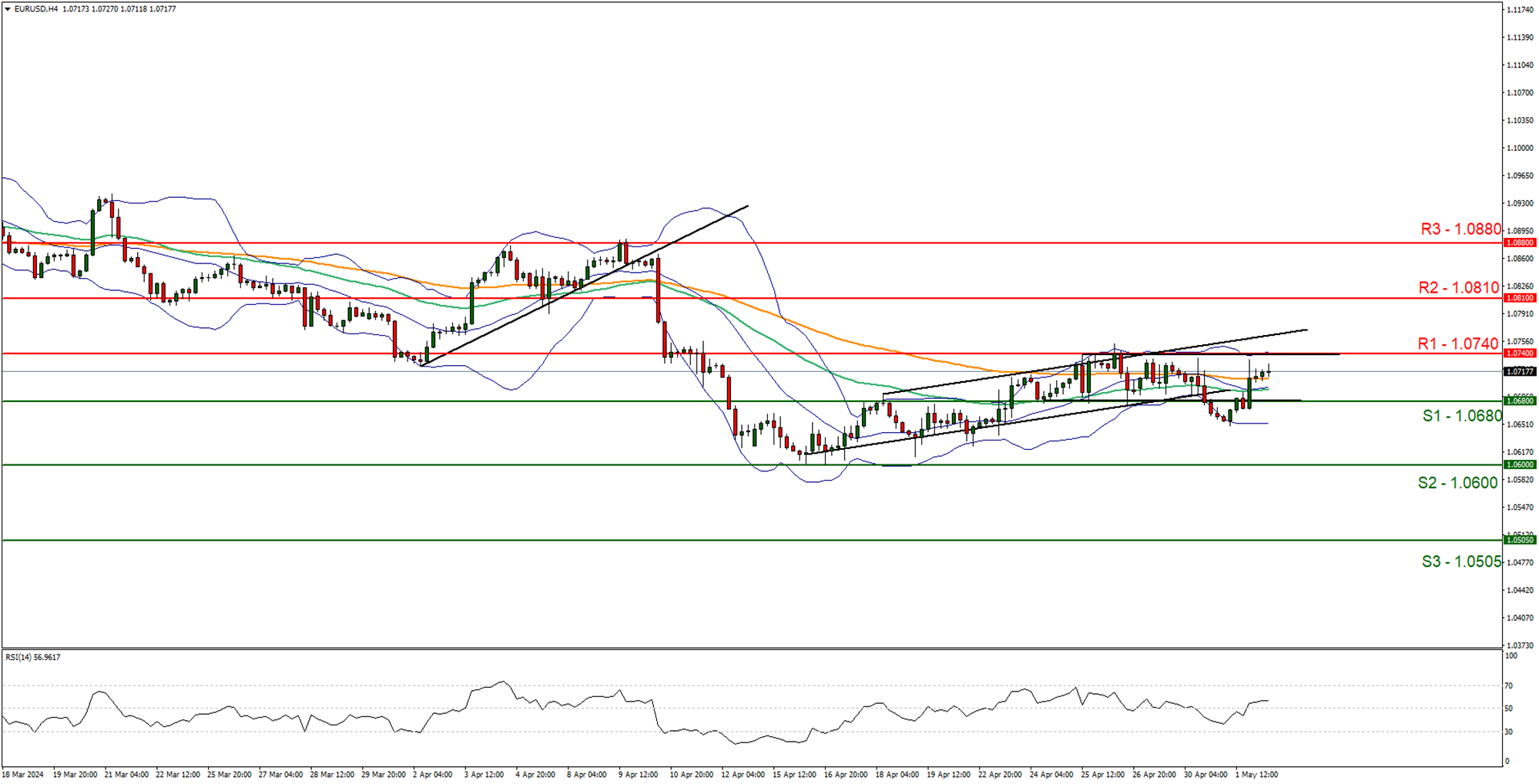

EUR/USD appears to be moving in a sideways fashion after having broken above our resistance turned to support level at 1.0680 (S1). The pair has currently re-emerged into our sideways moving channel that was incepted on the 24 of April. We now opt for a sideways bias and supporting our case is the narrowing of the Bollinger bands and the smoothening out of the 50MA and 100MA implying low market volatility, in addition to the RSI Indicator below our chart currently registering a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would require the pair to remain confined within the sideways moving channel defined by the 1.0680 (S1) support level and the 1.0740 (R1) resistance line. On the flip side for a bullish outlook, we would require a clear break above the 1.0740 (R1) resistance line with the next possible target for the bulls being the 1.0810 (R2) resistance level. Lastly for a bearish outlook, we would require a clear break below the 1.0680 (S1) support level, if not also the 1.0600 (S2) support level with the next possible target for the bears being the 1.0505 (S3) support base.

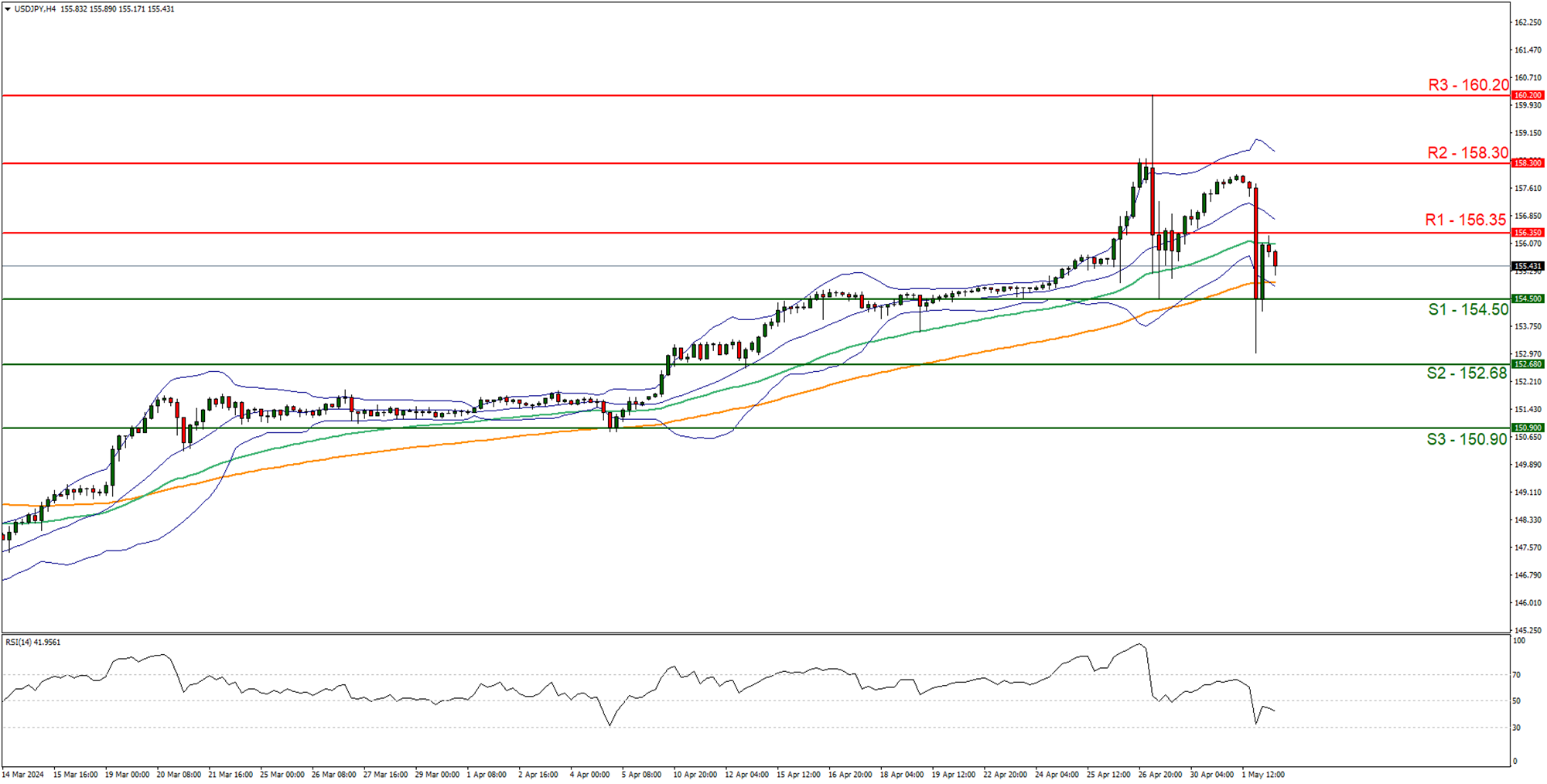

USD/JPY appears to be moving lower. We opt for a bearish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 40, implying some bearish market tendencies. For our bearish outlook to continue, we would require a clear break below the 154.50 (S1) support level, with the next possible target for the bears being the 152.68 (S2) support line. On the flip side For a bullish outlook we would require a clear break above the 156.35 (R1) resistance line with the next possible target for the bulls being the 158.30 (R2) resistance line. Lastly for a sideways bias we would require the pair to remain confined between the 154.50 (S1) support level and the 156.35 (R1) resistance line.

本日のその他の注目点:

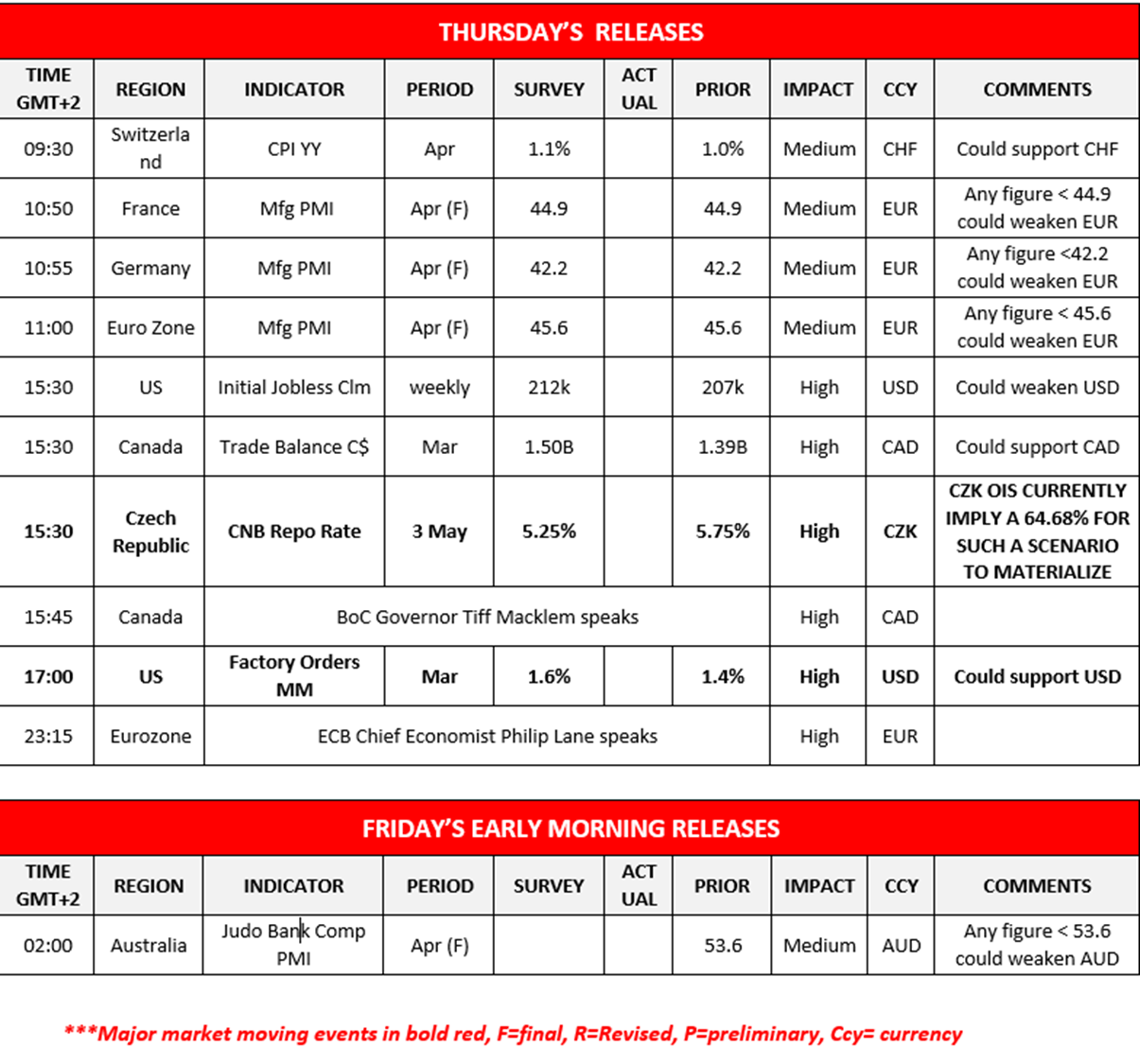

In a busy Thursday, we make a start with Switzerland’s CPI rate for April, France’s, Germany’s and the Eurozone’s final manufacturing PMI figures for April, and during the American session the US weekly initial jobless claims figure, Canada’s trade balance figure for March and ending off the day with the US Factory orders rate for March. In tomorrow’s Asian session we note Australia’s judo bank final composite PMI figure for April. On a monetary level, we note the CNB’s interest rate decision and the speeches by BoC Governor Macklem and ECB Chief Economist Lane.

EUR/USD 4時間チャート

• Support: 1.0680 (S1), 1.0600 (S2), 1.0505 (S3)

• Resistance: 1.0740 (R1), 1.0810 (R2), 1.0880 (R3)

USD/JPY H4

• Support: 154.50 (S1), 152.68 (S2), 150.90 (S3)

• Resistance: 156.35 (R1), 158.30 (R2), 160.20 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。