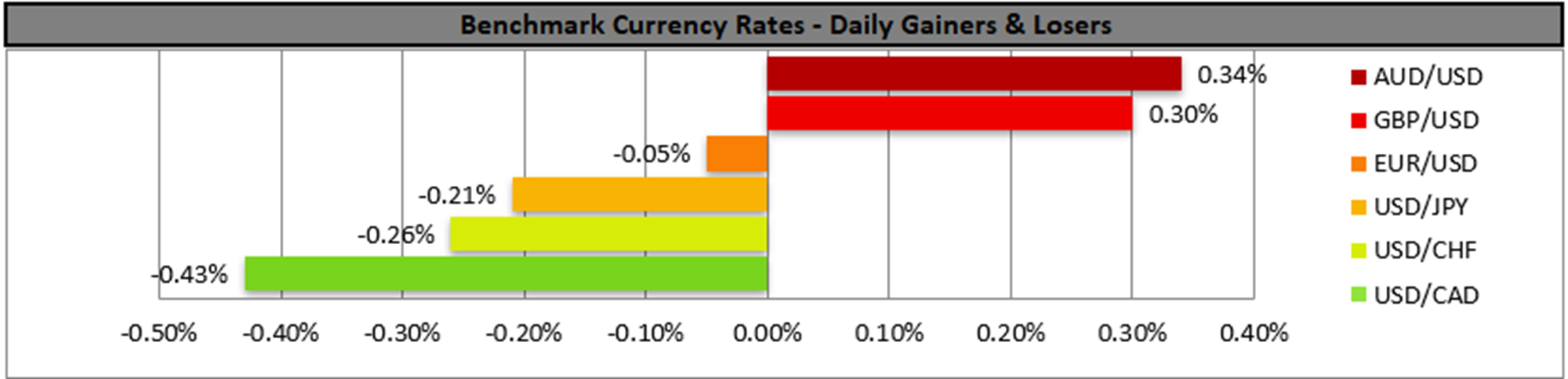

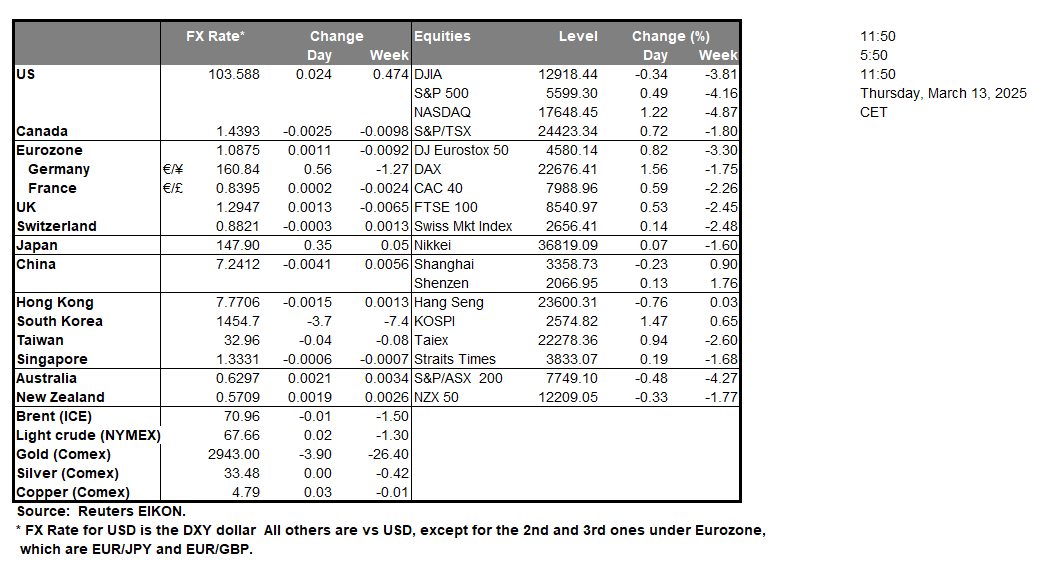

The USD edged higher against its counterparts, yesterday and during today’s Asian session despite a slowdown of February’s CPI rates on a headline and core level, in both cases slightly beyond expectations. The release implied an easing of inflationary pressures in the US economy and given the weaker-than-expected US employment data for the same month as released past Friday, more pressure may be exercised on the Fed to lower its interest rates. Currently, the market seems to keep almost fully pricing the scenario for the bank to remain on hold in its next meeting in the coming week. Today get February’s US PPI rates showing the level of inflation at a producers’ level and a slowdown could enhance market expectations for further easing of inflationary pressures in the US economy. Should the PPI rates slow down possibly beyond expectations, we may see the USD relenting some ground, while US stock markets could get some support. On a more fundamental level, the US tariff war continues to create uncertainty for the markets and we expect it to widen and possibly intensify which could turn any support for riskier assets as temporary. Furthermore, we note the possibility of a US Government shutdown which was mentioned also in yesterday’s report.

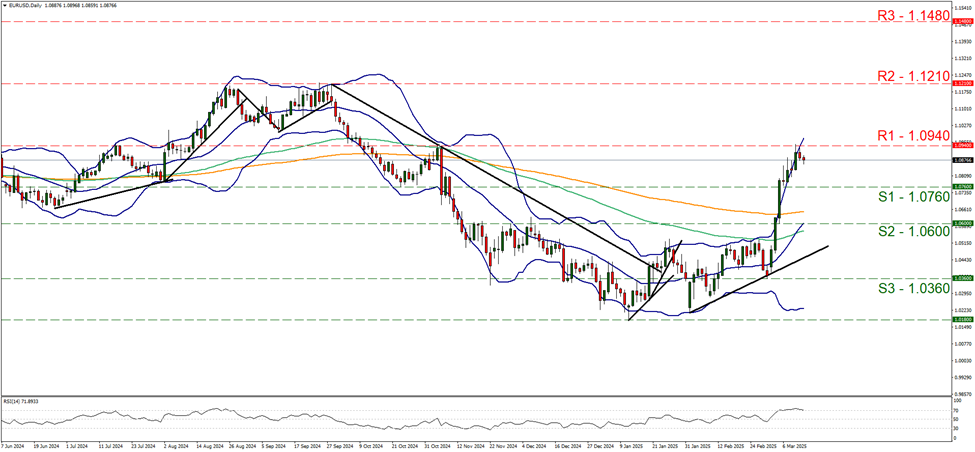

EUR/USD hit a ceiling at the 1.0940 (R1) resistance line yesterday and continued to correct lower in today’s Asian session. We tend to maintain a bullish outlook, despite the interruption of the upward movement, which has allowed for some space between the upper Bollinger band and the price action to be created, a space providing some room for the bulls to play again. We also note that the RSI indicator remains slightly above the reading of 70 which highlights the strong bullish sentiment of the market for the pair, yet at the same time may also imply that he pair is still at overbought levels and the correction lower could be continued. Should the bulls maintain control over the pair, we may see the pair breaking the 1.0940 (R1) resistance line with the next possible target for the bulls being the 1.1210 (R2) hurdle, a level that formed the top of a double top formation end of August to the mid of September. For a bearish outlook the bar is high, as the pair would have to break the 1.0760 (S1) line and start aiming for the 1.0600 (S2) support level.

In the FX market we also note the few losses of JPY yesterday against the USD and its recovery in today’s Asian session. Overall, there may be some safe haven inflows for the Japanese currency given its status as a safe haven instrument for international financial markets and the current mayhem, yet we highlight BoJ’s hawkish intentions as probably the main contributor to JPY’s strengthening over the past three months. BoJ Governor Ueda’s comments were characteristic as he sounded upbeat on consumption and warned for the bank’s huge balance sheet, both issues implying a possible tightening of the bank’s monetary policy on a quantitative level and a rates level. We note that the market expects the bank to remain on hold in its meeting next Wednesday, yet it also increasingly expects some tightening near the beginning of Q3.

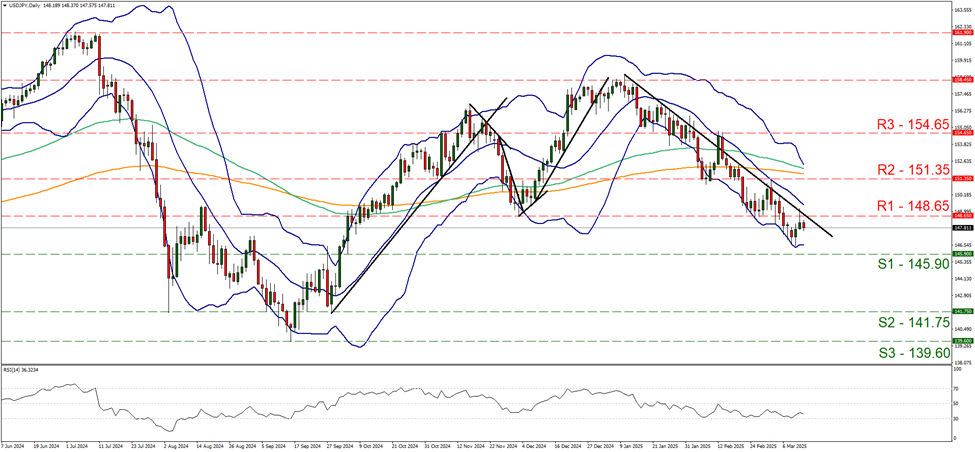

USD/JPY rose yesterday testing the 148.65 (R1) resistance line, yet corrected lower. Yet despite the rise of the pair, the downward trendline guiding the pair lower since the 10 of January remains intact for the time being allowing us to maintain our bearish outlook. Should the bears remain in control of the pair’s direction, we may see USD/JPY breaking the 145.90 (S1) support line, with the next possible target for the bears being the 141.75 (S2) support level. Should the bulls take over, we may see the pair breaking the 148.65 (R1) resistance line, continue to break the prementioned downward trendline in a first signal that the downward motion has been interrupted and start aiming if not reaching the 151.35 (R2) resistance level.

その他の注目材料

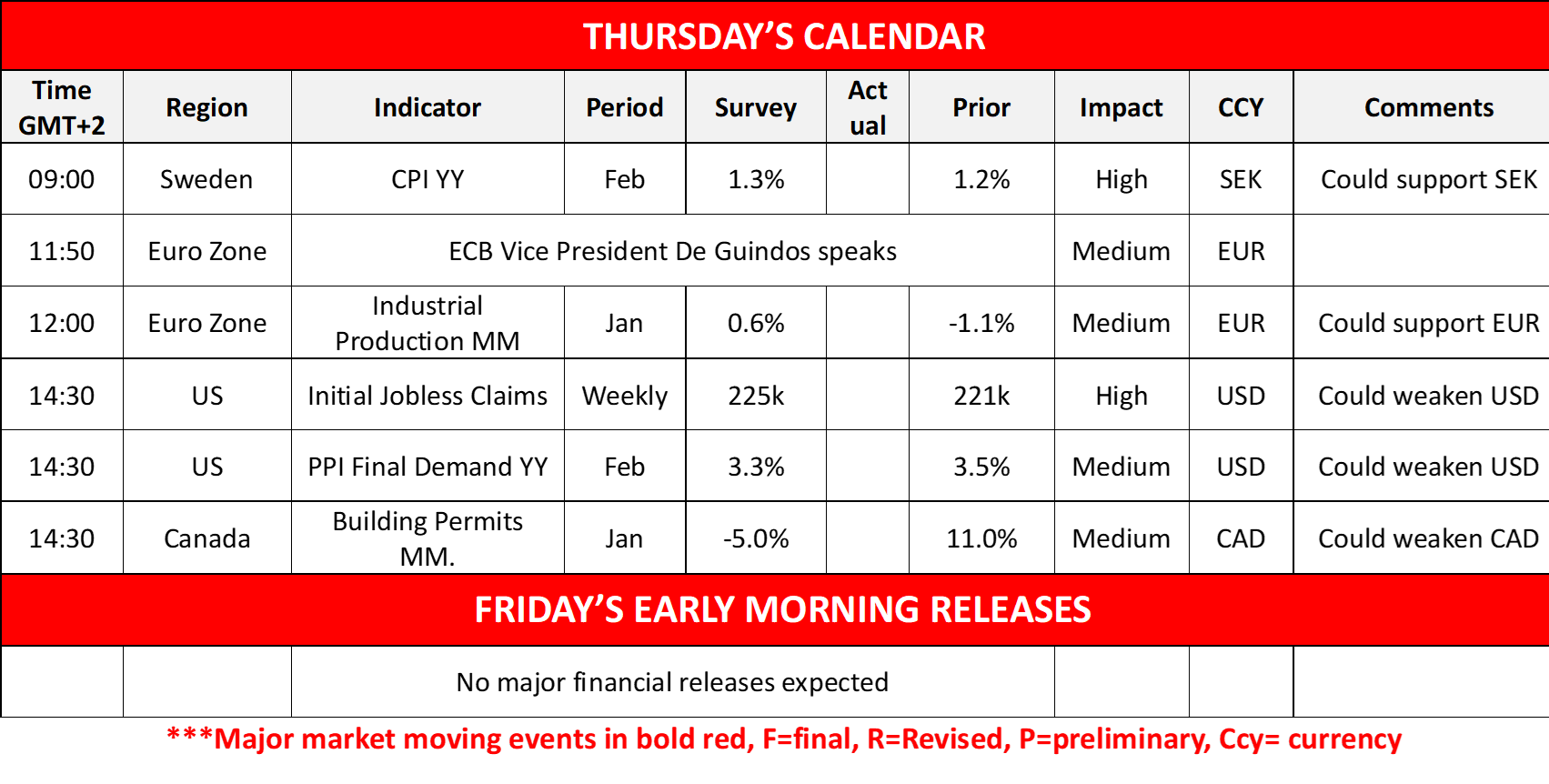

Today we get Sweden’s CPI rates for February and Euro Zone’s January industrial output for January while ECB Vice President De Guindos speaks. Later we get the US weekly initial jobless claims figure and from Canada the building permits for January.

EUR/USD デイリーチャート

- Support:1.0760 (S1), 1.0600 (S2), 1.0360 (S3)

- Resistance: 1.0940 (R1), 1.1210 (R2), 1.1480 (R3)

USD/JPY Daily Chart

- Support: 145.90 (S1), 141.75 (S2), 139.60 (S3)

- Resistance: 148.65 (R1), 151.35 (R2), 154.65 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。