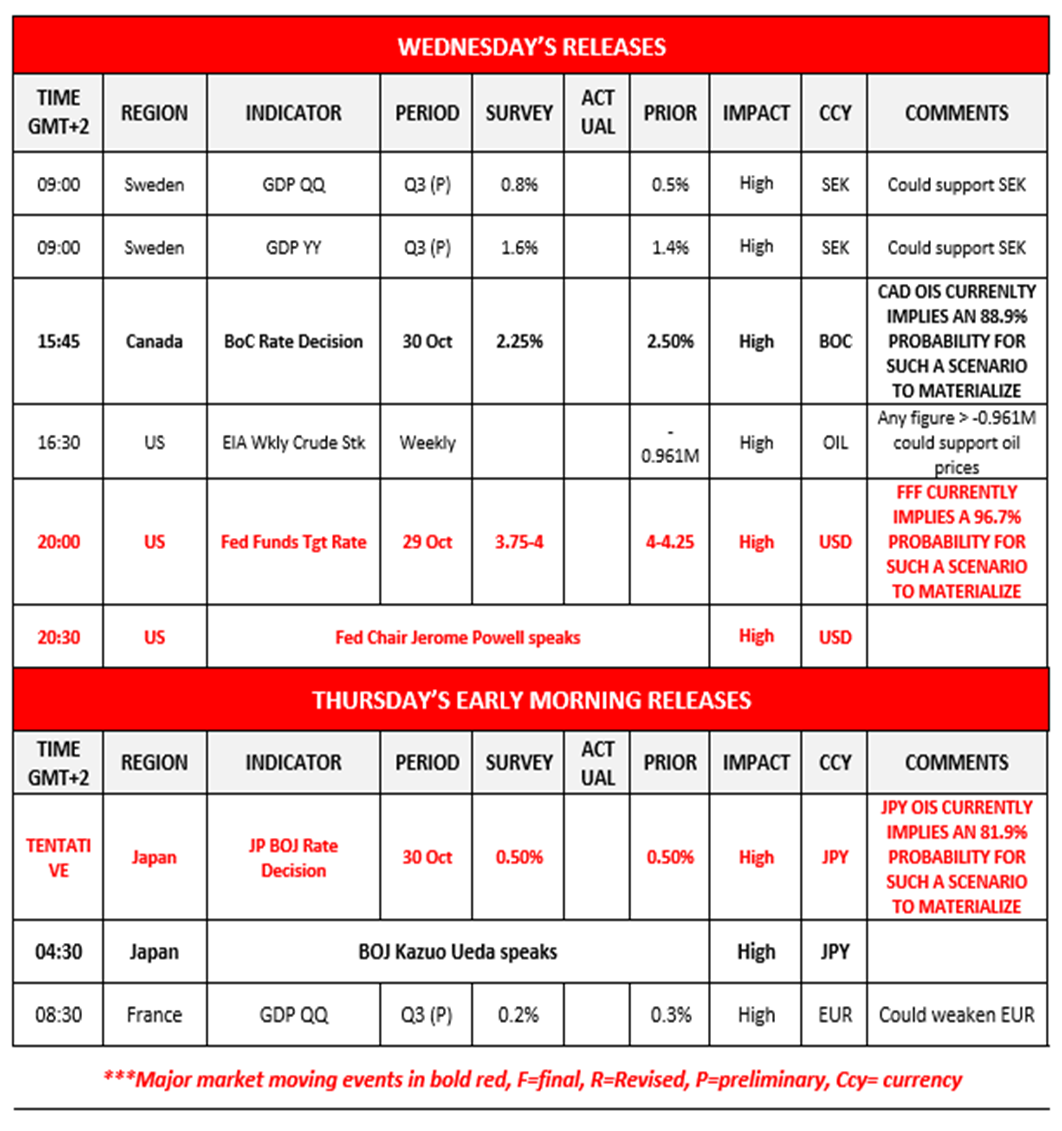

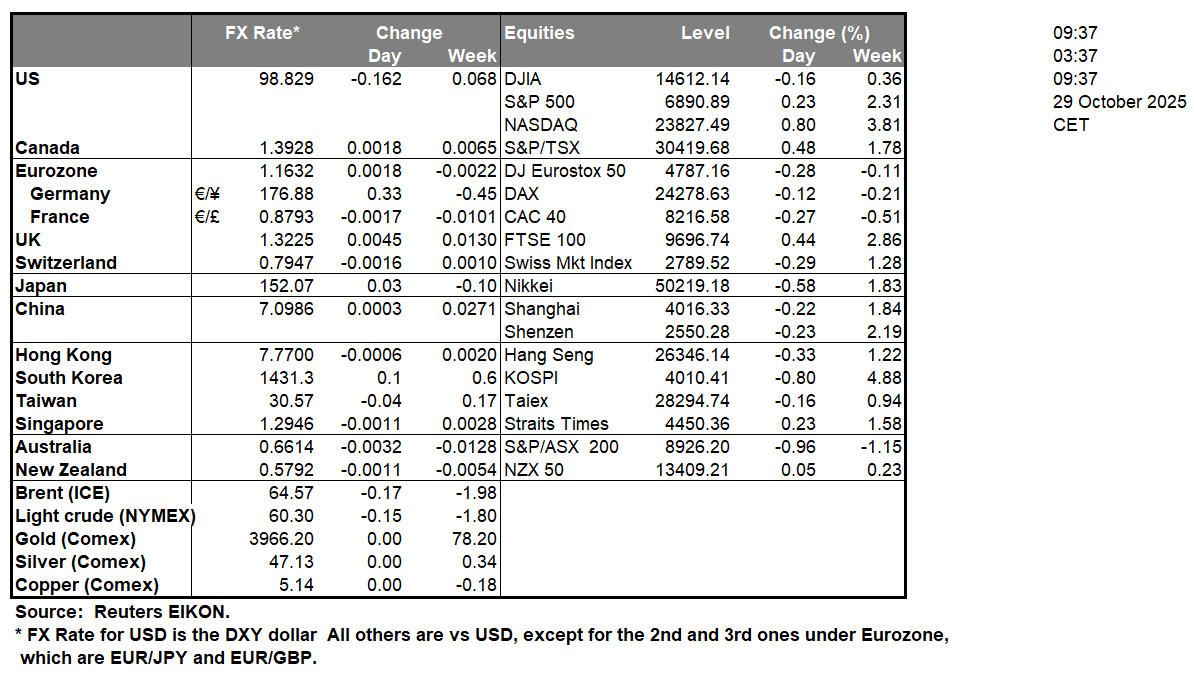

The Fed’s interest rate decision is set to occur later on today. The majority of market participants are currently anticipating the bank to cut rates by 25 basis points, with FFF currently implying a 96.7% probability for such a scenario to materialize. We tend to support the view that the bank could cut rates by 25 basis points considering the general loosening of the US labour market and the US CPI rates for September which failed to meet expectations on a headline level and on a core level came in lower than expected. However, there is a lack of data for the Fed, considering the ongoing US government shutdown which in turn has impacted the Bureau of Labour Statistics and thus with a lack of information in our view we wouldn’t be surprised to see more vague comments from Fed Chair Powell in the press conference following the bank’s decision. Overall, should the Fed decide to cut interest rates by 25 basis points it could potentially weigh on the greenback.The Bank of Canada’s interest rate decision is also set to occur today with the majority of market participants currently anticipating the bank to cut rates by 25 basis points. We tend to agree with this view, as CAD OIS also currently implies an 88.9% probability for such a scenario to materialize, which in tend could weigh on the Loonie.In terms of global trade, President Trump and President Xi Jinping are set to meet with one another today or tomorrow according to some media outlets. In turn should the two world leaders reach an agreement in regards to trade which would bring an end to their very public trade spart, it could weigh on gold’s price and possibly provide support for the US Equities markets. Earlier on today, Australia’s CPI rates for Q3 came in hotter than expected which in turn could provide support for the Aussie.

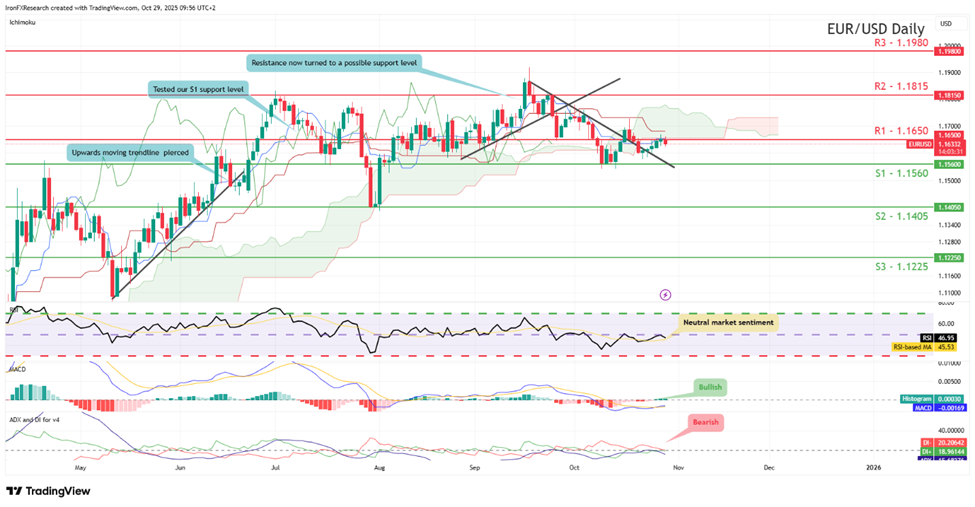

EUR/USD appears to be moving a tight sideways fashion with the pair failing to clear our 1.1650 (R1) resistance line. We opt for a sideways bias and supporting our case is the RSI indicator below our chart which currently registers a figure near 50 implying a neutral market sentiment. For our sideways bias to be maintained we would require the pair to remain confined between our 1.1560 (S1) support level and our 1.1650 (R1) resistance line. On the flip side we would, for a bullish outlook we would require a break above our 1.1650 (R1) resistance line with the next possible target for the bulls being our 1.1815 (R2) resistance level. Lastly, for a bearish outlook we would we would require a clear break below our 1.1560 (S1) support level with the next possible target for the bears being our 1.1405 (S2) support line.

WTICash appears to be retracing to lower ground after reaching our 61.75 (R1) resistance line. We now opt for a sideways bias for the commodity and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained we would require the commodity to remain confined between our 58.90 (S1) support level and our 61.75 (R1) resistance line. On the other hand, for a bearish outlook, we would require a clear break below our 58.90 (S1) support level with the next possible target for the bears being our 55.25 (S2) support line. Lastly, for a bullish outlook, we would require a clear break above our 61.75 (R1) resistance line with the next possible target for the bulls being our 66.15 (R2) resistance level.

その他の注目材料

Today we get Sweden’s preliminary GDP rates for Q3, followed by the Bank of Canada’s interest rate decision, the US weekly crude oil inventories figure and the Fed’s interest rate decision followed by Fed Chair Powell’s press conference. In tomorrow’s Asian session we note the BOJ’s interest rate decision, followed by the speech by BOJ Governor Ueda and France’s preliminary GDP rates for Q3

EUR/USD Daily Chart

- Support: 1.1560 (S1), 1.1405 (S2), 1.1225 (S3)

- Resistance: 1.1650 (R1), 1.1815 (R2), 1.1980 (R3)

WTICash Daily Chart

- Support: 58.90 (S1), 55.25 (S2), 52.00 (S3)

- Resistance: 61.75 (R1), 66.15 (R2), 69.70 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。