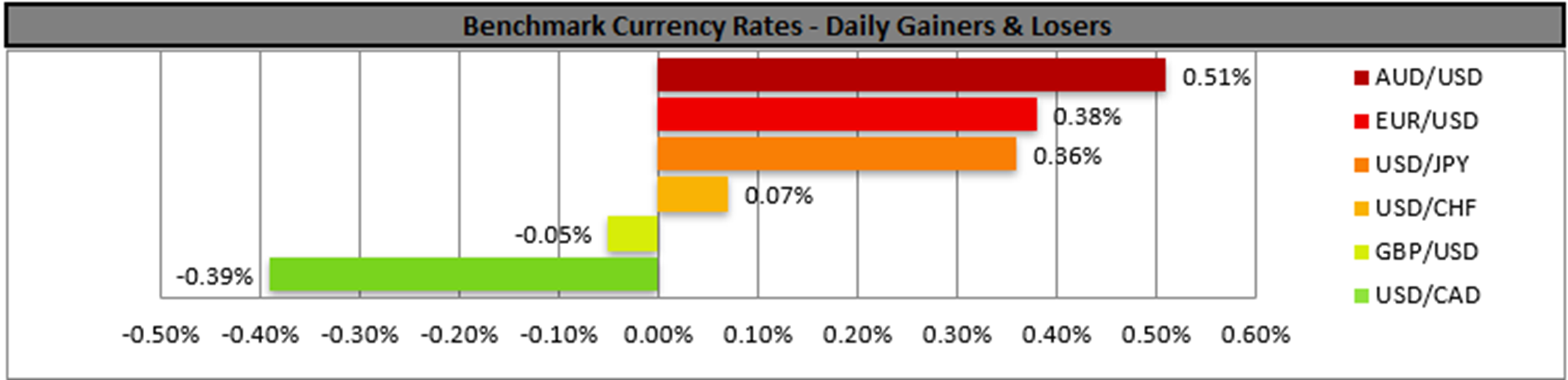

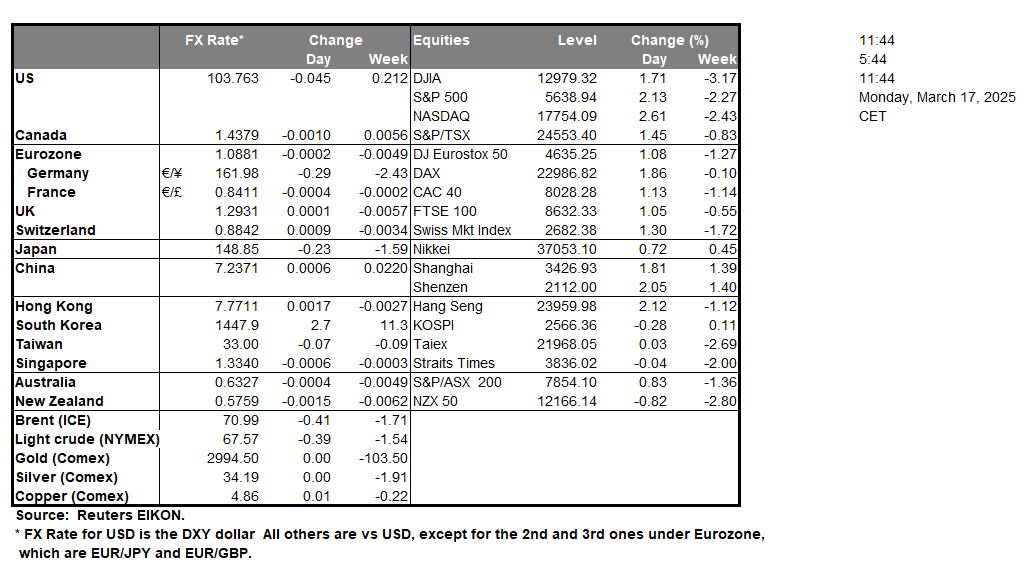

In today’s Asian session, China’s February economic data released, were encouraging as the urban investment growth rate accelerated beyond expectations, the industrial output growth rate slowed down less than expected and the retail sales growth rate accelerated as expected, reflecting a strengthening of the much-needed demand side in the Chinese economy in these times of trade wars and sanctions on China. Later today we highlight the release of the US retail sales for February. Our worries for the demand side of the US economy, were intensified after the slowdown of the CPI rates for February and even further after the preliminary UoM consumer sentiment showed that the average US consumer was more pessimistic than expected. Should the retail sales for February, get out of the negatives and accelerate as expected, market worries for the demand side could ease somewhat, while should the rates fail to reach their targets, the release could weigh on the USD as market worries for the demand side of the US economy could be reignited. On a fundamental level, Trump’s planned talk with Putin and possible developments in the war in Ukraine are in the forefront, while market worries for Trump’s tariffs are ever-present.

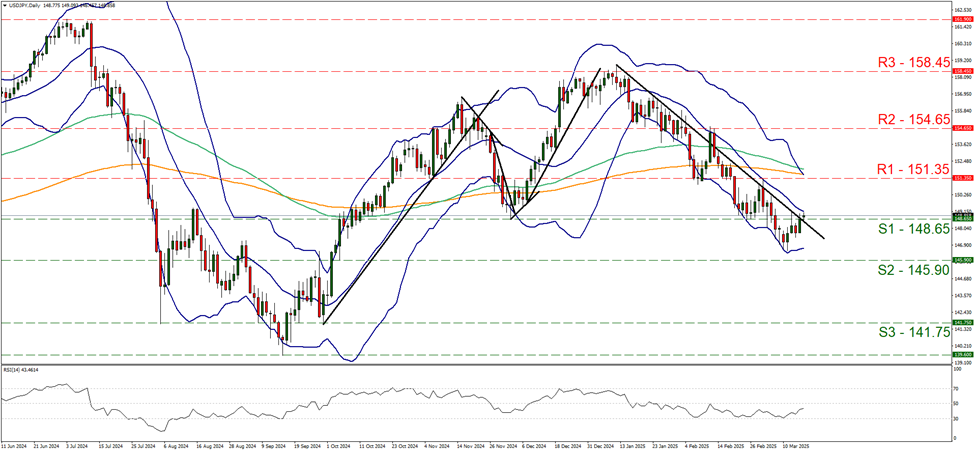

USD/JPY edged higher on Friday, breaking the 148.65 (S1) resistance line, now turned to support. The pair in its upward movement also broke the downward trendline guiding the pair since the 10 of January, hence forces us to switch out bearish outlook in favour of a sideways motion initially, even temporary. Also please note that the RSI indicator rose nearing the reading of 50, implying a substantial easing of the bearish sentiment of the market for the pair. Should the bulls take over, we may see the pair aiming if not breaching the 151.35 (R1) resistance level. Should the bears regain control over the pair, we may see USD/JPY, breaking the 148.65 (S1) support line and start aiming for the 145.90 (S2) support level.

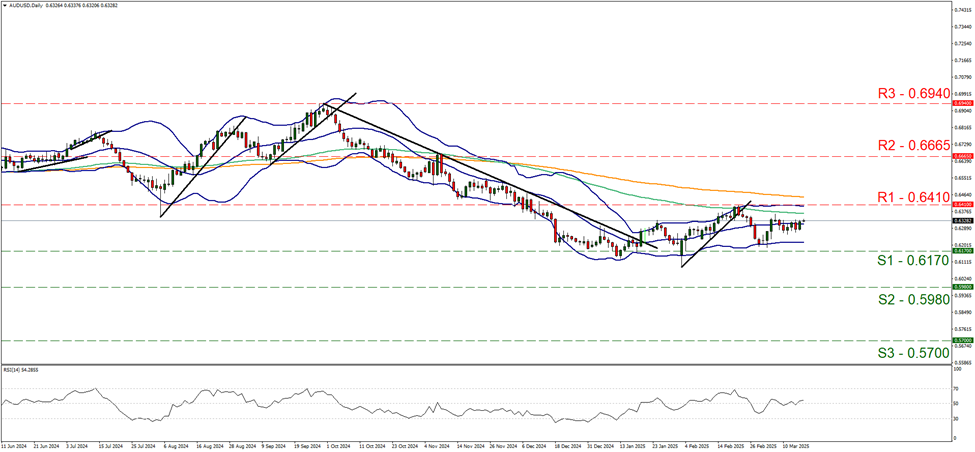

AUD/USD remained steady between the 0.6410 (R1) resistance line and the 0.6170 (S1) support level in the past few days. Given that the RSI indicator continues to run along the reading of 50, implying a rather indecisive market, while the Bollinger Bands have flattened out, implying easing volatility which may also allow for the pair to maintain its sideways motion between the prementioned levels. The pair’s price action seems about to edge higher in today’s Asian session, yet for a bullish outlook we would require AUD/USD to break the 0.6410 (R1) resistance line and start actively aiming for the 0.6665 (R2) resistance level. On the flip side, for a bearish outlook we would require the pair to break the 0.6170 (S1) support line and start aiming for the 0.5980 (S2) support barrier.

その他の注目材料

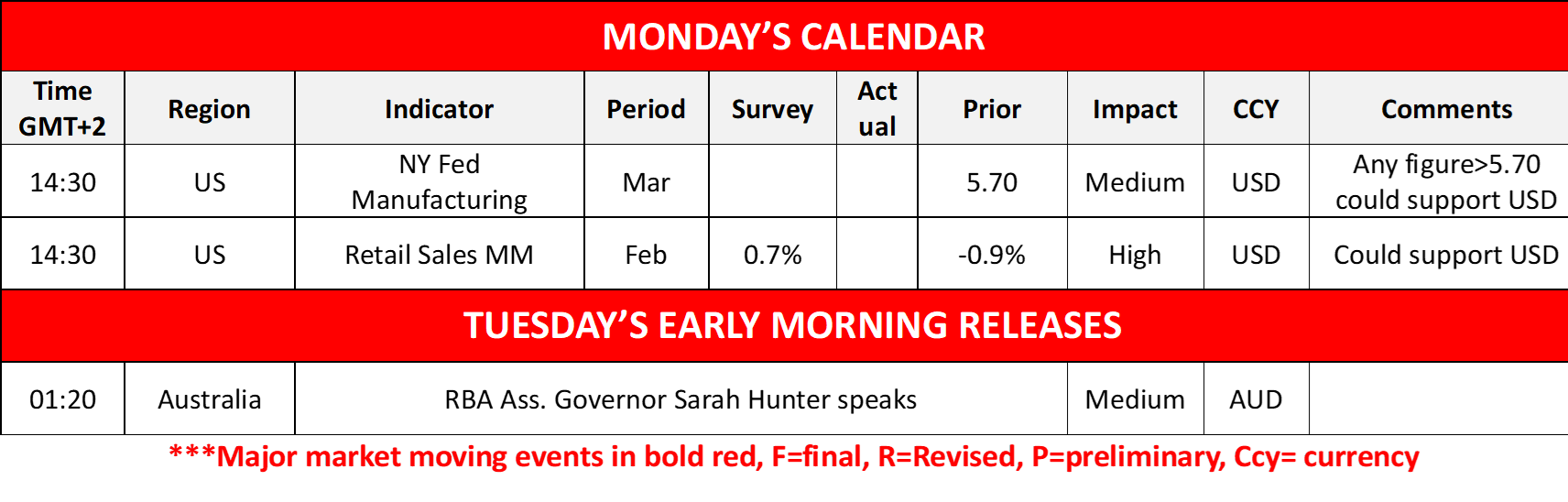

On an easy-going Monday, we get from the US the NY Fed Manufacturing for March and in tomorrow’s Asian session, we note that RBA Ass. Governor Sarah Hunter speaks.

今週の指数発表:

On Tuesday, we note Germany’s ZEW figures for March, Canada’s CPI rates and the US industrial production rate all for February and ending the day with New Zealand’s current account figure for Q4. On Wednesday we note the BOJ’s interest rate decision, Japan’s machinery orders rate for January and trade balance figure for February, followed by the Zone’s final HICP rate for February, the highlight of the week which if the Fed’s interest rate decision and New Zealand’s GDP rate for Q4. On Thursday, we get Australia’s employment data for February, China’s loan prime rate , the UK’s employment data for January, the SNB’s, Riskbank’s and the BoE’s interest rate decisions followed by the US weekly initial jobless claims figure, the US Philly Fed Business index for March, Canada’s producer prices rate for February and New Zealand’s trade balance figure for February. On Friday we note Japan’s CPI rates for February, Canada’s retail sales rate for January and the Zone’s preliminary consumer confidence figure for March.

USD/JPY Daily Chart

- Support: 148.65 (S1), 145.90 (S2), 141.75 (S3)

- Resistance: 151.35 (R1), 154.65 (R2), 158.45 (R3)

AUD/USD デイリーチャート

- Support: 0.6170 (S1), 0.5980 (S2), 0.5700 (S3)

- Resistance: 0.6410 (R1), 0.6665 (R2), 0.6940 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。