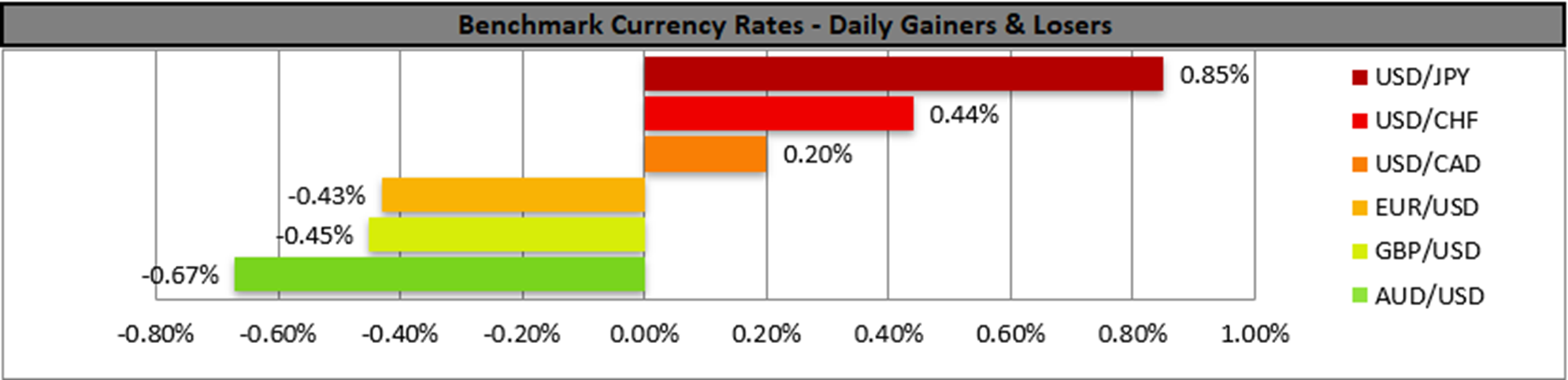

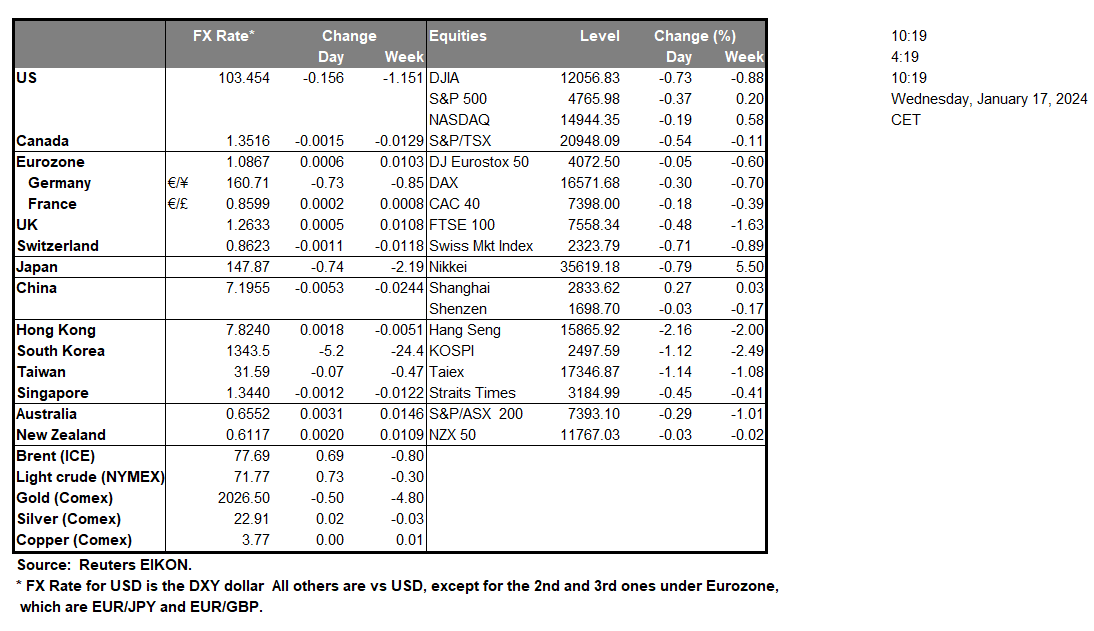

Canada’s Core CPI rates for December, came in as expected during yesterday’s trading session. The CPI rates implied that inflationary pressures may be easing in the Canadian economy, and as such could have weighed on the Loonie. Over in Asia, China’s GDP rates for Q4 of 2023, came in lower than expected on a yoy level. The lower-than-expected GDP rate may imply that the Chinese economy, may not be as resilient as was anticipated by economists. As such, the lower-than-expected GDP rate may have weighed also on the Aussie, given the close economic ties between the nations. In the US, Fed Governor Waller during his statements yesterday stated that “The data we have received the last few months is allowing the Committee to consider cutting the policy rate in 2024”, which could validate the market’s expectations of rate cuts by the Fed this year. Yet the Governor warned that the “changes in the path of policy to be carefully calibrated and not rushed”, as he sees “no reason to move as quickly or cut as rapidly as in the past”, a statement which we tend to agree with. As such the relatively hawkish remarks, may push back on the market expectations of 6 rate cuts this year, which could have provided support for the dollar. The UK’s CPI rates for December came in higher than expected, implying persistent inflationary pressures in the UK economy. Moreover, the CPI rates not only came in higher than expected but appeared to accelerate as well, which could pressure the BoE to adopt a more hawkish rhetoric, thus potentially aiding the pound.

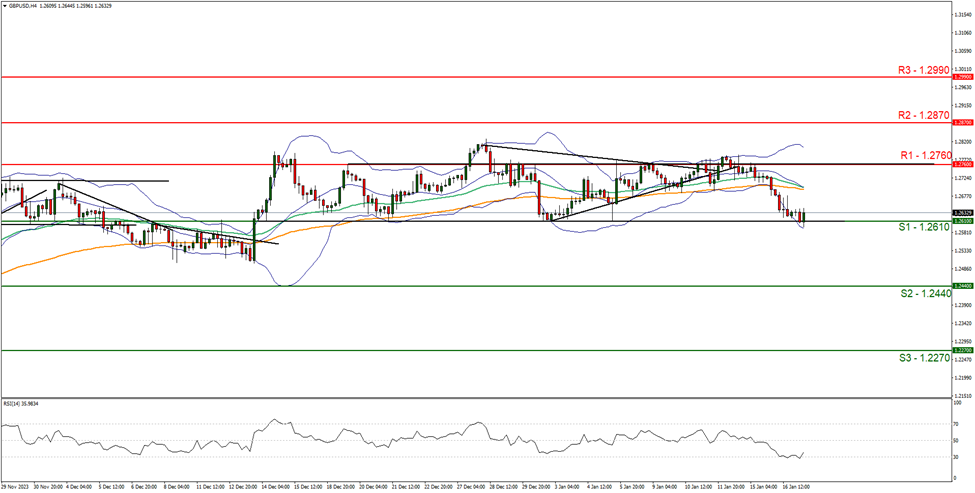

GDP/USD appears to have bounced off the 1.2610 (S1) support level. Despite the RSI indicator below our 4-hour chart currently registering a figure near 30, implying a bearish market sentiment, we tend to opt for a sideways bias for the pair. The pair appears to be moving in a relatively sideways fashion since the 14 of December, having formed a sideways-moving channel. For our sideways bias to continue, we would like to see the pair remain confined between the 1.2610 (S1) support level and the 1.2760 (R1) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.2610 (S1) support level, with the next possible target for the bears being the 1.2440 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 1.2760 (R1) resistance level with the next possible target for the bulls being the 1.2870 (R2) resistance ceiling.

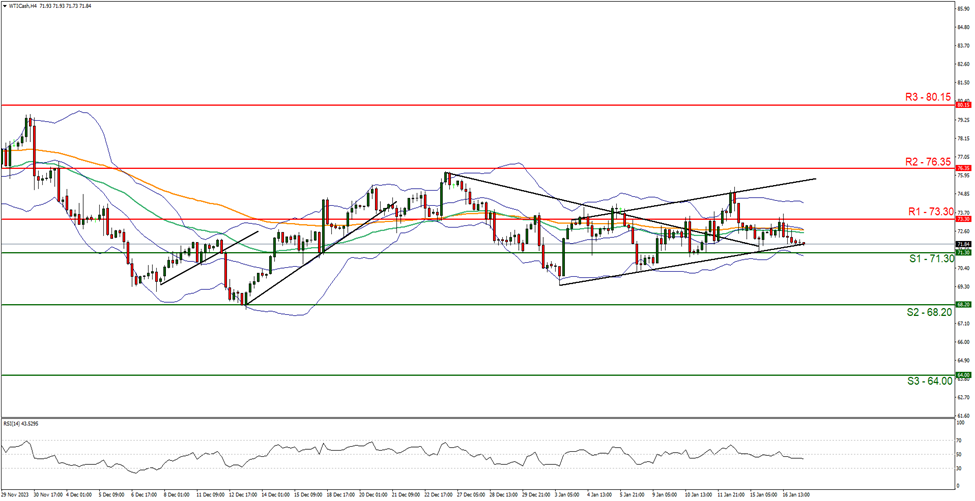

WTICash appears to be moving in a sideways motion, after failing to break above resistance at the 73.30 (R1) level and at the time of this report, appears to have broken the upwards-moving channel incepted on the 3rd of January. We maintain a sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure of 40, implying an uncertain market sentiment, in addition to the narrowing of the Bollinger bands which imply low market volatility. For our sideways bias to continue, we would like the commodity to remain confined between the 71.30 (S1) support level and the 73.30 (R1) resistance line. On the other hand, for a bullish outlook, we would like to see a clear break above the 73.30 (R1) resistance line, with the next possible target for the bulls being the 76.35 (R2) resistance ceiling. Lastly, for a bearish outlook, we would like to see a clear break below the 71.30 (S1) support level, with the next possible target for the bears being the 68.20 (S2) support base.

その他の注目材料

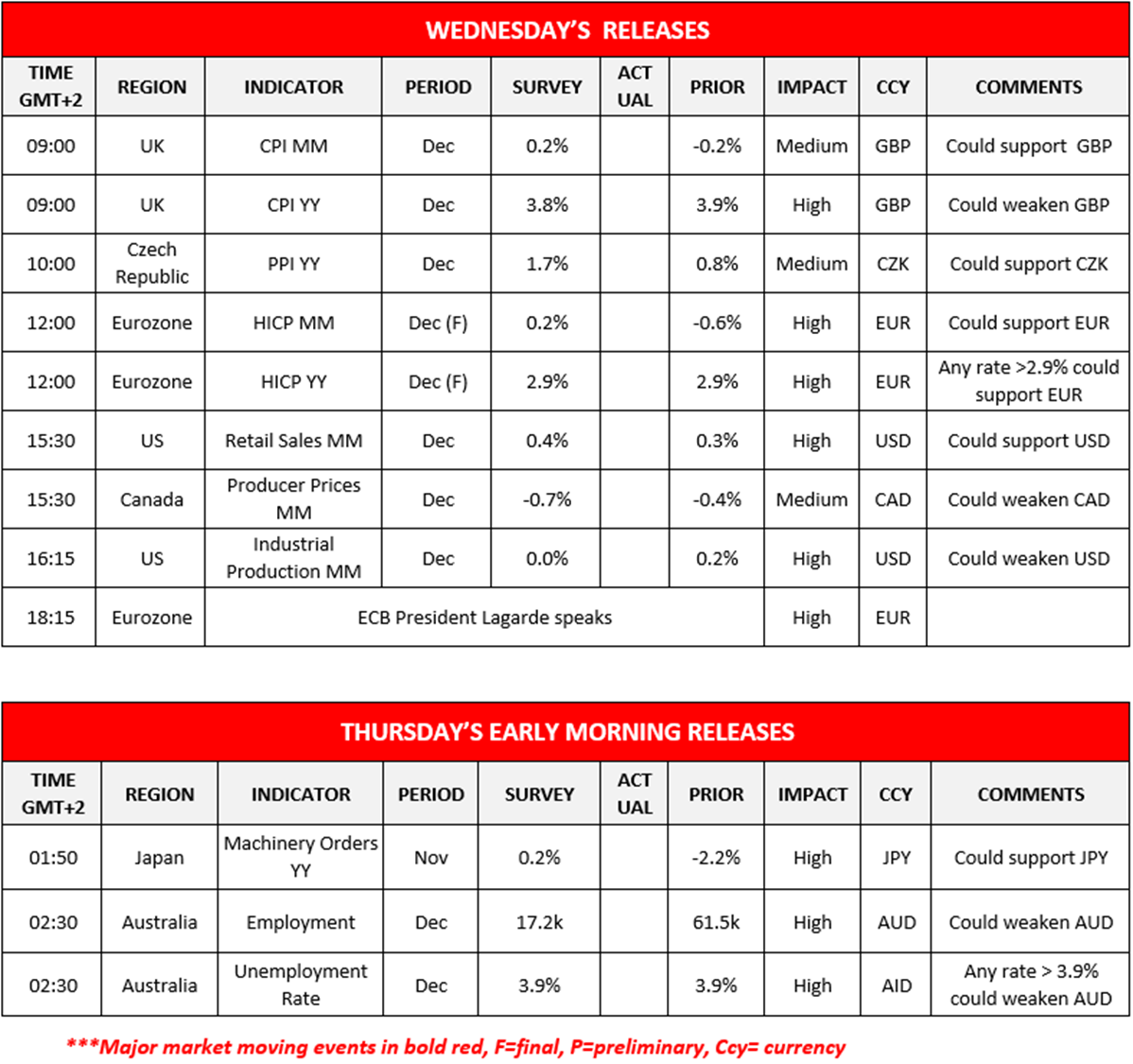

Today in the European session, we make a start with the UK’s CPI rates for December, followed by the Czech Republic’s PPI for the same month and the Eurozone’s final HICP rates for December. During the American session, we note the US Retail sales rate, Canada’s producer prices rate and the US industrial production rate, all for the month of December. In tomorrow’s Asian session, we note Japan’s machinery orders rate for November, followed by Australia’s employment data for December. On a monetary level, we highlight the speech by ECB President Lagarde later on today at the Davos World Economic Forum.

GBP/USD 4時間チャート

Support: 1.2610 (S1), 1.2440 (S2), 1.2270 (S3)

Resistance: 1.2760 (R1), 1.2870 (R2), 1.2990 (R3)

WTICash 4時間チャート

Support: 71.30 (S1), 68.20 (S2), 64.00 (S3)

Resistance: 73.30 (R1), 76.35 (R2), 80.15 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。